How to Calculate Manufacturing Overhead Costs Step by Step

Manufacturing overhead (or factory overhead) is the sum of all indirect costs incurred during the manufacturing process. You can calculate manufacturing overhead costs by adding your indirect expenses, such as direct materials and labor, into one total.

Examples of Manufacturing Overhead

Manufacturing overhead includes expenditures outside of raw materials or direct labor costs. Also known as “indirect costs,” these common resources benefit the production process but are not traceable to any specific product. Some examples of indirect costs include:

-

Indirect materials - The cost of consumables not directly attributable to finished goods, like cleaning supplies and industrial lubricants for factory equipment

-

Indirect labor - The cost of labor not directly attributable to finished goods, like salaries for janitorial and quality control staff, security guards, accountants, and office workers

-

Equipment repairs

-

Depreciation on manufacturing equipment - The amount of value your equipment loses each year. To calculate straight-line depreciation:

Depreciation per year rate = (Initial Value - Salvage Value) ÷ Useful Life of Asset

-

Financial costs - Property taxes, rent, insurance policies for your manufacturing facility

-

Utility bills - Electrical, gas, water, and other basic utilities

Fixed, Variable, and Semi-Variable Overhead Costs

In activity-based costing methodology, indirect expenses can be fixed, variable, or semi-variable. These distinctions help manufacturers identify cost drivers or activities that result in fees.

-

Fixed costs remain constant regardless of an increase or decrease in products manufactured. Regarding factory overhead, these might include mortgage or rent payments for your production facility, which are the same from month to month.

-

Variable overhead costs will fluctuate depending on increased or decreased activity in your factory. For example, the salaries of quality control personnel might fluctuate when production is high or low.

-

Semi-variable expenses are not dependent on the number of units produced in your facility but are subject to fluctuating circumstances. For instance, equipment repairs and maintenance are indirect semi-variable costs.

Calculate Manufacturing Overhead Costs and Rate

Determining your manufacturing overhead expenses and rate will allow you to monitor your company’s expenditures and the efficiency of your production. To calculate your costs:

-

Identify the indirect costs that enable your manufacturing facility to operate. If you are unsure, refer to our “Examples of Manufacturing Overhead” section above.

-

Add all indirect expenses together to determine your manufacturing overhead costs.

-

Plug these overhead costs into the manufacturing overhead rate formula: Overhead Costs / Sales x 100 = Manufacturing Overhead Rate Your overhead rate is expressed as a percentage. A higher percentage could mean a lagging or inefficient production process and is worth investigating further.

Manufacturing Overhead Costs and Rate Examples

Your factory has identified these indirect expenses associated with your production process:

| Indirect Cost | Expense Total |

|---|---|

| Facility Mortgage | $85,000 |

| Facility Property Taxes | $4,500 |

| Staff Salaries | $65,500 |

| Equipment Repairs & Maintenance | $15,000 |

| Depreciation on manufacturing equipment | $30,000 |

Altogether, your plant’s overhead costs total $200,000 annually. Your facility brought in $750,000 in sales that same year. You would calculate the overhead rate using this manufacturing overhead formula:

$200,000 / $750,000 x 100 = 26.66%

26.66% is your manufacturing overhead rate. Generally, your company should have an overhead rate of 35% or lower, though this can be higher or lower depending on your circumstances. A lower percentage indicates efficient operating procedures.

How to Calculate Cost Allocation Using Predetermined Overhead Rate

According to PorteBrown, generally accepted accounting principles (GAAP) require allocation of your total manufacturing overhead costs to each unit you assemble. To assign these costs to your products, divide your total manufacturing overhead by an allocation base. Your allocation base could be any of the following:

-

Direct labor hours

-

Direct materials costs

-

Direct machine hours

-

Number of units produced in one quarter

Direct machine hours make sense for a facility with a well-automated manufacturing process, while direct labor hours are an ideal allocation base for heavily-staffed operations. Whichever you choose, apply the same formula consistently each quarter to avoid misleading financial statements in the future.

For example, your current inventory required $50,000 in factory overhead with 5,000 direct labor hours last quarter. Divide your manufacturing overhead by your allocation base to determine your overhead cost allocation:

$50,000 / 5,000 = $10

You will spend $10 on overhead expenses for every unit your company produces. Therefore, you would assign $10 to each product to account for overhead costs in your financial statements. Of course, you can always adjust your predetermined overhead rate at the end of your accounting period if your expectations don’t match reality.

This forecast is called applied manufacturing overhead, a fixed overhead expense applied to a cost object like a product line or manufacturing process. Applied overhead usually differs from actual manufacturing overhead or the actual expenses incurred during production.

These two amounts seldom match in any accounting period, but the variance will generally average to zero after multiple quarters. If this variance persists over time, adjust your predetermined overhead rate to align it more closely to actual overhead figures reported in your financial statements.

Frequently Asked Questions

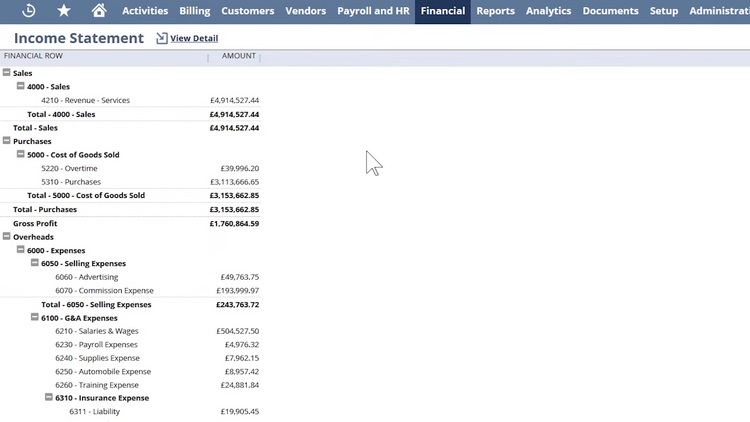

Where do you find manufacturing overhead in financial statements?

Manufacturing overhead factors into the cost of finished goods in inventory and work-in-progress inventory on your balance sheet and the cost of goods sold (COGs) on your income statement.

Why is it important to calculate manufacturing overhead?

Adding manufacturing overhead expenses to the total costs of products you sell provides a more accurate picture of how to price your goods for consumers. If you only take direct costs into account and do not factor in overhead, you’re more likely to underprice your products and decrease your profit margin overall.

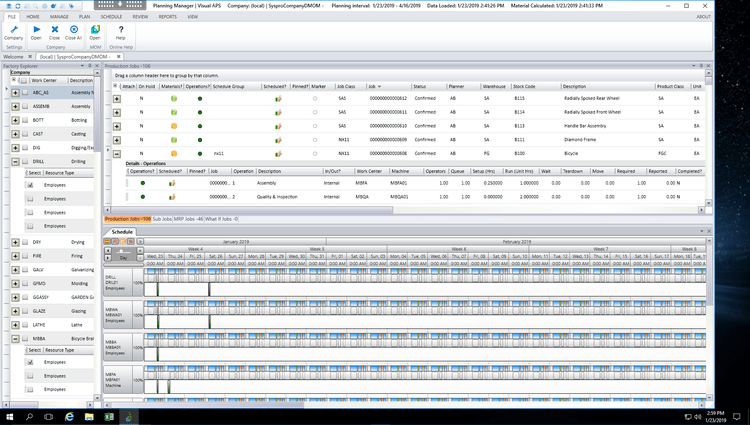

How do I automate production cost reporting?

Manufacturing Resource Planning (MRP) software provides accurate primary and secondary cost reporting on overhead, labor, and other manufacturing costs. MRP software also tracks demand forecasting, equipment maintenance scheduling, job costing, and shop floor control, among its many other functionalities.