The Best Construction Accounting Software

We’ve reviewed the top construction accounting software for functionalities like job costing and payroll compliance. Whether you’re a large general contractor or a small subcontractor, we can help you manage finances across projects of all sizes.

- Includes financial management, job costing, project management features

- Automated financial report generation

- Payroll module handles multiple prevailing wage, union, fringe, tax rates

- Customizable dashboard

- Encourages collaboration through real-time web access

- One-click access to tasks relevant to specific users

- Large network of resellers and knowledge experts

- Offers a complete bookkeeping system

- Has customizable report creation

Construction accounting software packages provide financial accounting designed specifically with contractors in mind. Features typically include project accounting, job costing, and specialized progress billing.

To help you find the best solution, we’ve used our review methodology to put together a collection of our best picks for construction accounting software.

- Foundation Software: Best Overall

- Viewpoint Spectrum: Best ERP System

- Sage 100 Contractor: Best On-Premise Option

- ComputerEase: Best Integrated Project Management

- Jonas Construction Software: Best Job Costing Module

- Viewpoint Vista: Best Analytic Tools

- Sage Intacct Construction: Best Financial Management Tools

- Acumatica Construction Edition: Most Versatile

- PENTA Construction: Best for Industrial Contractors

- INTERAC Construction Accounting: Best Billing Modules

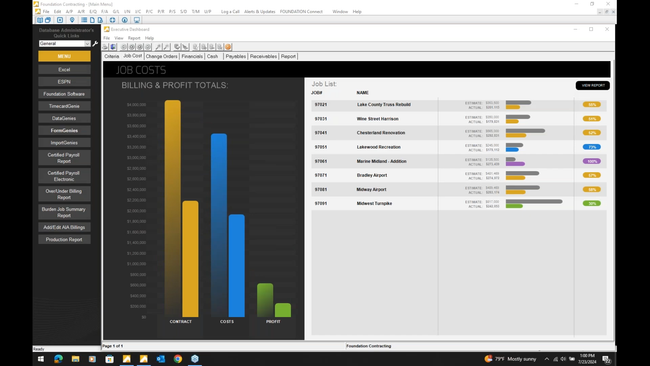

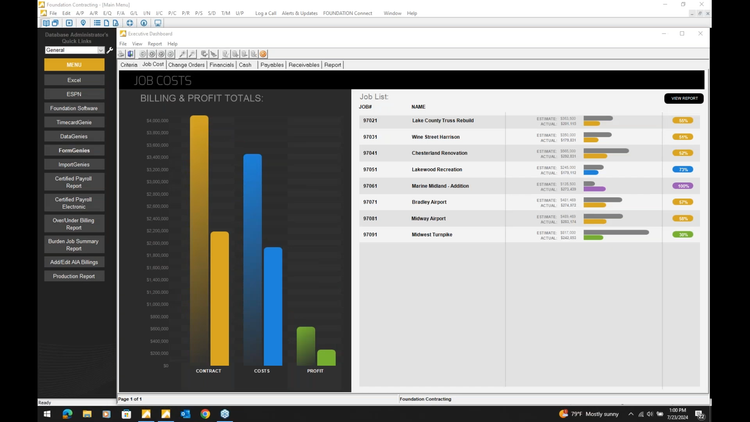

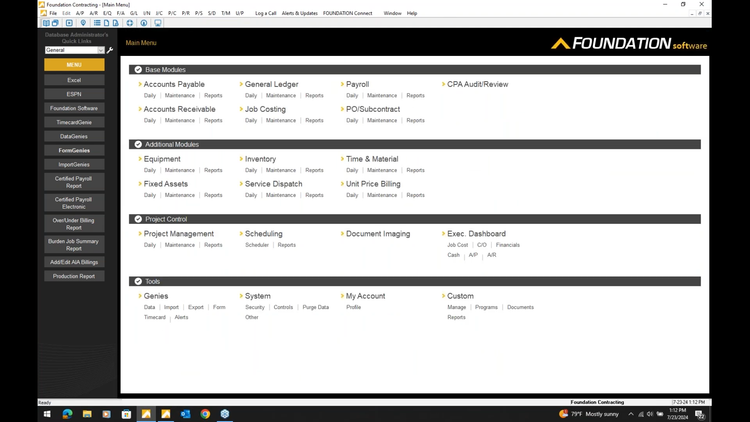

Foundation Software - Best Overall

Foundation Software syncs financial functions, like accounts payable (A/P) and receivable (A/R), with construction-specific features. Specifically, the job costing tool is effective for contractors looking to track finances accurately for every project. These include cash flows, overhead allocation, labor costs, and WIP reports, helping you see exactly where every expense was created.

The module features a project budgeting tool that compares estimated costs vs actuals. If you use an estimating software, you can easily import spreadsheets to start tracking instantly. And with any construction job, variables like schedule or scope change quickly, and Foundation Software lets you modify the budget to reflect updates. You can even break them down by custom codes or standard CSI divisions for more granular insights.

Foundation Software is best for small to midsize trade contractors who require an accounting-specific platform to integrate with a broader project management system. Additional accounting features include modules like AIA billing, payroll, and a general ledger with multi-company support. Pricing starts at $400/month, but you’ll need a custom quote based on your company size and desired features for an exact cost.

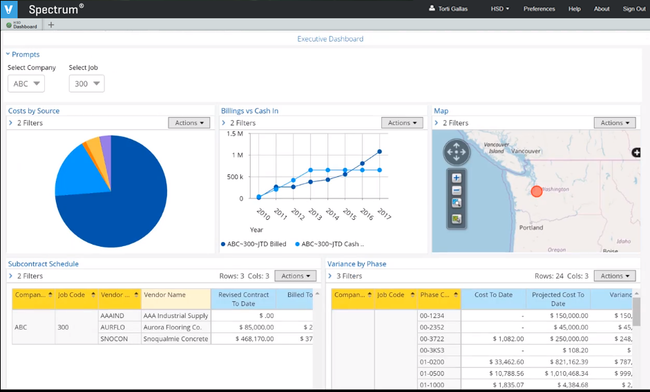

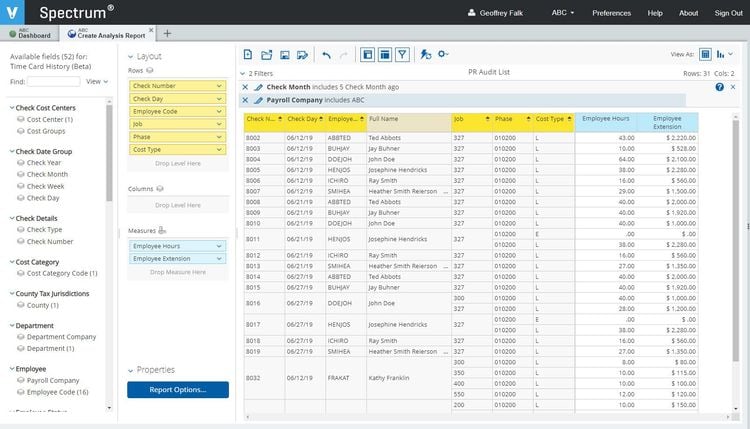

Viewpoint Spectrum - Best ERP System

Viewpoint Spectrum made our list because it’s a full-featured construction ERP, integrating accounting, payroll, equipment tracking, service management, and dispatching. We found its accounting system advanced, supporting multi-currency processing. Spectrum also handles more basic functions like invoice entry, reporting, cash management, and job costing.

Spectrum’s construction operations cover many capabilities, including equipment tracking, resource scheduling, and cost projections. We also found its project setup module worth mentioning. It links Spectrum with the company’s estimating software, transferring estimates directly into the job costing system. This automation sets up jobs, contracts, and subcontracts in their respective modules without re-entering data.

Sage 100 Contractor - Best On-Premise Option

We found Sage 100 Contractor best for companies that have outgrown QuickBooks and want an on-premise system. Although installed locally, the software can be downloaded on mobile devices so contractors can use it in the field and the office. Users can access its accounting features remotely, including AR and AP, for simple invoicing, progress billing, and payable management.

Sage 100 Contractor includes construction-specific features like project management tools, a report writer wizard, and equipment management. Its estimating and budgeting functionalities help manage budgets and completion of bids, while the scheduling tool automates subcontractor and supplier notices. Ultimately, it’s a comprehensive system that contractors can install on many different configurations, including stand-alone, network servers, and workstations.

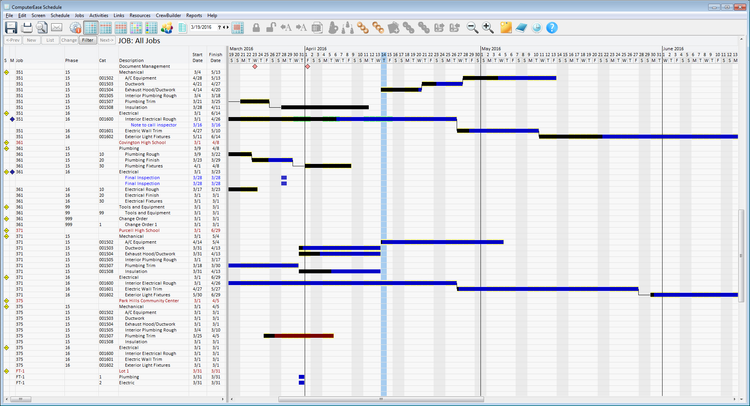

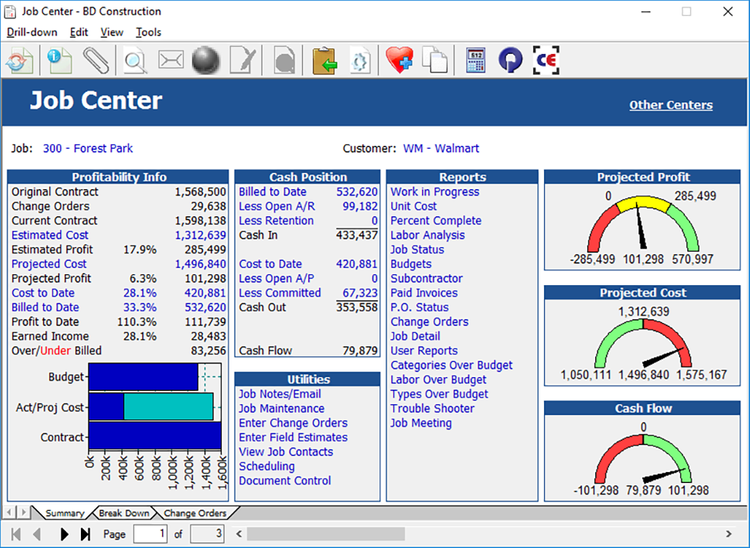

ComputerEase - Best Integrated Project Management

Deltek acquired ComputerEase in 2019, integrating the software’s field-to-office functions with the corporation’s project-based business expertise. It’s a great midmarket option, as it combines construction accounting with its strong project management module. You can create detailed timelines with interdependencies to ensure phases remain aligned after delays and adjustments.

The project management module also offers effective resource tracking tools to balance workloads and optimize labor costs. Easily see each crew member’s weekly or monthly schedule to ensure there’s no over or under-staffing. It also shows their assigned job, so skilled labor workers, like electricians or concrete finishers, only work on relevant tasks.

ComputerEase’s job costing tools integrate directly with project management for real-time data monitoring. View work in progress (WIP) report data so you always have up-to-date information on every project’s current cost. Track labor, material, and subcontract costs in one place and compare the total to the contract amount to ensure profitability. If costs don’t match the budget, easily adjust timelines or material purchases without leaving the program.

Though the interface is on the traditional side, Deltek continues modernizing the platform, including user-friendly entry screens and a dark mode to reduce eye strain.

Jonas Construction Software - Best Job Costing Module

Jonas Construction Software’s job costing module lets you track labor, equipment, materials, and subcontractor costs for each project. Easily see estimated vs actual costs to monitor how a job is progressing. This helps you create accurate invoices for your clients, as well as identify inefficiencies or inaccurate estimates.

Jonas Construction also uses the data from each job to view real-time insights into accurate project cost data across the entire company. It offers several charts and graphs for key metrics, including:

- Labor cost by each job: Compare the total labor cost for each job in an easy-to-read chart.

- Project profits by job: Easily see which jobs generated the most revenue and drill down into less profitable jobs to analyze potential overspending or delays.

- Contract value by PM: View the total value of contracts managed by each project manager to assess performance.

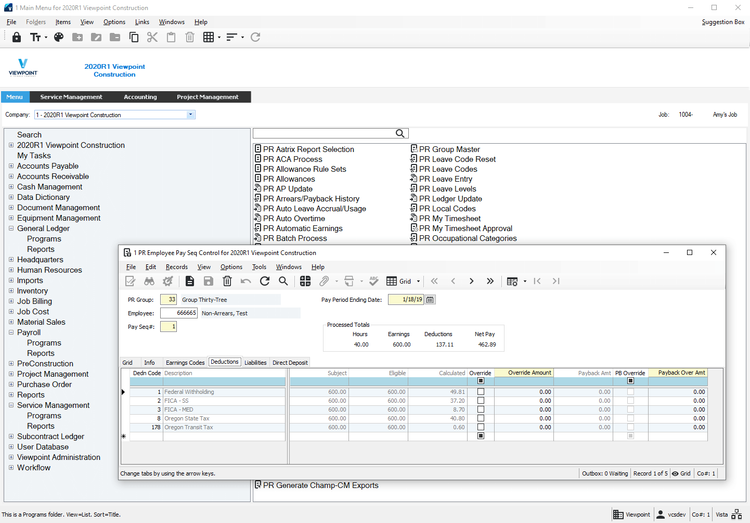

Viewpoint Vista - Best Analytic Tools

Viewpoint Vista by Trimble integrates construction management and accounting for large contractors. They typically take on more intricate, higher-margin work, requiring detailed cost and labor tracking. Vista makes tracking expenses, profitability, and other metrics at the company, department, and work order levels easy.

Additionally, Vista users can access Viewpoint Analytics to visualize construction data like daily logs, RFIs, and submittals. The software also delivers flexible reporting and analytics, with pre-built options for progress billing and contract summaries. Overall, Vista makes tracking change orders, labor, and equipment easy for granular breakdowns on project profitability.

Sage Intacct Construction - Best Financial Management Tools

Sage Intacct Construction is a great accounting software for contractors of all sizes needing cloud-based financial management. It offers basic accounting capabilities as well as more advanced features like real-time posting, streamlined bank reconciliation, and flexible journal entries. The software also handles multi-entity consolidation, making it a strong choice for construction companies with different locations.

We found Intacct Construction’s estimating and bidding tools useful. It has a comprehensive price database to help create competitive estimates, bids, and budgets. We also appreciate its role-based dashboards, KPI tracking, and dimensional reporting, where construction businesses can tag transactions to view data from any angle.

Acumatica Construction Edition - Most Versatile

Acumatica Construction Edition is a scalable option for both small contractors and larger construction companies. We picked it for features like multi-company and multicurrency support and intercompany accounting, making it versatile for a wide range of business sizes and types. We also like that Acumatica integrates easily with other systems like Procore, ProEst, and eSignature apps like DocuSign.

Acumatica’s payroll solution is fairly flexible, catering to requirements like multiple unions, classes, complex wages, and benefits packages. Additionally, the software also provides tools for creating and tracking subcontract status, purchase orders, and budget comparisons. This helps automate project commitments and change order processes, helping to control cost overruns.

PENTA Construction - Best for Industrial Contractors

We found PENTA Construction best for midsize to large commercial and industrial contractors. That’s because it delivers a deep feature set to support complex workflows with time and billing management, detailed job costing, and financial reporting. PENTA also handles construction accounting, including automated closing features and foreign exchange capabilities.

Additionally, PENTA includes an advanced labor management module with automatic David-Bacon work calculations and rate tables for fringe benefits. Large firms will also appreciate its equipment management module, providing tracking of equipment location and usage worldwide.

INTERAC Construction Accounting - Best Billing Modules

INTERAC Construction Accounting offers strong job costing and management capabilities. It provides subcontractor control and service billing modules tailored explicitly for general and specialty contractors. For heavy contractors, it includes equipment cost and equipment manager tools, along with an inventory control system.

INTERAC supports various billing formats, including AIA, T&M, free form, and contract billing, integrated into modules spanning both accounting and construction management. Last, it has extensive payroll features, supporting multi-state, multi-locality, prevailing wage, certifications, union contributions, and worker’s comp calculations.

What is Construction Accounting Software?

Construction accounting software performs project accounting specifically developed for construction projects. These solutions track financial data in real time while monitoring expenses (like the cost of materials and labor). Use software to streamline your revenue reports, invoicing, and payroll processes to stay on top of your company’s finances.

Some unique functionality offered by construction accounting programs modules include:

- Job costing: Track and report transactions specific to each job.

- Contracts and Subcontracts: Determine when to officially record income and expenses on a project based on details set out in the contract.

- Specialized Billing: Invoice clients based on retainage, fixed price, time and material, unit price, and progress billing.

Construction accounting is more complex than general accounting regarding sales, cost of goods sold, expenses, and breakeven. These industry-specific software can provide the tools you need to automate the process.

Our Methodology

We thoroughly review and research software to help you find the right solution for your business needs. While evaluating construction accounting software, we primarily looked at:

1 Scalability

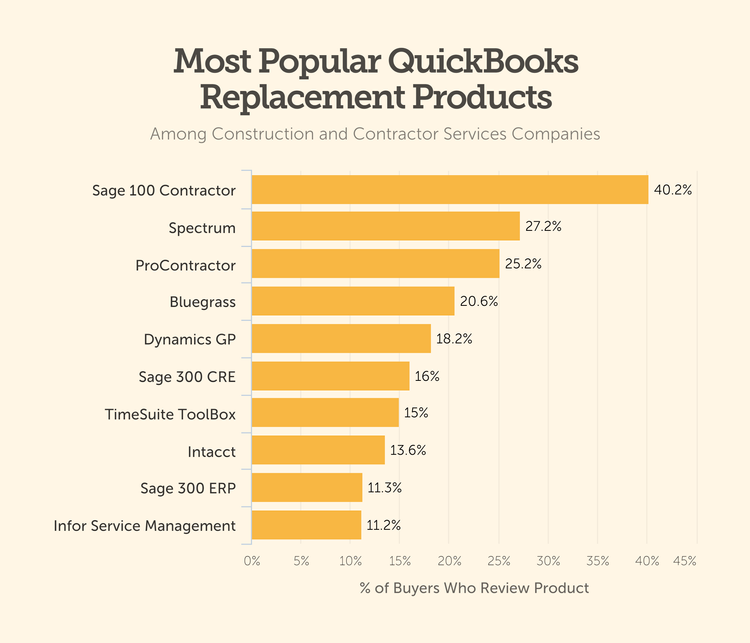

Many construction companies start out small, so scalability is another important factor in our evaluations. One of our construction technology trend reports revealed that most searchers want to replace QuickBooks products. While QuickBooks has basic invoicing and job costing features, it lacks the more intricate tools necessary to handle the needs of growing construction companies. Dedicated construction accounting solutions bring in extra features like bid generation and field service management.

2 Features

During our review of different construction accounting programs, we look at how many different features are included. We then weigh their importance against overall operations. For instance, software might have dozens of listed accounting features, but only a few are useful for construction-related tasks.

Here are the key features we look for in construction accounting software:

- Job costing module to track all transactions related to specific projects.

- Bid management to generate and customize professional-looking bids.

- Industry-specific billing tools that can invoice clients based on retainage or progress billing.

3 Value and Pricing

Our next step is to determine the value of the software by comparing the total cost of ownership against the available features. We know the importance of affordable software for the construction industry when prices can rise yearly. Of course, the value of the software will largely depend on the size of the business and how much it grows over time. Something like QuickBooks might be the most affordable option, but it won’t include all the accounting features needed for the construction industry.

Key Features

When shopping for construction accounting software, your business should focus on the solutions with these key features:

| Feature | Functionality | |

|---|---|---|

| Job Costing | Assign costs to labor, equipment, materials, and subcontractors associated with each construction project. | |

| General Ledger (GL) | Track bookkeeping information related to income and expenses. Creates balance sheets and income statements. Maintains all details to track profitability and help make financial decisions. | |

| Accounts Payable (AP) | Manage expenses from labor, equipment rentals, and materials. Maintain cash flow to ensure your bills are paid on time. | |

| Accounts Receivable (AR) | Store details on customers and integrate them into the general ledger. Includes construction billing and invoicing such as AIA, time and material, and progress billing. | |

| Financial Reporting | Create custom financial reports to visualize where your time and money are being spent for each project. Analyze expenses and net profit to see where improvements can be made to increase ROI. | |

| Payroll | Manage timecards, wage calculation, direct deposit, and tax management for subcontractors and employees assigned to the project. Manage all types of construction payroll, including Certified, Union, and Non-Union. |

Primary Benefits

Construction businesses that use manual methods to handle their accounting are at a huge competitive disadvantage against those using software, as filling out spreadsheets can take hours away from your other business tasks. Alternatively, construction businesses that use the wrong construction accounting program may struggle with integration issues or waste time on repetitive data entry tasks.

Whatever your day-to-day pain points may be, explore the benefits of construction accounting software to find out how an upgrade can help you:

Improve Job Costing

In construction accounting, job costing supplements the company’s general ledger. Tracking labor, equipment, material, and subcontractor costs is useful to both project managers (to ensure projects stay below budget) and financial managers (who attend to the big picture of the company’s financial health). The software lets you monitor financial performance in real time.

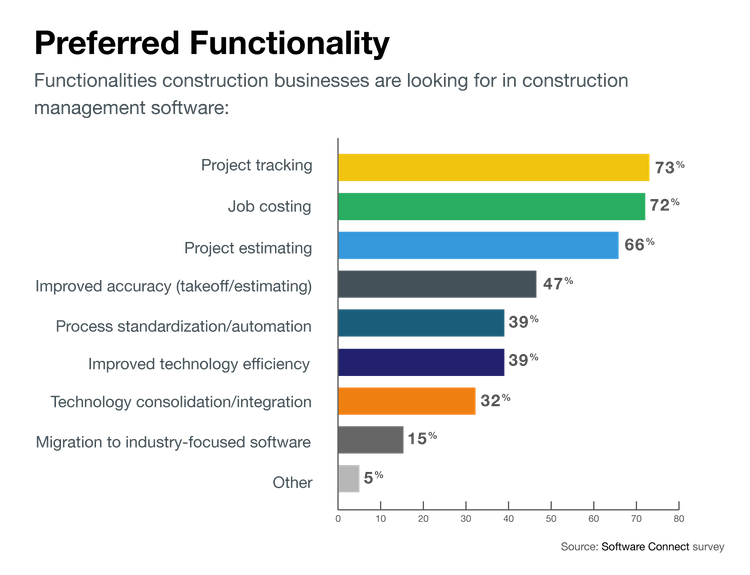

How many construction companies need job costing? Our Construction Technology Trends report found that job costing was the second most desired feature in construction software, with 72% of buyers saying it must be included in their ideal solution.

More Profitable Projects

You can better determine the most profitable new jobs by understanding the expenses of completing each project, such as job costs and overhead. Keep expenses down and finish the project within budget and scope by appropriately tracking and billing all costs.

Better record keeping via time tracking, material costs, change orders, and subcontractor contracts can also lead to a better ROI. Better insight provides a more complete view of operational plans and expectations. If a project is not performing up to standards, you can find out in real time before it affects profits or incurs a loss.

Accurate Financial Reporting

Construction accounting software can provide financial reporting that gives you better insight into your operations. These accurate reports can help facilitate better decision-making and let you monitor the performance of your business continuously. Since cost overruns happen in the construction industry, work-in-progress reports (WIP) track past work against a profit analysis schedule, providing real-time insight into estimated earnings against current billings.

Other reporting options within construction accounting software include consolidated financial statements, budget vs actual price margins on jobs, cash and working capital status, and profitability by customer.

Construction vs General Accounting

Here are some answers to frequently asked questions about construction accounting software:

What is the difference between generic accounting software and construction accounting software?

General accounting software is usually developed to be used by multiple industry types and, therefore, doesn’t offer features unique to any one industry. The functionality is built around a general ledger and allows you to track your income, assets, expenses, and liabilities.

A construction accounting software will have the same features as a general accounting software but then include industry-specific modules for construction.

What is the difference between construction management software and construction accounting software?

A construction management software will have more of a focus on non-accounting features such as estimating, scheduling, and project management. A construction management software may sometimes lack a traditional accounting setup of accounts payable, accounts receivable, and a general ledger. This will require you to integrate with a secondary solution for accounting.

A construction accounting solution will focus more on reporting, financial statements, and job costing. This can sometimes be defined as any accounting solution designed to be used by a construction company. This will include the AP, AR, and GL features, along with job costing and progress billing capabilities.

Integration

If you choose standalone cloud-based accounting software, it’s important to consider integration with your construction management system. Proper integration, which enables two-way data sync, can significantly increase automation for both processes. This way, you can ensure that projects align with financial goals and budgets through real time cost tracking and reporting.

What Does Your Business Need?

Depending on the size of your business or the types of projects being handled, you may look towards more advanced solutions.

- Small Businesses: Job costing will be the most important feature to help you manage your basic construction accounting. A small contractor may be able to survive using industry-neutral software such as QuickBooks or Xero. Still, it’s important to weigh the benefits of cost-savings in software against not having the ability to categorize costs and analyze what jobs are profitable. Accounting software for builders is a better option for this functionality.

- Mid-Sized Construction Firms: Growing construction businesses should look for more in-depth estimating tools and some level of bid management in software. They also need to have an industry-specific tool and won’t be able to survive using manual methods.

- Large Construction Companies: Enterprise-level companies may specialize in a specific field and need specialized software to meet their needs (such as a large commercial real-estate developer or a civil contractor). They may also have multiple entities with a need for many end-users. These enterprise-level organizations should look into a fully integrated construction ERP solution that provides every accounting and management tool necessary to run their day-to-day operations.

Pricing Guide

Construction accounting software pricing depends on several factors, such as the size of your business, how many total users you have, and what modules you need. Here’s a general breakdown of your expected yearly cost:

Low-Tier

- Company Size: 1-25 employees

- Average Yearly Cost: $5,000-$15,000 per year

- Examples: QuickBooks Online, Sage 100 Contractor, Jonas Construction

Mid-Tier

- Company Size: 25-150 employees

- Average Yearly Cost: $15,000-$50,000 per year

- Examples: Acumatica Construction Edition, Viewpoint Spectrum, Deltek ComputerEase, Sage Intacct Construction

High-Tier

- Company Size: 150-500 employees

- Average Yearly Cost: $50,000-$150,000 per year

- Examples: CMiC, Sage 300 CRE, Trimble Viewpoint Vista

Enterprise

- Company Size: 500+ employees

- Average Yearly Cost: $150,000+ per year

- Examples: CMiC Enterprise, Oracle Primavera, Trimble Viewpoint Vista, PENTA ERP, COINS

Free construction accounting software is available, though it is usually only offered as part of a trial or demo. Truly free options may be limited to small businesses with limited users and functionality.

Can QuickBooks Be Used for Construction Accounting?

QuickBooks can be used as construction accounting software given the availability of invoicing, job costing, and reporting features. Construction companies looking to use QuickBooks for construction accounting must choose a version that includes QuickBooks Projects, which includes the job costing feature. This feature is only available to QuickBooks Online Plus and Online Advanced customers.

While this software may work for some businesses, our QuickBooks Alternatives study surveyed over 4,000 cases of QuickBooks users searching for construction accounting replacements. Most cited a need for better job costing, project management, equipment management, bid management, and field service management.