The Best Legal Billing Software

Get the best software for your business. Compare product reviews, pricing below.

What is Legal Billing Software?

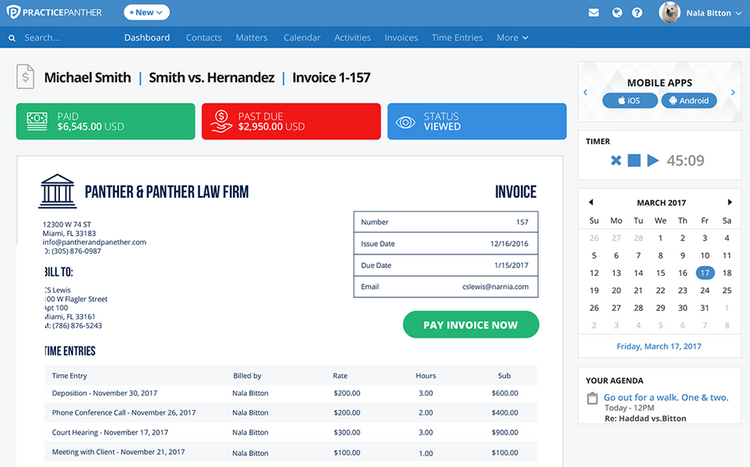

Legal billing software (also known as “legal e-billing”) provide a unified space to track billable hours, fees and expenses. These legal billing systems then generate and save accurate invoices, which can be sent to clients through built-in messaging tools. Legal billing software is a specific type of legal software that focuses strictly on tracking billable revenue and producing invoices.

By reducing administrative work and time tracking, legal billing software help legal practices minimize costs, generate more billable revenue, and more easily invoice and collect payments. Highly-customizable and automated features help stay within regulations and compliances, work within various billing guidelines, make fee-splitting simple, reduce human error, transparently communicate billable work, and more.

Features of Legal Billing Software

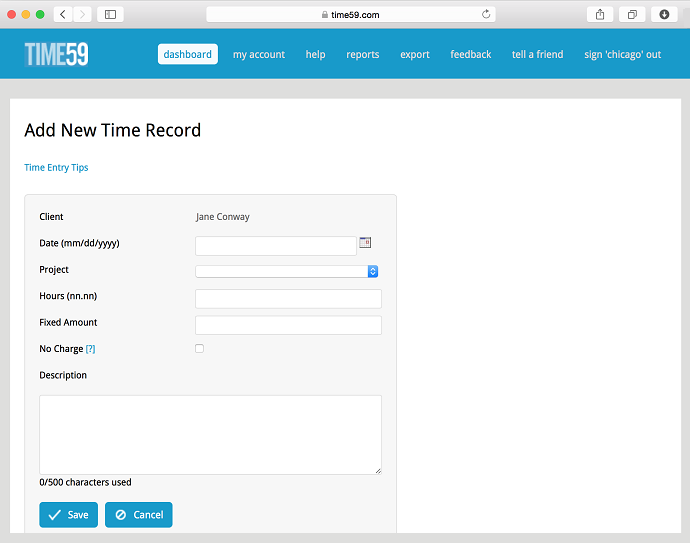

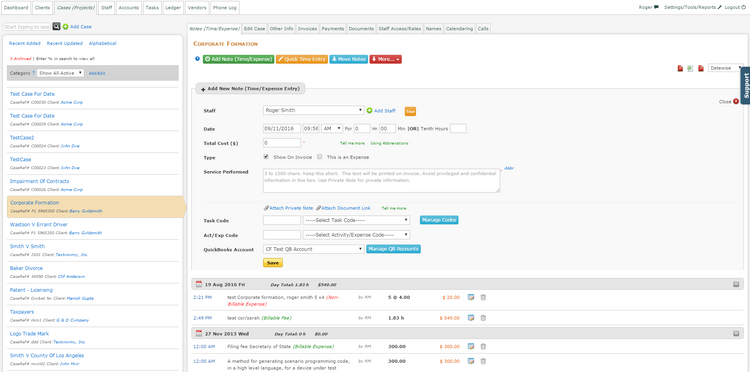

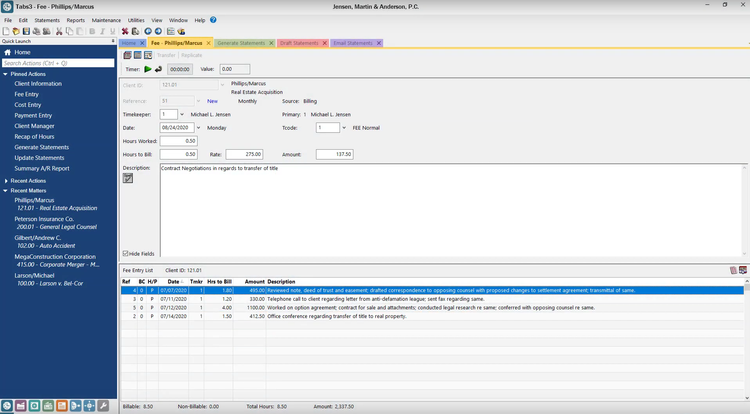

- Timekeeping: Make sure all billable hours are thoroughly and accurately counted with easy time tracking. Track time with phase codes, task codes, activity codes, and more.

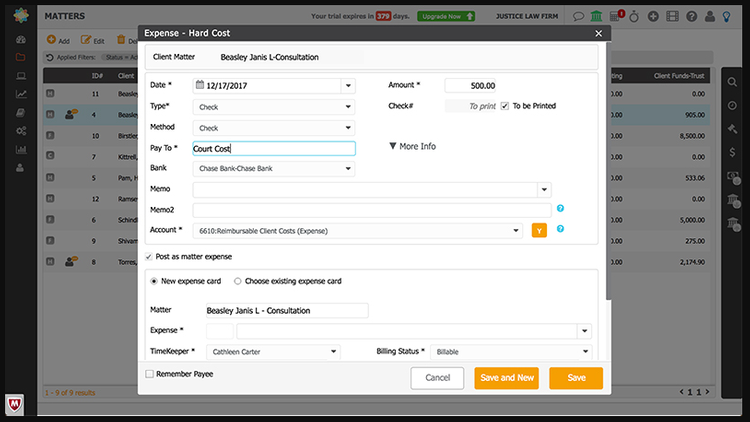

- Expense and Fee Tracking: Track all billable items, like court fees or expert witness expenses. log expenses as either billable or non-billable.

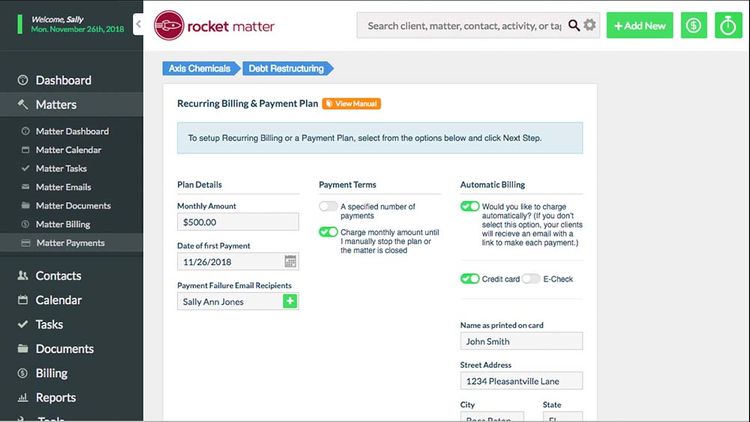

- Payment Processing: Collect online payments via credit cards, bank transfers, trust deposits, and services like LawPay. Invoices can include links, widgets, or even QR codes that let clients immediately make their payments.

- Automated Accounting: Incoming payments and outgoing payments can be automatically logged onto connected ledgers in real-time. This way, you will always know how much you are owed and how much you owe others. This also minimized data entry errors, which saves time and money.

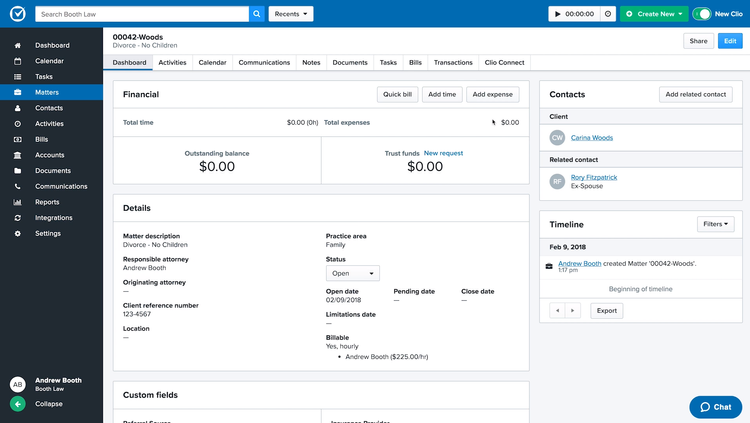

- Client Management: Store and retrieve client contact information from a single portal. View clients’ open and closed matters, budgets, guidelines, and more. Keep a history of calls and written communications.

- Calendar Sync: Create calendar events and sync with popular calendar apps such as Google Calendar and Office 365. Assign them timekeeping codes to ensure billable time is logged. Store billable calendar events like client phone calls or meetings.

Benefits of Legal Billing Software

Legal billing software is a critical component of case management that automates billing and invoicing for both inside and outside counsel. They help track every minute and expense by allowing staff to bill from their offices, homes, or mobile devices with a simple log in. By automating consistent and accurate records, legal practices can focus on the important casework, without worrying about costly and frustrating administrative duties.

Lower Costs And Improve Communication

According to a 2014 survey by Consero Group, a company that plans and hosts industry-specific conferences, 58% of Chief Litigation Officers said they were using a third-party legal billing software. Of that 58% of responders, 79% said that the software led to a 25% savings in outside counsel spending. And the other 21% reported even higher savings.

These e-billing solutions also keep clients happy by being as transparent as possible, as accurate as possible, and as flexible as possible. Law practices can customize rates to bill the same task at different amounts, for different clients. These rates will be stored and calculated by the software tools, minimizing human error. This allows for better estimates, more effective negotiations, and higher client satisfaction.

And much like more complex practice management software, many legal billing software also come with internal, centralized client communication tools. That leads to faster responses and fewer missed messages from clients. They also sync with email services like Gmail and Outlook, and they will not only integrate the content of emails into the communication tools, but also any attachments.

Makes Billing Easy

Make billing easy by pre-formating various tools and templates for staff to fill out for particular matters. Make sure all billable items (time, fees, and expenses) are logged with the appropriate names, matters, times, dates, rates, descriptions, coding, types, and more. You can customize the tools for different types of mattes, and pre-build drop-down menus for different Uniform Task-Based Management System (UTBMS) codes to save time and stay accurate. And firms can tailor these billing tools to comply with various billing guidelines.

After certain matters are complete, invoices can easily be generated by importing billing data into pre-made invoice templates. Invoices can then be linked with legal payment software, like LawPay or ProPay, or with credit card billing systems. These tools help businesses pay invoices with just a few clicks through intuitive systems. Add features like payment plans, discounts for early payments, interest rates for late payments, and more.

And e-billing services help law practices stay compliant with Legal Electronic Data Exchange Standard (LEDES) and other billing standards, like ESIS Advocator System and GreatAmerican. So clients will know exactly what they are paying. These legal billing software are extremely useful for auditing individual invoices or entire practices, as all billing data are fully stored and searchable.

Set up automatic vetting for each invoice to catch inconsistencies and errors with things like clients’ billing guides. This leads to fewer rejected invoices and helps find and amend invoices when clients find issues. Or if there is a dispute, these e-billing software store shareable contracts, billing times, billing codes, billing guides, and everything else.

Security And Document Management

Legal practices store extremely sensitive data about clients, finances, cases, strategies, and more, so legal billing software come with high levels of encryption and security. And these systems are highly flexible when it comes to who can see, edit, delete, and/or share data and documents. And legal e-billing systems stay up-to-date and compliant with a variety of payment services, like being PCI-compliant with credit card payments.

Keeping things like case progress, tax documents, financial information, contacts, receipts, reports, invoices, and contracts visible, searchable and shareable are vital for efficiently working legal matters within legal teams and departments. You can easily organize documents by labeling them by things like client, case, date, or staff member. And you can password-protect this data to allow only certain people to access and/or download.

Some e-billing software will safely store your documents for you with regular backups. And others will easily sync with other document management software, like DropBox, NetDocuments, Google Drive, or Doc-link. This makes document storage and retrieval simple, without compromising yourself or your clients.

Budgeting For Both Clients And Practices

Many legal billing software will make you create a predetermined budget before beginning a legal matter. Budgets will help allocate time, staff, and resources throughout a case. Some software even have a tracker at the top of the dashboard of each case, with a bar being filled as the case goes along. And most e-billing software will send alerts when certain milestones are crossed.

Most software also have tools to track the same tasks as billable or un-billable. So even if you are not billing for a particular item, storing those hours and expenses will help determine internal budgeting and resource allocation.

Internal Reports

These billing solutions will also run reports, letting you know how well certain individuals, teams, or departments are at sticking to a budget. And these reports will work year-over-year or month-after-month. Also track who on staff is bringing in the most revenue and who is trailing behind. See what kinds of matters are most profitable and which ones are not. And review what resources your clients need and what they do not.

Tools For Clients

These budgeting tools help generate fair, accurate budgets for clients. Some even have limited client dashboards or client portals, so clients can view progress and see what kinds of work are being done on different matters. And they help legal practices be mindful of budgets throughout their cases. And legal departments being able to run reports for different variables helps legal teams create better budgets going forward, project future costs and earnings, and aid in staff management.

Fees, Expenses And Vendors

Make sure you are not missing out on auxiliary billable items, like fees and expenses. And keep track of third-party vendor costs and additional spending, like postage. Store receipts and third-party invoices for any necessary audits. And run reports to see what kinds of expenses are driving up budgets.

Legal Billing Software Pricing Guide

Legal e-billing software starts at $15/month and can rise to $79/month/user or higher. From those basic rates, pricing becomes highly variable, with costs for numbers of users, numbers of cases, available features, types of integrations, document storage, customer support, and more.

Most legal billing software do charge by the month or through annual fees, but some charge one-time licensing fees or through commissions. And while many legal billing software advertise their rates, others ask for firms’ sizes and needs to create custom services and quotes. By offering customizable, tiered services, legal e-billing software can help all law practices, from small law firms to massive legal departments.

Trust Accounting And Tax Compliance

Most legal e-billing software make trust accounting simple with their internal systems. Set and manage client trusts and Interest on Lawyer Trust Accounts (IOLTA), while staying compliant with the fund level and other regulations. Set up alerts to warn you of over-drafting, or have your trust automatically pull funds when needed.

Use the same trust accounting system and tools for clients to pay in to, and for firms to pay out of. And then you can import and export this data on to your office’s internal legal accounting software, like Brief Accounting and QuickBooks Online. Or instead of syncing and cross-references data across different software, some legal billing software, like Rocket Matter and Clio, include fully functioning accounting software as part of their broader services.

And most e-billing software adhere to a multitude of local, state, federal, and international tax and regulatory standards. These tools shift time and resources from manual research and calculations to valuable legal work.

Legal departments and law firms need to equip themselves with the tools that will help them comply with various jurisdictional and local tax laws, as well as enable them to conduct business as efficiently as possible. This explains why legal electronic billing software is quickly eclipsing paper billing throughout the world as the invoicing standard. Roger Jarman, CT TyMetrix