Accounts Receivable vs. Accounts Payable

In bookkeeping, Accounts Payable (AP) are the amounts you owe to your vendors and suppliers. Accounts Receivable (AR) are the amounts your customers owe to your business. For small business owners, it’s important to understand how these two differ and how you can automate them using accounting software.

What Are Accounts Receivable?

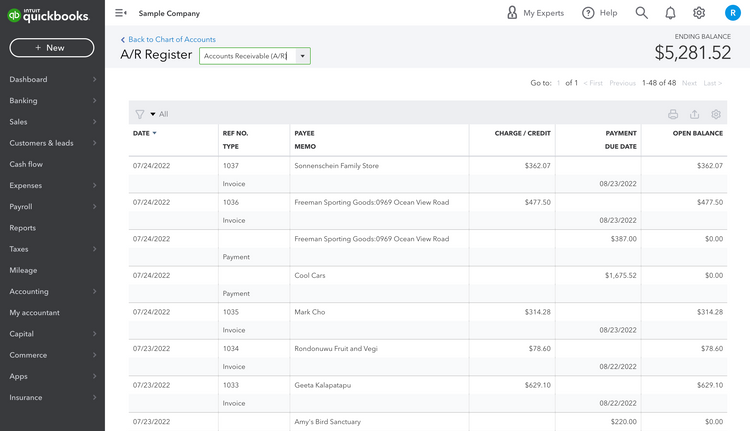

Accounts receivable represent future cash inflow from your clients to your business, considered a current asset. This asset is expected to be collected within a 12-month period, meaning the transactions will remain in your accounts receivable ledger until your customer pays their bill.

How to Use Accounts Receivable with Examples

After completing a transaction, send your customer an invoice documenting the supply date, a unique invoice number, a description of goods and services, the total amount payable, credit terms, and how to pay.

Until your customer pays their bill, you can record this transaction under accounts receivable as debit and credit your sales account. Below is an example of what it may look like:

| Types of Accounts | Debit | Credit |

|---|---|---|

| Accounts Receivable | $1,000 | – |

| Sales | – | $1,000 |

What Are Accounts Payable?

Accounts payable represent future cash outflow from your business to your suppliers and vendors. These short-term debts are considered current liabilities. A current liability refers to amounts due to your creditors within 12 months. These transactions remain in your accounts payable ledger until you pay your bill.

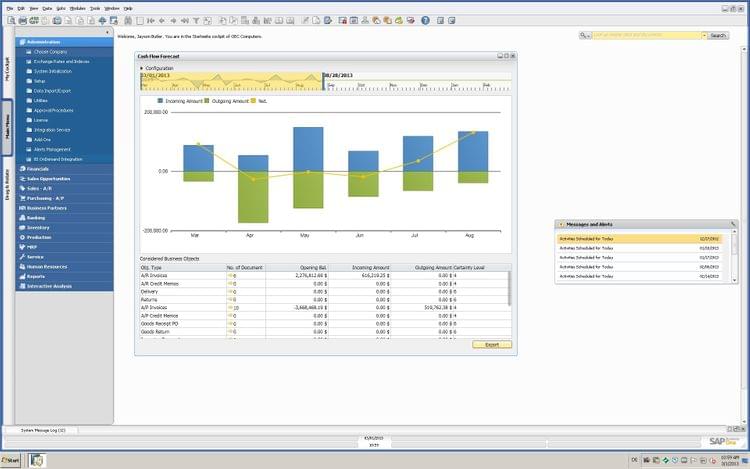

This method of collecting payments is known as accrual accounting. Rather than recognizing payments based on the time you receive or pay out cash, accrual accounting tracks incoming and outgoing cash before the transactions occur. As a result, you record expenses at the same time you record an account payable.

Automate your financial statements with top accounts payable automation software.

How to Use Accounts Payable with Examples

After completing a transaction, you send your vendor a purchase order documenting the items requested, price per unit, quantity, payment terms, and delivery details. A purchase order allows the supplier to extend credit with the understanding you will pay upon receiving their goods or services.

Until you secure your order, you can record this transaction under accounts payable as credit. Let’s say that you order office supplies for your company. You can make a journal entry in your general ledger documenting that transaction:

| Date | Type of Accounts | Debit | Credit |

|---|---|---|---|

| 24-Mar-23 | Expenses - Office Supplies | $250 | – |

| – | Accounts payable - Office Supply Store A | – | $250 |

Key Differences

Knowing the difference between the two is vital whether you’re a business owner or bookkeeping for a small business. The table below outlines these at a glance:

| Premise | Accounts Payable | Accounts Receivable |

|---|---|---|

| Definition | What you owe vendors/suppliers | What your customers owe you |

| Cause | Buying items on credit | Selling products/services on credit |

| Result | You pay your vendor/supplier | The customer pays off their debt |

| Responsibility | Lies with your business | Lies with your debtors |

| Balance Sheet Location | Current liability section | Current asset section |

| Cash Flow | Cash Outflow | Cash Inflow |

| Offset | None | Allowance for doubtful accounts |

Why Are Accounts Payable and Accounts Receivable Important?

Accounts Payable Allows you to track bills and measure the cost-effectiveness of your business. They also help you pay your invoices on time, prevent late payment fees, and avoid tying up working capital in your balance sheet. Working capital represents the operating liquidity of your business, calculated as current assets minus current liabilities.

To free up more working capital, check your suppliers’ payment terms. You can sometimes negotiate a discount for early payment on purchases.

Accounts Receivable Promotes healthy cash flow management. This liability account tracks outstanding customer invoices, showing your credit sales and who to contact for payment. It also allows you to write off bad debts should a customer fail to pay and highlights the profitability of your business.

To calculate profitability, take the total of your accounts receivable and assets. Then, subtract the sum of your accounts payable. A positive number indicates that your business is profitable. A negative number is a warning to limit expenses and revisit your company’s balance sheet.

FAQs

Where are accounts receivable and accounts payable on a balance sheet?

Your accounts receivable fall under the current assets section of your balance sheet. Your accounts payable fall under the current liability section.

Are accounts receivable an asset or liability?

Accounts receivable represent an asset for your company because the amount owed to your company will convert to cash within one year.

Are accounts payable an asset or liability?

Accounts payable are considered a liability for your company because the amount you owe to creditors is a claim against your company’s assets.

Why should I automate accounts payable and accounts receivable reports?

Automation through bookkeeping software streamlines your business operations and improves your bottom line. You can do these tasks and more in one program:

- Minimize accounting errors

- Generate invoices and track customer payments

- Manage payments to suppliers and vendors

- Run balance sheets, cash flow statements, and more

Want to optimize your AR and AP? Find the best accounting software to enhance your cashflow. Or get free software recommendations from one of our advisors.