What Is an Accounts Receivable Aging Report?

An accounts receivable (AR) aging report displays unpaid and outstanding customer invoices grouped by date ranges of time since issued. It helps you understand the distribution and average age of your outstanding invoices. Accounts receivable (AR) aging reports are summaries commonly used in accounting software.

Key takeaways:

- Accounts receivable aging report helps identify open customer invoices based on how long they have been outstanding.

- Benefits include reevaluating your credit risk, implementing payment terms for clients, and revising client follow-up procedures.

- The AR aging schedule breaks dates in 30-day increments, helping identify late payments and bad debts.

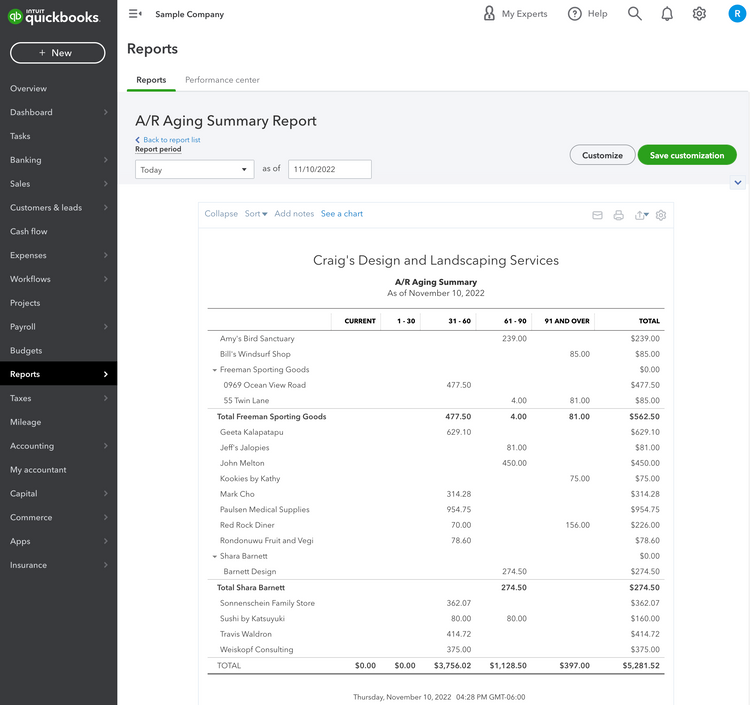

Example of an AR Aging Report

| Vendor | Current | 1-30 Days | 31-60 Days | 61-90 Days | 90+ Days |

|---|---|---|---|---|---|

| Vendor 1 | – | – | $131.97 | – | $388.70 |

| Vendor 2 | – | $150.25 | $120.14 | – | – |

| Vendor 3 | – | $42.58 | – | $517.20 | – |

| Total | $0.00 | $192.83 | $252.11 | $517.20 | $388.70 |

As seen here, even a delay of one month can lead to significant losses for small business owners. A 2023 survey by Intuit reported that 73% of small businesses have been negatively affected by extended payment terms or late payment terms.

Benefits of AR Aging

Reviewing your AR aging reports monthly (or even weekly) will allow you to receive payments on time and better strategize your collection process in the following ways:

- Examine credit policies: Multiple late payments could indicate a problem with your credit policies, including the maximum credit limit for clients, what happens when a payment is past due, how early payment discounts work, etc

- Reevaluate credit risk: Compare your credit risk to industry standards to see if you’re taking on too much. Decide if you should continue servicing customers with a history of late payments

- Implement payment terms: Communicate that clients must pay invoices in a certain number of days (for example, 10, 15, 30, 45, or 60 days) to reduce potential cash flow issues

- Revisit dunning procedures: Determine if you should make any changes to how you follow up with clients. For example, customers in the 1-30 days age group may respond well to a reminder mailed within seven days of the invoice due date. Conversely, you may need to turn clients in the 91+ days age group over to a collection agency

How to Create and Use an AR Aging Report

- Step One: Review your unpaid customer invoices

- Step Two: Use the aging schedule to categorize invoices based on the length of time lapsed

- Step Three: Create a list of all customers’ names with outstanding balances

- Step Four: Categorize clients based on the number of days unpaid and the total amount due

- Step Five: Use your AR aging report to pinpoint trends and determine which customers are late and by how long; take appropriate steps to contact clients and collect past due invoices

Accounts Receivable Aging Schedule: Estimating Bad Debts

An aging schedule shows date ranges broken into five columns to help you easily identify late payments:

- Current: Invoice due immediately

- 1-30 Days: Due within 30 days

- 31-60 Days: Past due 31-60 days

- 61-90 Days: Past due 61-90 days

- 91+ Days: Past due 91 or more days

Where does estimating bad debts come into the equation? An aging schedule allows you to view uncollectible receivables at a glance, signifying a doubtful account. The uncollectible amount then becomes a bad debt for write-off on your financial statements. After all, the longer a debt goes uncollected, the greater the chance it will remain that way.

The aging schedule makes allowances for these bad debts and creates more accurate financial reports of your receivable balance. Also known as a contra-asset account, the allowance acts as a reserve against the accounts receivable assets in your balance sheet. An AR aging report allows you to estimate how much should be set aside based on the standard length of time payments go uncollected and how many require a write-off as bad debts.

How to Automate Your Accounts Receivable Aging Reports

While running AR aging reports is critical, it can be time-consuming. Tired of manually running financial reports? Consider accounting software that offers AR reporting in addition to other bookkeeping management tools. Overall, AR software helps lower labor costs related to the recording and collection of customer payments, refines collection processes by setting timetables for escalating outstanding accounts, automates payment reminder alerts, and, above all, minimizes the average time clients take to pay off their balance.

Other features of accounts receivable software might include the following:

- Customer database management: Track customer names, contact info, preferred payment methods, addresses, and more in an easily filtered and searched AP database

- Credit verification: Improve the efficiency of collections functions; trigger credit checks and receive your results within the accounts receivable module

- Invoice creation: Document information such as cost breakdowns for products, services, and tax, payment due dates, acceptable payment methods, what the terms for customer payment are, etc

- Recurring billing support: Set up recurring payments via ACH or other methods to boost collection rates and reduce time spent obtaining payments

- Early payment discounts: Secure a competitive edge and boost customer satisfaction with early payment discounts

- Interest and late fee terms: Apply flexible interest and late fees that determine how much to charge customers with delayed payments

- Billing/collection email integration: Create and send emails from the AR module to follow up on outstanding invoices

- Collection letter templates: Reduce labor costs when collecting overdue customer balances with collection letter templates, also known as dunning letters

- Collection call scripts: Optimize collection functions by providing scripts to employees to ensure call quality

Managing Cash Flow with Accounts Receivable Reports Is Essential

AR aging reports help minimize cash flow issues and maintain the financial health of your business. Automating these, along with your other financial reporting processes, makes it that much easier to identify potential problems and cultivate a healthy cash flow.

AR software manages receivables data all in one place, increasing the efficiency of collecting client payments.