Fund Accounting Software Buyer Trends

A 2018 survey of 516 organizations purchasing fund accounting software.

Each year, thousands of nonprofits and government entities contact Software Connect for help selecting fund accounting software. These regular conversations provide us unique insight on market trends and software buyers’ needs.

We reviewed our notes on a random sample of 516 software buyers looking for fund accounting systems in the past two years. We have categorized and analyzed their motivations and requirements in the following report.

Key findings:

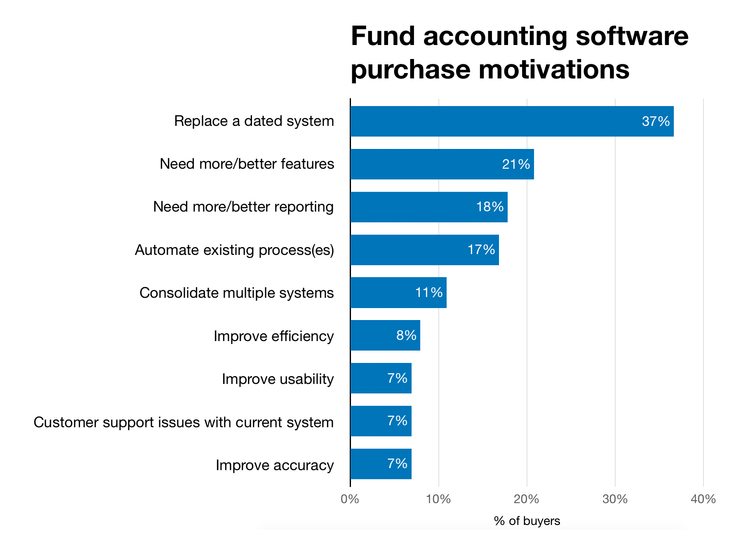

- Fund accounting software buyers are more likely to replace aged/dated systems. 37% of our sample reported “replace a dated” system as their search motivation. That’s 16 points higher than the average for all software categories.

- QuickBooks has smaller market share in the nonprofit/government sector. 20% of fund accounting buyers are coming from QuickBooks, compared to 35% for all accounting systems.

Purchase Motivations

Well over one-third of software buyers wanted to “to replace a dated system.” Buyers coming from dated systems were far more common in the fund accounting space (37 percent) than in general accounting (29 percent), and even more so than across all software categories (22 percent).

Why are so many nonprofits and government entities coming from dated systems? Mostly out of necessity. Liesa Malik of Tangicloud explained, “This goes back to tight budgets and that ‘making do with what you have’ mentality. Organizations may hang on to software for 10, 15, even 30 years.”

The next most common purchase motivations cited a need for more or better features (21 percent) and reporting (18 percent). For example, an Ohio-based low-income senior housing provider needed better purchase requisition features. They needed a system that can “route requests to the appropriate departments so when orders are received, the costs coordinate with the originally approved amount and can be checked against if there are discrepancies.”

For-profit software publishers offer great software for commercial operations. But when a software publisher focuses on developing solutions for a specific market like nonprofit & government, they are not likely to bolt on a few features and call it a day. These publishers spend years in the industry developing expertise and mindset, then use that knowledge to completely embed crucial functions and features throughout the accounting system. Liesa Malik, COO, Tangicloud

Another less common purchase motivator included customer support support issues with their current software. For example, one California municipality of 35,000 residents sought to displace a custom ERP system with an off-the-shelf product. Their custom system had been developed by a single employee who was retiring, and they needed a replacement with consistent support.

QuickBooks and Fund Accounting

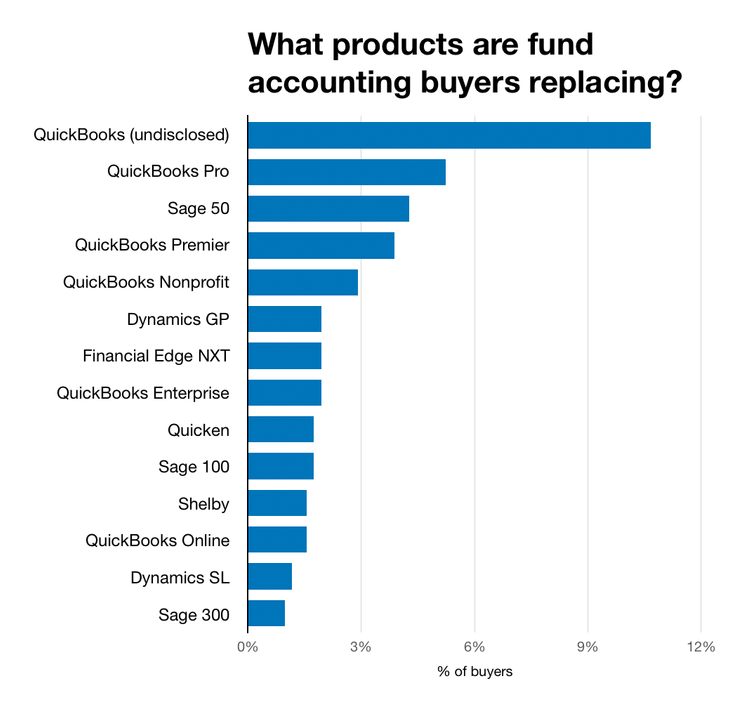

It’s difficult to talk about any accounting-related system without mentioning QuickBooks; it’s the 400-pound gorilla in the room. However, QuickBooks seems to have a smaller market share in fund accounting than other verticals. In our general accounting software buyer study, we found that 35 percent of buyers were replacing QuickBooks. For fund accounting buyers only, that proportion dropped to 20 percent.

Quickbooks is a terrific bookkeeping software for those just getting started. It’s easy to use and they have great training documents. A nonprofit with just one or two paid employees can use this software happily. However, as an organization grows, Quickbooks is challenged with fully operating in the fund accounting world. Larger organizations have a need for more general ledger segments, advanced allocations, budget controls, workflow and approvals and other features to help manage spending and reporting to funders. Quickbooks lacks the depth of functionality required to manage these needs. Tangicloud’s Malik

A Christian nonprofit that supports children in East Africa told us they planned to replace QuickBooks in favor of an industry-specific product to improve financial visibility between offices. They were motivated to improve grant tracking, citing funds specifically for “child sponsorship, education, feeding ministry, activity day and clothing distribution.”

Fund accounting software can save considerable time and labor over for-profit accounting systems. For-profit systems typically require another reporting layer (if even available) to track restricted funds.

Deployment Preferences

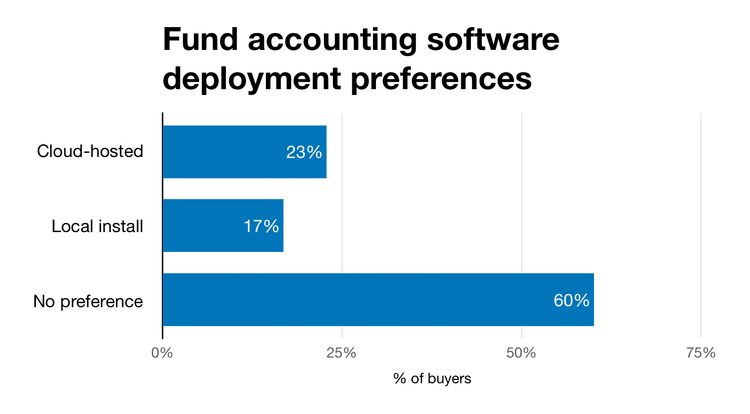

More than half of organizations surveyed (60 percent) have no preference as to whether their software is cloud-hosted or installed locally. Those who did express a preference were fairly evenly split, with 23 percent preferring the cloud and 17 percent opting for a local install.

The market is very confused about cloud deployment options and technologies. Many accounting software vendors do not offer true SaaS (Software as a Service) solutions where the software platform is optimized for deployment in the cloud. Tangicloud’s Malik

Spending Limits

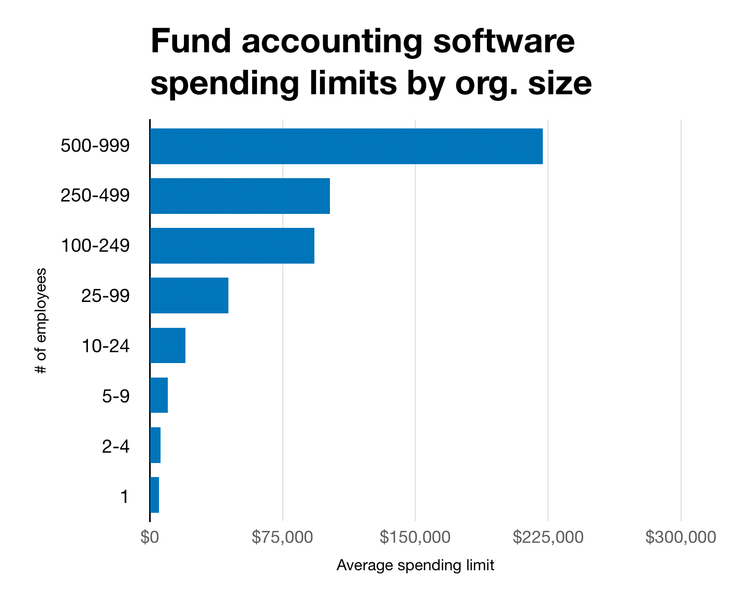

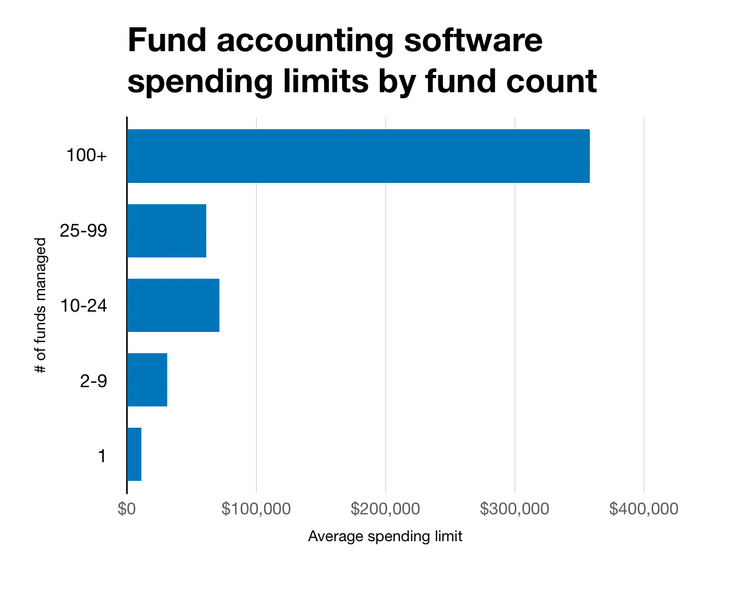

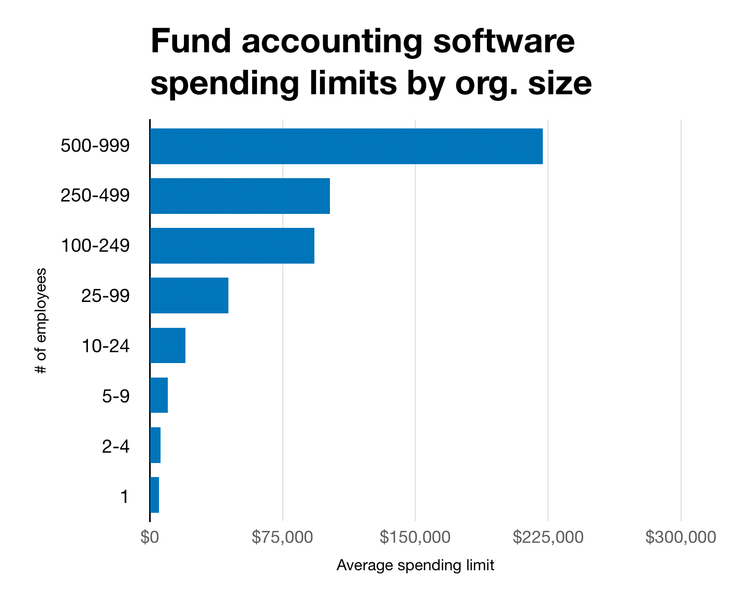

Typically spending limits are correlated with annual revenue, accounting operation complexity, and/or organization size. The average budget for software buyers with more than 1,000 employees was more than $3.4 million. Meanwhile, those with 500 to 999 employees spent more than twice as much ($222,024) as the next-largest group (250 to 499 employees), which budgeted an average of $101,768.

Interestingly we also found a correlation between organizations managing more funds and larger spending limits. However, we know that shouldn’t be the case. Large organizations may have no funds at all when they derive their revenue from fees or memberships. Small organizations may have many funds, yet have low revenue. Regardless, we thought it was interesting to share.

Demographics

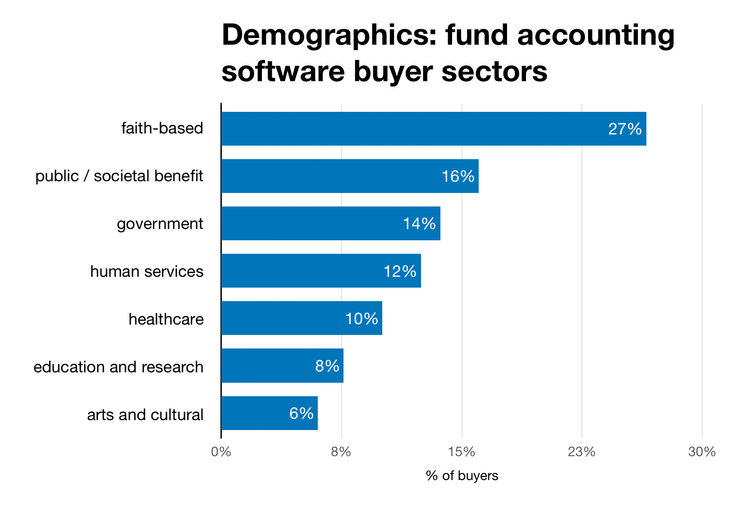

Slightly more than one-quarter of software buyers in our report are faith-based organizations, whereas 16 percent are nonprofits that specialize in public or social benefit. Another 14 percent are government entities, 12 percent operate in human services and 10 percent provide healthcare. The rest of the participants fall into the categories of education and research or arts and culture.

In terms of size, the largest proportion (34 percent) have between 10 and 24 employees, followed by the 19 percent of organizations with 25 to 99 employees. Only 11 percent have more than 250 workers, whereas 5 percent are run by a single person.

The Takeaway

Improved financial clarity is crucial for nonprofits and agencies looking to lower operational costs and maximize the impact of each dollar. The ability to demonstrate responsible financial stewardship and application of funds to their intended purpose is often a prerequisite for accessing or continuing to access grants or endowments. The results of failing to meet specific spending restrictions can have negative consequences, including discontinued funding. By improving their ability to document the impact of previous expenditures, nonprofits can improve their ability to receive future funding.

Software Connect provides free software research and recommendations for end users looking to evaluate software options.