How to Calculate Total Manufacturing Cost

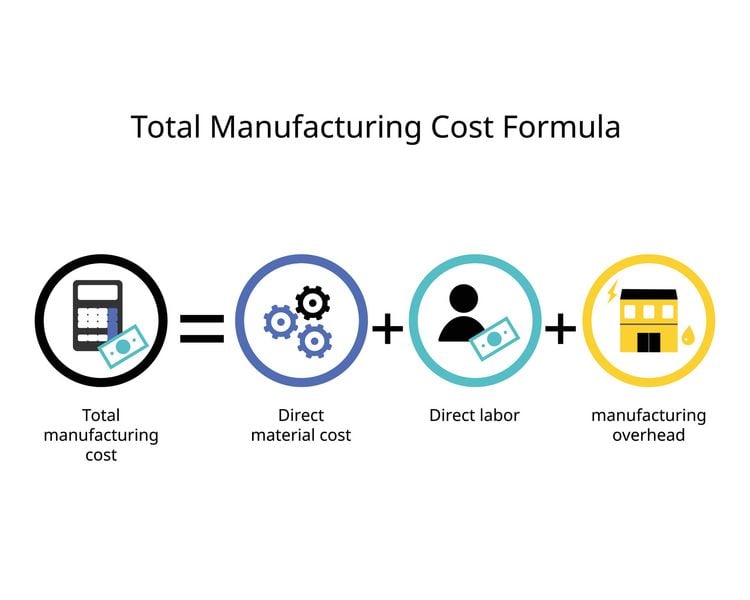

Calculating total manufacturing cost involves a simple formula:

Total Manufacturing Cost = Direct Materials + Direct Labor + Manufacturing Overhead

While this formula is as easy as adding these costs together, you must first know how to calculate direct materials, direct labor, and manufacturing overhead. These calculations are only possible by maintaining detailed financial records on each variable. Determining the total cost of creating a finished product will help inform financial decisions such as setting product pricing, determining profit margins, and increasing productivity.

Direct Materials Cost

Direct materials are the raw materials used in the creation of a product. The cost of raw materials can fluctuate based on the amount of material purchased and the current price of the materials at the time of purchase. The price of these materials may also include shipping costs, so buying in bulk can be a way to cut down on expenses.

The formula to determine this cost is as follows:

Total Direct Material Costs = Beginning Direct Materials + Purchased Direct Materials - Ending Direct Materials

The beginning direct materials are those you have already purchased for a production run. Next, the “purchased direct materials” are the materials that still need to be bought for manufacturing the product. Finally, the “ending direct materials” are any surplus leftover from the previous production run.

Example: A blanket factory wants to run production on an order of blankets. The factory already purchased $5,000 worth of fabric for this production run (Beginning Direct Materials), and $1000 worth of filling material still needs to be bought (Purchased Direct Materials). There was $1500 worth of filling material and fabric leftover from the last production run (Ending Direct Materials)

$5,000 + $1,000 - $1,500 = $4,500 Total Direct materials

Direct Labor Cost

Direct labor is the labor done by employees responsible for the hands-on work that goes into manufacturing the products. These employees might include assembly line workers, machine operators, and quality control. Workers like janitorial staff and supervisors all play an essential role in the success of your business, but they are considered “indirect labor” for the sake of these calculations.

To calculate the direct labor cost, you must determine your workers’ direct hourly labor rates and the direct labor hours per unit. Next, add the payroll taxes that your business pays and the cost of any benefits that direct laborers receive. These benefits include:

- Pensions

- Vacation pay

- Workers’ compensation insurance

- Holiday pay

Finally, be sure only to calculate the total labor cost incurred during the product’s production time.

Manufacturing Overhead

Your business’s total manufacturing overhead summarizes the indirect costs of producing finished goods. These costs include indirect labor, indirect materials, utilities, maintenance, repairs, insurance, taxes, and depreciation. These expenses impact your income statement and balance sheet, so you must calculate manufacturing overhead when determining your total manufacturing cost.

Direct vs. Indirect Manufacturing Cost

Direct manufacturing costs are the costs of labor and materials that businesses use to create a product. Examples of these direct costs would be the laborers that make the product and the materials like fabric that factory workers would use to create a blanket.

Indirect manufacturing costs include labor and materials costs. Still, indirect laborers might be managers and quality assurance staff, and indirect materials would be the oil used to maintain the sewing machines in a blanket factory.

These indirect costs are still significant when determining total manufacturing costs, but they would be included in overhead costs instead of direct labor or materials. It is important to note that what one company determines is an indirect cost, another company might designate it as a direct cost. This distinction is subjective to the industry and the company’s decision.

Manufacturing Cost vs. Production Cost

Manufacturing costs are only the expenses related to creating a product, while production costs are all the expenses incurred to keep an entire business operating. Production costs include fixed costs like marketing, equipment, and any rentals or leases of buildings or equipment.

Total Manufacturing Cost vs. Cost of Goods Manufactured (COGM)

While the total manufacturing cost is related to COGM, they have distinct differences. COGM is the expenses incurred directly related only to the goods that your company actually produces, while the total manufacturing cost is every expense incurred during a production run, regardless of how many products your company finishes or if you used every material purchased for the product.

An example of this difference is if the company producing blankets determines that the total manufacturing cost for 1000 blankets is $20,000. Due to a staffing shortage, only 750 blankets could be produced by the end of the period, lowering the COGM to $15,000. Regardless of the number of blankets made during the production process, $20,000 was still allocated for the labor, overhead, and materials used in this production run.

Benefits of Calculating Your Total Manufacturing Cost

Calculating the total manufacturing cost of your products is critical to the success of your manufacturing business. This number will allow you first to determine the pricing of the product. If your profit margin needs to be higher to justify the ideal pricing of the product, you can either raise the price or find opportunities to cut costs. Cost cutting can involve:

- Reducing staffing of direct labor.

- Minimizing material waste.

- Finding ways to improve efficiency, so more products are produced in a shorter period.

Knowing the total cost of manufacturing a product can also assist in monitoring your company’s overall financial health. Awareness of your business’s financial health can lead to creating new products or even discontinuing products that are no longer profitable for your company.

FAQ

Q: What is the total manufacturing cost formula?

A: Total Manufacturing Cost = Direct Materials + Direct Labor + Manufacturing Overhead

Q: What is not included in manufacturing costs?

A: Manufacturing costs only include the costs directly related to creating a product. Fixed production costs like marketing and facility rentals are not included.

Q: Is the cost of labor included in the manufacturing overhead?

A: Yes and no. Only the cost of indirect labor is included in the manufacturing overhead.

Q: Why do I need to calculate the total manufacturing cost?

A: Calculating the total manufacturing cost will help your business set product pricing, determine profit margins, increase productivity, and reduce waste.

Q: Can Manufacturing ERP software help calculate total manufacturing cost?

A: Yes,Manufacturing ERP software helps manufacturing companies keep track of all costs associated with producing goods. With thorough bookkeeping through your ERP, these numbers will be readily available to conduct the calculations needed to find the total manufacturing cost of your product.

Further reading:

- What is MES? Understanding Manufacturing Execution Systems

- ERP vs. MRP: What are the Key Differences?

- The 6 Types of Manufacturing Processes