The Best Accounts Payable Software

We’ve reviewed the top accounts payable software for companies of all sizes. Whether you need expense management for global operations or are a small retailer looking for streamlined vendor payment workflows, we’ll help you find a system that fits your needs.

- Invoice-based and performance-based workflows

- Handles multi-entity

- Integrations with popular accounting software

- HIPAA compliant

- Automated purchase order matching

- Integration with NetSuite, QuickBooks, Microsoft Dynamics GP, Sage, and Xero

- Subscription and transaction-based pricing

- Integrates with NetSuite, Blackbaud, Microsoft Dynamics, Intacct, MRI and QuickBooks

- Serves real estate, HOA, construction and financial industries

To help you find the best accounts payable solution, we’ve researched a wide range of products to put together a collection of our top AP software. Our advanced review methodology carefully evaluates pricing, scalability, and key features like customizable invoices and approval workflows.

- Tipalti: Best Overall

- MineralTree: Best for Healthcare

- AvidXchange: Best for Midsize Companies

- BILL: Best Payment Tools

- Stampli: Best AI Tools

- Airbase: Best for Spend Management

- Yooz: Advanced Automation Tools

- Procurify: Best Procure-to-Pay Platform

- Coupa AP Automation: Best for Large Companies

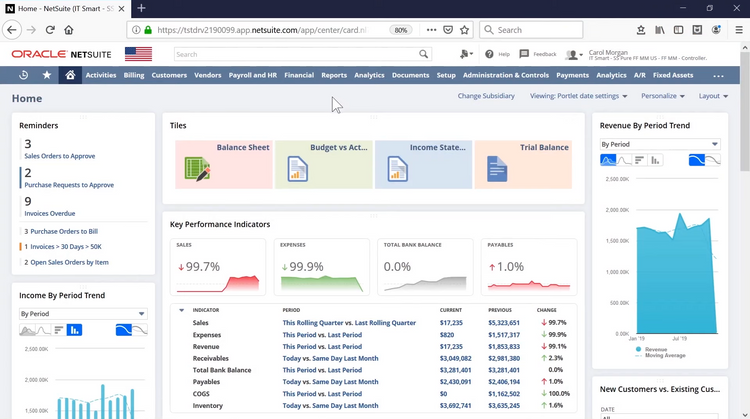

Tipalti - Best Overall

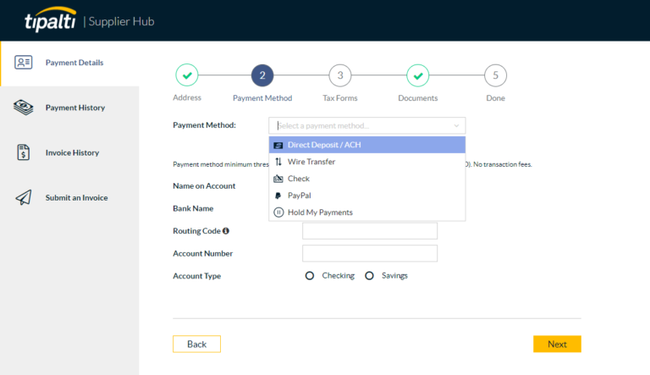

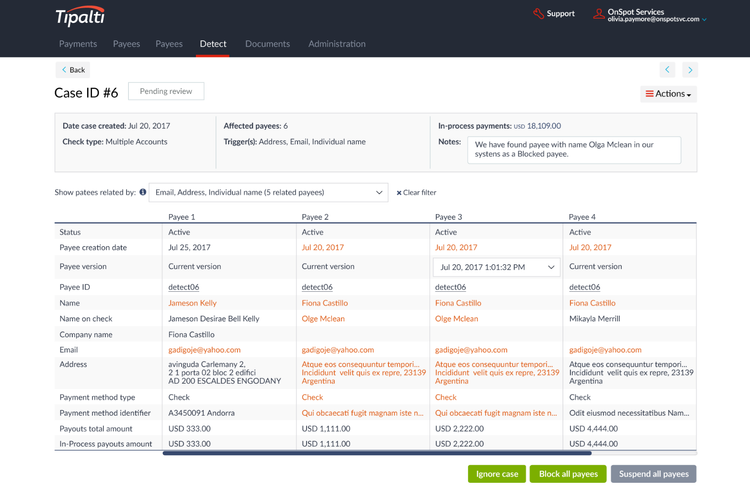

Tipalti offers global support, including international payment capabilities and tax compliance features. The platform handles transactions in over 120 currencies across 196 countries, ensuring seamless and efficient cross-border payments. Tipalti covers a variety of payment methods, including wire, ACH, and PayPal, alongside a self-serve dashboard for payees. Overall, it’s a good fit for mid to large-sized businesses dealing with global payment operations.

In addition to handling multiple currencies, Tipalti also has a supplier management portal. It streamlines the onboarding process by allowing suppliers to manage info like tax details, ensuring adherence to international tax laws. Also, Tipalti integrates with ERP and accounting systems for streamlined payment reconciliation, including NetSuite, QuickBooks, and Xero.

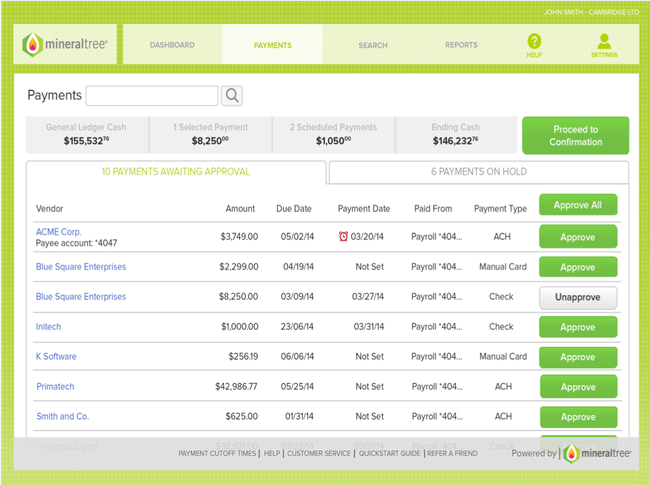

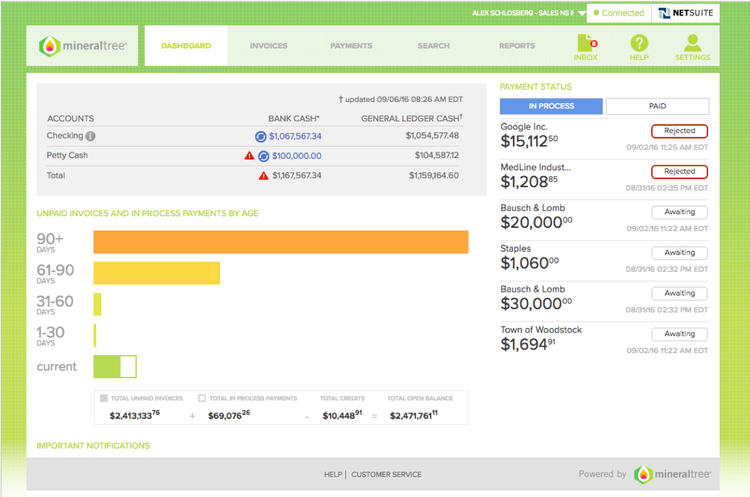

MineralTree - Best for Healthcare

MineralTree TotalAP can help healthcare organizations remain compliant with industry regulations. The system is one of the only AP providers audited and certified for SOC 2 and HIPAA regulations, giving you confidence it meets the industry’s strict security processes. MineralTree ensures all patient refunds, rebates, and checks issued on the platform are secure and approved. It’s a great way of reducing lengthy manual approval workflows for invoices and payments.

Additionally, the system keeps full audit trails of your accounts payable. Every step of an invoice’s journey is documented, from the initial draft to the final approval and send-off. It’s great for hospitals and clinics that process thousands of invoices per year, where miscommunications can cause huge problems for you and your patients. With the audit trail, you can pull up any past invoice in one central location to confirm amounts and easily resolve any issue.

MineralTree is ideal for mid to large-sized healthcare organizations managing multiple locations. It connects with hundreds of ERP systems, so you don’t have to disrupt established processes when integrating MineralTree into your tech stack. These include NetSuite, Sage Intacct, and more. Pricing starts at $200/month but will depend on your transaction volume and organization size.

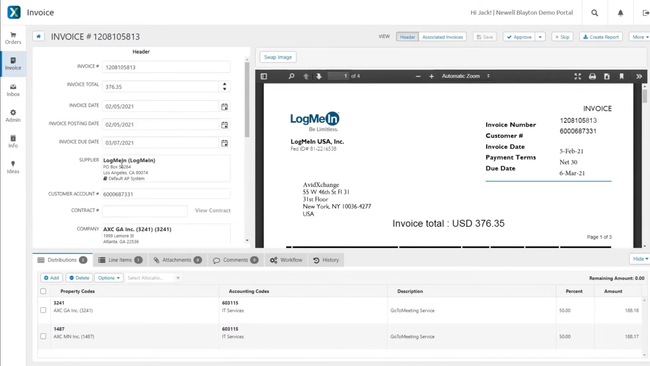

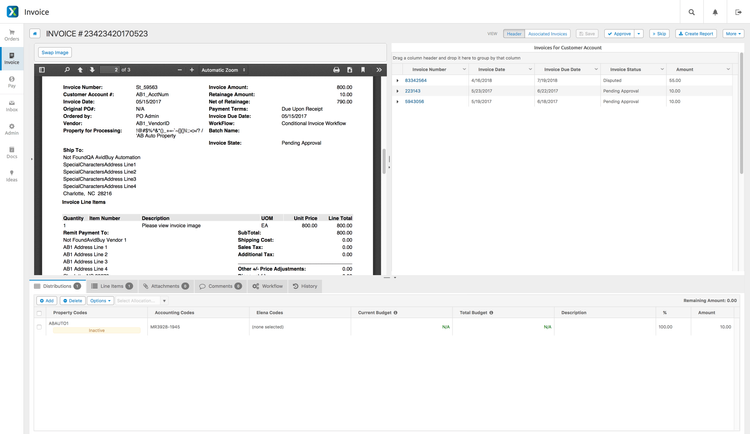

AvidXchange - Best for Midsize Companies

AvidXchange best serves medium-sized organizations. Its automated purchase-to-pay process helps mid-market businesses streamline their AP operations, especially as companies scale and deal with higher volumes of financial transactions. Additionally, AvidXchange will likely connect with midsized organizations’ existing ERP systems. These integrations include Sage Intacct, QuickBooks, NetSuite, Sage 100, and more.

The software’s use of optical character recognition (OCR) technology reduces manual data-entry errors, and the ability to customize invoice approval processes ensures that AvidXchange can meet the specific requirements of different AP teams. This level of automation and customization makes the platform particularly suitable for mid-market companies facing challenges with invoice overflow.

BILL - Best Payment Tools

We recommend BILL because it supports a variety of payment methods, including e-payments, checks, and international wire transfers, catering to a global vendor base. The software also features a Vendor Direct program, allowing payments via credit card even to vendors who typically do not accept card payments, by processing the payment and sending it via ACH ePayment, check, or Vendor Direct virtual card.

BILL offers automated invoice creation with customizable templates, streamlining the invoicing process and reducing manual input. The mobile app adds another layer of flexibility, allowing users to capture receipts and approve bills on the go. This is useful for businesses needing to process and approve payments away from the office.

Stampli - Best AI Tools

Stampli includes advanced accounts payable automation features, like an AI component named “Billy the Bot” that aids in invoice processing, approvals, and GL coding. We found that this AI integration and customizable approval workflows position Stampli as a solid choice for businesses needing smart AP processing.

Stampli provides full visibility into bill activities and statuses, helping businesses make faster decisions with more accurate coding. An intuitive dashboard and advanced search and reporting capabilities further support this transparency. Finally, Stampli offers seamless integration with popular ERP systems like NetSuite and Intacct for uninterrupted data flow.

Airbase - Best for Spend Management

We like Airbase’s holistic approach to spend management, combining guided procurement, AP automation, expense management, and corporate card usage into one platform. It’s designed to ensure compliance across all non-payroll expenditures, making it an ideal choice for businesses looking to manage their spending efficiently.

The software automates invoice processing, including complex aspects like amortizations and PO matching, leading to a low-touch, accurate, and secure AP process. Additionally, Airbase offers a versatile card program that integrates pre-approvals and purchase details directly into the general ledger, enhancing control over spend. With a focus on user experience, Airbase simplifies expense reporting and reimbursements, making the process more efficient for employees and accountants alike.

Yooz - Advanced Automation Tools

Yooz offers automation capabilities for increased accuracy and speed, reducing cycle times and enabling early payment discounts. It features OCR functionality for efficient invoice processing and AI-based data extraction to automate GL coding and PO matching. Overall, Yooz is designed to streamline the accounts payable process from purchase to payment, making it highly efficient for mid-sized to large businesses dealing with a high volume of invoices.

In addition to a high degree of automation, Yooz integrates with over 250 financial management systems. Popular platforms include Sage, QuickBooks, NetSuite, and more. Yooz includes a mobile app for same-day invoice approvals. From creating purchase requests to generating purchase orders and managing deliveries, Yooz covers every step of the AP process.

Procurify - Best Procure-to-Pay Platform

We found that Procurify takes a well-integrated approach to purchasing and accounts payable processes. It unifies procurement and invoice management, streamlining the entire procure-to-pay cycle.

For the purchasing process, Procurify handles everything from request creation and management to real-time status updates and notifications. It also has the ability to request items from a product catalog or through online shopping via PunchOuts. Overall, it simplifies expense creation and submission, accelerating reimbursement.

Procurify also automates accounts payable processes, including automatic OCR invoice capture and 2-way and 3-way matching for reconciliation. Overall, it enhances AP reconciliation with capabilities to sync approved bills to ERP and accounting systems, track and report accruals, and reconcile deposits and prepayments.

Coupa AP Automation - Best for Large Companies

Coupa AP Automation’s expense management module helps enterprises reduce errors and streamline workflows. The system automatically imports expense line items and receipts from multiple different sources, helping you consolidate all your data into one repository. This is useful for large companies that require company-wide expense reports without manually crunching the numbers.

Coupa AP Automation also helps global companies prevent fraud for global expenses. Its advanced audit algorithms can identify suspect or fraudulent patterns based on employee history and current report details. It also includes multi-currency support so global office and travel expenses can be audited as well. This helps ensure proper expense reporting across the entire company.

Additionally, Coupa leverages AI to analyze travel and expense programs. The system generates tailored recommendations for expense-saving opportunities. It integrates travel with all other company expenses for full visibility into spending trends, ensuring that unnecessary costs are minimized. This can greatly impact large companies, as manual processes cannot monitor such large volumes of data simultaneously, leading to expense programs becoming inflated.

What is Accounts Payable Software?

Accounts Payable (AP) software is designed to manage the money a business owes to its creditors by automating tasks such as invoice processing, approvals, and payments.

These solutions provide a coordinated system for ensuring AP automation for tasks such as invoice processing, payables approvals, and executing payments. The software allows you to completely streamline accounting business processes, bypassing manual data entry, which can take hours or days to complete.

Key financial benefits of using an AP management solution include the ability to:

- Decrease labor costs related to manual processes by switching to automation

- Avoid late payment penalties and take advantage of early payment discounts through intuitive invoice management

- Free up cash for interest-earning positions or other business uses of capital by better timing of payments by routing through approval workflows

- Identify cost-cutting opportunities in corporate spending through better categorization of expenses

Accounts payable can also be used as a subset of a larger accounting software solutions for managing financial data. The available features tie in closely with other core accounting modules, such as accounts receivable and a general ledger.

Managing expenses is a task every business, government agency, church, non-profit, or school faces. Accounts payable is the best way for every organization to control expenses and, if applicable, increase sales. This guide provides a practical how-to for selecting the right AP software to cut unnecessary costs and create efficiency in payables processing.

Key Features

- AP record creation

- Bookkeeping

- Check-writing

- Vendor/supplier database management

- Document management

- Records/account lookup (search) and filtering

- 1099 tax form processing

- Electronic payments

- Optical character recognition (OCR) from machine learning and artificial intelligence (AI)

- Recurring payments

- Purchase order reconciliation

- Payment approval authorization management

- Due date alerting

Benefits

Automated accounting solutions provide many useful benefits to businesses of all types, from new startups to midsize companies to global enterprises:

Automated Business Processes

Traditional approval processes are time-consuming and prone to errors. AP automation software streamlines these processes, saving time and improving accuracy by reducing human errors. This software also provides real-time monitoring for better control and improved record-keeping. Furthermore, AP software enables electronic payments, such as Automated Clearing House (ACH) payments, reducing operating costs and errors associated with physical checks, thereby mitigating the risk of fraud.

Faster Report Capabilities for Greater Efficiency

AP software’s reporting features enhance cash management by analyzing historical and real-time KPIs tailored to your business needs. Tools like aging reports help prioritize payments by identifying past-due records. AP automation improves efficiency, reduces time for check issuance and report preparation, eliminates late fees, and minimizes errors such as duplicate payments, thereby saving time spent on corrections during invoice processing or book balancing.

Better Customer, Vendor, and Supplier Relationships

Customer relationship management (CRM) is crucial in AP departments for managing payments between vendors, suppliers, and clients. Maintaining detailed vendor records and payment histories through AP software can improve vendor relations.

AP reports help assess your firm’s purchasing habits, informing decisions on vendor consolidation or switching for better prices or terms. This data aids in negotiating improved payment terms and prices. AP software also facilitates automatic payments for potential early payment discounts.

Finally, AP software aids in verifying vendor invoices to prevent payment scams. It uses tools like AP positive pay, which cross-verifies authorized payments with known bank accounts to avoid fraudulent transactions.

How to Choose AP Software

Accounts payable software provides the tools necessary to drive down costs, increase productivity, improve cash management, and improve vendor relations.

The size of your organization, your existing information system environment, and your particular functional requirements will determine which AP software option is right for you. In fact, accounts payable functionality is often part of a larger accounting or ERP suite. Understanding all your options can help you make the right call on a new software integration.

- Accounts payable software for small businesses: SMBs can save thousands annually on accounts payable by taking advantage of early discounts and interest-earning opportunities via timing payments while avoiding late payments, paying vendors by their preferred method, and eliminating unnecessary administrative and processing costs.

- Accounts payable software for midsized businesses: The biggest decision a midsize company in a position to upgrade will need to make (regarding accounts payable) is how in-depth do you need the software to go? Will an AP module in a larger accounting package do the trick? Or are the AP processes so involved that a standalone should be considered?

- Accounts payable software for large enterprises: Companies with a high level of accounts payable (or a large amount of money owed to suppliers) will want to ensure they have a high level of reporting that can be provided from their AP solution. This is because investors in a company will look at AP figures to calculate insightful financial ratios. This debt ratio will help you understand a company’s strengths and weaknesses and any strategies they may have. Usually, big companies will use AP automation to manage debt, and see how this debt will affect the future business life cycle.

Pricing Guide

Accounts payable (AP) software pricing varies based on user count and feature set, with plans tailored to small, mid-sized, and larger teams:

-

Starter Plans: For 1-4 users, prices range from $10 to $999/month, offering core AP functions like invoice and payment processing.

-

Mid-Range Tier: Suitable for 5-9 users, this tier ranges from $15 to $1,646/month, adding more sophisticated features like system integrations and advanced workflow automation.

-

Advanced Tier: For teams of 10+ users, pricing starts at $24 and can exceed $1,795/month, including all mid-range features plus enhanced analytics, custom integrations, and possibly unlimited transaction volumes.

Pricing can be influenced by factors such as the number of users, transaction volume, integration complexity, customization needs, and required support levels. Companies should evaluate their specific needs against the software’s offerings to find the most cost-effective solution.

Is Using Quickbooks an Option?

Accounts Payable is one of the core functionalities included with any version of QuickBooks. QuickBooks allows AP workflows to be input through two workflows:

- Purchase order > Receive inventory > Enter bills against inventory > Bill payment

- Enter bills > Pay bills

Considerations When Choosing

Before selecting an AP software to integrate into your business process, consider what sort of modules you need most:

Entering records and check printing

The core of the payables process involves recording entries and issuing checks. Automation at this stage can save time in managing accounts payable. When choosing AP software, consider its ability to auto-fill check fields, schedule batch prints, and handle the mailing of payments.

Reporting

There are many important reports in accounts payable. The ability to report on your accounts payable entries can have a significant impact on tightening your cash flow. Perhaps most importantly, your accounts payable module must clearly show payments made, pending clearances, and processed transactions.

Master vendor list

Your AP module won’t only track individual payments - it can manage an ongoing vendor database. The precise way each software package handles the vendor list will vary. You’ll want to make sure that the software supports all the vendor information you need to keep on hand, such as contact info, addresses, vendor terms, payment details, and other data

Purchase order and invoice reconciliation

No one likes to think they’ve lost money through errors or fraud, yet audits often prove that this has happened. Your accounts payable software should include controls to identify the authenticity of each payment by associating each payment record with the original purchase order and/or the vendor bill.

1099 reporting (US)

Whenever you make non-payroll payments to non-corporate entities at some point, as the payee, your AP module should allow you to flag these payments and create the necessary paperwork for 1099 tax forms.

Other accounts payable software modules to consider:

- Alternate payment methods

- Payment planning

- Advanced reporting

- Rebates and vouchers

Additional integration

Accounts payable transactions don’t occur in a vacuum; they’re part of broader business operations. Your AP software should efficiently relay current liabilities from the payables ledger to the general ledger, ideally in real time. If full integration isn’t feasible, ensure that the AP module can export data in a format readable by the general ledger.

Another key integration point is with the purchase order module. Integration with this module is vital as both AP and Purchase Order processes benefit from access to the master vendor list. If bank reconciliation is a separate application, it’s crucial to ensure integration for accurate payment tracking and reconciliation of AP and bank records.

Common Pain Points

While accounts payable software provides many benefits to businesses, there are still a few specific pain points to address when seeking AP software.

-

Too much or little coverage: Not all companies require a comprehensive AP solution. Ensure your software can manage your invoice volume and vendor data. While small businesses dealing with few invoices might not need costly, full-fledged AP software, growing businesses should opt for scalable AP systems to accommodate growth.

-

Converting to automatic digital systems from manual paper methods: A Skynova blog post reported that companies process an average of 500 invoices a month, or 6,000 invoices each year, with 48% of these invoices arriving by U.S. mail. Manual AP processes can cost $35 more than the same work done through automated processes.

-

Human error and fraud: The Association for Financial Professionals found in 2022 that 65% of surveyed organizations were victims of payments fraud. It’s important to spot fraudulent activity before it spirals out of control. Preventative measures to reduce your chance of fraud include switching to electronic payments, reconciling checking accounts promptly, storing paper blank check stock under lock and key, and using a centralized check writing review process.

Market Trends

As one of the fundamental parts of business, accounts payable solutions have seen a lot of growth over the years. Some recent trends include:

- The increase of cloud technology. Progressive IT teams are much more in favor of self-monitoring cloud systems over physical hardware. Software-as-a-service (SaaS) deployments become far simpler, and automatic updates give you the most up-to-date solution possible.

- Integrated AP automation solutions vs stand-alone products. Software integrations are incredibly convenient for companies with multiple, interrelated departments. Typically, the AP module is included with most core accounting packages and will sync in with any accounts receivable or general ledger tools used by the program to perform necessary checks and balances. However, stand-alone AP solutions have become a much easier solution to implement. Stand-alone solutions typically offer more in-depth functionality, such as reports and dashboards created within the AP automation program.

- The demand to become a profit center. Many AP departments will be urged to take a proactive role in adding more value to their organization, which means finding ways to reduce invoice processing costs, earn rebates, take advantage of early payment discounts, and achieve a reduction in invoice processing time. AP departments can set all these goals, making you more efficient. AP automation software is the leading driver for a business to achieve these goals.