The Best Small Business Invoicing Software

We compared the top small business invoicing software for freelancers, service providers, and startups who want simple tools without the fluff. Our list includes free tools and affordable solutions for companies just starting out.

- Customizable payment terms

- No setup costs

- Recurring invoicing

- Basic inventory management capabilities

- Free trial available and no setup fees

- Navigable, user-friendly interface

- Accounting features are free

- Multi-currency invoicing

- Unlimited bank accounts and credit cards

These platforms automate billing while letting you handle the books and reports. We rounded up our favorite invoicing tools for small businesses and freelancers alike.

Not a small business? Check out our best accounting software roundup for more options.

- FreshBooks: Best for Service-Based Businesses

- Xero: Best for Freelancers & Small Businesses

- Wave: Best Free Option

- Odoo: Best ERP Option

- CustomBooks: Best for Recurring Billing

- Digital Purchase Order: Best for Operations-Led Organizations

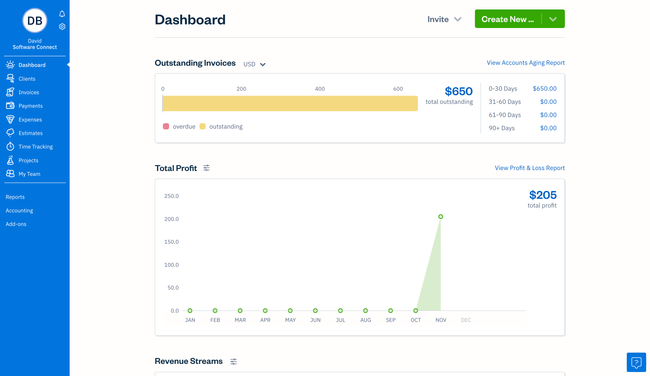

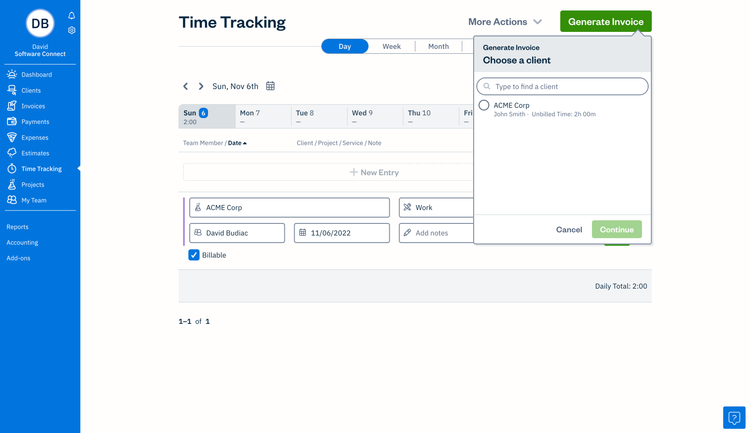

FreshBooks - Best for Service-Based Businesses

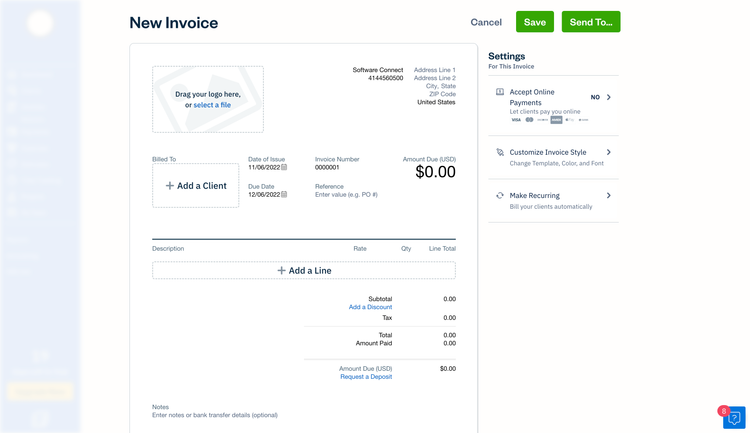

If you run a service-based business and want more control over invoice customization, FreshBooks is a solid choice. You can take your pick from three layout templates and drag and drop details like itemized lists, totals, and company info. You can also personalize each invoice with your logo, brand colors, and any client-specific information like discounts or taxes.

FreshBooks also makes it easier to bill for hours worked using its embedded time tracking tools. You can assign time entries to clients or projects and set custom rates by client or task type. When it’s time to send the invoice, you have multiple format options—send it as an online page, or export as Word, Excel, or PDF.

Plans start at $21/month for the Lite plan, but it only lets you invoice up to five clients. Higher-tier plans like Premium go up to $65/month. All tiers integrate with Stripe, so your clients can pay via debit or credit card, Apple Pay, or Google Pay.

Check out our full review of FreshBooks for ratings, pros, and cons.

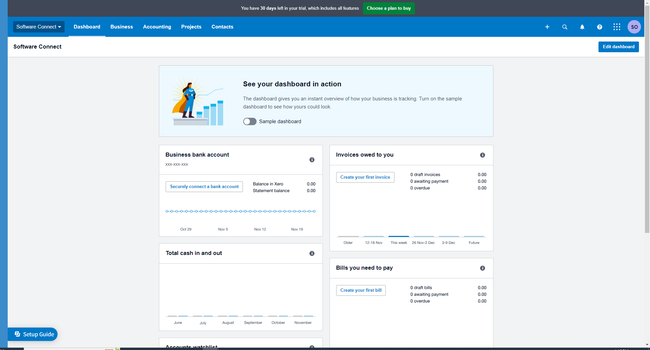

Xero - Best for Freelancers & Small Businesses

Xero is ideal if you don’t have a full-time accountant yet but still want to stay on top of your cash flow. This is largely because of its automated workflows–think recurring invoices and payment reminders. It also helps you manage your growing client base with easy setup for online payments–essential when time and cash are tight. You can accept payments via credit card, Stripe, Apple Pay, or Google Pay–but you can also shop around and choose your own gateway, if you need to find better rates.

Plus, the built-in invoice template is easy to use. While you can’t do a ton of customization, like changing font colors, in the app itself, the form is still professional and functional overall. Where Xero stands out is its design flexibility outside of the app. You can upload a Microsoft Word template with your custom branding and formatting. From there, it’s as easy as scheduling recurring invoices for your repeat customers.

This small business billing software offers over 1,000 third-party integrations, such as Shopify, HubSpot, and WooCommerce. As your business grows, it’s easy to expand into payroll, inventory, or CRM tools.

Plans start at $20/month for the Early plan, though you’re restricted to 20 monthly invoices. For unlimited invoicing, you’ll need higher-tier plans like Growing or Established. There’s no free version, but it’s still among the best value picks for early-stage companies ready to scale.

Explore full pricing details and more features in our Xero review.

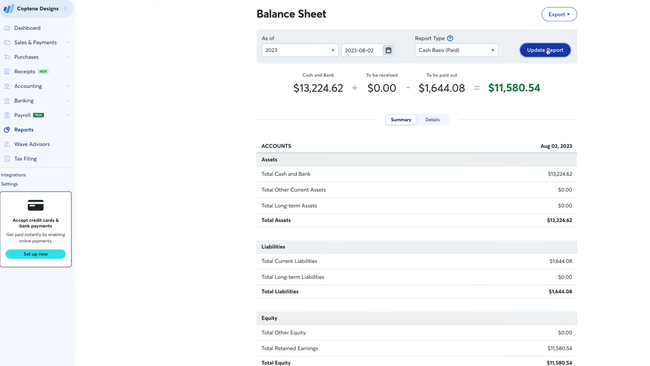

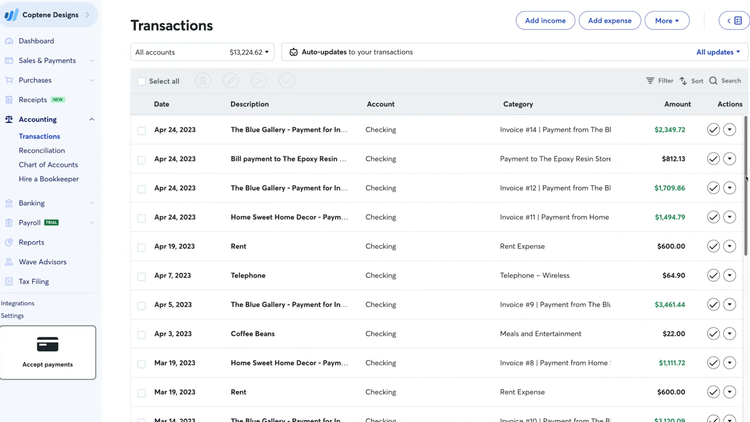

Wave - Best Free Option

If you’re working with a tight budget, Wave packs a ton of small business invoicing features into one free plan. It’s a great match if you’re a consultant, freelancer, or startup that doesn’t want to invest in software upfront.

You can create and send unlimited invoices and even add your logo, brand colors, and custom headers or footers, all for free. Plus, you can tweak messaging with thank-you notes or late payment terms. You’ll also get basic status tracking—view invoices marked as sent, viewed, overdue, or paid all from one dashboard.

Wave accepts credit card and ACH payments through its built-in gateway, with transaction fees of 2.9% + 60¢ per transaction. This is pretty typical for most processors. One thing to keep in mind though: you can’t switch gateways—you’re locked into Wave Payments. That said, setup is fairly simple and doesn’t require additional integrations.

One thing that sets Wave apart as an invoice system for small businesses is how much you get for free: you can create unlimited invoices and even invoice on the go with the mobile app. That said, Wave recently restricted auto-importing bank transactions to the paid Pro plan, starting at $170/year billed annually. You’ll also need the paid plan if you want to automate late payment reminders and digitally capture receipts, and it also accepts online payments at a discounted rate.

Read our full Wave review for ratings, features, pros, and cons.

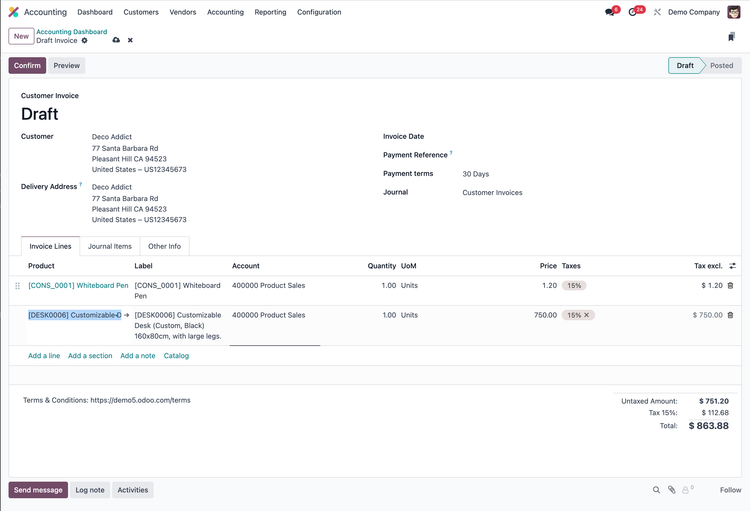

Odoo - Best ERP Option

If you want total control over how your invoicing software works—and how it fits into the rest of your business—Odoo is a good choice. Unlike basic accounting tools, Odoo is a modular ERP system, which means you can expand it as your business grows. Start with just the accounting app, then add CRM, inventory, or HR when you’re ready.

Odoo gives you seven fully customizable invoicing templates. Like most of the options on this list, you can change logos, fonts, layouts, taglines, and even background images. You can also modify the footer, company tagline, and printing format. It supports recurring invoices, multi-currency billing, and automated reminders to help you handle late payments.

The system also supports complex workflows, like pulling in sales order details or syncing with stock levels. Odoo gives you granular control over every invoice field—ideal for businesses with unique billing rules. It integrates with major payment gateways like Stripe, PayPal, and Authorize.net, and supports dozens more through built-in connectors or API access.

Paid plans range from $31.10 to $46.70/user/month depending on features and app combinations. Odoo’s free plan is limited to one app, though you’ll likely need the paid version over time as you require more functionalities like sales and purchasing.

See if Odoo fits your business operations in our full review.

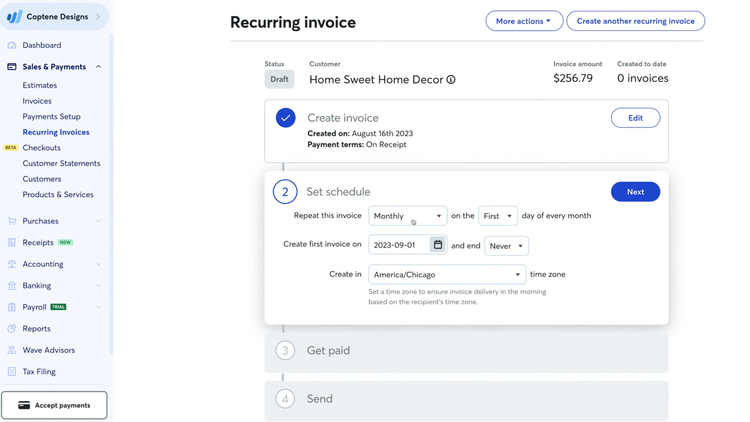

CustomBooks - Best for Recurring Billing

CustomBooks is a straightforward accounting and invoicing software designed for small and growing businesses. It stands out for its ability to automate recurring billing, so you don’t have to recreate the same invoices. Beyond that, it also offers core accounting and business reporting tools to help manage day-to-day finances.

CustomBooks’ recurring invoice templates let you automate billing for retainers, subscriptions, monthly services, or repeat clients. You can easily build templates with custom branding and payment terms, set late fee rules, and then schedule statements to go out automatically. And if an online payment is processed through the portal, the system will update it automatically. Together, these tools help reduce administrative work while making sure you never miss billing a client.

For just the basic accounting and invoicing features, CustomBooks starts at $19/month for the Start-Up plan. To receive recurring billing support, the Business Plan starts at $99/month with higher tiers for more features like online sales and advanced inventory management.

Explore pricing details and learn more in our full CustomBooks review.

Digital Purchase Order - Best for Operations-Led Organizations

Digital Purchase Order (DPO) is best for businesses that control spend through purchase orders. The invoice processing tool operates on the notion that purchases are approved before money leaves the organization. Invoices enter through a single inbox, and DPO uses OCR to automatically capture details. This reduces the time your team spends on accounts payable or untangling issues caused by disjointed workflows.

Once an invoice enters the system, it ties directly to a PO that authorized the spend. In simple mode, your team can quickly log basic invoice details and keep payables moving forward. In advanced mode, the system matches invoices line by line to PO items. That way, it’s clear which have been fully received and which remain outstanding. Your team can select predefined tax and VAT settings when entering invoices, so totals always match what vendors bill while still reflecting approved POs.

Because you can set approval levels and chains in advance, you can easily track invoice statuses in real time and release only the approved ones for payment. Any supporting documents also live directly in the PO, with archived approvals and records laying out a clear audit trail. Ideal for small to mid-sized companies, Digital Purchase Order starts at $30/month for up to three users.

What Is Small Business Invoicing Software?

Small business invoicing software is designed to help you create and send billing documents to customers. Invoicing solutions for small businesses provide automation features that help auto-complete data fields and calculate line items, like expenses, billable time, and goods and services provided to the client. Most platforms will also generate and apply sales tax. Overall, this reduces the time it takes to run your invoicing process, which cuts down on labor costs, helps prevent under-billing, and increases customer satisfaction.

Small business invoicing software is usually a more simplistic, easier to use, and inexpensive version of a more advanced billing and invoicing software. These solutions are targeted towards freelancers or small businesses with a smaller number of clients who may not need all the bells and whistles they find with other solutions.

These options can also be small business accounting software with an invoicing module or a stand-alone invoicing tool that integrates with existing accounting systems (such as QuickBooks Online or Xero).

Key Features

Invoicing programs for small businesses typically include these basic capabilities:

- Invoice creation: Modify customizable invoice templates to generate bills. Add services performed or products purchased and automate sales tax application. Handle recurring invoice scheduling, payment reminder documentation, logo & branding support; schedule recurring invoices and send via email

- Quotes and Estimates: Create a formal estimate that shows the products or services needed and the cost associated with them; easily adjust a “valid for” date on quotes

- Online Payments: Include ACH payments and credit card processing; support other payment options like PayPal, Apple Pay, Google Pay, and Samsung Pay; save customer details for easier payment collection.

- Time Tracking: Record time spent working for your customers; create invoices based on the work you have provided; use real-time and after-the-fact employee time tracking to streamline client billing.

- Expense Tracking: Monitor costs associated with each service or project by keeping records of when and how expenses were incurred; add reimbursable expenses to an invoice.

Primary Benefits

Some of the top benefits of invoicing software for your small business include:

Automate the Invoicing Process For Your Small Business

Find a solution that meshes well with other applications. For example, an invoicing tool that also offers (or integrates with) time tracking and project management will allow you to flow through your work day at a quicker pace.

While small business invoicing systems often include these features, similar platforms might also be marketed as project time tracking software or simply time and billing software. Time and billing may be best suited for businesses that rely heavily on capturing billable hours. Internally, tracking billable hours vs non-billable hours can give an oversight as to how profitable your labor resources are, or perhaps better improve your workforce planning.

A real world example of small businesses finding success with integrated invoicing and time tracking is within the professional services sector. If you’re a law firm, you likely bill clients at an hourly rate for services provided. Before beginning client work, you’ll want to “clock in” to their project, and “clock out” when you’re done. Once you complete the work, the platform calculates your time against your hourly rate, which creates a dollar figure on your invoice.

Create Invoices From Anywhere With Online Access

In today’s age, you can access all types of software via the cloud. Small business invoicing software that runs online provides a cost-effective, scalable, and flexible way of handling any billing needs.

One of the most popular reasons people are moving to online small business invoicing software is for the accessibility it offers. You can log into online programs via browser. As such, they do not require any sort of native application to work. This means you can use the software while at home, at a coffee shop, or wherever you have access to the internet.

This level of accessibility means your invoices are stored in the cloud. Employees can upload and approve invoices even if they are traveling. Invoices are also never lost. Cloud storage offered by your software provider means they control any and all data storage and backups.

Other benefits of cloud small business invoicing software include subscription-based pricing, online payment processing, and reducing paperwork within your business.

What Does Small Business Invoicing Software Cost?

The cost of small business invoicing software depends on several factors: the number of users, the volume of invoices sent each month, the need for features beyond basic invoicing (like time tracking or expense management), and whether you require integrations with other systems.

Most solutions targeting small businesses fall into an entry-level tier designed for companies with 1 to 20 employees. These options typically have a total cost of ownership between $500 and $5,000 per year. This includes the cost of the software subscription and any processing or add-on fees. Common examples in this category include QuickBooks Online, FreshBooks, and Xero.

Payment processing—whether via credit card or ACH—is usually billed separately as a percentage of each transaction. This adds to your total monthly spending and can vary depending on which processor or gateway is used.

Subscription-based models are more common, as they typically include access to support and regular updates. Businesses often choose this approach for the added peace of mind that comes with ongoing product improvements and technical help when needed.