The Best Free Accounting Software for Small Businesses

Free software for small business bookkeeping can cut costs while still giving you essential tools like invoicing and expense tracking. In this guide, we cover the best free options and their limitations, so you’ll know when it’s time to upgrade.

- Client portal with sales and purchase approvals

- Easily integrate with dozens of Zoho products

- Time-tracking

- Community version is free

- Heavy customization options

- Double entry inventory system

- Accounting features are free

- Multi-currency invoicing

- Unlimited bank accounts and credit cards

Running your small business isn’t cheap, and every expense adds up. One way that many small businesses can cut costs while remaining competitive is to use free accounting software. Free accounting software is a great way to simplify and automate financial tasks such as core accounting, invoicing, or expense reports.

- Zoho Books: Best for Startups

- Odoo: Best for Scalability into ERP

- Wave: Best for Professional Services

- ZipBooks: Most User-Friendly

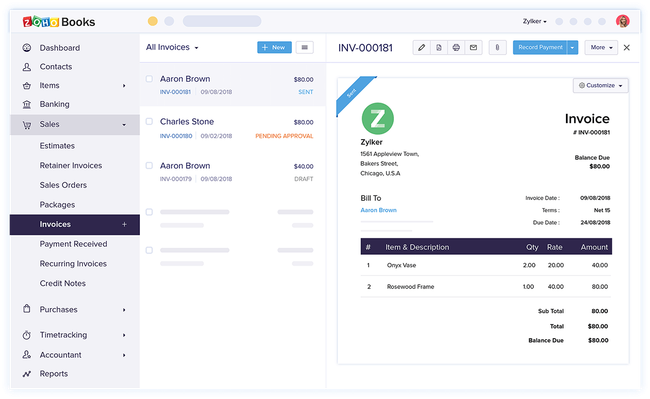

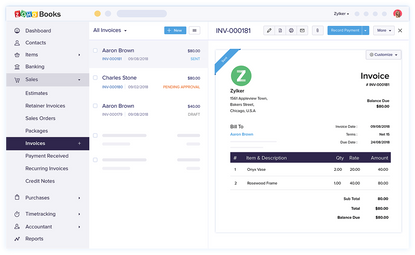

Zoho Books - Best for Startups

Zoho Books is ideal for freelancers and smaller organizations. Its recurring billing and ACH payments workflow also makes it a good fit for product-based and eCommerce businesses. You can select from 21 invoice templates or create your own HTML version, then set up a schedule for repeat customers. With each cycle, Zoho Books generates invoices automatically and supports direct ACH transfers, so payments flow directly from customer bank accounts.

Zoho also provides online retailers with sales tax automation, a feature most accounting tools still manually handle. You can set rules that apply the correct tax based on your and your customers’ locations. Combined with its inventory management tools, it gives product sellers a toolkit to track stock levels and streamline order-to-cash processes.

However, the free plan limits eligibility to companies making less than $50,000 per year and does not offer multi-currency support. Starting at around $40/month, the Professional plan adds support for multiple users. Composite items and multi-warehouse management require either the Elite plan or integration with Zoho Inventory.

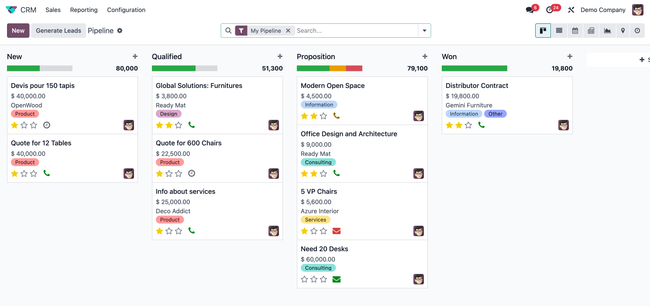

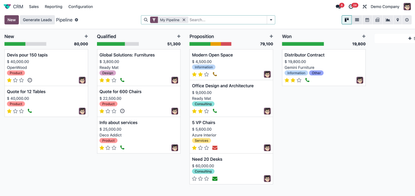

Odoo - Best for Scalability into ERP

As part of Odoo’s “one app plan,” companies can use the accounting module for free, gaining access to accounts payable and receivable alongside automated reconciliation. This makes it a strong choice if you’ll need ERP-level control down the line, especially as your business grows. While most free tools only offer invoicing basics, Odoo provides tools more commonly seen in mid-market ERP solutions, like:

- AI-powered expense matching

- Customizable chart of accounts

- Cost code assignments

Another differentiator is invoice customization. You can choose from seven templates and modify headings, footers, and sections to best suit your needs. Unlike Wave, Odoo doesn’t stamp free invoices with a watermark, so documents look professional right out of the box.

However, the tradeoff is complexity. The platform doesn’t walk you through workflows, expecting you to configure them to best match your operations. This could be a challenge for solopreneurs without accounting expertise. Additionally, as your company scales, you’ll likely need to add modules like inventory or CRM. This would bump you into the paid plans starting at $38.90/user/month.

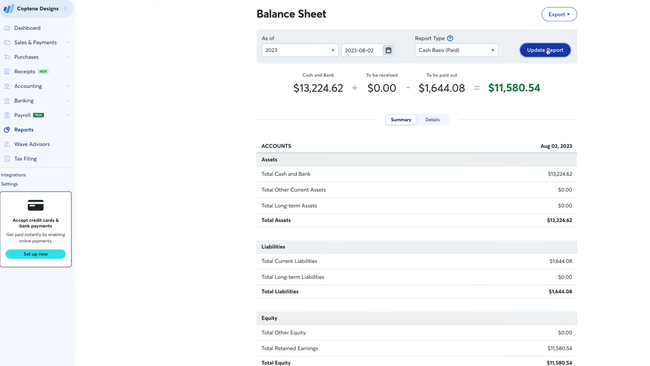

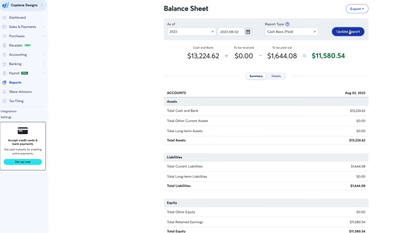

Wave - Best for Professional Services

Wave Accounting includes automated invoicing and payment collection flow for project-based work or hourly billing. You start by creating an invoice in one of three templates, then apply your branding and accent colors. You can then send it to your client, which triggers a follow-up cadence with reminders that nudge clients about due dates.

For recurring projects, you can flip a client to automatic billing and even enable autopay, so charges occur on a schedule rather than relying on manual entry. This is where Wave delivers the most value: this closed loop of sending, reminding, auto-billing, and settling funds. For professionals who would rather focus on clients than accounting, Wave also provides outsourced bookkeeping services starting at $149/month.

Wave’s free plan is best for freelancers and small businesses with fewer than ten employees, particularly those in professional services where transactions are invoice-driven. However, invoices carry a “powered by Wave” watermark on the free plan, and customization is minimal compared to systems like Zoho Books. While invoicing tools are completely free, payment processing fees vary by method, with credit card payments generally around 2.9% plus transaction fees.

ZipBooks - Most User-Friendly

ZipBooks is best for freelancers needing simple workflows and in-app guidance. Its defining tool is the invoice quality scoring engine, which analyzes as you build them. If you create an invoice without a logo or clear terms, ZipBooks prompts you to add them. Skipping details like customer notes or categories prompts ZipBooks to offer ways to make the document look more professional. This is especially useful if you don’t have a dedicated bookkeeper but want to build customer trust and encourage faster payments.

The workflows themselves are intentionally simple. From the home dashboard, you can search across all records and link invoices directly to clients, vendors, and expenses. This stands in contrast to Odoo, which provides ERP-level flexibility. ZipBooks focuses on keeping everything easy to find, standardized, and approachable. Its US is straightforward and avoids overwhelming users with options, providing a lightweight system with actionable feedback.

However, ZipBooks’ free plan is one of the most limited:

- Supports only one bank account connection

- Only offers four basic reports

- Requires upgrade for time tracking & reconciliation

The Smarter plan at $15/month adds recurring invoices, saved items, reminders, auto-billing, time tracking, and multiple bank connections.

How to Choose Free Accounting Software

With all these free accounting software products, how do you know which will be best for your business? There are a few criteria that you should consider, including the individual features, the scalability of the software, the integrations offered, and the deployment method (cloud-based or on-premises).

You should also factor in the bookkeeping software’s ease of use. Small business owners are not always trained accountants, so an intuitive interface and easy-to-understand tools can be critical to their success.

Compare some of the top free accounting software options:

Is Free Accounting Software Actually Free?

As seen above, there are genuinely free software options. Still, each of them has limitations regarding features, scalability, integrations, and connectivity. Odoo’s “one app plan” is forever free software, but you’ll likely need to upgrade to a paid tier as your needs grow to include inventory management or CRM. On the other hand, Zoho Books is totally free, but because it only offers support for one user and one accountant, you may feel compelled to upgrade to their paid plan. Free accounting software only gives you a taste of the features you could get from their paid plans.

When Should You Use Paid Software?

When your company reaches a certain size (such as over $1 million in annual revenue), you will need to move beyond the basic bookkeeping functions of free software and graduate to paid software that can do more for you.

Additional solutions like QuickBooks Online, Xero, and FreshBooks have more inventory and project management features that can benefit your growing business.

Also, free accounting software options have limited customer support (if at all), so a paid software option will be necessary if you need advanced assistance.

Looking to compare paid accounting software for your small business? Check out our list of the best accounting software. Or get free help from one of our software advisors.