SAP Financial Consolidation

Financial consolidation software for current SAP customers with complex tax and statutory requirements.

Product Overview

SAP Financial Consolidation is a software for current SAP customers with complex tax and statutory requirements. Key features include automated consolidation processes, matrix consolidation for diverse reporting needs, and real-time reporting capabilities on platforms like SAP HANA. SAP Financial Consolidation is still being maintained and supported by SAP, with mainstream maintenance extended until December 31, 2030.Pros

- Automated consolidation processes

- Matrix consolidation

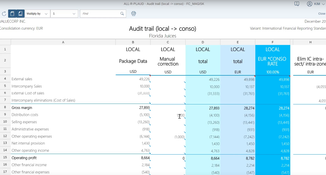

- Fully traceable audit trail

Cons

- Only for SAP Business One customers

- Complex implementation

- Overwhelming for businesses with simpler consolidation needs

Target Market

Larger enterprises with more than 1,000 employees and complex consolidation needs, including handling multiple currencies, compliance with various accounting standards, and dealing with diverse business entities.SAP Financial Consolidation helps create financial statements in multiple currencies and among varying levels of departments, entities, mergers, and acquisitions. It also helps streamline compliance and meet management/global regulatory requirements when it comes to financial close reporting. The solution will help meet accounting standards such as IFRS and GAAP.

This product is only available for current users of SAP solutions, such as SAP Business One.

SAP Financial Consolidation Key Features

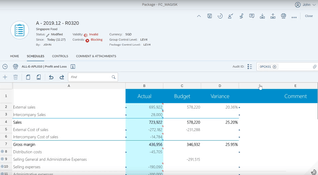

- Automated consolidation processes: Streamline the production of financial statements and meet reporting requirements such as local Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

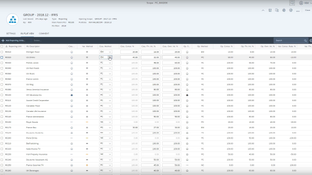

- Matrix consolidation: Satisfy both statutory consolidation and management reporting requirements by using two different reporting unit rollups in a single consolidation.

- Performance: Run all processes with a fully traceable audit trail that doesn’t compromise performance.

- Reporting structures: Combine legal and management reporting structures in a single consolidated view. Compare what-if simulations side-by-side to analyze organizational changes, mergers, or acquisitions.

- Real-time reporting: SAP Financial Consolidation runs on the SAP HANA® platform, in addition to Microsoft SQL and Oracle.

- Open integration: Seamlessly integrate data and master data from both SAP and non-SAP sources into financial planning and consolidation environment.

- Compliance: Includes version control and granular audit trails to track all adjustments made during consolidation.

- Risk management: Allows users to generate scenario analyses and what-if simulations to predict the impact of currency fluctuations, market changes, or acquisitions.

- Role-based assess: Facilitates segregation of duties among users and role-based permissions to ensure only certain personnel can access financial data.

SAP Financial Consolidation Alternatives

1 Prophix

A multi-user financial software application with budgeting, planning, financial consolidation, management reporting, and analysis tools.

2 CCH Tagetik

An enterprise performance management (EPM) software offering budgeting, forecasting, consolidation, and performance reporting.

3 OneStream

A corporate performance management (CPM) software providing data management, financial close, consolidation, planning, reporting, and analytics.

Video Overview

Product Overview

Developer Overview

User Reviews of SAP Financial Consolidation

No reviews have been submitted. Do you use SAP Financial Consolidation? Have you considered it as part of your software evaluation process? Share your perspective by writing a review, and help other organizations like yours make smarter, more informed software selection decisions!