The Best Multi-Currency Accounting Software

Multi-currency accounting software manages transactions, accounts, and reports in multiple currencies. We tested various systems for multinational corporations, eCommerce companies, and global trade operations like import and export.

- Hundreds of third-party add-ons available

- Feature sets for multiple industries

- Highly customizable

- Basic inventory management capabilities

- Free trial available and no setup fees

- Navigable, user-friendly interface

- Customizable invoicing

- Extensive pre-built and custom reports

- Automatic exchange rates

Using our review methodology, we evaluated systems that strongly focus on multi-currency support, automatic conversion, and dual reporting standards. We selected our favorites, including NetSuite, Xero, QuickBooks Online, and Gravity Software.

- NetSuite: Best Automatic Currency Conversion

- Xero: Strong Dynamic Exchange Rate

- QuickBooks Online: Best Global Tax Compliance

- Gravity Software: Best for Multi-Entity Operations

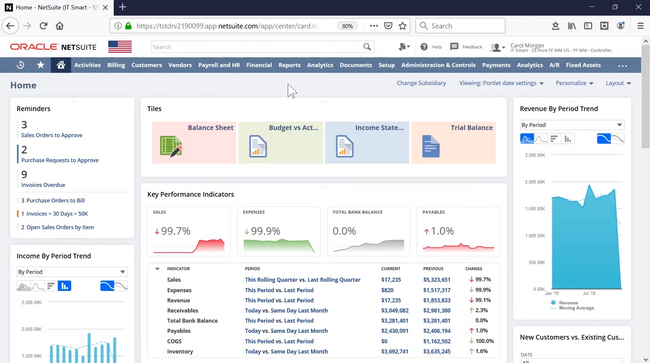

NetSuite - Best Automatic Currency Conversion

NetSuite’s automatic currency conversion feature can help you streamline your financial processes, improve accuracy, and enhance compliance with international standards. The system integrates with various financial services and exchange rate providers, automatically producing real-time exchange rates.

When a transaction occurs in a foreign country, NetSuite will instantly convert the amount into your organization’s base currency using the latest exchange rate. The functionality can also manage currency revaluations at the period’s end to adjust fluctuations and ensure accuracy.

For example, perhaps you operate in three regions: the U.S., Europe, and Asia, with headquarters in the U.S. Your European office invoices a client in EUR for €50,000. NetSuite’s automatic currency conversion will convert this to USD, logging $55,000 into your financial system.

However, NetSuite comes at a higher price point, with their most basic accounting package starting at around $1,299 for only up to 10 users. A premium version with over 30 users can cost you around $6,000.

For more information, read our full review on NetSuite.

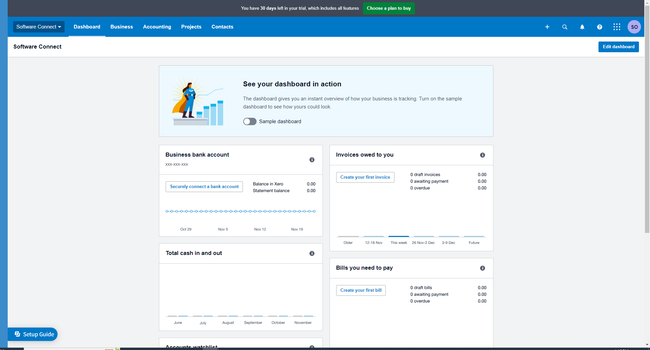

Xero - Strong Dynamic Exchange Rate

Xero is distinguished by its multi-currency accounting capabilities, making it a top choice for businesses engaged in international transactions. Designed to simplify foreign financial complexities, Xero provides an all-in-one platform to track, report, and manage transactions across currencies.

A couple of its notable features include the automatic updating of exchange rates and full support for international tax requirements, from VAT to GST. Integration with renowned payment gateways ensures businesses can seamlessly accept payments in multiple currencies. Moreover, the facility to convert invoice amounts based on current exchange rates and the ability to add foreign currency accounts elevate the user experience, keeping businesses in sync with global operations.

Read our full Xero review.

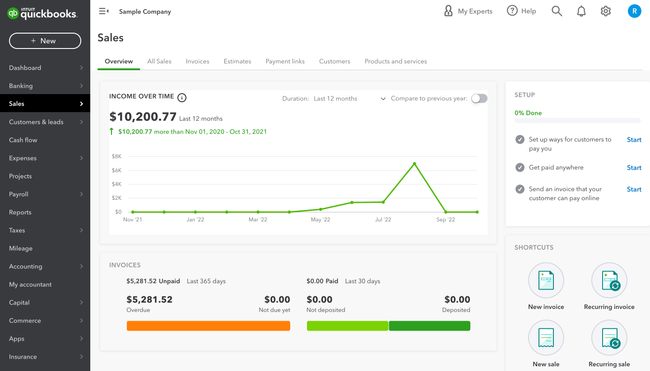

QuickBooks Online - Best Global Tax Compliance

Boasting support for over 160 currencies, QuickBooks Online allows businesses to manage and track global transactions effortlessly. Designed with international businesses in mind, it offers a blend of ease and accuracy, updating exchange rates daily and automatically converting transactions to the base currency.

QuickBooks Online shines in its provision to set up foreign currency accounts and its intrinsic support for international tax obligations, from VAT to GST. With a suite of customizable foreign currency features, businesses can cater to an expansive international customer base without the hassle of manual calculations.

Read our full QuickBooks Online review.

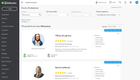

Gravity Software - Best for Multi-Entity Operations

Gravity Software addresses the intricacies of managing multiple currencies across diverse entities. It consolidates this data efficiently, aiding companies in transcending the capabilities of platforms like Xero and QuickBooks.

Its automatic exchange rate update feature is not just about convenience but ensures real-time accuracy in financial reporting. The platform’s handling of complex transactions and its comprehensive support for global tax compliance make it a frontrunner for businesses with a broad international footprint. Additionally, Gravity’s integration with popular payment gateways streamlines the invoicing and payment processes, allowing businesses to operate fluidly in any currency.

Read our full Gravity Software review.

What is Multi-Currency Accounting Software?

Multi-currency accounting is the process of recording financial transactions in more than one currency. This can be challenging for businesses that operate in multiple countries or engage in international trade. However, it is also essential for businesses that want to accurately track their financial performance, make informed decisions, and comply with accounting regulations.

Challenges

One of the biggest challenges of multi-currency accounting is exchange rate fluctuations. Exchange rates can vary significantly over time, meaning the value of transactions recorded in one currency may change when converted into another currency. This can make it difficult to accurately track financial performance and calculate profits, losses, and taxes.

Another challenge is currency conversions. Converting one currency into another requires knowledge of exchange rates and a thorough understanding of accounting principles.

Finally, accounting for multiple currencies can be complex, as it involves tracking transactions in different currencies, reconciling accounts, and preparing financial statements in accordance with accounting standards.

Benefits

- Increases Accuracy: Ensures that financial transactions are recorded in their original currency and converted into the reporting currency for financial reporting purposes. This can provide a more accurate picture of a business’s financial performance.

- Improves Financial Reporting: Provides a more comprehensive view of a business’s financial performance across different countries and currencies. This helps businesses make informed decisions about their operations and investments.

- Enables Better Decision Making: Provides accurate and up-to-date financial information and facilitates the analysis of financial performance across different currencies and countries.

Implementation of Multi-Currency Accounting Software

Implementing a multi-currency accounting system requires careful planning and preparation. This involves identifying the applicable accounting standards and regulations and selecting the appropriate accounting software and financial management tools.

It also involves data migration and setup, which can be a complex and time-consuming process. Businesses must ensure their data is accurately transferred from their existing accounting system to the new multi-currency accounting system. Finally, businesses need to provide training and support to their staff to ensure that they can effectively use the new system and comply with accounting standards and regulations.

Implementing a multi-currency accounting system requires a significant investment of time and resources but can ultimately provide significant benefits for businesses operating in multiple currencies.