The Best Nonprofit Software

Nonprofit software helps nonprofit organizations with donor management, fund accounting, and campaign reporting. We tested the top solutions to bring you our reviews below.

- Automatically processes recurring gifts

- Includes role-based work centers

- Integrated data appends for list maintenance

- No cap on users

- Unlimited online giving pages/forms

- Strong training and support

- All-in-one financial solution

- Customize and export timely financial reports

- Easy for newly trained volunteers to learn

Nonprofit software automates all areas of NPOs, from fundraising events and donor database management to general accounting and customer relationship management (CRM).

We used our advanced review methodology to rank the top nonprofit management software based on features like donor tracking, grant management, and more.

- Blackbaud Raiser’s Edge NXT: Best Overall

- Bloomerang: Best for Fundraising

- Aplos Fund Accounting: Best for Faith-Based Organizations

- FastFund: Best QuickBooks Alternative

- Donorbox: Best Free Option

- Sage Intacct: Best for Multiple Entities

- NetSuite: Best Financial Analytics

- Denali Fund Accounting: Best for Grant Management

- MIP Accounting: Best for Governments

- Bonterra: Best for Human Services

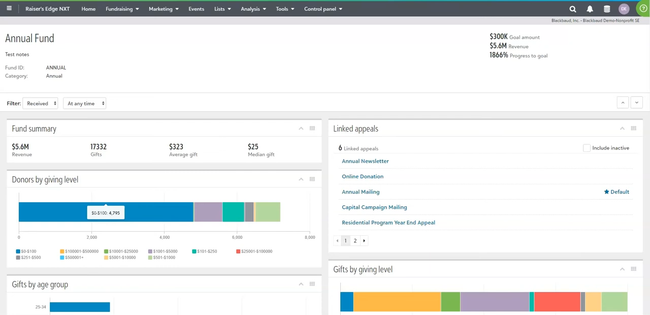

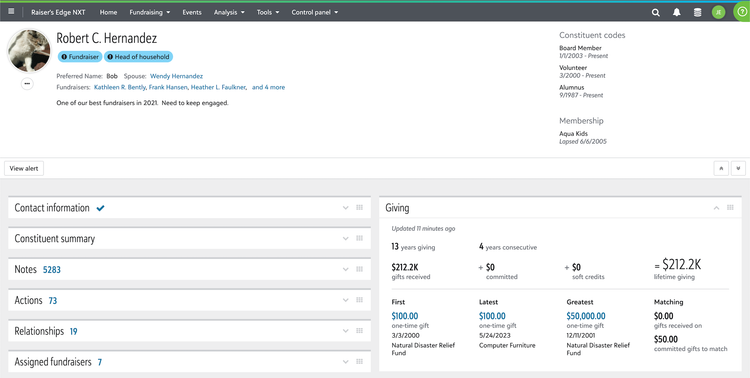

Blackbaud Raiser’s Edge NXT - Best Overall

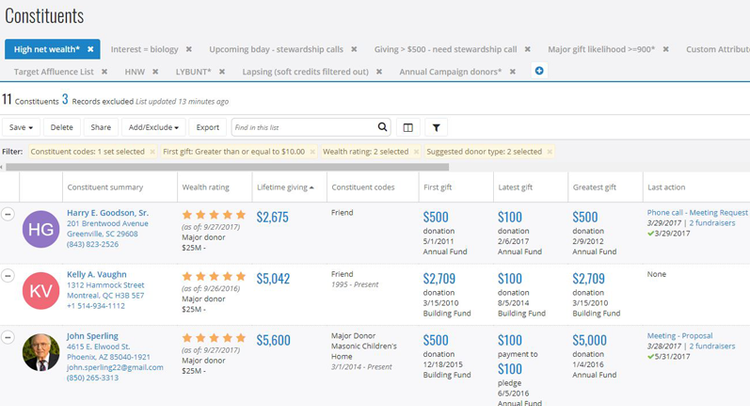

Blackbaud Raiser’s Edge NXT stands out as a top choice for medium to large nonprofits looking to streamline fundraising and donor management. It covers everything from pledge tracking and gift management to automated annual fund workflows. It also has an intuitive user interface, making entering and maintaining donor details easy. And it comes with built-in email and communication tools for managing both your donors and volunteer networks.

Beyond fundraising, Raiser’s Edge supports fund accounting with a flexible general ledger built for nonprofits that need detailed reporting across various programs and events. The Accounts Receivable (A/R) and Accounts Payable (A/P) modules enable nonprofits to create invoices, handle bills, and monitor funding sources. Additionally, the software can track grant requirements and provide intelligent suggestions, such as top prospects, recommended ask amounts, and donors at risk of lapsing.

Raiser’s Edge offers numerous customizable reports and dashboards to monitor fundraising performance, donor behavior, and campaign effectiveness. However, pricing information isn’t publicly available, so you are required to contact the sales team for a quote. Additionally, those unfamiliar with fund accounting may find the system challenging to use or have a steep learning curve.

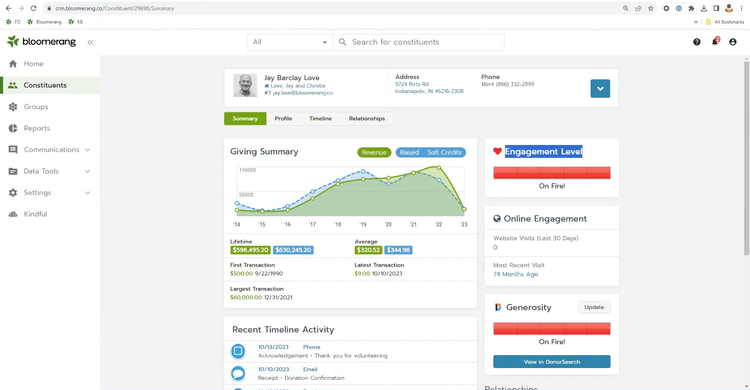

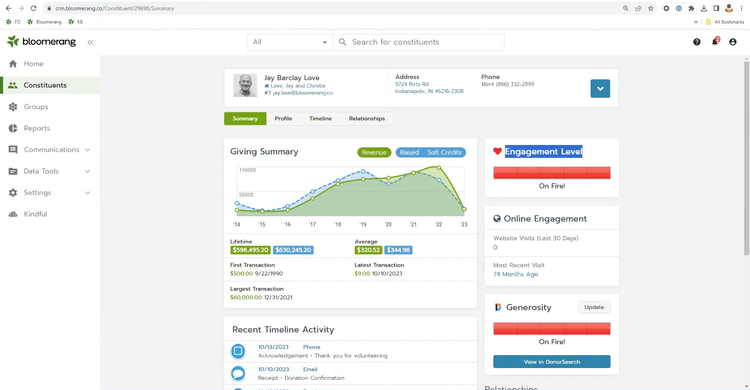

Bloomerang - Best for Fundraising

Bloomerang is purpose-built to help small to mid-sized nonprofits improve donor retention and grow recurring giving. The platform was designed for organizations with 2 to 200 employees and comes with intuitive tools to find, contact, and engage donors.

Bloomerang’s core features include a CRM, donor management, online giving, email marketing, and detailed donor reporting. The system even provides tools enabling organizations to score donors based on engagement and generosity. Other notable fundraising features include event management, a mobile app, and volunteer management for hosting fundraisers. Add-on features like auctions and peer-to-peer fundraising are also available in higher-tier plans.

Pricing for Bloomerang starts at just $40/month for basic fundraising tools. However, the full CRM suite starts at $125/month for up to 1,000 constituent records and includes additional fundraising features. While pricing includes a flat monthly fee, that figure can increase as the number of constituents in your organization grows.

Explore more Fundraising Software Systems.

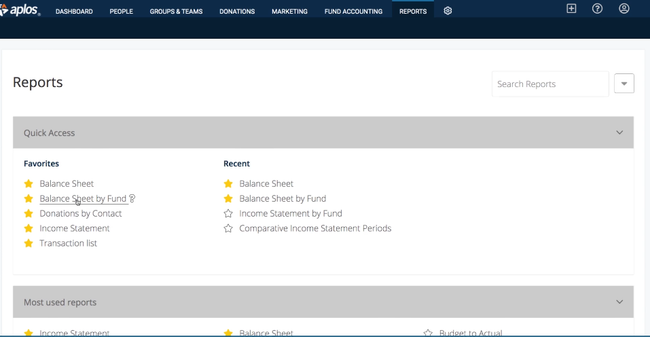

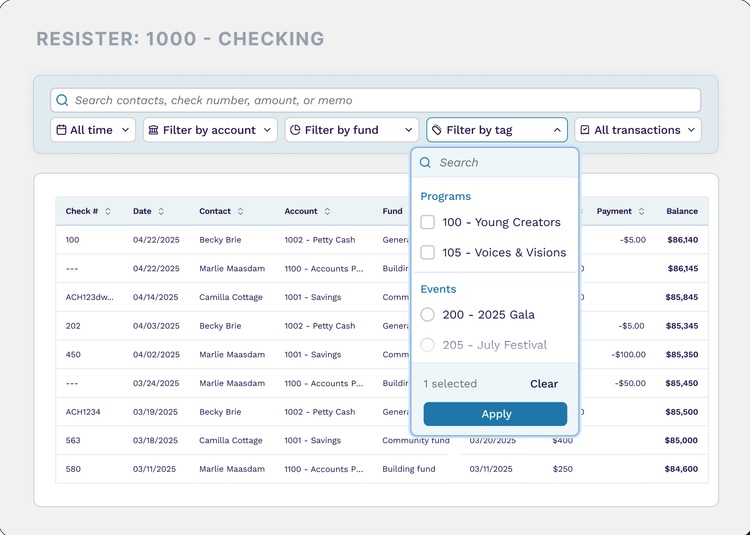

Aplos Fund Accounting - Best for Faith-Based Organizations

Aplos is a fund accounting software purpose-built for churches, ministries, and other nonprofits. For faith-based organizations, the software provides dedicated tracking of tithes, offerings, and designated funds, surpassing the tools offered in basic accounting systems like QuickBooks.

Its fund accounting tools are designed for real-world church finances. Each donation can be designated to a specific purpose, whether it’s a general tithe, a mission trip, or a campaign to fix the leaky roof. And Aplos keeps the fund balances completely separate with a clear audit trail. That way, pastors and treasurers have a clear view of where every dollar goes without the need for complex reports on Excel. It also offers add-on tools like payroll and a CRM in higher-tier plans.

Aplos is best for small to mid-sized organizations looking for a straightforward system to manage fund accounting and church finances. Larger, multi-campus organizations that need deeper multi-entity reporting or church management capabilities may find other options a better fit. That said, pricing starts at $79/month with frequent discounts and a 15-day free trial for new users.

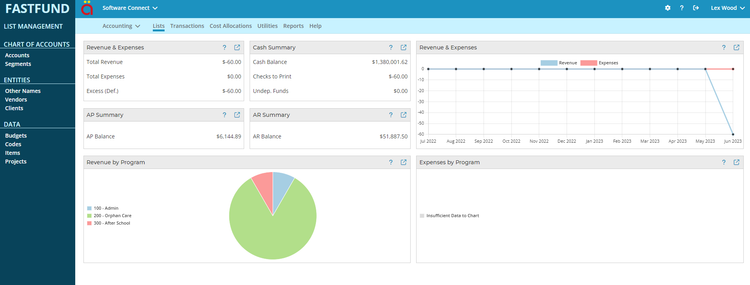

FastFund - Best QuickBooks Alternative

FastFund Accounting is designed for nonprofits that need a FASB-compliant fund accounting system. It helps you track every dollar with true fund accounting, offering a customizable chart of accounts to monitor funds, programs, departments, and donors. This ensures transparency and compliance with nonprofit reporting requirements without the extra hassle.

FastFund includes core accounting capabilities such as automated recurring transactions, budget management, expense and revenue allocation, and direct bank integration. It also streamlines IRS Form 990 reporting, helping you tackle year-end tax reports. Plus, you can expand its capabilities with add on modules for fundraising, donor management, and payroll processing, making it a flexible solution for nonprofits looking to centralize their financials and donor-related operations in a single system.

Pricing for FastFund starts at $50/month for the standard plan which includes core accounting features, budgeting, and bank integration. The fundraising bundle is an additional $50/month which includes capabilities to manage and track your donors.

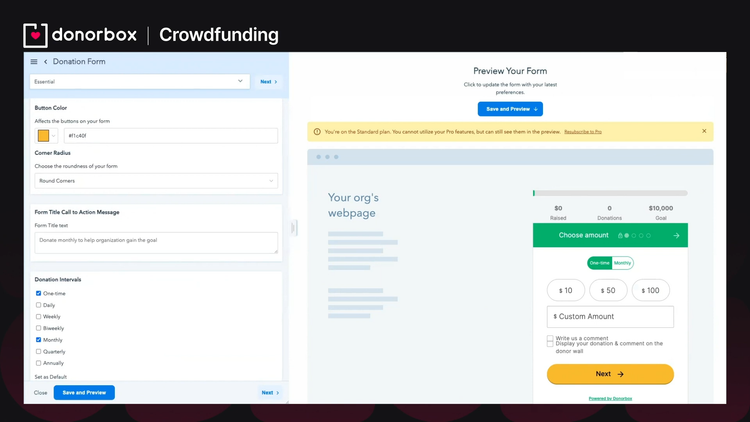

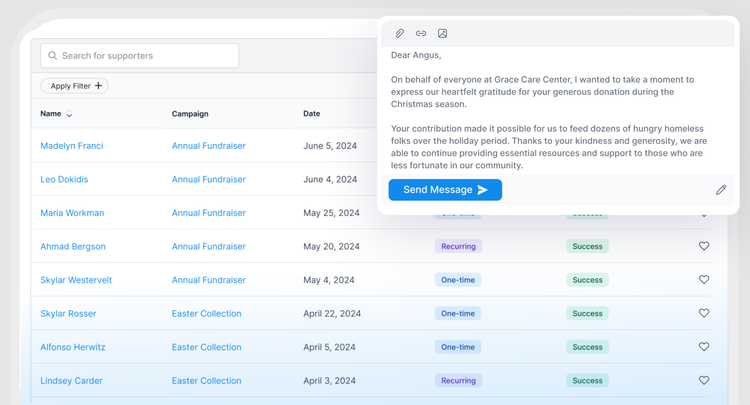

Donorbox - Best Free Option

Donorbox is great for new nonprofits with a free plan for organizations with small teams and minimal giving. It provides a good starting point for NPOs that need to collect donations online and start tracking donors without breaking the bank. However, if you want to store your donor’s information in the add-on CRM, expect to pay for each saved contact.

One huge benefit of Donorbox is that it’s easy to integrate with your organization’s existing website and even lets your supporters set up their own fundraising campaigns to raise money for you. Payment processing is also available through many methods, including ACH and SEPA bank transfers, Google Pay and Apple Pay, credit cards, and Stripe.

While Donorbox offers a free plan, payment processing with Stripe and PayPal will incur a charge. PayPal payments incur 1.99% + 49 cents per transaction, and Stripe payments incur 2.2% + 30 cents per transaction. And if you have more than 5 team members or need customized forms, DonorBox paid plans start at $150/month.

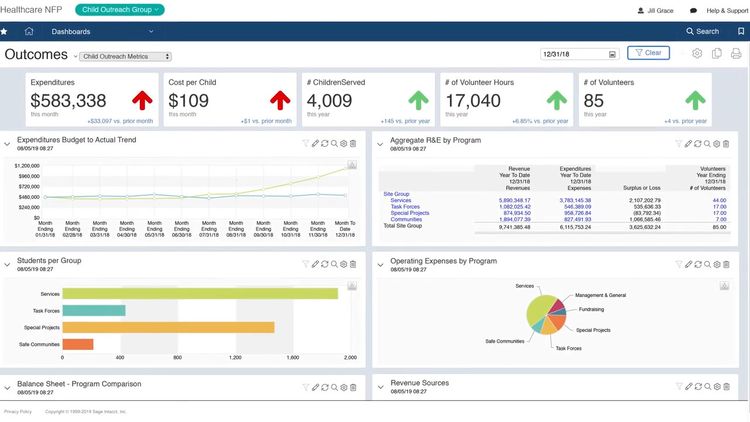

Sage Intacct - Best for Multiple Entities

Sage Intacct is not exclusively designed only for nonprofits like the other systems previously mentioned but still remains a popular choice among NPOs. This is due to its strength in granular financial tracking, automated revenue recognition, and comprehensive reporting. For nonprofits specifically, Sage includes the ability to manage funds, grants, and donations from multiple sources, from which you can then run reports and enable separate quarter or year-end closes.

The platform automates revenue recognition in accordance to GAAP standards, ensuring compliance with nonprofit accounting regulations. It also streamlines the allocation for funds across various special programs or locations. Additionally, Sage Intacct generates essential financial reports, including the Statements of Activities, Financial Position, Cash Flow, and Form 990 reports. With simple 1-click consolidations, the system provides visibility into your entire NPOs financials, including all entities, multiple currencies, and tax jurisdictions.

Although not solely built for nonprofits, Sage Intacct’s multidimensional architecture supports the complex financial needs of growing organizations, including multi-entity, multi-currency, and global consolidations. However, its pricing may be a barrier for smaller nonprofits. As exact pricing details are not publicly available, you must set up a consultation call for a quote.

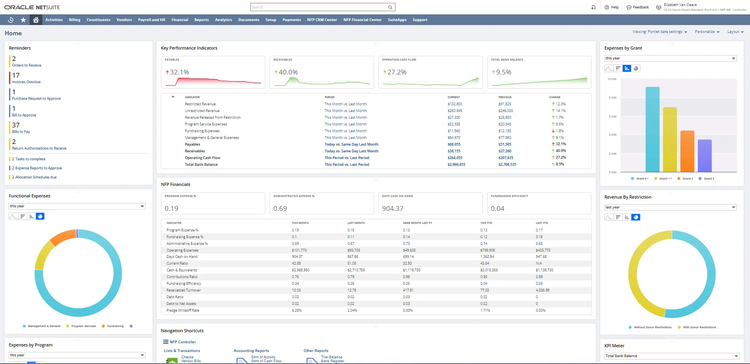

NetSuite - Best Financial Analytics

NetSuite is another widely used ERP system among nonprofits, despite not being a specialized nonprofit software. Its strong financial capabilities include a chart of accounts, budgeting management, tax setup, expense allocations, and bank reconciliations. These features enable nonprofits to manage and track both restricted and unrestricted funds properly.

NetSuite’s integrated CRM module provides a complete view of the donor and constituent lifecycle, covering leads, opportunities, donations, and other support offerings. It also offers analytics and reporting connecting data across the entire platform with SuiteAnalytics, giving actionable insights into metrics like program performance, donation trends, and resource utilization.

While the base NetSuite ERP is available as a “donation” to your nonprofit, the full nonprofit management capabilities require nonprofits to apply and purchase to the Nonprofit add-on. However, as a nonprofit, you receive discounted user license rates through the NetSuite Social Impact program.

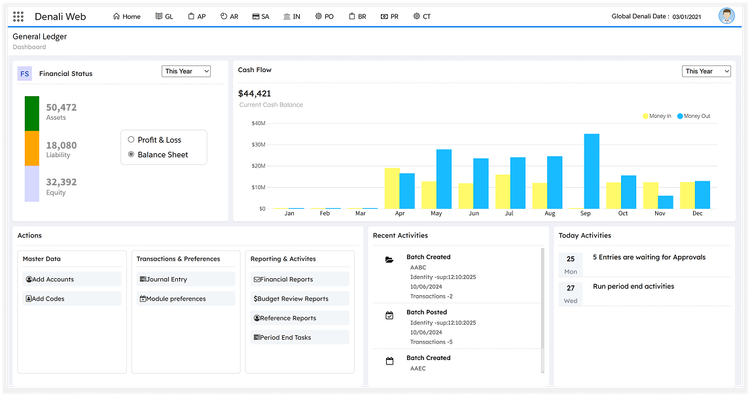

Denali Fund Accounting - Best for Grant Management

Denali Fund Accounting is a great option for organizations managing federal grants, private grants, and corporate sponsorships. It also helps nonprofits maintain compliance with GAAP and FASB guidelines, reducing the risk of failing audits. That is because the system has an audit trail that ensures all previous entries cannot be deleted, and if changes are made, they are tracked and recorded for additional accountability.

Denali Fund includes modules for accounts payable and receivable, payroll, bank reconciliation, purchase orders, order entry, inventory control, donor tracking, and job costing. While some of these modules can be purchased individually as a standalone, others require additional components for full functionality. The system also offers an integrated point-of-sale solution, making it a versatile option for nonprofit thrift stores like St. Vincent de Paul or Goodwill.

On the other hand, Denali Fund is likely too complicated for those new to fund accounting. It’s a fairly in-depth accounting system, so its learning curve is steeper.

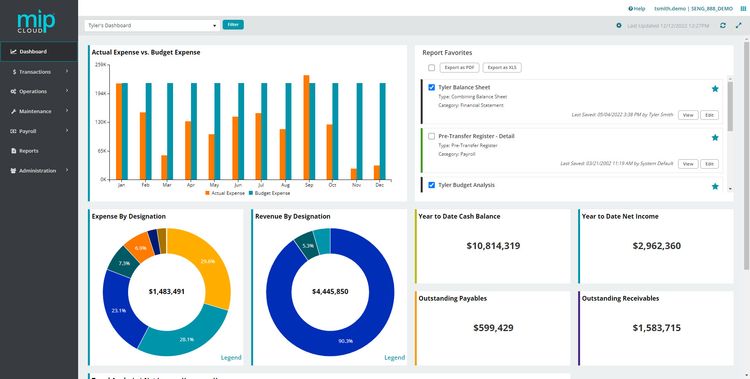

MIP Accounting - Best for Governments

MIP Accounting is best for nonprofits like government agencies and municipalities offering fraud protection, a clear audit trail, and GASB-compliant, audit-ready reports. Audit trails can be accessed at any time by creating multidimensional charts for expenses and revenue.

The software provides robust capabilities for managing multiple funding sources and creating and managing budgets. MIP facilitates detailed tracking of restrictions on net assets and allows for the automatic allocation of costs across multiple cost centers. This is especially useful for government agencies that manage complex budgets and need to ensure accurate fund distribution.

However, user feedback and online reviews indicate that the software’s interface appears outdated and not particularly user-friendly. Some reviews also highlight challenges with customizing reports, noting a lack of support for multi-entity reporting and a somewhat cumbersome reporting process.

Explore more Nonprofit Accounting Software Systems

Bonterra - Best for Human Services

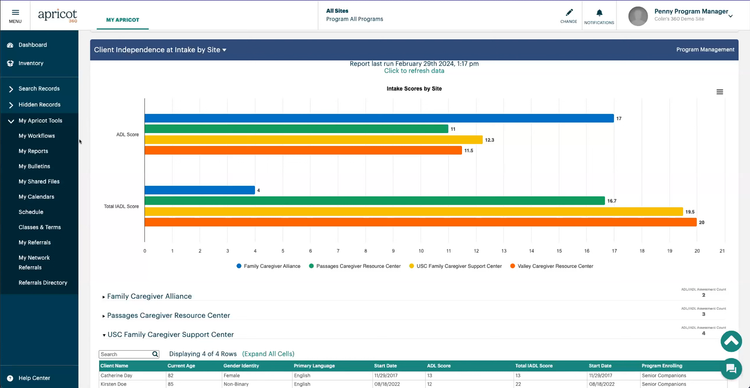

Bonterra is a great choice for nonprofits in sectors like housing, workforce development, health, and family services. Previously known as Apricot, this platform is built to both manage your NPO’s delivery of critical programs and measure their impact.

Organizations can use this platform to handle client intake, record case notes, run assessments, and report on client outcomes from a single system. It supports flexible form building and customized workflows and has program-specific dashboards if you run multiple services through one nonprofit. The system also ensures HIPAA compliance and gives staff cloud access to update and review records from anywhere.

What we like most about Bonterra is that they also offer Bonterra Fundraising, which includes donor tracking, email marketing, and online giving tools. This means you can manage both fundraising and human services in one platform. Pricing is quote-based, so it may not be the best fit for emerging nonprofits, but each system is tailored to your organization’s size, complexity, and unique requirements, which larger NPOs may appreciate.

What Is Nonprofit Software?

Nonprofit software, sometimes called nonprofit technology or nonprofit apps, consists of tools for administration, fundraising, donor management, accounting, and marketing. Users include advocacy groups, charitable institutions, government organizations, and faith/religious-based congregations.

For nonprofit organizations, using an industry-specific solution to account for donors and donations, fundraising operations, gifts, membership, and other funding sources is crucial to maximizing outreach, productivity, and engagement with donors.

What Are The Features of Nonprofit Software?

- Communication tools: Includes email marketing, text messages, or traditional direct mail for outreach. A common feature in nonprofit CRM software.

- Fundraising: Execute highly targeted marketing plans. Enable the creation of custom campaigns to link online donations and physical donations in a single system. Keep track of donations tied to specific campaigns.

- Campaign reporting: Create custom reports to account for donations, grants, pledges, and other funding sources. This includes data-driven analysis to measure fundraising performance, donor retention, and historical fundraising campaign success.

- Donation management: Track donations and pledges made by donors through fundraising campaigns. Anticipate inbound donations; process recurring donations with ACH or credit card payments; organize corporate donations, matched gifts, and any other source of contributions.

- Contact management: Keep records on past donors to streamline communication of donation pleas, marketing materials, and invites for various events.

- Event planning: Organize and host charitable events, such as in-person fundraisers or awareness campaigns.

- Membership management: Track different levels of memberships, such as group/family or single. Share documents with members via their updated contact information. Allow referrals for new members, allow members to sign up for events, or adjust online billing preferences.

What Are The Benefits of Nonprofit Software?

Nonprofits can benefit from software in some key areas, such as:

Improve Your Volunteer and Donor Databases

Anything that helps your organization stay organized regarding people-to-people relationships will fall under a nonprofit database and membership software. One could think of these solutions as being nonprofit CRMs since nonprofits are primarily looking to track metrics on 3 distinct types of people:

- Donors: Analyze which campaigns they give to, manage communications between them and the organization, and provide them with the appropriate tax forms at year-end.

- Members: Databases act as a way to grow your membership programs. Like how memberships are managed in a professional association, membership databases provide constituent relationship management and track member information, communication efforts with members, help keep members engaged, and give members access to their accounts. Fees can be managed in a straightforward manner, and members can sign up for in-demand volunteer spots or help organize fundraising campaigns.

- Volunteers: Store contact info, release forms, hours worked, availability, and past experiences. Provide real-time reports to see which individuals are having the most level of success. Determine which events have drawn the most interest.

Create End Of Year Donation Statements and Donor Contribution Summary Reports

All nonprofit organizations that receive contributions totaling $250 or more, OR provide goods and services to donors to make contributions of more than $75, must send donation receipt letters for tax purposes. The government regulates end-of-year donation letters to any business with legal nonprofit status. These forms allow your donors to deduct donations from their taxes.

These donation statements are proof that a donor has contributed to your organization—something the donor can keep as proof if the government starts to investigate their claimed tax deductions further. By easily providing these to donors, you’ll be able to build trust and a level of comfort that will encourage repeat donations.

A donor contribution summary report tracks each donor’s contribution total as needed. They include your organization’s name, the donor’s name, the dates of contributions, the amounts of contributions, and a statement explaining whether or not your organization provided any goods or services in exchange for these gifts.

Donor contribution summary reports can be sent to donors via direct mail or email. Most nonprofit software will include a cover letter of sorts–acting as a great tool to keep your donors up to date on what’s happening with the organization, before listing each donation for the calendar year.

Create Form 990

All tax-exempt organizations in the US must file an annual information return with the IRS, which includes Form 990. This form allows the IRS to gather information about the organization and educates organizations about tax law requirements and compliance. Tax Form 990 can also help educate the public on programs offered by the nonprofit organization.

While nonprofit organizations do not have to pay federal, state, or local income tax, they still have to pay payroll, sales, and use taxes. Most tax-exempt organizations must file an annual informational return with the IRS–which includes Form 990. Nonprofit software can provide step-by-step instructions for preparing and filing Form 990, including receipt of confirmation that it was accepted.

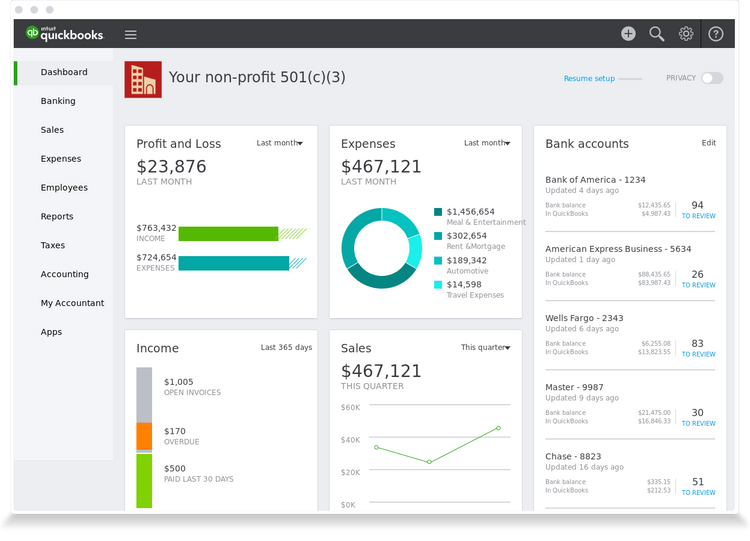

Is QuickBooks a Nonprofit Software?

QuickBooks is not a nonprofit accounting software, but it remains a widely used option for small to midsized organizations. As of 2025, QuickBooks offers two main products that nonprofits may consider.

- QuickBooks Online: A cloud-based accounting platform that is the most commonly used QB version today.

- QuickBooks Enterprise: A desktop-based solution with advanced features for larger, more complex organizations.

While neither program is built exclusively for nonprofits, both can be configured to handle fund accounting, budgeting, donation tracking, and basic financial reporting.

QuickBooks Online vs. Enterprise for Nonprofits

QuickBooks Online is best suited for small to mid-sized nonprofits that need remote access, simple fund tracking, and integration with third-party donor management apps. It includes:

- Customizable chart of accounts for tracking income and expenses by fund, program, or grant. (class tracking only available in the Advanced Plan)

- Bank reconciliations and budgeting

- Support for donor records using the “customer” fields

- Can integrate with leading donor management tools like: DonorBox or Bloomerang

However, QBO still uses for-profit language by default (e.g., “customers,” “sales”) and lacks native nonprofit reports like a Statement of Activities. These reports must be manually built or added via integrations.

QuickBooks Enterprise, while desktop-based, includes a dedicated nonprofit edition template that offers stronger reporting and pre-built tools:

- Pre-configured reports for Form 990, donor summaries, and functional expenses

- Up to 40 users with customizable roles

- More control over budgeting and department tracking -Optional cloud-hosting for remote access

Enterprise is a better fit for larger organizations needing stronger internal controls, multi-user access, and detailed financial segmentation. However, it comes at a higher cost and lacks the real-time accessibility without costly add ons.

How Much Does Nonprofit Software Cost?

Pricing for nonprofit software will range from $30/month to well over $1,000/month depending on what the software offers. Specialized systems focused solely on features like donor management or online giving might fall at the lower end of that spectrum. In comparison, a complete nonprofit platform that combines fund accounting with fundraising campaigns and grant management may fall toward the higher end and often exceeds $500/month.

Most systems charge per user per month and require a minimum number of users. Software with local installations (desktop software) usually has a one-time fee for purchasing it outright and offers optional yearly fees for support and updates.

Are There Any Free Nonprofit Software Solutions?

Nonprofit organizations are always trying to reduce or eliminate as many traditional business expenses as possible so they can spend more of their limited funds on the mission itself. As a result, it’s no surprise that most NPOs prefer free software options.

Realistically, you’ll be hard-pressed to find a free nonprofit software solution capable of proper donation tracking or membership/volunteer management without downsides. Most “free” options are just trials or basic versions of paid options to attract customers. However, combining these tools could let a nonprofit decide which are worth their paid counterparts. Fortunately, many solutions are relatively inexpensive, depending on exactly what features your organization requires.

Review some of the best free NPO software products available.