The Best Accounting Software For Multiple Entities

We curated this guide to the top accounting software for multiple companies. These leading platforms include key features like global consolidation and multi-currency support.

- Feature sets for multiple industries

- Highly customizable

- Advanced audit trail

- Multi-dimensional reporting capabilities

- Scalability for multi-entity support and user growth

- Integrates with Salesforce, Versapay, etc.

- Automated reconciliation

- Mobile accessibility

- Seamless multi-entity management

These systems consolidate financial transactions and reports across multiple locations within a larger organization. We ranked our picks based on user reviews and our internal review process.

- NetSuite: Best Overall

- Sage Intacct: Best Reporting Tools

- Gravity Software: Best for Franchises

- Acumatica: Best Cloud ERP

- Zoho Books: Most Scalable Option

- Dynamics 365 Business Central: Best Localized Versions

- Accounting Seed: Best for Salesforce Users

- QuickBooks Desktop Enterprise: Best for Mid-Sized Businesses

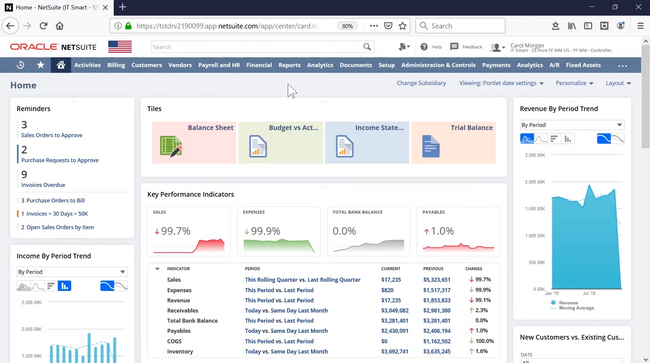

NetSuite - Best Overall

NetSuite simplifies accounting across different business units, subsidiaries, and regions on a single platform. It helps ensure compliance with various standards, tax codes, and regulations, reducing financial fraud risks and streamlining the close process with automated consolidations.

NetSuite expands this capability on a global scale, supporting operations in over 217 countries, 27 languages, and 190 currencies. The system’s real-time currency conversion also provides a glimpse into business performance across geographies. Overall, the system offers seamless consolidation, real-time subsidiary financial data, and the ability to easily create different books to meet various accounting requirements.

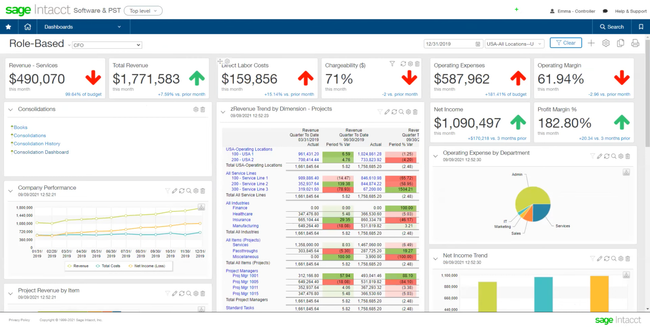

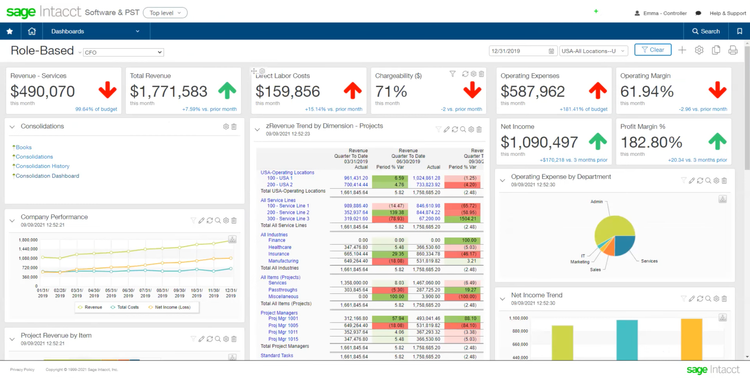

Sage Intacct - Best Reporting Tools

Sage Intacct includes advanced reporting capabilities, which provide deep financial and operational insights. Its dimensional reporting feature allows for detailed analysis, helping businesses make more informed decisions. With 150 pre-built reports and a custom report writer with a drag-and-drop interface, Intacct offers both ease of use and depth in reporting.

Additionally, Intacct handles multi-entity management, streamlining operations across various subsidiaries within a single platform. It simplifies inter-entity transactions and consolidates reports efficiently.

Another key feature is its multi-dimensional chart of accounts. It organizes data with standard attributes such as departments, locations, and vendors and allows for custom attributes as well. This approach results in a more organized and scalable ledger system for better financial management overall.

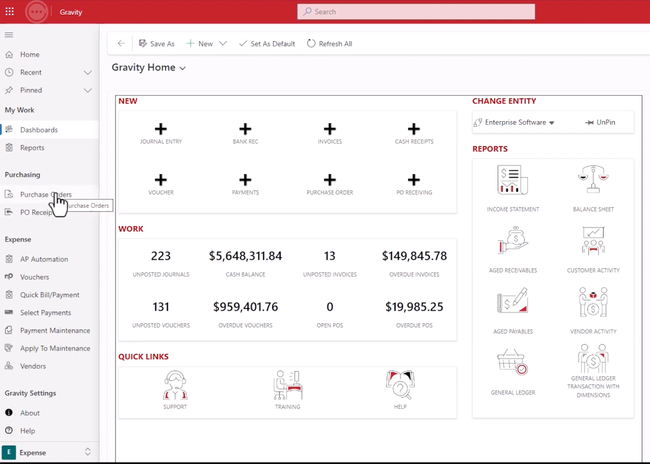

Gravity Software - Best for Franchises

Gravity Software offers full visibility into performance across every location. You can configure a segmented chart of accounts to organize your financials by branch, streamlining the month and year-end financial close with consolidated reporting throughout your entire company.

Additionally, you can create detailed reports for each franchise individually. Build custom dashboards to view KPIs and overall financial performance. These can be profit and loss or cash flow charts for easy, at-a-glance checkups. The system also tags every transaction with dimension codes, making analyzing your data easier and ensuring accuracy.

Gravity Software is best for companies that have outgrown QuickBooks Online and need a more comprehensive accounting system. Beyond franchises, the system supports several industries like healthcare, professional services, and even nonprofits. Pricing starts at $375/month for the first user in the Starter plan,, and is $275/user/month for each additional user. While it has exceptional multi-entity features, it does lack an in-house payroll module, so you’ll need to integrate a third-party system.

Acumatica - Best Cloud ERP

Acumatica is a cloud ERP system with a fully integrated suite of business management modules, including accounting. The software supports reporting for an unlimited number of companies within the organization, with shared charts of accounts, calendars, and currencies. Additionally, it helps automate financial processes like reporting, inventory transfers, vendor payments, cash management, and inter-company transfers.

Acumatica is also useful for companies needing more precise reporting. The software centralizes cash management and financial transactions while accurately attributing income and expenses to the initiating company. Finally, Acumatica provides a complete set of ready-to-use reports in every module, with simple report customization through its Report Designer.

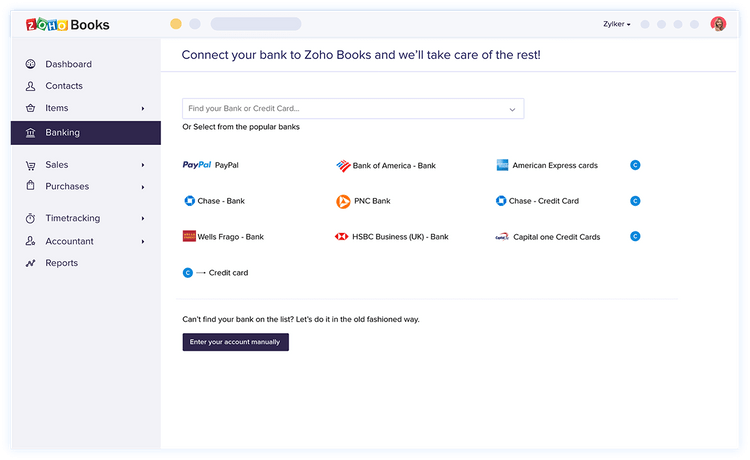

Zoho Books - Most Scalable Option

Zoho Books integrates easily with other Zoho products and third-party applications. This ecosystem approach ensures that as a business grows and its needs become more complex, it can easily integrate Zoho Books with other systems like Zoho Inventory and Zoho CRM.

Zoho Books allows users to create different organizations within the platform, one for each business entity they manage. We found this useful for those transitioning from other platforms like Wave. That’s because Zoho Books offers a custom plan that can include up to five organizations, making it easier to handle accounting for multiple entities.

Finally, Zoho Books handles unlimited invoice tracking, expense management, and over 50 extensive accounting reports. It also supports the reconciliation of multiple credit cards and bank accounts, a huge plus for organizations with several branches.

Dynamics 365 Business Central - Best Localized Versions

Business Central meets the diverse needs of domestic and international sites. It supports over 40 localized versions for online implementations and on-premises setups, ensuring compliance with local legal requirements and business practices.

The software also supports 47 languages and translates transactions into the local currency, applying the exchange rates for that date. It can also generate reports in a unified currency for customer balances, which streamlines the financial analysis process.

Another highlight we wanted to mention: Business Central can integrate and transfer data across different accounting structures, with built-in support for various file formats including F&O. This is important because it ensures that financial data from different entities is compatible with the headquarters’ accounting framework.

Accounting Seed - Best for Salesforce Users

Accounting Seed offers tight Salesforce integration. Because it’s native to Salesforce, Accounting Seed cannot function independently of the software. However, Salesforce users will be happy to find it integrates with many popular applications, including Salesforce Sales Cloud and Service Cloud. This allows for a flexible and scalable business solution that grows with organizations.

In addition, Accounting Seed provides multi-company and multi-currency accounting capabilities. The software consolidates financial data from multiple entities into a single report while automatically handling currency translation. Users can also create a multi-dimensional chart of accounts, tag transactions with several dimensions, and generate reports that offer deep insights into the business’s performance across various sectors.

Ultimately, it’s a solid choice for multi-entity corporations already utilizing Salesforce that want to consolidate finances across different regions.

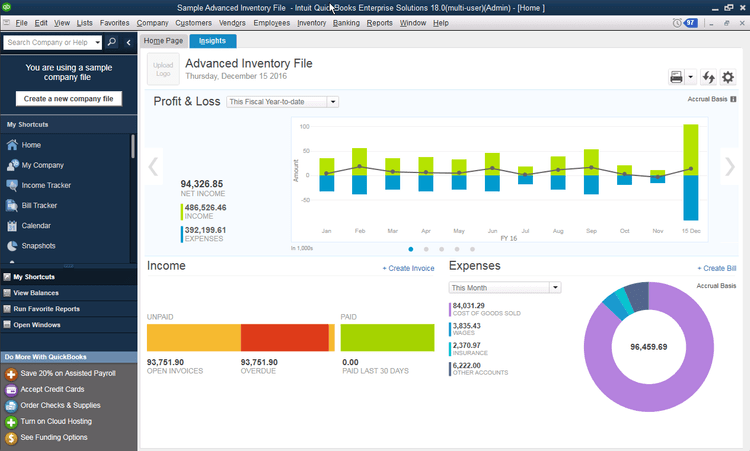

QuickBooks Desktop Enterprise - Best for Mid-Sized Businesses

QuickBooks Desktop Enterprise is adaptable for medium-sized businesses with multiple entities. Users can generate detailed intercompany transaction reports and manage entity relationships from a single dashboard. With more than 200 customizable reports, QuickBooks Desktop Enterprise provides the tools for multi-entity companies to maintain comprehensive financial oversight.

The system also goes beyond accounting functionality, including order management, job costing, and integrated payroll, to meet the increasingly complex needs of growing companies. Enterprise supports up to 40 users with granular permission settings to safeguard sensitive data. Organizations can also assign users specific access levels to over 115 activities.

Finally, its inventory module is quite useful for mid-sized companies, tracking stock across multiple locations and meeting demand through strategic stock transfers.

What is Accounting Software for Multiple Entities?

Accounting software for multiple entities is a unified accounting system for organizations with multiple locations or separate business units operating under one organizational arm. This accounting database helps improve your cash flow and set up capabilities such as centralized accounts payables (expenses), receivables (invoices), and general ledger reports. It can also include multi-currency support for international business needs.

Growing companies may find the need for multi-entity accounting software once they begin to expand by opening up a new location. These multi-location organizations may have issues with decentralized payables, different currencies, and transactions between entities.

Financial management software for multiple entities posts data in a way that lets separate entities monitor the performance of other locations or branches. It also helps management visualize successful versus struggling operations and rely less on receiving this information from a specific bookkeeper.

Accounting software for multiple entities also eliminates duplicate data entry and the use of manual spreadsheets to consolidate company files. This leads to quicker book closings, faster report creation, and centralized payables and receivables with multiple charts of accounts.

Features of Accounting Software for Multiple Entities

- Shared Master Files: Access files for all entities, including vendors, customers, and other chart of accounts.

- Consolidated Reports: Drill down to a specific location, department, or upwards to look at your organization’s overall financial performance.

- Inter-Entity Accounting: Handle intercompany billing by having your software break up invoices among multiple entities and create separate billing dates. Transfer money from one company to another. Let a company purchase raw materials from another.

- Dashboards: Compare sales between entities. Create unique dashboards for each entity, depending on the desired data. View top customers and receivables at each level of the organization.

Benefits

Whether you are a small business owner looking to run two separate entities under one accounting program or a large global operation that wants to drill down sales data into the country, region, and local level, there are plenty of benefits available:

Close Books Faster

The automation provided by accounting software for multiple entities helps shorten your month-end closing time. Eliminating manual processes or workarounds (such as spreadsheets) can save dozens of hours each week.

This can improve project and financial visibility and allow the creation of new reports that help make better decisions. Some accounting solutions can run consolidated reports spanning all of their entities in under a minute, allowing managers to quickly compare their budgets against actual revenue and expenses.

Shared Chart of Accounts

Within a single company, you can specify multiple entities or companies that comprise that group. You can toggle between the two via drop-down lists.

All entities or companies in a group will get copies of the chart of accounts, meaning they are operating under one chart of accounts. Even if bank accounts are unique and specified to belong to one specific entity, your accounting software can still consolidate the chart of accounts.

Comparative Financial Reports

Whether a trial balance, receivables and/or payables report, balance sheet, or income statement, you can compare quarters for your separate entities.

This can provide a real-time view of reports and analytics across all companies. It can also let you know which companies meet goals or expectations and who may fall short. Overperforming branches can be rewarded appropriately, and your business can easily create benchmarks for future quarters.

Pricing Guide

Pricing for multi-entity accounting software depends on your company size, user count, desired features, and whether you get cloud or on-premise deployment. Here’s a breakdown of your expected cost based on your business size:

Low-Tier

- Company Size: 1–20 employees

- Average Yearly Cost: $1,000–$7,000 per year

- Product Examples: QuickBooks Online Advanced, Xero with multi-currency and tracking categories, Zoho Books (Premium or Ultimate tiers)

Mid-Tier

- Company Size: 20–100 employees

- Average Yearly Cost: $15,000–$35,000 per year

- Product Examples: Sage Intacct, Oracle NetSuite Starter Pack, Microsoft Dynamics 365 Business Central (with multi-entity add-ons), Acumatica

High-Tier

- Company Size: 100–500 employees

- Average Yearly Cost: $35,000–$125,000 per year

- Product Examples: Microsoft Dynamics 365 Finance, SAP Business ByDesign, Sage Intacct (Multi-Entity Global Consolidations module)

Enterprise Tier

- Company Size: 500+ employees

- Average Yearly Cost: $125,000–$600,000+ per year

- Product Examples: Oracle Fusion Cloud ERP, Workday Financial Management, SAP S/4HANA, NetSuite OneWorld

Can QuickBooks Handle Multi-Entity Accounting?

QuickBooks Online only allows one company per subscription. Each additional company will require a new QuickBooks Online account. For every new company, you’ll have to pay for a new subscription.

For accountants who manage multi-company clients, QuickBooks offers the ability to buy one QuickBooks Online Plus subscription at wholesale price (currently $40/month) and up to 14 additional companies for $5/company/month.

While QuickBooks is a great choice for small businesses, it has limitations once you begin adding entities:

- Building reports with separate reporting requirements is almost impossible without some level of export process to Excel.

- QuickBooks can not process transactions in multiple currencies, meaning you’re left to manually handle the conversion before inputting the totals into your system.

- QuickBooks only has one chart of accounts, so you’ll need a separate QuickBooks account for every entity that needs its own chart of accounts.

- Transactions between entities (such as intercompany billing) are possible but difficult to handle and monitor properly.