The Best Accounts Payable Automation Software

We’ve reviewed the best AP automation software to help simplify invoicing, payments, and reconciliation. Our top picks cover features like ERP integration, global payment processing, or AI-driven invoice management.

- Integrates with NetSuite, Blackbaud, Microsoft Dynamics, Intacct, MRI, and QuickBooks

- Serves real estate, HOA, construction and financial industries

- Subscription and transaction-based pricing

- Automated invoice creation with customizable templates

- American Express partnership for Vendor Pay

- Mobile app for on-the-go management of payments & invoices

- Handles multi-entity

- Integrations with popular accounting software

- Invoice-based and performance-based workflows

We’ve ranked the best accounts payable automation software based on integration options, ease of use, and key features like electronic invoice processing and reporting capabilities. Here’s a rundown of our top products based on our internal review process and user reviews.

- AvidXchange: Best Overall

- BILL: Best AI-Powered Invoicing

- Tipalti: Best for Global Payments

- Stampli: Best Invoice Management

- Airbase: Best Spend Management

- Yooz: Best AI-Powered Option

- Procurify: Best Procurement Integration

- MineralTree: Best for Security and Compliance

- Precoro: Top Integration Options

- Basware: Best for Network Connectivity

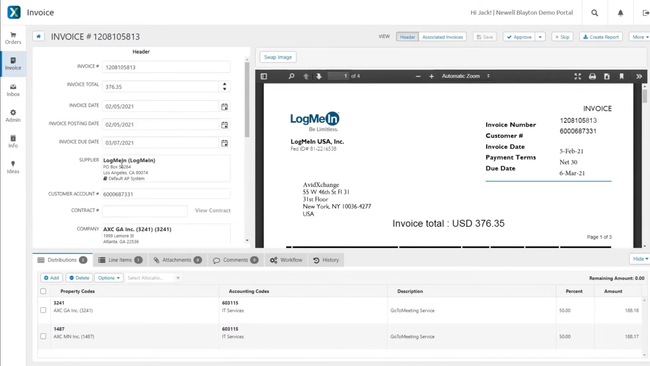

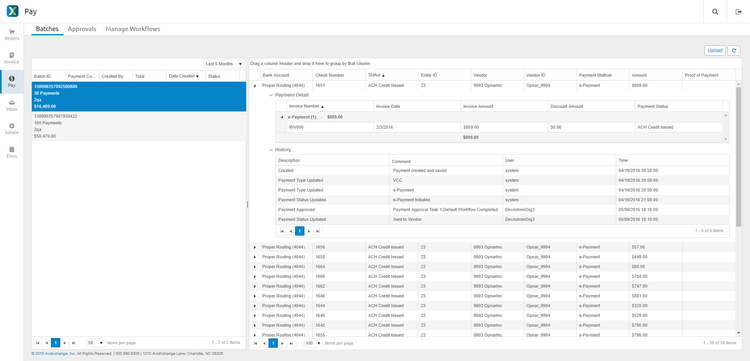

AvidXchange - Best Overall

The AvidPay module in AvidXchange helps automate time-consuming tasks like cutting checks, reconciling transactions, and managing supplier relationships. Once invoices are approved, you can initiate payments directly within the AvidPay interface. You have multiple methods to choose from, including:

- Virtual Card Payments: Secure, rebate-generating transactions for greater financial control.

- Paper Checks: Mailed on your behalf with full tracking for vendors requiring traditional methods.

- eCheck/ACH: Direct deposit for faster processing and lower transaction fees.

You can monitor payment statuses from initiation to vendor receipt at any time for total visibility. AvidPay’s automated reconciliation ensures accuracy by integrating with over 225 ERP and accounting platforms. After processing the payment, this module logs the transaction in your accounting software and auto-matches it to the correct invoice. From there, it flags any discrepancies like overages, shortfalls, or missing invoices. Plus, you can generate detailed payment reports to streamline financial audits down the line.

Unlike self-service e-payment platforms, Avidxchange actively manages your supplier preferences so vendors always receive funds through their requested method. It also automatically updates supplier payment details, reducing the need for manual maintenance and preventing errors in the future. Overall, it’s a solid pick if you’re in real estate and marketing with 10 to 500 employees.

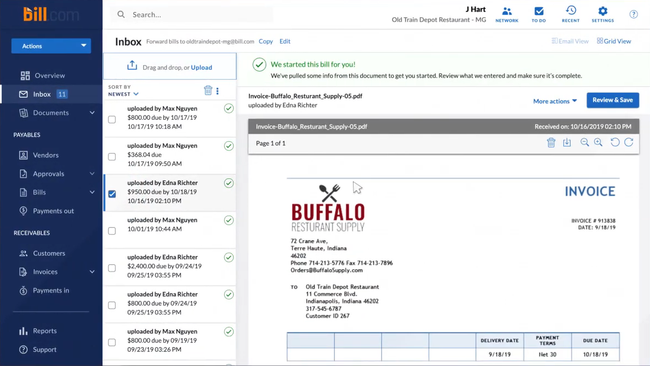

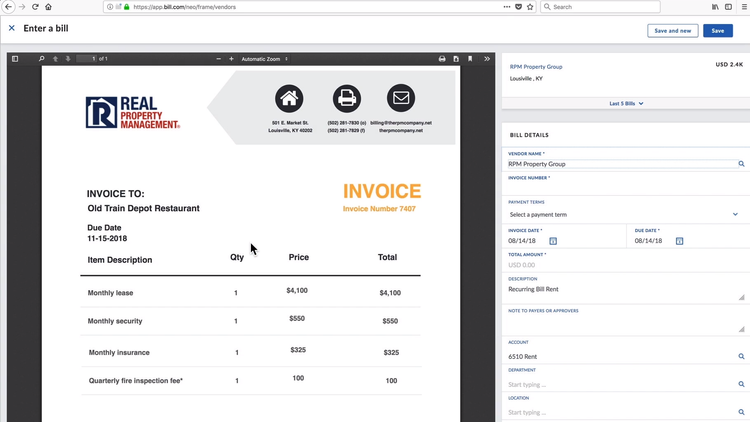

BILL - Best AI-Powered Invoicing

BILL Accounts Payable & Receivable, formerly Bill.com, features an inbox and AI-powered bill creation module. It captures invoices through mobile uploads, email, or direct vendor submission; from there, it instantly extracts key details like supplier names, invoice amounts, and due dates. Its AI engine even remembers recurring preferences, like which departments approve which vendors, so the system grows more efficient over time without any manual input.

As BILL pulls invoices into the platform, it automatically flags duplicates and splits bundled PDFs into individual records. It also pre-fills fields based on historical data; so if you receive regular invoices from an advertising agency, BILL learns to associate that vendor with the marketing department and auto-fills the GL account for professional services.

Once the bill is created, it’s routed through a customizable approval workflow built around your company’s policies. You can tailor these workflows to vendor, department, or dollar thresholds that run autonomously once you’ve set them. BILL provides a timestamped audit trail for every invoice and payment. And once payments are processed, it auto-syncs then with your accounting platform, including QuickBooks, Xero, NetSuite, Sage Intacct, and Microsoft Dynamics 365.

BILL starts at $45/user/month, though you’ll need the Corporate plan at $79/user/month for AI-driven invoicing and customizable approval workflows. While the AI does streamline data entry, some users report that it occasionally misses fields or fails to auto-populate invoice details. These issues are more likely with image-based or poorly formatted documents, so using clean, structured PDFs can help improve accuracy.

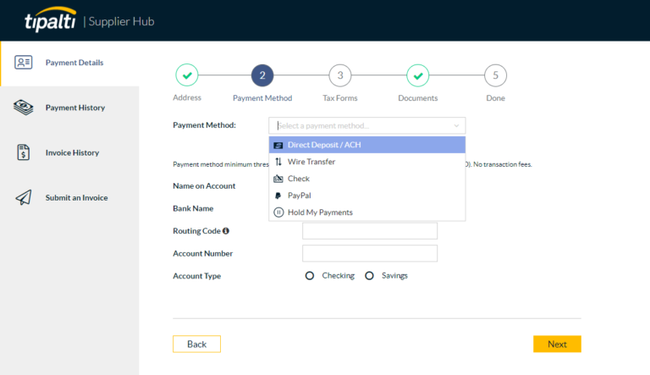

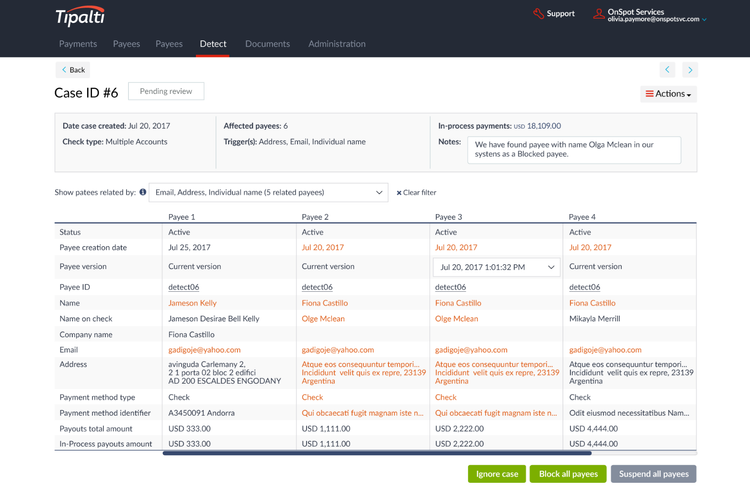

Tipalti - Best for Global Payments

Tipalti supports over 190 countries, 120 currencies, and multiple payment methods. This makes it a solid choice for businesses with international suppliers and partners, as it simplifies cross-border transactions and reduces payment-related errors.

Tipalti’s advanced tax compliance features, including automated tax form collection and built-in regulatory compliance checks, ensure organizations adhere to global financial regulations. Its supplier management portal further streamlines the payment process by allowing vendors to manage their own payment details and preferences.

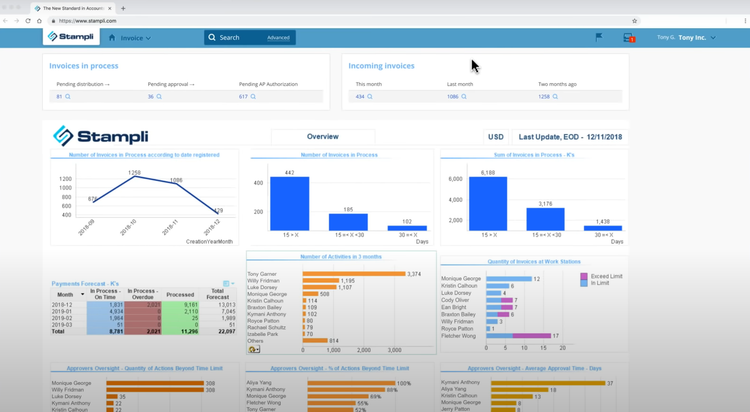

Stampli - Best Invoice Management

Stampli delivers an AI-driven platform that automates invoice capture, coding, and approval workflows. Its intelligent system, Billy the Bot, reduces manual tasks by learning from user actions to automate repetitive processes and decision-making.

Stampli’s interactive invoice dashboard provides live insights into invoice statuses, approvals, and exceptions, enabling businesses to maintain control over their accounts payable process. The platform’s collaboration tools help team members communicate directly within the invoice, simplifying the resolution of discrepancies and questions.

Airbase - Best Spend Management

Airbase combines accounts payable, expense management, and corporate card programs into a single platform, offering a full spend management solution. This integration provides businesses with unparalleled visibility and control over all non-payroll spending.

Airbase’s real-time reporting and custom approval workflows allow businesses to enforce spending policies and gain insights into their financial operations. Its ability to issue virtual and physical cards with built-in spend controls further enhances its utility by empowering companies to manage and control employee spending proactively.

Yooz - Best AI-Powered Option

Yooz leverages advanced technologies like AI, machine learning, and optical character recognition to offer a highly automated and intelligent accounts payable solution. It also includes smart data capture technology, which ensures accurate invoice processing and reduces manual data entry.

Yooz’s dynamic workflow automation adapts to organizations’’ unique processes, providing customized approval routes and automated matching of invoices, purchase orders, and delivery receipts. The platform’s intuitive interface and ease of use make it accessible to users of all technical levels, enhancing adoption and efficiency.

Procurify - Best Procurement Integration

Procurify uniquely integrates procurement and accounts payable processes, enabling businesses to manage the entire spending lifecycle from purchase request to payment. This integration fosters collaboration between procurement and finance teams, improving spend visibility and control.

Procurify’s interface is fairly mobile-friendly, allowing users to manage purchase orders, approvals, and expenses on the go. The platform’s real-time budget tracking and customizable reports provide valuable insights into spending patterns, helping businesses make informed financial decisions.

MineralTree - Best for Security and Compliance

MineralTree provides features like two-factor authentication, payment fraud detection, and role-based access controls. These security measures protect sensitive financial data and ensure compliance with industry regulations.

MineralTree’s direct integration with banks for payment processing enhances security and streamlines payment. Additionally, MineralTree maintains certifications like SOC 1, SOC 2, Type 2, SOC2+, and PCI DSS Level 1, demonstrating high compliance standards. Its unique Invoice-to-Pay tool automates accounts payable workflows, from invoice capture to payment execution.

Precoro - Top Integration Options

Precoro integrates with popular software like QuickBooks Online, NetSuite, and Xero. These enable the automatic transfer of financial data between systems, reducing manual data entry and the likelihood of errors. This ensures a smooth, cohesive workflow for businesses using these platforms.

The integration with Power BI and the availability of an API further enhance Precoro’s appeal. Power BI integration means businesses can leverage advanced analytics and data visualization tools for deeper insights into their spending and accounting processes. The API allows custom integrations, providing flexibility and scalability to meet specific business requirements.

Basware - Best for Network Connectivity

Basware offers an extensive global supplier network, facilitating seamless electronic invoicing and communication between businesses and their suppliers. This network connectivity improves efficiency, reduces errors, and enhances supplier relationships.

Basware’s predictive analytics and AI-driven insights help businesses optimize their spending and procurement strategies. It can also support various procurement processes, from sourcing to contract management, making it a versatile tool for improving procurement efficiency and effectiveness.

What is Accounts Payable Automation Software?

Accounts payable (AP) automation is a specialized system of accounts payable software designed to help businesses reduce the time spent on invoicing tasks. By automating your payment processes, you can cut down on costly accounting errors and common invoicing delays.

Additionally, AP automation software streamlines the payment process on both ends. Vendors and suppliers can receive your payments faster when you submit digital invoices. And it’s easier to confirm payment was sent when you have an electronic trail.

AP Automation Software Key Features

- AP purchase order and invoice records: Generate and organize records for all your business transactions, starting with the original purchase order

- Optical character recognition (OCR): Scan physical invoice documents into a digital system to maintain a standardized digital formatting

- Electronic payments: Simplify the payment process by using ACH or EFT formats; coordinate your online accounting capabilities

- Check-writing: Create and print individual or batch check runs for your business payments

- Recurring payments: Avoid late payments by sending out automated reminder notifications when payment is due to vendors, suppliers, and distribution partners

- Contact database management: Organize all your contact information for vendors, suppliers, distributors, customers, and employees

- Account lookup: Keep digitized records of all transactions; easily search records which accounts are on-time and which are outstanding by date, vendor, or other factors

- Tax form documenting: Process W-2s, 1099 and other tax forms electronically

- General accounting: Balance your AP against your accounts receivable (AR) in a general ledger to ensure your company finances stay in order

Benefits

There are many incredible benefits to automating your payable processes:

Reduce Payment Errors

Traditional accounts payable processes increase the chances of human error. Even the most skilled accountant on your AP team can accidentally move a decimal place when calculating invoices. It’s simply a matter of statistics, as the more manual tasks there are, the more chances there are for small mistakes to add up. Automated AP processes cut down on the potential for mistakes.

By reducing invoice processing mistakes, AP automation helps drive down costs from potential errors. Since the software records the original purchase order, the applications always check the payment price against the agreed-upon costs.

Avoid Late Payments (and Penalties)

Payments always have due dates. Missing a payment or being a few days late can lead to fees. Worse, it can damage your relationship with your suppliers. To protect your vendor relationships, you need to make timely payments. But even if you mail out a physical check on time, there’s always the chance the mail could delay the delivery.

Electronic payments don’t take days to deliver - they’re virtually instantaneous. Automated reminders can notify your billing department whenever a payment is due. You can even set a timeline for how far in advance you get these reminders based on your accounts receivable schedule.

Standardized Payment Forms

Financial data is tricky enough to manage when presented in a standardized format. Yet every business partner you have has their own preferred invoicing method. You can’t modify your payment processes to accommodate every single one. Instead, electronic data interchange (EDI) and optical character recognition (OCR) applications let you scan invoices from all your vendors and suppliers into one digital format.

By standardizing invoices as they arrive, you can reduce data entry. An accounting system with EDI and OCR tools will automatically import the invoice data you need to optimize the payment process. Then, your AP team can focus on making payments instead of manual data entry.

Mobile Access Anywhere

AP automation solutions generally include mobile apps for extra accessibility during approval. If you are in charge of payment authorizations, you must be accessible even on the go. With mobile apps, you can provide approval to your AP team at your convenience. And this can lower your processing costs as you don’t have to waste time going into the office to give invoice approval.

Keep Accurate Payment Records

Whenever you pay a vendor or supplier, you update your records to show your account was paid off. Once the vendor receives your payment, they will update their accounts receivable balance. Unfortunately, your payment is vulnerable once it leaves your hands until it arrives in theirs. Unless you want to pay more for delivery confirmation, you cannot track your payments through traditional shipping methods. If the payment never arrives, it’s your word against theirs.

Paying electronically adds a layer of protection to your vendor interactions: Automated AP software tracks your electronic invoice payments so you always have a record of when invoices were paid. If there are ever any discrepancies with a vendor, you’re covered by your digital records.

Additionally, these AP reports provide valuable bargaining information when it’s time to negotiate with vendors. Looking at your past payments can help you set up better terms. And in the long run, you can use your AP records to see which vendors have historically offered you the best purchase prices. An integrated ERP system will allow you to track your AP payments and locate potential invoicing bottlenecks.

Fraud Protection

Finally, automated AP helps protect your company from fraud. Since all payments are automatically recorded, it’s easy to generate an audit trail to find any discrepancies from potentially fraudulent actions.

AP Automation Software Pricing

AP automation software costs can range from $8,000 to over $250,000 per year depending on your company size, user count, and desired features:

| Tier | Company Size | Total Cost of Ownership | Example AP Automation Software |

|---|---|---|---|

| Entry-Level | 1–20 employees | $8,000–$15,000 per year | Melio, Plooto |

| Mid-Tier | 20–100 employees | $15,000–$35,000 per year | Stampli, MineralTree, AvidXchange |

| High-Tier | 100–500 employees | $35,000–$100,000 per year | Tipalti, Yooz |

| Enterprise Tier | 500+ employees | $100,000–$250,000+ per year | SAP Concur Invoice, Coupa |