The Best QuickBooks POS Alternatives

We reviewed over 20 top alternatives to QuickBooks POS and selected our favorites. See our results below.

- Clean design

- Frequent updates

- Offers their own payment processor

- Hybrid architecture with local network reliability and cloud-based features

- Strong built-in CRM tools

- Intuitive employee scheduling system

- Payment processing and POS

- Works in-store and online

- Transparent pricing

With QuickBooks POS discontinued in 2023, many retailers and restaurants are looking for alternative point-of-sale software. We researched and tested 20+ options that integrate with your QuickBooks accounting data for a smooth transition.

- Lightspeed POS: Best Overall

- Revel Systems: Best for Enterprises

- Square: Best for Small Businesses

1 Lightspeed POS - Best Overall

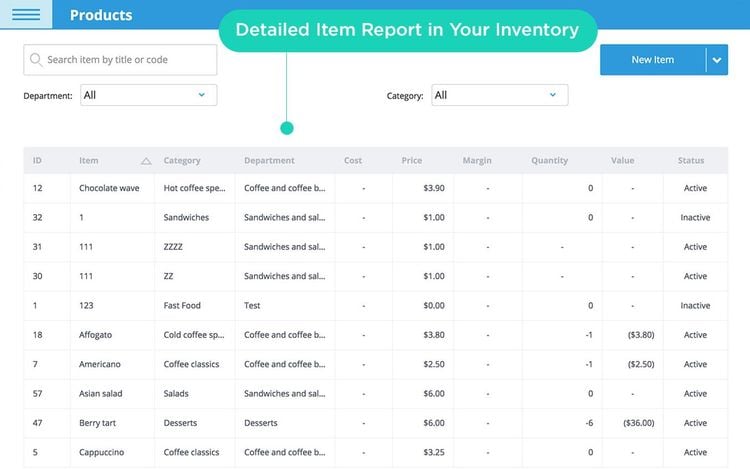

Why We Chose It: Lightspeed POS tops our list with a score of 8.8 for its strong inventory management features. It simplifies tracking items across multiple locations, setting automated reorder points, managing purchase orders, and handling product variations. Moreover, we like that it has an integrated supplier network for smoother procurement processes.

We found Lightspeed POS best for retail and restaurant businesses, offering compatibility with a diverse range of hardware. This includes essential equipment like barcode scanners, receipt printers, cash drawers, and payment terminals, ensuring seamless integration with existing setups. Moreover, Lightspeed POS provides the flexibility to utilize iPads as kitchen display systems, enabling kitchen staff to manage incoming orders with ease and efficiency.

Lightspeed seamlessly integrates with QuickBooks Online, syncing sales data, financials, and inventory updates across multiple locations. However, businesses using payment processors other than Lightspeed Payments may incur additional monthly fees, impacting revenue.

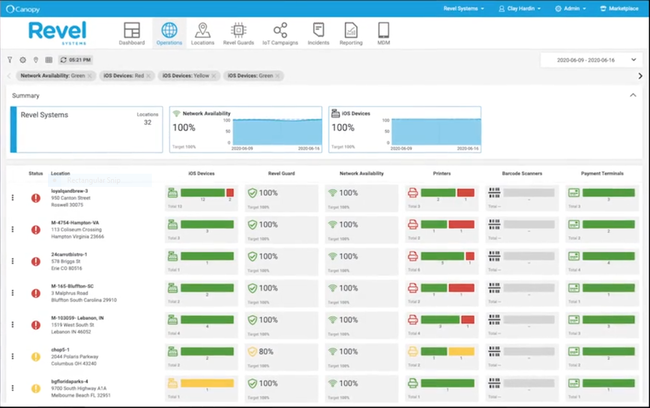

2 Revel Systems - Best for Enterprises

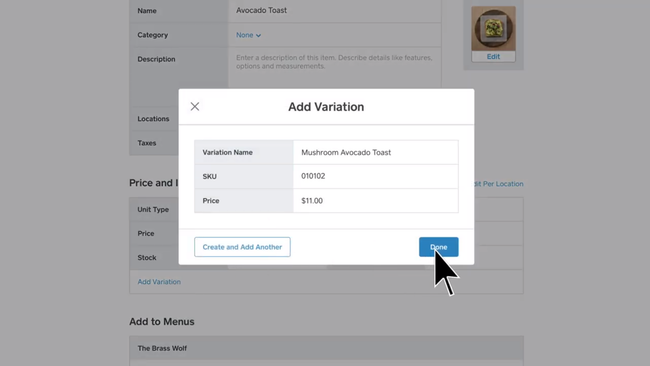

Why We Chose It: We found Revel Systems best for large-scale operations and enterprises in the restaurant and retail sectors. Its integration with QuickBooks Online automates daily transactions into summarized invoices for better product cost analysis. We also like that Revel can handle complex inventory needs, manage multiple product variants, and provide detailed real-time tracking down to ingredient levels.

Revel enhances operational efficiency by automatically updating inventory levels, sending low-stock alerts, and generating purchase orders. The integration also supports payroll processing by syncing employee time data, facilitating seamless wage calculations and payments through QuickBooks.

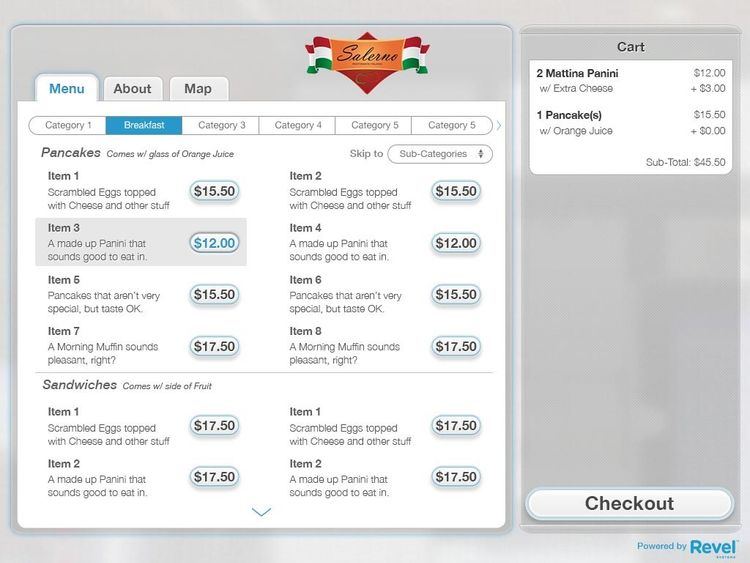

Revel supports various payment methods, including mobile wallets, and ensures secure data transmission. It offers EMV, Apple Pay, and dedicated in-house support. However, we found some users reported hardware and network problems. These included issues like orders or payments not going through properly and difficulty connecting to the internet for online orders.

3 Square - Best for Small Businesses

Why We Chose It: Square is another top pick of ours, with a score of 8.5. The platform syncs with QuickBooks Online, making it easier to manage financials across multiple locations. It automates the import of sales data into QuickBooks, creating detailed sales receipts that include item names, quantities sold, discounts, and taxes. We also found that Square integrates with QuickBooks Desktop.

Square’s inventory management capabilities are designed to support scaling retailers. It offers stock forecasting, automated purchase orders, and real-time tracking across multiple locations. We also like that it’s compatible with iPhones, iPads, Android devices, and Square’s own hardware terminals. However, the 2.6% + 10¢ per transaction fee adds up quickly, especially for companies processing large transaction volumes.

4 Shopify POS

Why We Chose It: Intuit partnered with Shopify to provide a migration tool, 24/7 support, and premium onboarding when switching from QuickBooks POS. Shopify’s integration with QuickBooks Online supports various functionalities, including directly synchronizing order data, customer information, and financial transactions. Shopify also syncs with QuickBooks Desktop through the QuickBooks Desktop Connector app.

Additionally, Shopify offers tools for automating purchase orders and managing stock across multiple locations. It supports Android, iOS, and any device using Google Chrome or Safari web browsers. Based on our findings, Shopify POS now syncs with QuickBooks Desktop once daily at a time specified by the user instead of every 5 minutes. This change aims to lessen the system’s workload and minimize errors caused by frequent updates. However, it also means that you won’t get real-time updates on financial data unless you manually sync it.

5 Clover POS

Why We Chose It: Clover POS syncs sales data, inventory, and financial records to QuickBooks through third-party applications like Commerce Sync. We added it to our list because it’s tailored for eCommerce and physical retailers, with in-store, online, and mobile sales functionalities.

Moreover, Clover offers features tailored for various business types, including multi-location inventory management and low-stock alerts. Square works on Android devices and proprietary Clover hardware, which runs on a modified version of Android. This means it might not be the best choice for companies mainly using iOS software. Also, we discovered that Clover requires businesses to use their own hardware, such as the Clover Station or Clover Mini, which limits merchants to their specific system.

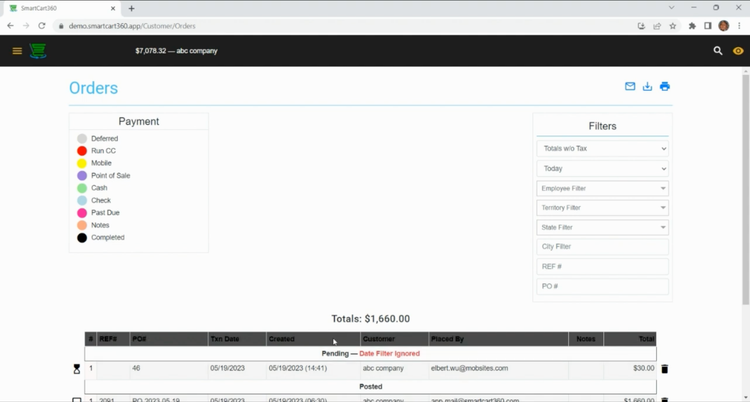

6 SmartCart360

Why We Chose It: SmartCart360 is a strong QuickBooks POS alternative designed specifically to replace the latter. We like its advanced inventory control features like low stock alerts, purchase order creation, and lot tracking. It also has comprehensive reporting capabilities, providing businesses valuable insights into sales, inventory, and customer data.

The software seamlessly integrates with popular accounting software like QuickBooks Online and QuickBooks Desktop, streamlining financial processes. Additionally, it offers a loyalty program tool to incentivize repeat customers and facilitates eCommerce integration to sync online and in-store sales.

With secure payment processing and PCI compliance, SmartCart360 is a solid choice for businesses seeking to upgrade from QuickBooks POS or implement a new POS system. It supports Android and iOS devices, so it’s a versatile pick for SMBs.

7 eHopper

Why We Chose It: We chose eHopper because it’s highly affordable, starting at just $10/month/license, and features sales tracking, inventory management, and customer engagement tools. Its user-friendly interface is accessible across various devices, including Android tablets, iPads, Windows PCs, and Poynt terminals.

One notable advantage of eHopper is its free credit card processing, which can significantly lower small businesses’ operating costs. The system also supports various payment methods, including in-person and online transactions via cash, credit/debit cards, mobile wallets, and portable card readers.

eHopper seamlessly integrates with QuickBooks Online, enabling automatic sharing of inventory, sales, and financial data. However, our research did reveal some potential downsides. eHopper offers fewer integration options compared to competitors like Shopify POS. It also performs better in retail than food services, partially because of its complex split payment process.

8 Toast POS

Why We Chose It: Toast POS is a restaurant management system that integrates seamlessly with QuickBooks. The integration, powered by xtraCHEF by Toast, facilitates the automation of invoice and payroll data into QuickBooks. It also provides specialized features for managing food costs, tracking inventory levels in real time, and generating detailed financial reports.

We found Toast’s inventory management tools helpful for managing food costs more effectively. These include features like recipe costing, waste tracking, and order management. These functionalities are supported on iOS and Android-based devices, including Toast’s proprietary hardware. Using Toast POS means committing to a long-term contract if you opt for their hardware, which could be a factor for new businesses to consider.

Why Seek a QuickBooks POS Alternative?

Intuit announced that, as of October 2023, QuickBooks POS would no longer receive security patches, updates, or support. Additional reasons to find alternatives include:

-

Industry-Specific Features: Certain alternatives are designed with specific industries in mind. For instance, Toast POS offers tools like online ordering, delivery, and contactless payments, which are ideal for restaurants and the food service industry.

-

Modern Capabilities: QuickBooks POS primarily operates as an on-premise solution, which limits its capability to leverage cloud-based advantages.

-

Security Risks: Continuing to use QuickBooks POS after the discontinuation date may expose businesses to potential security vulnerabilities due to the lack of security patches and updates.

How to Integrate POS Software with QuickBooks

To link your POS system with QuickBooks, follow these steps:

- Choose a POS system that smoothly connects with QuickBooks, such as Square, Clover, Shopify, Toast, or TouchBistro.

- Know whether you’re using QuickBooks Online or QuickBooks Desktop, as the setup might differ slightly.

- Set up the integration in your POS system by choosing the QuickBooks option and entering your QuickBooks login details. This kick-starts the sync between the two systems.

- Once integrated, your POS system automatically sends sales data, including costs and quantities sold, to QuickBooks, giving you a clear view of your finances.

Integration can be direct, where the POS and QuickBooks sync quickly, or indirect, where data is downloaded from the POS as a CSV file and manually uploaded to QuickBooks. Direct is better since it’s more automated. Some POS systems, like Square, have dedicated apps for QuickBooks Online syncing, while others, like Clover, need third-party apps for integration.

Which POS Software Is Best for QuickBooks?

The top POS software for integrating with QuickBooks includes:

- Lightspeed POS: Solid choice for retailers needing strong inventory management and integration with QuickBooks Online. It offers customizable receipts, omnichannel management, and detailed customer profiles.

- Square POS: Best all-around choice for small businesses. It has a free plan, affordable hardware, and connects with QuickBooks through a third-party service.

- Shopify POS: Good for companies with a strong online presence. It has a free app, syncs with QuickBooks, and lets you sell on social media and other online platforms.

- Revel POS: Great for larger businesses with multiple locations. It offers advanced features and seamless integration with QuickBooks.

- TouchBistro: Tailored for restaurants and catering services. It simplifies restaurant accounting and includes a kitchen display system.

How to Choose a QuickBooks POS Alternative

When choosing a QuickBooks POS alternative, consider several key factors to ensure that the new system aligns well with your business needs:

- Feature Set: Evaluate whether the alternative offers the specific features that your business requires. This might include inventory tracking, customer relationship management, sales reporting, and employee management. Also, check if the platform supports modern payment technologies such as NFC for tap-to-pay transactions.

- Industry Suitability: Some POS systems are tailored for specific industries. For instance, restaurants, retail stores, and service-oriented businesses might have different needs regarding order management, booking, and customer engagement.

- Integration Capabilities: Consider how well the POS system integrates with your current software, such as accounting software, eCommerce platforms, and CRM systems.

- Usability: The ease of use of a POS system is important, especially in high-pressure environments like retail or hospitality, where quick transaction processing is essential. Look for a system with an intuitive interface that can reduce training time and improve efficiency.

- Cost: Evaluate the total cost of ownership, including upfront costs, monthly or annual subscription fees, and any charges for support, maintenance, or additional features. Some systems offer a lower upfront cost but may require higher ongoing payments.

- Scalability: Ensure that the POS system can scale with your business. This includes handling an increasing volume of transactions, adding new sales channels, and expanding to new locations.

- Security and Compliance: The chosen POS system should comply with industry standards for data security, such as PCI DSS for payment processing. This helps protect sensitive customer and business data.

- Hardware Requirements: If your business requires specific hardware, such as barcode scanners, receipt printers, or mobile devices for sales, ensure the POS system is compatible with these devices. Also, consider whether the POS provider offers hardware or if you can use third-party options.