Patriot Software Review: Pros, Cons, Ratings

We like Patriot Software’s affordability, payroll integration, and unlimited accounting users. Unlike more expensive options, Patriot allows a full accounting team to access the platform without additional fees. We also like how seamless and easy it is to integrate the accounting solution with their payroll module.

- Create & print unlimited 1099 and 1096s

- Does not require use of their accounting package

- Low starting price

- Customizable invoices

- Difficult to upload 3rd party time sheets

- Limited inventory management

- Limited report customization

- Developer Patriot Software, Inc.

- Client OS Windows

- Deployment Cloud Hosted

What Is Patriot Software?

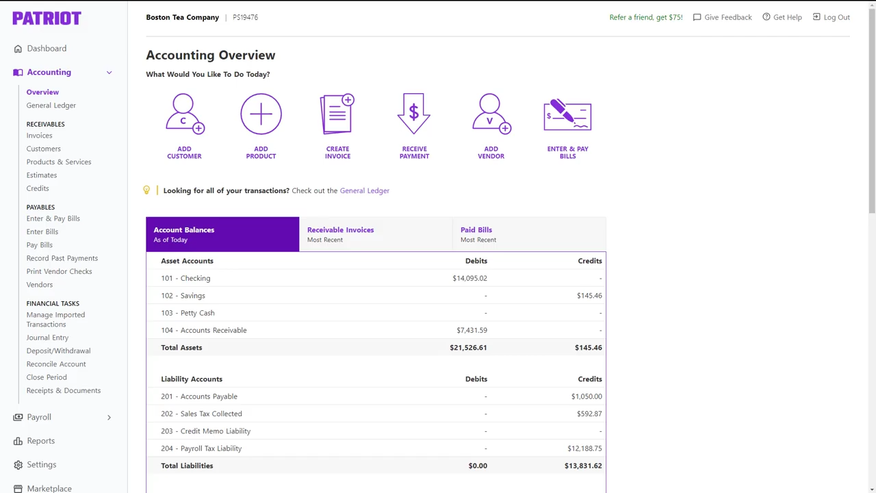

Patriot Software is cloud-hosted 1099 and accounting software that allows for basic payroll handling. It also gives payroll services the option to cover all aspects of filing and depositing taxes. In addition, the accounting package lets users quickly pay vendors, handle invoicing, record payments, and track cash bank deposits and withdrawals.

Our Ratings

| Usability - 8 | Navigable and user-friendly interface; presents accounting processes in straightforward language for better accessibility; does not allow users to edit employee info during payroll process; data entry can be challenging on phone or tablet. |

| Support - 10 | Offers email, phone, and live chat support from 9 am - 7 pm EST Mon-Fri; includes help icons within the software to provide contextual guidance; training articles and videos within the platform explain common accounting tasks. |

| Scalability - 6.9 | Provides fewer integrations compared to solutions like QuickBooks; offers integrations for time tracking and human resources functionalities; not a great option for larger businesses with complex payroll facets. |

| Security - 10 | Supports multi-factor authentication; can download financial reports in CSV format. |

| Value - 8.4 | Affordable price point compared to similar accounting software; can incur higher monthly costs when implementing add-ons in time tracking and HR; recurring invoices available for $30/month, comparable to QuickBooks. |

| Performance - 8 | System instantly auto-calculates hourly and salary employee payments, product totals, etc; experienced delays when approving payroll and navigating to the Invoices page. |

| Key Features - 8.1 | Takes less than 3 minutes to run payroll; can drill down into individual transactions from financial reports, but customization is restricted; limited inventory management does not allow tracking item quantities. |

Who Uses Patriot Software?

We recommend Patriot Software for nonprofits and small service businesses. This financial solution is for business owners without an accounting background who want to streamline their payroll processes and payments to contractors and vendors.

What Features Are Missing?

Inventory management: Though users can add products and services to Patriot Software, they cannot specify the quantity on hand or track item locations. It also does not allow users to set sales prices or costs, but they can create service and product records for invoice use.

Pricing Plans

| Plan | Pricing | Features |

| Accounting Basic | $20/month/unlimited users |

|

| Accounting Premium | $30/month/unlimited users | Includes Accounting Basic features, plus:

|

| Basic Payroll | $17/month (+$4 per employee/contractor) |

|

| Full Service Payroll | $37/month (+5 per employee/contractor) | Includes Basic Payroll features, plus Patriot helps file the following:

|

Does Patriot Software Have Time Tracking?

Patriot Software does not have a built-in time-tracking module. Still, users can integrate this functionality into the software as an add-on. Features include custom overtime rules, time summary reporting, manual hour entry or time punch, and an employee portal. Pricing starts at $6/month at $2 per employee.

Does Patriot Payroll Pay Taxes?

Patriot Software will file and deposit your federal, state, and local payroll taxes if companies have the Full Service Payroll package. Each additional state filing is $12 per month per state. The Full Service Payroll version of Patriot will also submit companies 940, 941, W-2, and W-3 data to the relevant tax agencies each quarter or at the year’s end for no additional fee.

Does Patriot Software Offer HR Tools?

In August 2024, Patriot Software introduced a free HR Center for its payroll and HR customers. Payroll software customers can access customized HR compliance alerts and an assessment tool. HR software customers will find more advanced features like HR document templates, sample policies, and even an LMS system.

Alternatives

Summary

We recommend Patriot Software for nonprofits and smaller organizations in the service industry. With straightforward explanations of everyday financial practices and a user-friendly design, it’s the perfect solution for the small business owner without an accounting background.

However, inventory-based businesses should look for another option. While Patriot Software does allow users to add products and services to the platform, users cannot track stock levels or item locations. Furthermore, mid-level and enterprise companies will likely need software with more human resources functionalities.

Patriot Software is still a great pick for its inexpensive accounting functionality, quick and easy payroll, and unlimited user access.

User Reviews of Patriot Software

Write a ReviewPatriot is an easy to use program that costs only $10/month

Patriot is an easy to use program that costs only $10/month and starts at $2/employee but decreases as you add more. They provide an automated report you can use for payroll taxes, or you can get the full service payroll which does this for you which costs $25/month.

Both options provide an employee portal where people can update their information and view payroll history. For $5/month more you can get a time and attendance system to track employee hours.