The Best Government & Public Sector ERP Software

We’ve analyzed the top ERP systems for governments and public sector organizations of all sizes. These platforms help consolidate data across the entire agency, and include key features such as grant management and capital budgeting.

- Drag-and-drop tools to customize data visualization

- Exports data to Microsoft Excel

- Simplified property and asset management through GIS integration

- Cloud accounting solution

- Comprehensive training resources

- Modules for accounts payable, receivable, etc

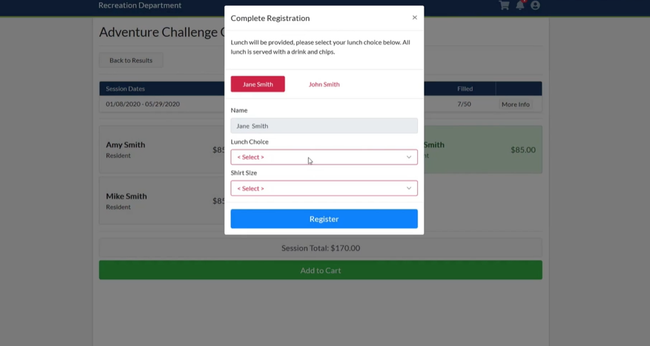

- Web portals and mobile apps for employees, residents, and vendors

- Can customize the system by only selecting specific modules that you need

- Streamlines finance, payroll, clerical work, and utilities operations

It’s well-known in the private sector how ERP software can streamline operations to increase profits. Yet many are still unaware of how ERP solutions can improve public sector and government entities.

Learn more about these products to find the right ERP software to streamline your public sector services:

- Tyler Enterprise ERP: Best Overall

- Blackbaud Financial Edge NXT: Best for Fund and Grant Management

- Edmunds GovTech: Best for Small Municipalities

- CenterPoint Fund Accounting for Government: Customizable Reporting

- Spectrum by Harris Local Government: Modular Architecture

- Caselle Connect: Advanced Financial Modules

- OpenGov ERP: Best for State Agencies

- MIP Fund Accounting: Holistic Grant Management

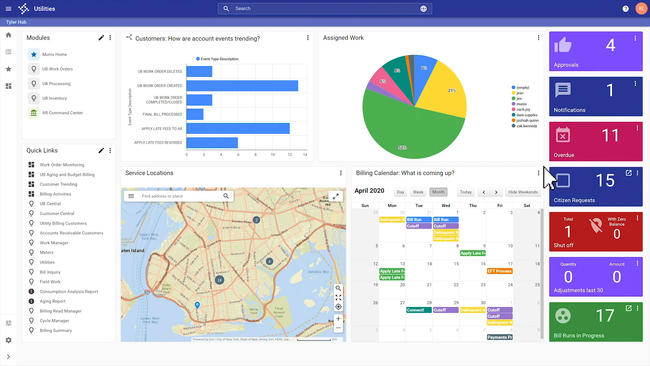

Tyler Enterprise ERP - Best Overall

Tyler Technologies’ Enterprise ERP is one of the most widely adopted public sector ERP solutions that supports counties, cities, and state agencies across the United States. The platform was built specifically for government operations, offering a complete suite that covers finance, human resources, procurement, and citizen services.

What sets Tyler Tech apart is its comprehensive financial management that handles everything from budgeting and payroll to procurement and compliance reporting. Governments can track restricted funds accurately, ensure compliance with GASB standards, and generate detailed reports for auditors to review. It also includes role-based security permissions that ensure only authorized employees can access restricted financial information. These tools help state and local governments manage large, complex districts while maintaining accountability and public trust.

Tyler ERP is sold modularly, allowing organizations to start with core finance and expand into other areas like utility billing, permitting, and licensing over time. And while it delivers strong administrative capabilities, it lacks built-in project management, so organizations will need to purchase third-party tools for capital or infrastructure projects. Pricing quotes are tailored to an organization’s size and desired modules; Tyler ERP is often considered a premium-priced option compared to other options we reviewed.

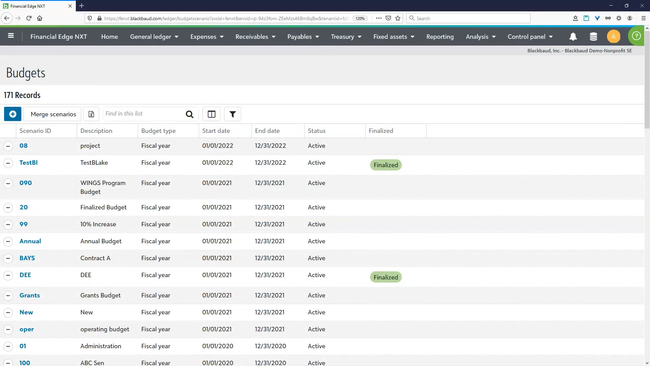

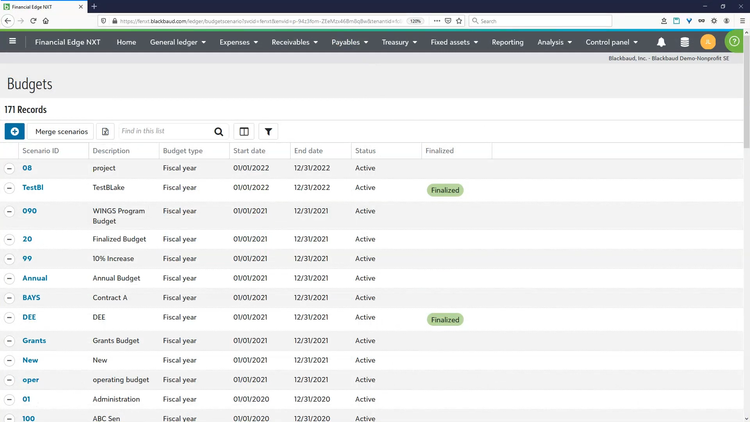

Blackbaud Financial Edge NXT - Best for Fund and Grant Management

Blackbaud Financial Edge NXT is a financial management software designed for the unique needs of governments and nonprofits. Built with fund accounting at its core, the platform helps the public sector accurately track tax dollars and complex grant funding.

Blackbaud FE stands out for its grant lifecycle management. Governments can set up detailed budgets, allocate funds across individual departments or programs, and track every expense using grant-awarded dollars. It also helps organizations automate reimbursement by calculating direct and indirect costs to ensure no dollars are left unclaimed. And if restricted funds are misused, the system automatically flags those transactions before they become audit issues.

Because Blackbaud focuses heavily on accounting and grant oversight, it does not deliver the broader operational modules like payroll or procurement that you might expect in a full ERP. This makes it a better fit for organizations that already have tools for administrative functions and need a system for financial and grant management. Pricing is quote-based and generally scales based on user count, required modules, and grant complexity.

Edmunds GovTech - Best for Small Municipalities

Edmunds GovTech specializes in catering to the needs of smaller municipalities with a user-friendly interface packed with features. It brings core public sector functionality for finance, tax administration, utility billing, and payroll into a single platform. Edmunds provides an approachable option for townships, boroughs, and smaller city governments that need modernized software but don’t have the resources for a system like Tyler Technologies.

The included utility billing and collections module lets municipalities manage water, sewer, and electrical services with unlimited meters and customer accounts. It supports automated meter readings, recurring billing, and delinquency tracking, helping smaller organizations run utility services professionally. Additional tools for managing work orders allow maintenance teams to track jobs, while drill-down reports help finance teams or city clerks monitor revenue and outstanding balances. And with a built-in customer self-service portal, bills can be paid online without burdening departments with minimal staff.

Edmunds is tailored to smaller municipalities, so it does not offer the same advanced reporting or workflow automations as larger systems like Tyler Technologies. Pricing is quote-based but is generally more affordable than enterprise ERP platforms, making it a practical fit for governments that require integrated finance with tax and utility billing in one system.

CenterPoint Fund Accounting for Government - Customizable Reporting

CenterPoint Fund Accounting for Municipals offers adaptable reporting features tailored to governmental accountants. It delivers the ability to craft bespoke reports for specific funds, including grants, departments, or projects. With built-in budgeting and forecasting tools, CenterPoint offers custom reports for a holistic financial overview. Finally, it ensures compliance by incorporating GSP reporting essentials.

Spectrum by Harris Local Government - Modular Architecture

Unlike some ERP systems that might require a full-scale rollout, Spectrum’s modular design allows organizations to implement it department by department. Municipalities can integrate these modules to form a cohesive system as needed, offering flexibility and a tailored approach. This can reduce disruption and improve the chances of successful adoption.

Spectrum covers a broad range of applications from applicant tracking to asset management, budgeting, purchasing, and employee history. It meets the essential needs of local governments and utility authorities in a single suite.

Caselle Connect - Advanced Financial Modules

Caselle Conect presents modules ranging from credit card authorization to materials and project management. The system goes beyond basic financial management to deliver end-to-end auditing. This ensures that each transaction is traceable from start to finish. Additionally, it makes GASB reporting easy, enabling the tracking of fixed assets and capital projects. Lastly, the materials management and project management tools help organizations comply with GASB 34 requirements.

OpenGov ERP - Best for State Agencies

The budgeting and performance management suite in OpenGov gives state agencies a more transparent way to allocate and plan resources. The AI-assisted budget builder includes guided workflows that auto-track changes, flag errors, and ensure version control, minimizing manual rework.

The platform also offers a digital budget book tool. This makes publishing interactive, GFOA-compliant reports online or exporting them as PDFs easy. Finance teams spend less time formatting spreadsheets, freeing them up to focus more on outcomes.

Plus, OpenGov factors performance management into each step of the budgeting process. Your team can link every funding decision to KPIs, goals, and outcome metrics—whether they’re assessing infrastructure timelines or measuring the results of a public health program. Real-time dashboards give department directors a clear view of what’s on track and where course corrections are needed.

OpenGov is a higher-tier government ERP software; it’s ideal for agencies with 100 to 500 employees, with the total cost of ownership falling somewhere in the $100,000–$350,000/year range. Like most platforms in this space, final costs require a custom quote.

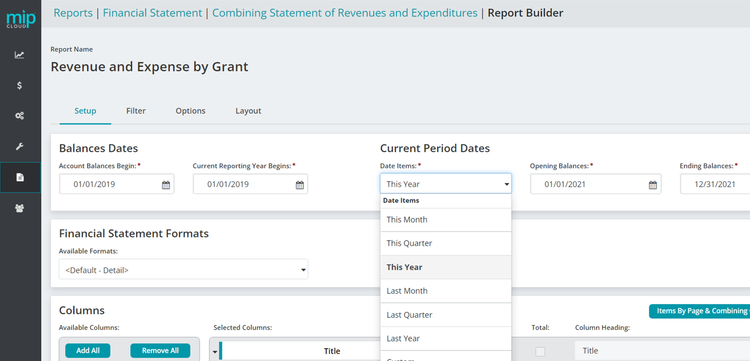

MIP Fund Accounting - Holistic Grant Management

MIP Fund Accounting is a top pick for its comprehensive grant management capabilities. The software allows organizations to maintain comprehensive profiles for each grant. This includes tracking grantor details, contact information, reporting periods, indirect cost rates, notes, custom fields, and more.

For every grant, users can view all financial activity, including outstanding invoices, payments, and credits. This detailed transaction tracking ensures transparency and helps organizations comply with grant stipulations.

What is ERP Software for Government and the Public Sector?

ERP software for use by government and public sector organizations is designed to make it easier to deliver services, manage resources, and maintain transparency in the delivery of public services. This software enables government organizations to better serve their constituents while adhering to regulatory requirements and fiscal responsibilities.

More specific government accounting software can offer more financial functionality and Government Accounting Standards Board (GASB) compliance.

Key Features

Government ERP software should include the following key features:

- Financial Management: Use these tools to manage budgets, allocate funds, track expenditures, and generate financial reports. Most importantly, maintain transparency and compliance with financial regulations.

- Grant and Fund Management: Public sector organizations frequently receive and distribute grants and funds. ERP systems assist in managing grant applications, tracking fund disbursements, and ensuring accountability.

- Budgeting and Planning: ERP systems assist in creating, managing, and monitoring budgets, helping government agencies allocate resources effectively.

- Compliance and Security: ERP solutions in government settings must adhere to strict security and compliance standards to protect sensitive data and maintain the integrity of government operations.

- Human Resource Management: This module handles employee data, payroll processing, benefits administration, recruitment, and workforce planning. It ensures efficient management of government employees and compliance with labor laws.

- Project Management: For government initiatives and projects, ERP software aids in planning, scheduling, and tracking progress. It helps manage resources, monitor budgets, and evaluate project outcomes.

- Workflow Automation: Automation features streamline routine processes, reducing manual work and improving efficiency. This is especially important for government agencies dealing with high volumes of paperwork.

- Performance Management: Various performance measurement and evaluation tools to assess the effectiveness of government programs and services.

- Reporting and Analytics: A range of customizable reporting and analytics capabilities allow government organizations to make data-driven decisions and meet reporting requirements.

- Inventory Control: Streamline the procurement of goods and services from requisition to purchase order to payment.

Benefits

There are many benefits to using ERP in government organizations and the public sector. In addition to automating a wide range of workflows, an ERP can give real-time insight into performance. This also increases transparency by clearly showing operations and building audit trails.

ERP also offers government and public sector organizations additional data security by keeping all information secure in one location. No more creating endless passwords for different programs. Instead, an ERP keeps everything under a single lock and key. And having one software instead of many reduces overall operational costs, particularly useful for charitable and nonprofit organizations.

Pricing

Pricing for government ERP software can range from $10,000 for small municipalities to over $1 million per year for state-level use. Final costs depend on factors like the number of modules purchased, user count, implementation scope, and deployment model. Some vendors may price based on population served or annual operating budget.

| Tier | Size | TCO | Example Products |

|---|---|---|---|

| Entry-Level | <25 employees | $10,000–$25,000/year | Edmunds GovTech Basic Suite, Caselle Complete, Tyler Incode (basic) |

| Mid-Tier | 25–150 employees | $25,000–$100,000/year | Edmunds Full Suite, Tyler Incode (advanced) |

| High-Tier | 150–500 employees | $100,000–$350,000/year | Tyler Enterprise ERP, OpenGov (full suite), CGI Advantage, CityView Enterprise |

| Enterprise | 500+ employees or state-level use | $350,000–$1 million+/year | Oracle Public Sector Cloud, SAP S/4HANA, Tyler Enterprise Suite |

What to Look For

Along with the key features, there are other things to consider when looking at ERP software for a government or public sector business. To ensure the system works in your organization’s best interest, remember to look for:

- Public Engagement Tools: Some ERP systems offer citizen portals or self-service features, allowing citizens to access information, submit requests, and interact with government agencies online.

- Software Integration Options: ERP software should seamlessly integrate with other government systems, such as tax management, land records, and case management, to create a unified platform for data sharing and decision-making.

- Remote and Mobile Accessibility: Many ERP solutions now offer mobile apps or responsive web interfaces, enabling government employees to access critical information and perform tasks remotely.