What is Progress Billing? Benefits & How to Implement

What is Progress Billing?

Progress billing is a type of invoice that bills for work completed during a lengthy project. Instead of invoicing at the completion of the project, progress billing occurs incrementally as the entire project advances. This billing method is used when companies want to keep track of their spending while they’re working on a project or if there’s no clear end date.

Primarily used for large-scale projects in the construction industry, progress billing is a way to reimburse a company for the work they have done. It allows you to track costs, payments, and work and is an invaluable tool in project management and getting paid for the work that has been done.

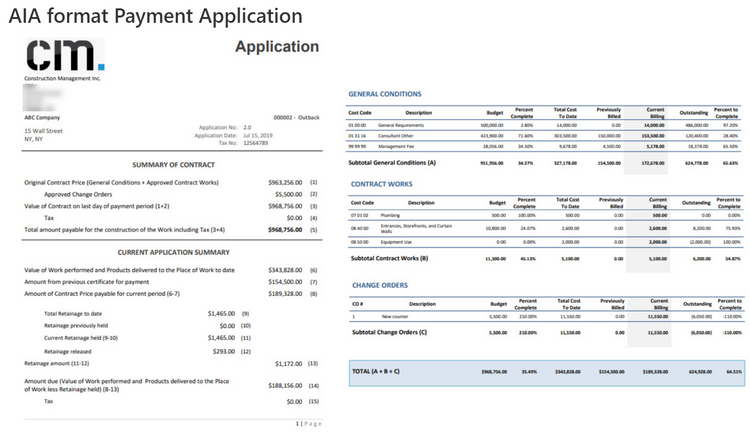

Using a schedule of values, stakeholders on construction projects can list the value and cost of every billable work item on a step-by-step timeline and the percentage of work completed to date. This will provide insight into the total amount of money that has been spent so far and how much remains to be spent. It helps stakeholders track progress, identify issues early in the process, and adjust plans accordingly. It also allows businesses to pay down invoices at a quicker pace and have fewer liabilities in their construction accounting software, as they no longer have to wait for an official invoice to settle before they can pay.

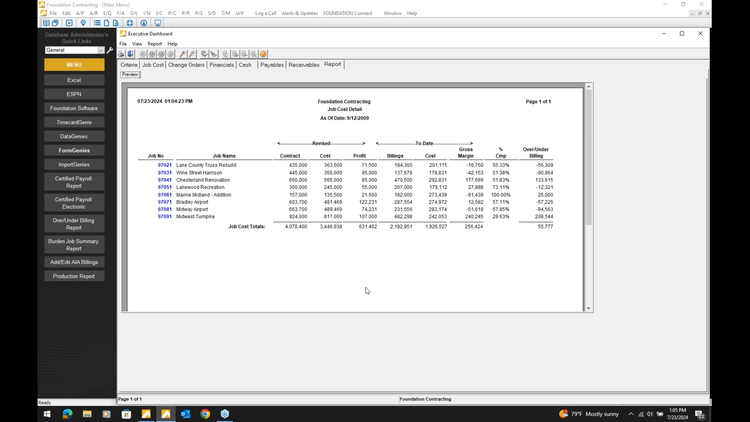

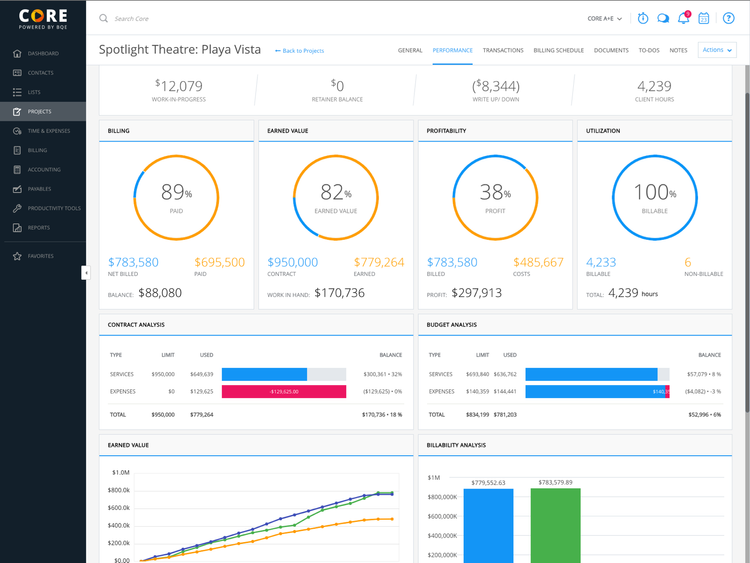

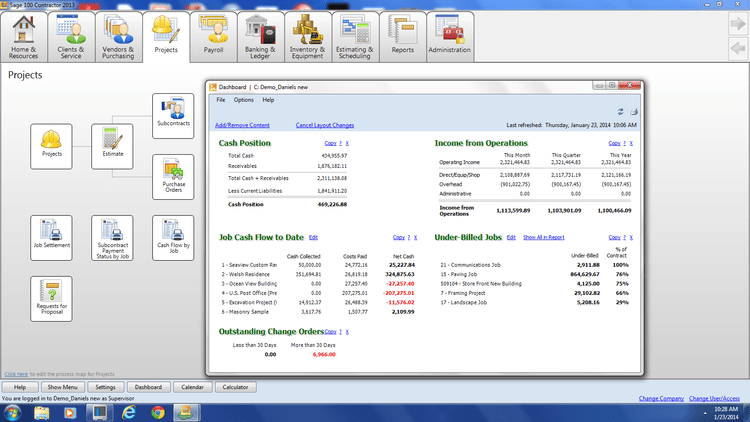

Most construction project management software will include construction invoice templates that project managers, general contractors, subcontractors, and independent contractors can take advantage of. These invoices will include line items for work to be performed, a contract amount, contractor’s certification, and more.

Main Sections

Progress billing invoices have a different workflow compared to other construction billing types.

- Progress Invoicing: Create invoice documents for the contractor’s financial management obligations, such as detailed labor and material costs. Display line items clearly, along with other additional information. Create an accounts receivable structure that can incorporate partial payments based on completion percentage, project milestone dependencies, specific project dates, or project categories in terms of the type of work performed.

- Change Orders: Affect payment application on a construction project via changes to the scope of work, or the work outlined in the contract. These change orders bring about adjustments to time and money, which is why it’s important to account for them during initial negotiations.

- Project Management and Job Costing: Automatically create alerts when certain billing thresholds have been reached and pair them with completed tasks along the way. Identify individual job charges and pair them with line items.

- AIA Billing: A standardized methodology of progress billing created by the American Institute of Architects via forms G-702 and G-703.

How to Implement Progress Billing

Progress billing offers a tremendous opportunity to improve cash flow, manage risk, and better meet customer demands. But if you don’t have the right tools, the management of progress billing and retainage can become overwhelming and inefficient.

- Develop a clear and detailed scope of work: Include what the project will entail, how long it’ll take, who will be involved, and what the final product should look like.

- Develop a detailed work plan: Stay on track with your milestones and determine when each task needs to be completed within your project schedule to avoid falling behind or missing deadlines.

- Develop a detailed payment schedule: Break down all charges into categories such as labor costs and equipment rentals (if any). Don’t forget about taxes! Be sure they’re calculated into every invoice so you don’t end up paying them out of pocket at the end of the year because they weren’t included in your progress billing invoices throughout the year.

Key Benefits

Progress billing is an important tool for small businesses and freelancers, who often don’t have enough capital to pay upfront for their projects. It’s also useful in industries where customers are not able to pay upfront, such as healthcare or construction.

Vendor Benefits

- Accuracy: Ensures all expenses and time spent working are accounted for throughout the duration of a project.

- Improved cash flow: Sending frequent invoices instead of one lump sum at the end allows cash to always flow back into your business while expenses are being made. It also helps you keep track of overall finances with detailed bookkeeping.

- Low risk: Because invoices are being sent while work is being done, if a customer doesn’t pay on time, you can stop working until the payment is made. This reduces the risk of lengthy and costly disputes or not being paid after a project.

Client Benefits

- Smaller Payments: Progress billing eliminates large payment sums, so you don’t have to dish out large amounts of cash before or after a project. The steady flow allows for more money to come in before the next payment.

- Better informed: Each invoice explains every expense and task completed, so you can be sure you’re not paying for unnecessary work. Through each invoice, you can essentially track the progress of your project.

- Low risk: Progress billing is low risk for the client because if work isn’t done to their specifications, they don’t have to pay until it is.

Who Uses Progress Billing?

Progress billing can be used for any type of project-based industry, including:

- Construction–building homes or new buildings

- Engineering–designing roads and bridges

- Architecture–designing houses and buildings

Within these industries, users of progress billing software capabilities may include:

- General Contractors: Responsible for coordinating all aspects of a building project, they will coordinate with architects, engineers, and subcontractors to ensure that their part in the billing process goes smoothly.

- Subcontractors: Responsible for specific parts of projects such as plumbing or electrical wiring, they may require a constant flow of payments in order to keep their payroll consistent and ensure their staff are adequately compensated before, during, and after their jobs.

- Developers: These decision-makers handle property acquisition and manage the construction project of a new real estate project. They can also be considered a general contractor and will coordinate with architects, engineers, and subcontractors to execute project tasks and ensure project funding is established

- Property owners, managers, investors, and management companies: These individuals are responsible for hiring the necessary contractors to develop or improve their own property. They are responsible for paying their general contractor on time and may need to agree to specific progress invoicing during the initial planning stages.

Streamline Progress Billing with Software

There are several benefits associated with managing your progress billing through a program designed specifically for the task, such as construction accounting software or general billing and invoicing systems](/roundups/best-invoicing-software/):

- Detailed time tracking: Allows you to track the amount of time spent on each task by individual employees. This ensures that everyone is working as hard as possible and it also allows you to allocate more resources when needed so that deadlines are met on time (or even earlier).

- Receivable Tracking: Helps businesses keep track of receivables so they don’t lose money unnecessarily due to outstanding invoices. If someone isn’t paid within 30 days, there may be penalties or interest charges associated with this, which can quickly add up to thousands of dollars per month.

- Consistency: Software provides a consistent platform rather than having salespeople or project managers create their own manual invoices.

- Streamlined Calculations: This provides a mechanism to handle a percentage of work calculations and other financial computations, which can decrease accounting errors.