The Best Bank Accounting Software

Find the right bank accounting software–whether you’re a cross-border firm needing global consolidation, an online bank seeking scalability, or a credit union needing better compliance support.

- Hundreds of third-party add-ons available

- Feature sets for multiple industries

- Highly customizable

- Combined ERP and CRM

- Similar interface to MS Word and Outlook

- Integrations with Microsoft applications

- HANA database

- Large network of resellers

- Strong BI tools

Financial institutions use bank accounting software to streamline processes such as financial management, reporting, general ledger balancing, budgeting, and compliance. We used our advanced review methodology to select the top options for several different types of banks and credit unions.

- NetSuite: Best Overall

- Dynamics 365 Business Central: Best for Online Banks

- SAP S/4HANA: Best for International Retail Banks

- Flexi Software: Best for Credit Unions

- Multiview: Best for Regional Banks

- Sage Intacct: Best for Community Banks

- CustomBooks: Best for Niche Banks

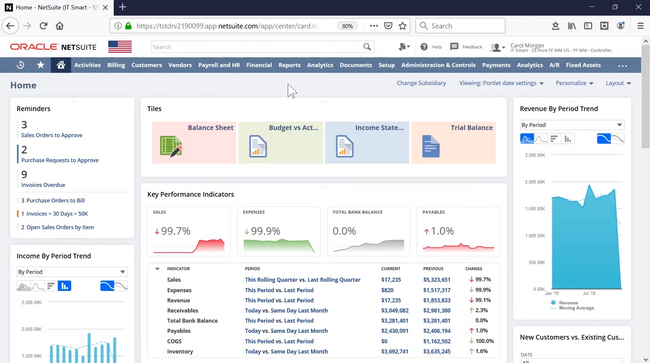

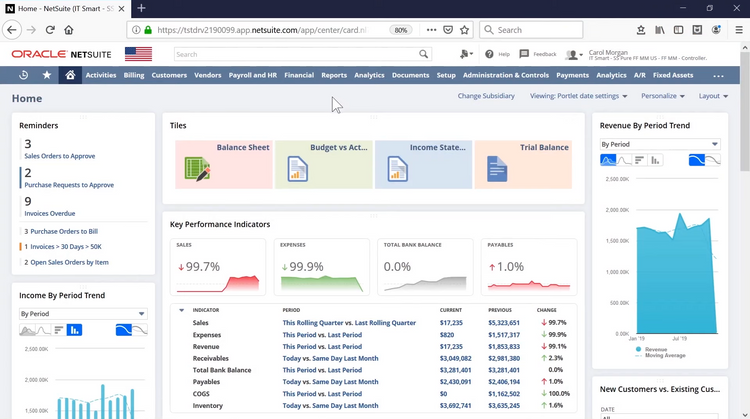

NetSuite - Best Overall

NetSuite’s multi-subsidiary and global financial consolidation tools make it an apt choice for banks operating across multiple regions. With the Subsidiary Navigator, you can instantly switch between financial views for different branches. From there, you can drill down into region-specific metrics, like:

- Assets under management (AUM) per subsidiary

- Loan portfolios by region

- Branch-specific KPIs

Additionally, NetSuite pulls in real-time exchange rates for multi-currency consolidation. This helps you prevent foreign exchange discrepancies and ensures compliance with local reporting requirements. At month-end, it automates intercompany eliminations and provides a period close checklist. This guides your controllers through tasks like revaluing open foreign currency balances for error-free reporting.

NetSuite starts at around $2,000 per month, at minimum. However, most firms find their monthly expenses land somewhere between $3,000 and $5,000, depending on the complexity of their setup.

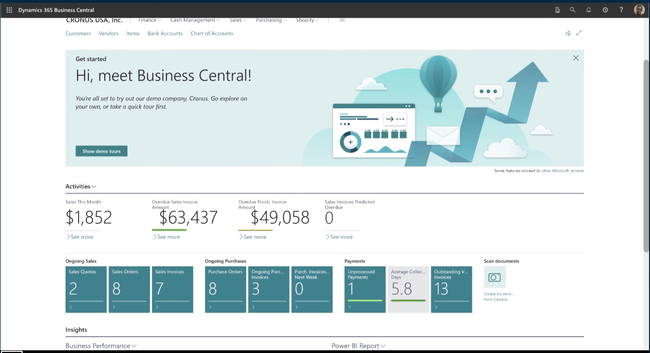

Dynamics 365 Business Central - Best for Online Banks

Dynamics 365 Business Central is best for online banks because it can scale with growing companies and effectively manage finances. Online banking has seen huge growth in the banking market over the past few years, so these companies need a scalable solution from their accounting software. Dynamics 365 Business Central can handle large data inputs and global market expansion to support growing online banks.

Plus, its financial performance features help you make more informed decisions with reporting and data analysis, all of which are easily exported to Excel. Integrated AI can help create cash-flow projections to evaluate the company’s future performance. However, Business Central can be clunky with third-party integrations, including bank management software.

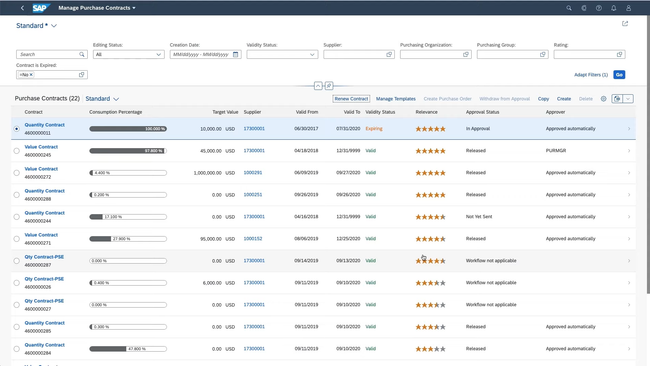

SAP S/4HANA - Best for International Retail Banks

SAP S/4HANA can handle extremely large amounts of data from enterprise companies with billions in revenue. The system helps companies stay up to date on their financials and operations with real-time data processing. With embedded AI and predictive analytics, global banks can stay ahead of market dips by budgeting for future projections.

SAP S/4HANA has an open API for businesses with several other tools, allowing easy integrations. Its user-friendly interface simplifies complex banking tasks like loan and deposit accounting, increasing bankers’ productivity company-wide. Finally, the program prioritizes security, with multi-factor authentication and user roles, to protect sensitive data. Because of the system’s complexity, SAP S/4HANA will require dedicated resources to implement.

Flexi Software - Best for Credit Unions

Flexi Software easily integrates with top credit union systems like Fiserv and Jack Henry, so businesses won’t have to change systems or operate each separately. It also features multi-entity consolidation, which is essential for credit unions with several locations that need to visualize company-wide financial data.

As a dedicated bank accounting software, it ensures compliance with key accounting rules and regulations like NCUA Regulations, the Customer Identification Program (CIP), and the Bank Secrecy Act (BSA). Its core accounting suite automates processes like AP/AR, purchasing, and general ledger, saving credit unions time on back-office tasks. However, the UI is a bit dated, which can turn away companies looking for a modern system.

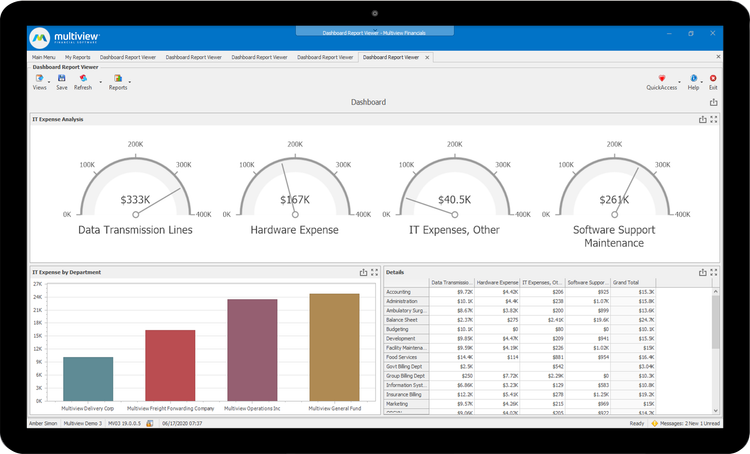

Multiview - Best for Regional Banks

Multiview includes strong reporting tools and security. The system offers its ViewPoint reporting and analytics tool, which helps banks analyze insights to better manage their finances. Multiple departments can contribute to budgeting and forecasting, enabling company-wide collaboration.

Multiview’s security measures stand out amongst other ERPs. They perform third-party testing through security consultants to find vulnerabilities and potential exploits. The system is also constantly monitored for machine health so it doesn’t crash and cause downtimes. These features are essential for banks, as they contain sensitive information that customers trust them to keep private.

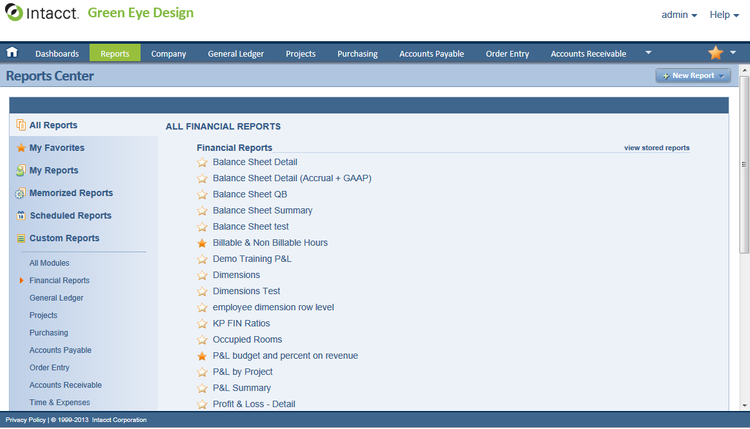

Sage Intacct - Best for Community Banks

Sage Intacct is a solid fit for small community banks that require financial management. While it’s built for smaller businesses, the system includes multi-entity management and prebuilt GAAP compliance to support community banks with multiple locations.

Its modern interface and customizable dashboards show specific metrics and KPIs like revenues, expenses, and profit margins. Sage integrates well with other systems, including CRM and payroll systems like Salesforce or ADP, helping businesses sync data across multiple platforms. Leveraged as a bank accounting software, Intacct also offers a fraud detection feature, which identifies suspicious activity for banking security.

CustomBooks - Best for Niche Banks

CustomBooks provides strong accounting features at a more affordable price. Its cloud banking module auto-syncs transactions into the system to make data entry more efficient. This allows for total control over finances, which is ideal for small banks to save money from slipping through the cracks.

The midsize Business plan is $99/month. This package includes essential modules like reports, sales, banking, and accounting, making it suitable for niche banks that don’t require advanced large-scale ERPs. However, its interface leans traditional, with multiple icons displayed on-screen at once, which may take some getting used to.

What is Bank Accounting Software?

Bank accounting software is a system used by financial institutions to help automate and streamline back-office processes. These specialized systems help banks and credit unions manage financial transactions, records, reporting, and multi-entity accounting all in one platform. They also integrate with bank management systems like Jack Henry to create a unified system.

Accounting software for banks most commonly uses ERP systems that can handle complex transactions like loans and deposits while also including advanced features like projections, budgeting, and global enterprise management.

Key Features

- Core Accounting Automation: Automate general ledger, accounts receivable, and accounts payable processes.

- Reporting: Create financial reports on key metrics with data from multi-entity consolidation. Metrics include budgets, revenues, and expenses.

- Security: Ensure sensitive customer information is secure through encryptions, fraud detection, and user roles.

- Integrations: Integrate the system with a current bank management software to create an all-in-one system that enables data synchronization.

- Compliance: Ensure compliance with strict banking laws and regulations like customer protection laws and reporting requirements such as credit risk.

- CRM: Manage a large number of customers and clients by storing all information within one database for easy access. Extract target demographics to support sales and marketing campaigns.

- Global Support: Support multi-currency and international transactions with different languages.

- Audit Trails: Record all transactions to support audit processes.

Primary Benefits

Efficiency and Accuracy

Bank accounting software allows financial institutions to automate routine tasks like transaction entries to save businesses time and effort. Because they are done automatically, data inputs made by the system are always accurate and accessible in real time. Double-entry accounting systems also ensure accuracy compared to manual entries on spreadsheets, which are prone to human error.

Security

Banks and credit unions must keep all customer information secure and compliant with banking laws. Bank accounting systems are encrypted to protect against possible hackers to prevent data from being stolen. Other features like fraud detection and employee permissions also keep the data secure while detecting fraudulent activities on accounts.

Enhanced Financial Management

Accounting systems for banks help companies manage their finances more effectively with features like multi-entity support, budgeting, and revenue forecasting. This allows banks with several locations to consolidate data into one database for efficient reporting and chart generation, enabling granular insights.

Pricing

Bank accounting systems typically cost between $70 and $10,000/month. This extremely wide range is dependent on many factors, such as company size, number of users, and overall budget. Because most systems are ERPs, pricing is not publicly available, so financial institutions must request a quote from the developer to get an exact price.

One exception to that range is SAP S4/HANA, whose starting price is over $10,000. This system is built for global enterprises with hundreds of entities, making it suitable only for enterprise-level commercial banks.

Smaller companies like niche banks that only require more basic features can purchase a non-ERP system like CustomBooks for less. This system can cost as little as $19/month and goes up to a maximum of $349/month, making it more affordable than full ERPs like NetSuite or Multiview.