The Best Accounting Software for Consultants

We reviewed the most popular accounting systems on the market and selected our favorites for independent consultants to large firms.

- Basic inventory management capabilities

- Free trial available and no setup fees

- Navigable, user-friendly interface

- Customizable payment terms

- No setup costs

- Recurring invoicing

- Customizable invoicing

- Extensive pre-built and custom reports

- Automatic exchange rates

Accounting software for consultants provides streamlined and automated tools for basic financial processes including invoicing, general ledger, revenues, and expense tracking. We used our advanced review methodology to select the top options for independent consultants to large consulting firms.

- Xero: Best Overall

- FreshBooks: Best for Independent Consultants

- QuickBooks Online: Best Time Tracking Tools

- NetSuite: Best for Large Consulting Firms

- Wave: Best Free Option

- Zoho Books: Best Integration Options

- Striven: Best for Midsize Companies

- Sage Intacct: Advanced Financial Management

- CustomBooks: Best QuickBooks Competitor

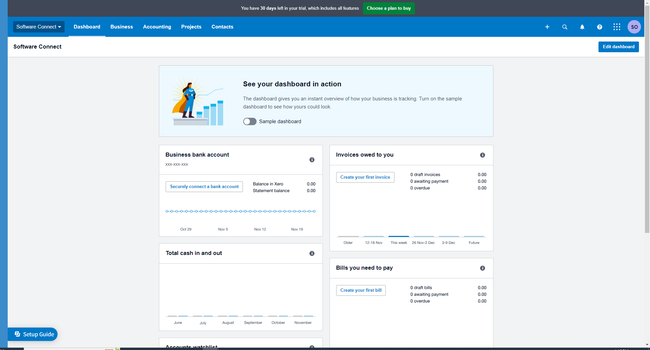

Xero - Best Overall

Xero’s invoicing and billing tools help you get paid faster. You can create branded invoices for a more professional client experience. Xero lets you tweak fonts, colors, logos, and message fields for personal touches. You can even build advanced templates in Microsoft Word for more control. This takes a little extra setup, but once uploaded to Xero, you can reuse it for all your future invoices.

You can add a “Pay Now” button to invoices so clients can pay instantly with a credit card, PayPal, or direct debit. Xero also integrates with over 40 payment apps, including Stripe and Square, though these may charge transaction fees of anywhere from 1.5% to 3.5%. Leveraged as a consultant accounting software, Xero also lets you set automatic reminders to nudge clients for payments.

If you’re just starting out, the Early plan is an affordable option, beginning at $20/month for unlimited users. Just keep in mind that it limits you to five bills and 20 invoices per month; this is fine for solo consultants but might be restrictive if you’re growing.

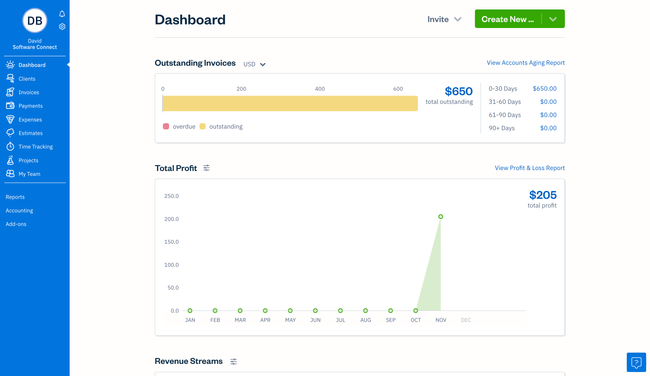

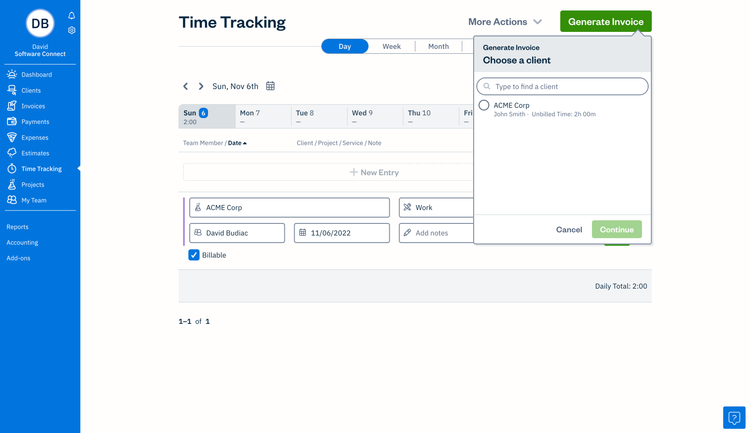

FreshBooks - Best for Independent Consultants

Freshbooks’s user-friendly interface makes it easy to leverage its features without being an expert accountant, which speeds up initial setup. Its mobile app allows for bookkeeping on the go, which is great for consultants who have busy travel schedules.

Its customizable invoicing feature lets you customize each invoice for every client. It also offers unlimited invoices and automatic payment reminders for recipients. Additionally, FreshBooks automates basic accounting features like charts of accounts, balance sheets, general ledgers, and P&Ls.

FreshBooks’s popular Plus plan is $38/month and includes recurring invoices, bank transfers, and reporting. However, you’re limited to 50 clients, so we wouldn’t recommend it for consultants over that limit.

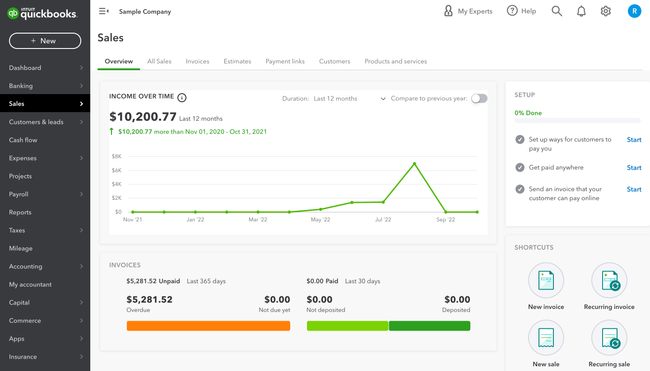

QuickBooks Online - Best Time Tracking Tools

QuickBooks Online’s time-tracking module optimizes the process for small consulting businesses and independents. Employees can clock in and out from their computer or mobile app, allowing clients to see how long consultants work for instantly. It also enables payroll syncing so invoices and payments are accurate.

QuickBooks’ batch invoicing feature is effective for consultants with hundreds of invoices. The automation lets users send all invoices simultaneously, making it a huge time saver. The system also ensures compliance for tax season, making it easy to file as an independent consultant. One downside is that it’s fairly pricey, with its base Simple Start plan being $35/month. Those requiring time tracking must upgrade to the Essentials plan at $65/month.

NetSuite - Best for Large Consulting Firms

NetSuite’s Professional Services Automation (PSA) system is best for large consulting firms that manage several complex projects at once. It includes project accounting, timesheet and expense management, and project reporting features. These are essential for large firms with 50-100 employees working on projects requiring accurate timekeeping and billing.

You can combine NetSuite PSA with its accounting software to integrate all financials and bookkeeping into one system. It automates the general ledger, AR, AP, and payment management. This can keep firms compliant with taxes through the complexities of time-based projects. While it doesn’t have public pricing, NetSuite starts at around $2,000/month.

Wave - Best Free Option

Wave is a good option for new and independent consultants because of its free plan. It allows for unlimited estimates, invoices, bills, and cash flow management, all for free. Users can even connect their bank for simple bookkeeping.

Wave also features a user-friendly interface, with its point-and-click functionality making it easy for users inexperienced with accounting. Its free invoice customization options let businesses add their logo and colors, which helps new consultants look professional and credible when invoicing clients. One downside to Wave is if users are looking to accept online payments through the system, there is a 2.9% transaction fee for both the free and Pro plans.

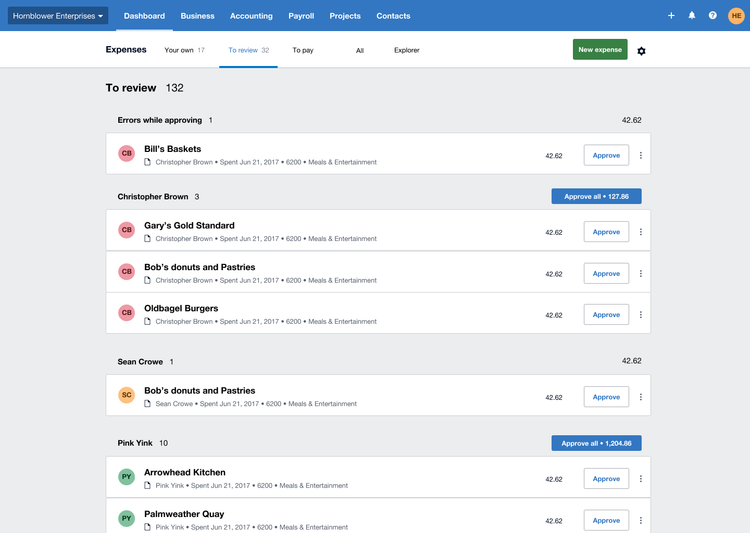

Zoho Books - Best Integration Options

Zoho Books is an online accounting for small consulting businesses needing streamlined project management. It integrates with over 45 Zoho applications, including Zoho Project, Zoho CRM, and Zoho Payroll. This lets you connect your accounting with the rest of your business operations. For example, Zoho Projects tracks project-based invoicing and expenses, so you always know what’s billable. With Zoho CRM, you can organize client interactions while automating revenue tracking.

Zoho Books works best for independent consultants or consulting firms with up to 10 employees. If you only need bookkeeping and financial management, you can subscribe to Zoho Books as a standalone product, starting at $15 per month. However, you’ll likely need Zoho Projects and Zoho CRM to get the most out of the system. Instead of purchasing tools separately, Zoho One offers all the apps in one subscription, starting at $37 per employee per month.

Striven - Best for Midsize Companies

Striven includes a wide range of features beyond core accounting. The system includes marketing and client management tools to help businesses attract and retain clients. The calendar feature lets consultees schedule appointments and lets team members book events internally to avoid time conflicts. The ERP package also includes HR and CRM capabilities.

Because it is an ERP, Striven has features that may not apply to consulting companies, like inventory management. On the flip side, its comprehensive feature set makes it a good option for midsize companies requiring more than basic accounting. It comes with a moderate price tag, with the Standard plan being $35/month/user.

Sage Intacct - Advanced Financial Management

Sage Intacct has strong core financial tools and consulting-specific features like professional services automation. The system uses AI to help identify financial trends, giving businesses a better understanding of problem areas and successes. Reports and dashboards also give real-time data visualizations for metrics such as total work hours, revenues, and expenses.

Plus, Intacct includes HR, payroll, and talent management, all integrated into one system. The AI-powered time tracking enables streamlined and accurate timekeeping for employees. The system integrates with payroll, automating hourly pay conversions, which makes it easy to pay employees. However, Intacct does not include a built-in CRM module, which must be integrated from another system.

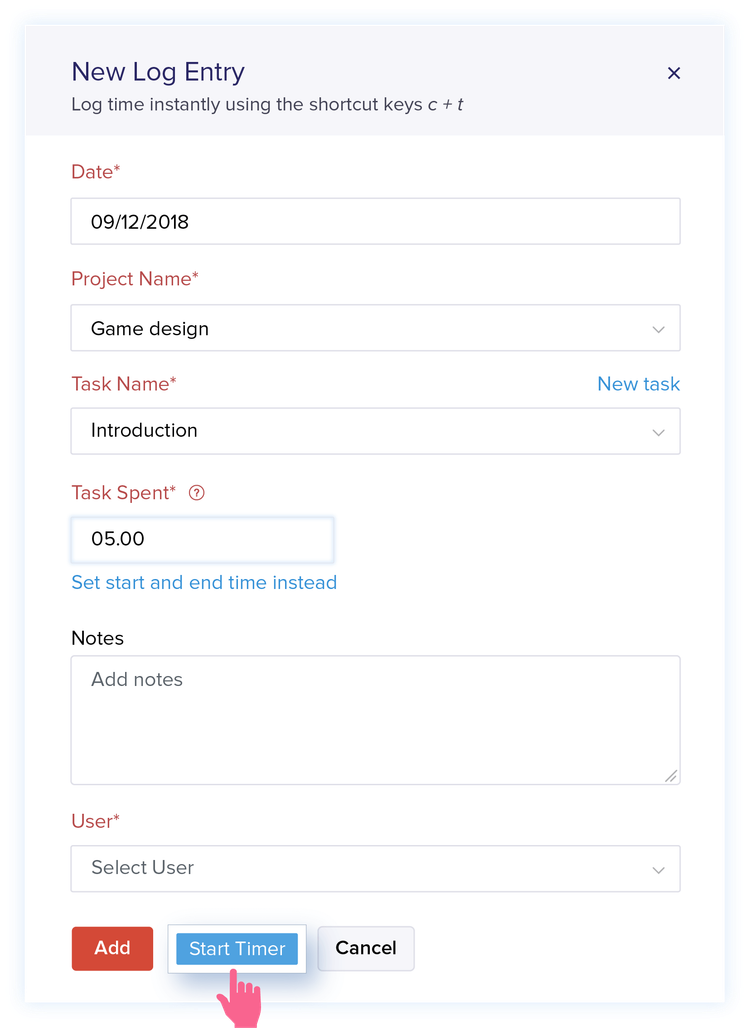

CustomBooks - Best QuickBooks Competitor

CustomBooks best suits small businesses and is a scalable competitor to QuickBooks. Project and time-tracking tools are available on its base Start-Up plan for $19/month. This is a good option for new businesses on a budget to still get these capabilities. It also includes all basic accounting tools, including personalized invoicing options like custom product fields and promise dates.

Additionally, CustomBooks includes custom reporting features that allow businesses to visualize their financial health through charts and data consolidation. Every plan provides full support, so businesses don’t have to pay extra for different support tiers. However, it lacks a mobile app, which can inconvenience users who desire a native app experience.

What is Accounting Software for Consultants?

Accounting software for consultants is a system that aims to automate bookkeeping tasks such as general ledger, billing, invoicing, and time tracking from independent consultants to large firms. Accounting software usually connects to a business’s bank to streamline transactions and automatically record revenues and expenses. These software are most commonly web-based with mobile apps so consultants who are constantly on the road can manage finances from anywhere.

Depending on the size of your consulting firm, ERP systems are also commonly used for accounting and include CRM, HR, and payroll features. These systems are more comprehensive, with consulting-specific tools like project management to track several complex clients simultaneously.

Key Features

- Time Tracking: Easily track billable hours for every client and project. Keep accurate time records that clients can see for transparency.

- Billing and Invoicing: Send accurate and professional invoices to clients with your logo and colors. Automate recurring invoices with templates to streamline the process. Pay bills directly through the system with an integrated bank account.

- Project Management: Manage project-based clients, assign task checklists, and workable hours for enhanced productivity.

- General Ledger: Streamline and record all incoming and outgoing transactions. Automate payments and bills easily while keeping a comprehensive financial record.

- Financial reporting: Gain insight into financial data with reports on revenues, expenses, and total project hours.

Primary Benefits

Streamlined Accounting

Businesses or independent consultants who use pen and paper or Excel spreadsheets for their bookkeeping will greatly benefit from digitized accounting processes. Systems automatically record bank transactions, keeping accurate data of revenues and expenses so you don’t have to. All financial information is usually stored in the cloud so users can access it anywhere and on any device.

Another benefit of accounting software is the ability to save time through automated accounting tasks. Being an independent consultant requires long hours of meeting with clients, researching, and growing a business. With automated accounting processes, you can save hours a week compared to a manual accounting system.

Enhanced Client and Project Management

Keeping track of clients and ongoing projects is essential for any size consulting business. Through accounting software for consultants, companies can accurately record billable hours worked, create task checklists per client or project, and keep detailed records of each, ensuring jobs are completed timely and accurately.

Pricing

Accounting software for consultants can range anywhere from $0 to $300/ month. This number largely depends on your business and its needs. Independent consultants just starting out will only require basic accounting, which can be accessed through free base plans like Xero and Zoho Books. Small businesses that need more features will look to spend more, like the QuickBooks Essentials plan for $60/month, which includes time tracking.

ERP systems are generally quote-based and cost anywhere from $1,000 to $10,000, depending on the number of users and features included. These systems are reserved for large firms that require a comprehensive solution for inventory management, payroll, customer relationship management, and more, in addition to accounting for their business.