The W-2 Form Deadline: Basics for Employers

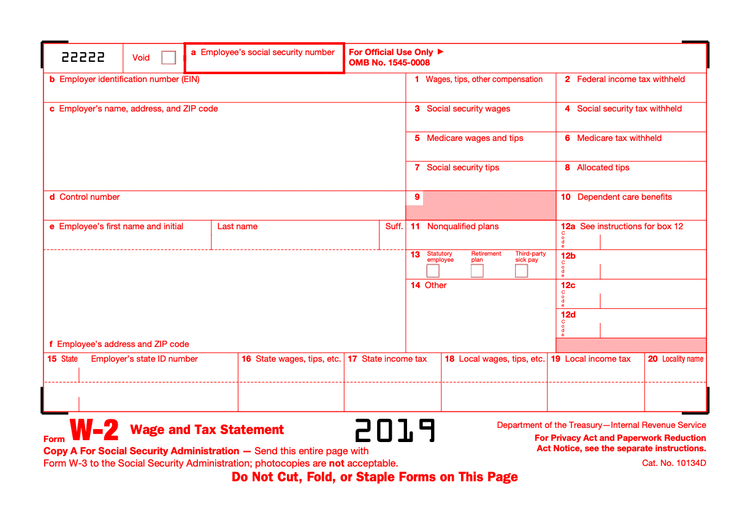

Tax Form W2 is part of the ‘W series’ of tax forms and is a six-part federal Wage and Tax Statement. This form reports all of the wages earned by employees and taxes that were withheld for that year.

Providing the W2 to an employee on time is one of the many responsibilities an employer has. It becomes one that employees take the most notice of once the calendar rolls over into a new year. And who can blame them? Employees expecting a refund may want to file their taxes as soon as possible. And the employer must file Form W-2 for each employee they are withholding income, social security, or Medicare tax from.

Here’s what you need to know about all things W-2:

What Is The Form W-2 Deadline?

The deadline date by which you need to have distributed W-2’s to employees is January 31st. Employees don’t technically have to have W-2’s in hand, but at a minimum, the envelope must bear an official January 31st or earlier postmark. W-2’s can also be electronically distributed. Employees legally have the right to request a paper copy, should they so desire, so keep that in mind if you choose an electronic distribution route.

While January 31st is the deadline for distributing W-2’s to employees, it’s not the actual filing deadline. Employers must file their W-2 and W-3’s by either February 28th (paper returns) or March 31st (electronic filing).

W-2 Penalties For Late Filing

A small business can be penalized anywhere from $50-$550 per return, depending on the length of delay:

| W-2 Penalties | Length of Delay |

|---|---|

| $50/return | Within 30 days of the due date |

| $110/return | 31 days from the due date up until August 1st |

| $270/return | After August 1st |

| $550/return | Intentionally neglecting to file |

Creating Employee W-2’s

There are multiple methods for creating employee Form W-2s. A more traditional route is to order W-2 forms directly from the IRS and manually compile them. You’ll want to check out the official IRS “General Instructions for Forms W-2 and W-3” to ensure you are accurately assembling the info.

Another option is to use your payroll records to create W-2 forms via the “Business Services Online” tools from the Social Security Administration. Not only does the Business Services Online tool allow for form creation, but it also supports the complete electronic filing process.

A third (and perhaps the path of least resistance) method for creating W-2 form is via payroll software. W-2 form creation is a fundamental capability within any reputable business payroll software. It allows for almost complete automation and eliminates the majority of opportunities for manual errors. Some cloud-based payroll solutions will allow users to access their W-2 form via the online portal they are already using to view paystubs. This usually gives an employer the most convenient method of providing the W-2 form to its employees, who the IRS says are quickly moving towards filing their returns online (8 in 10 in 2018).

This 3 step process for creating W-2 forms in Dynamics GP, for example, is typical of the ease of using accounting or specialized payroll software to print W-2 forms.

How To Classify W-2 and 1099 Workers

Employers are legally required to accurately distinguish between a W-2 employee and 1099 contractor.

The employment website TenTilTwo.com recently answered the question of what makes for a W-2 employee versus a 1099 contractor:

“If the position requires the employee to be directed as to how, when, where and with what to do the job… …then he is a W-2 employee. If however, the job will be done independently, then a 1099 may be the way to go.”

Being able to legitimately utilize a 1099 classification provides a number of benefits to employers. Aside from eliminating any tax responsibility on the wages, a 1099 classification gets the employer off the hook for a number of compliance issues related to non-discrimination, benefits, and wage protection laws. The deadline for 1099’s is also January 31st.

If you’ve got a case you’re not sure about, you can check out the IRS’s 20 factor test for determining “worker classification.” If you’re still not sure, reach out to either your CPA or tax attorney for advice that can save you some legal headaches.

Avoiding Mistakes In Form W-2

In 2013, the government audited 6,000 companies. At the time, FoxBusiness.com reported then President Obama’s estimation that the crackdown would lead to an additional $7B in revenue. The latest IRS data shows that they audited almost 934,000 individual income tax returns in the fiscal year 2017, the lowest number of audits since 2003.

The IRS now offers a voluntary reclassification program that can help you settle up and retroactively convert 1099 employees to a W-2 status.

The specific penalties for being late or inaccurate with W-2’s are fully documented in the “General Instructions for Forms W-2 and W-3.”

First, penalty amounts depend on a few factors, including:

- How late you were (for deadline related issues),

- Whether or not the IRS thinks the mistakes were intentional (for accuracy infractions), and

- The size of your business.

Second, the IRS does name exact dollar amounts for specific infractions. Penalties can range from $30 to $250 per W-2.

If any failure to provide a correct payee statement (Form W-2) to an employee is due to intentional disregard of the requirements to furnish a correct payee statement, the penalty is $250 per Form W-2 with no maximum penalty. The IRS describes penalty for “Intentional disregard of payee statement requirements”

Finally, employers should be aware that there’s no protection in pointing the finger at 3rd party filers:

Use of a reporting agent or other third-party payroll service provider does not relieve an employer of the responsibility to ensure that Forms W-2 are furnished to employees and that Forms W-2 and W-3 are filed with the SSA, correctly and on time. The IRS describing the risk involved using 3rd party filers