The Best Expense Management Software

Expense reporting software streamlines how businesses track, record, and manage their spending. Our guide includes platforms that integrate with popular accounting systems, offer great value, and suit companies of all sizes.

- Simple and straightforward pricing

- Both punchout and Punch-In catalogs

- Integrations for the top accounting systems e.g. QuickBooks Online, NetSuite, Xero

- Adheres to regional labor laws for global teams

- Mobile app for time tracking and project management

- Offers API access and integrates with Slack, Jira and Teams

- Sold by module

- Global compliance with multiple currencies and tax regulations

- Mobile app with receipt capture

We researched the top expense tracking software using our advanced review methodology to bring you the best in reporting, receipt scanning, and reimbursement management.

- Precoro: Best Overall

- Deltek Replicon Time: Best Expense Sheet Module

- Concur Expense: Best Invoice Automation

- Ramp: Best Corporate Card Platform

- Emburse Certify: Best for Global Companies

- Coupa: Best Spend Management Tools

- Digital Purchase Order: Strong Multi-Currency Support

- Expensify: Best Free Option

- Zoho Expense: Best Product Ecosystem

- Rydoo: Best Travel Expense Management

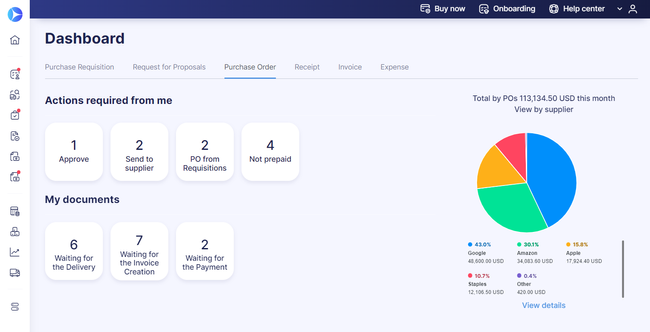

Precoro - Best Overall

The expense module in Precoro merges employee reimbursement and corporate expense tracking into one automated workflow. For example, self-service reimbursement tools let your team create and submit expense requests in a few quick steps:

- Fill in required fields like amount, description, and category

- Upload receipts via mobile devices or supporting files (.jpg, .png, .pdf, etc.)

- Submit directly through the Precoro platform

From there, your managers will receive real-time alerts, so they can quickly approve or reject requests. Precoro even supports adding comments or requesting more info from employees. You can set up the approval flow based on cost centers (like marketing purchases) or thresholds (like any invoices over $5,000), so the document automatically progresses to the Accounting department after approval.

This module feeds directly into Precoro’s reporting dashboard. Here you can access overall spending line graphs, budget vs. actual variances, and transaction counts. You can also view the action panel for any pending tasks or required actions connected to related documents for faster processing.

Precoro starts at $499/month billed annually for the Core plan, which includes automated approvals and expense management tools. However, for features like real-time budget tracking, you’ll need to upgrade to the Automation plan at $999/month, which is best for scaling business operations in the mid-market range.

Deltek Replicon Time - Best Expense Sheet Module

Deltek Replicon Time includes an expense sheet module that offers a structured, compliance-friendly approach. It’s fully embedded in the software’s project management ecosystem, delivering accurate cost tracking and syncing directly with payroll and billing.

With multi-line expense entry capabilities, you can input every transaction’s date, amount, and currency. You can also categorize the expense by type, like hotel, airfare, or mileage, which saves you from misclassified costs and policy violations. You can tag each expense to a specific project, which auto-populates the associated client. Replicon then lets you select project tasks for even tighter cost control, helping you improve invoicing accuracy.

We also like that Replicon includes configurable rate-based expenses. For example, when it comes to mileage, you can input quantities like miles driven; default reimbursement rates apply, but you can override these whenever you need. Either way, automated calculations for variable costs like these save a ton of processing time.

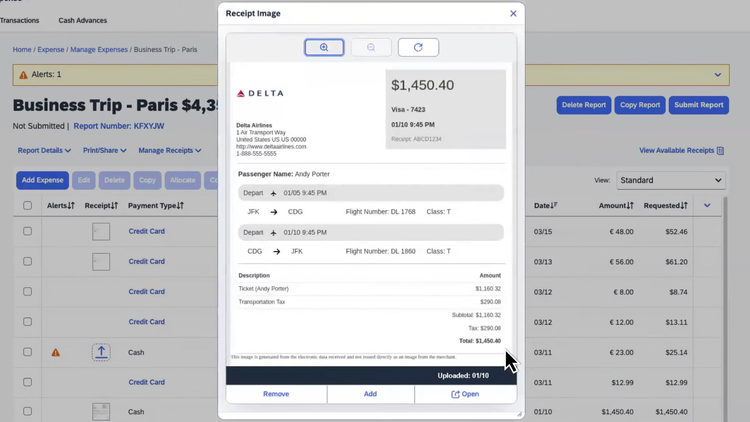

Replicon supports mobile receipt capture in multiple file formats, which is vital if you have field teams or remote workers. Once submitted, the expense sheet routes to approvers based on configured workflows. It alerts users via push notification or email when expenses are approved or rejected. Replicon Expense Quick Start begins at $3/user/month, though each plan has a 10-user minimum; for that reason, we don’t recommend it for companies with fewer than ten users.

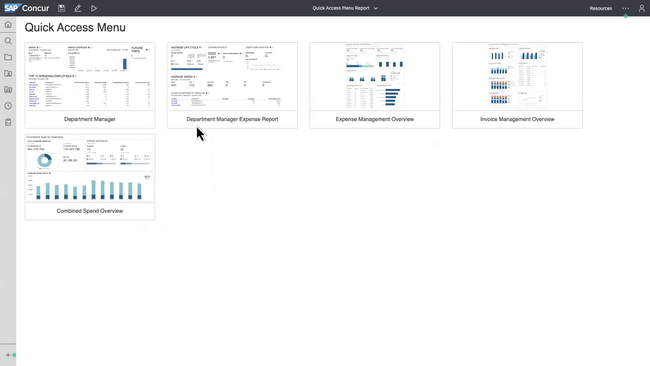

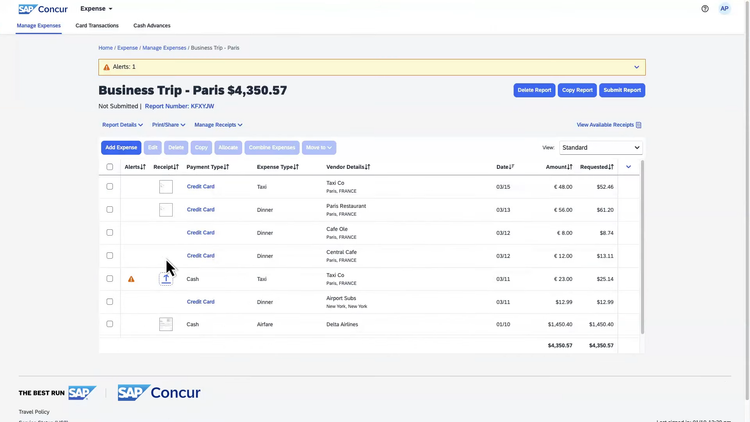

Concur Expense - Best Invoice Automation

SAP Concur Expense is ideal for companies managing high volumes of invoices or complex approval workflows. Its invoice automation uses optical character recognition (OCR) to extract key data points from emails, electronic submissions, or hard copies. The system flags any discrepancies for quick validation by your team.

With SAP Leonardo machine learning, Concur Expense processes and categorizes data at both the header and line-item levels:

- Data Extraction: Pulls details like quantity, description, & unit price

- Expense Categorization: Classifies expenses into appropriate groups for easier coding

This simplifies your expense reporting, allowing you to handle extensive transactions with minimal manual effort. From there, Concur Expense offers automated two- or three-way matching, comparing invoices with POs and goods receipts to help prevent overpayments.

You can customize workflows to ensure invoices route to the right approvers. They can make real-time approvals using the SAP Concur mobile app, with invoice images and comments for added clarity. The system then automatically prepares payment batches, so your accounts payable team spends less time on manual workloads.

Pricing for SAP Concur starts at around $9 per user per month, with costs varying based on your organization’s size and required modules and features. This system typically requires five users for its most basic plan.

Ramp - Best Corporate Card Platform

Ramp is a popular choice for businesses seeking a corporate charge card paired with strong expense and spend management software. It covers expense tracking, bill pay, and a 1.5% cashback card as part of its finance operation platform.

Ramp enables businesses to issue virtual and physical corporate cards tied to specific funds or spending areas. You can assign cards to particular employees or more broadly for one-time purchases, subscriptions, or vendor-specific payments with granular controls on limits and merchants. When employees make purchases, Ramp automatically requests receipts, codes them, and matches them to the correct transactions. And like most modern expense management platforms, Ramp supports OCR functionality to capture the details quickly.

Ramp is best for established U.S.-based companies with primarily domestic spending. It can support occasional international purchases, but it is not ideal for high-volume global procurement workflows. Pricing is competitive with other low-cost platforms, as the core platform is free and advanced spend management features start at $15 per user per month.

Emburse Certify - Best for Global Companies

Emburse Certify supports over 140 currencies and 64 languages, catering to international businesses and their diverse needs. Additionally, the software offers GPS tracking, transforming trip information into accurate, reimbursable mileage expenses with less effort.

The software integrates with a wide range of accounting, collaboration, and travel platforms, such as Oracle Netsuite, Paycor, QuickBooks Online, and Sage, allowing for streamlined processes across different business systems. Last, Certify simplifies travel management, offering tools for booking trips, creating policies, identifying spending trends, and negotiating better rates.

Coupa - Best Spend Management Tools

Coupa manages all types of business spending, including direct and indirect expenses, services procurement, and travel fees. Additionally, Coupa offers strategic sourcing features, including supplier and contract lifecycle management, helping businesses negotiate better rates and terms.

The platform’s real-time dashboard and reporting tools deliver immediate insights into spend. This helps identify savings opportunities and improve budget management. Finally, Coupa has advanced compliance controls and fraud detection mechanisms to ensure spending adheres to company policies and external regulations.

Digital Purchase Order - Strong Multi-Currency Support

Digital Purchase Order is a cloud-based spend management platform that helps businesses stay on top of employee expenses. DPO is designed for teams that require a structured workflow for submitting, reviewing, and managing company spend. While the platform is often used to streamline the entire procurement process, it provides a dedicated expense management module built to replace spreadsheets and email chains.

For teams managing spend across different countries and regions, DPO provides built-in multi-currency support. Admins can configure exchange rates and set up individual approval chains for expenses originating in various currencies, helping standardize how global spend is submitted, reviewed, and documented. This is especially useful for companies managing international charges or enforcing region-specific spending rules, since each expense follows a transparent approval chain with receipts and supporting documents attached.

DPO provides a fast onboarding process that can get teams up and running within 24 business hours. The platform is also affordable for small and growing companies with access to their entire product suite, starting at just $30 per month for up to 3 users. For up to 10 users and dedicated account setup support, the Executive Edition is $100 per month.

Expensify - Best Free Option

Expensify is best for startups and small businesses because it offers a free plan. The plan allows a single admin to manage workspace settings, issue Expensify Cards, and handle payments and expenses. It includes unlimited receipt scanning and next-day ACH reimbursements, streamlining the expense reporting and reimbursement process.

The free plan does have its restrictions. For instance, it does not allow for custom categories or integration with accounting packages. Features like multi-level approval workflows, direct accounting integration, and custom export formats are reserved for paid plans.

Zoho Expense - Best Product Ecosystem

Zoho Expense is a strong choice for businesses seeking more than just expense management capabilities. That’s because Zoho One is a complete business platform that offers additional business functionality for accounting, CRM, HR, and project management.

Beyond its broad product ecosystem, Zoho Expense uses OCR technology to scan and record expense details from receipts automatically. Additionally, for international companies, it supports multiple currencies and compliance with most global tax regulations.

While Zoho Expense is offered as part of the Zoho One suite, which bundles Zoho Books, Zoho Projects, and Zoho CRM, it can also integrate with popular platforms like QuickBooks and Xero for accounting.

Zoho is best for small to mid-sized companies that want a tightly connected ecosystem of business tools with bundled pricing starting at $37/employee/month. For the Zoho Expense module alone, pricing is comparable to Expensify, offering a free tier with paid plans starting at $4 per user per month.

Rydoo - Best Travel Expense Management

Rydoo is ideal for mid-sized businesses with significant travel expenses. Its mobile app enables employees to scan receipts, submit expenses, and track approvals from anywhere, ideal for on-the-go professionals. Rydoo integrates with travel platforms to manage bookings, itineraries, and fees in one place, making tracking and reconciling travel spending easier.

Additionally, the platform supports per diem rates and mileage tracking, including GPS capabilities for accurate distance recording. Users can set up customizable approval workflows with specific rules and hierarchies for expense approvals, adapting to the diverse organizational structures of medium-sized companies.

What is Expense Management Software?

Expense management software gives you visibility into the costs associated with each service or project by keeping records of when and how expenses were incurred. With a more accessible expense reporting system, you can better analyze your current spending habits to shape your future expense policies. Additionally, this accounting software streamlines the reimbursement process so employees aren’t frustrated by a long wait time to get their money back.

Aside from the operational benefits of diligently tracking expenses, proper compliance can make your company far safer during a tax audit. For detailed information on allowable business expense deductions, review the IRS guide on Deducting Business Expenses.

This guide will help you evaluate and select the best expense management software for your specific needs. Before diving into the details, it’s helpful to understand the types of costs these systems are designed to manage, such as:

|

|

|

Expense management solutions best suit administrators and accounting specialists who review, approve, and report employee expenses.

Expense Management vs. Spend Management

Though closely related, expense management and spend management have distinct scopes within business processes:

Expense management has a narrower scope, focusing on employee-initiated expenses like travel, lodging, and corporate credit card charges. Key features include receipt capture and storage, expense report submission, and reimbursement processing.

Spend management has a broader scope, focusing on all organizational spending, including vendor payments, department budgets, and expense management, which is a subcomponent. Key features include budgeting, forecasting, procurement, invoice processing, and AP automation.

Key Features

| Functionality | Description |

|---|---|

| Expense Recording | Input and save important information about the expense, like the amount, date/time of purchase, and a description. Track individual employee or department-wide expenses. |

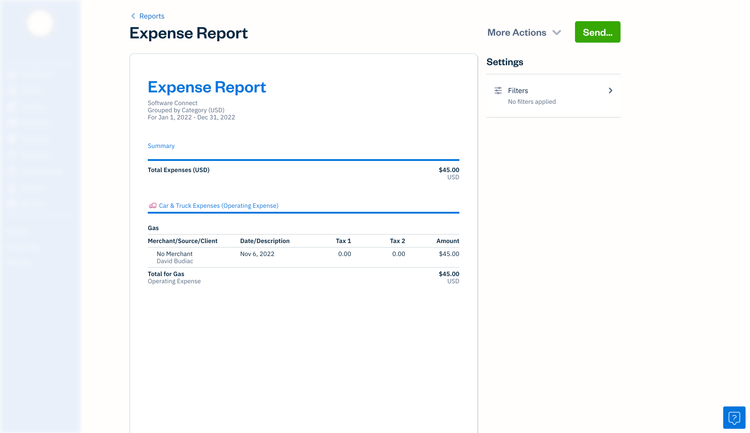

| Expense Report Management | Employees can submit expenses and create entries for the report. The software will process the report and automate the approval process. You’ll also see real-time reports that give you visibility into how money is being spent and expense trends. |

| Receipt Scanning and Management | Scanned images of receipts are uploaded and stored into the expense tracking software for better organization and easy access. Allow employees to submit expenses themselves for reimbursement. |

| Reimbursement Management | Expense tracking software automates the reimbursement process. When an expense report is submitted, the software checks the report against your company’s policies, like pre-approved expenditures and spending caps. |

| Corporate Credit Card Monitoring | Company credit cards can be linked with expense management software to automate the monitoring of these accounts. The software will alert management of suspicious activity and automatically approve recurring expenses that have been authorized previously. |

Benefits

-

Streamline reimbursement approval process: Employees can submit a reimbursement request from anywhere with expense tracking software. Information about the request is immediately available to management for approval, questioning, or denial.

-

Flag or deny invalid business expenses: Expense tracking software protects your business from employee fraud by flagging or prohibiting invalid business expenses. You can set dollar amount limits on travel expenses like hotels and food or flag items that shouldn’t be charged to the company.

-

Currency conversion for international expenses: If you or your employees need to travel, expense tracking software can automatically convert currency for internationally incurred business expenses.

-

Increased productivity: Expense tracking software saves tons of time by automating time-consuming tasks, allowing you to spend more time on profit-generating endeavors like sales and marketing. You’ll be able to spend less time tracking down receipts, managing expense claims, and putting together expense reports.

-

Accurate documentation for taxes: Come tax time, you’ll have all your receipts and expense documents in one place. Some expense tracking systems can notify you of potential inaccuracies. You won’t have to worry about getting audited for a missing receipt or incorrect tax data.

Pricing

Pricing for expense tracker software ranges from $5,000 to over $150,000 per year, depending on your business size, user count, and desired features. It’s generally priced per user (or anyone submitting expenses), especially in cloud-based models.

- Free expense tracking software like Expensify is generally best for one to five employees.

- Standard plans usually range from $5,000-15,000/year for 10 to 50 employees; key features include multi-level approvals and customizable policies.

- Mid-tier expense tracker software costs between $20,000-40,000/year for 50 to 150 employees; this includes department-level cost tracking and budget vs. actual analysis.

- Professional plans range from $50,000-150,000/year for 150 to 500 employees, with multi-currency support and custom workflows.

- Enterprise expense management software can exceed $150,000/year for 500 to over 5,000 employees; key features include full-suite spend management and dynamic approvals.

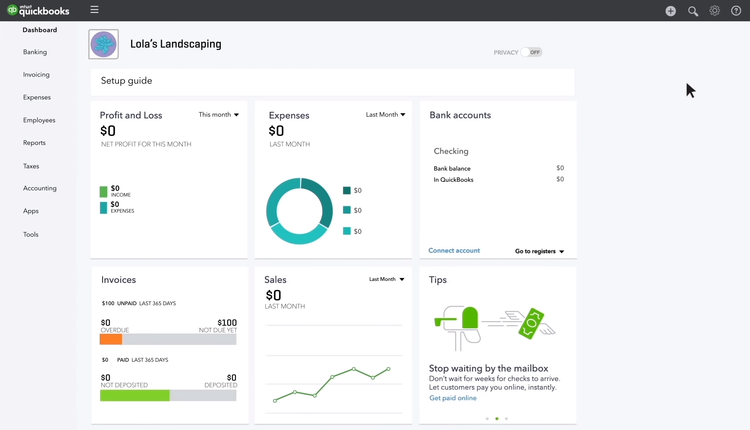

Can I Use QuickBooks to Manage Expenses?

Startups and small businesses can use QuickBooks for basic time and expense tracking. You can save photos of your receipts, keep track of tax deductions, connect bank and credit card accounts, and access built-in expense reports. Choose from QuickBooks Online, QuickBooks Desktop Enterprise, or Intuit Enterprise Suite.

Medium—to large businesses will need a solution with more in-depth features, such as corporate account card monitoring or expense approval/denial claims.

Free Expense Tracking Software

Free expense tracking software is best for individuals and home use. Some tiny businesses can get away with using the basic features in free software but often outgrow the solution quickly. Some popular free expense tracking systems include:

- Zoho Expense offers a free small business expense tracking software plan for 3 users that lets you auto-scan 20 receipts per month, track projects, import card transactions, convert currency, and store up to 5 GB of receipt documents. Zoho Expense’s Premium and Enterprise plans are not free. Still, they accommodate more users, allow unlimited auto-scans, and manage business trip expenses (including travel allowance, cost approval, and itinerary management).

- Expensify has free expense tracking software functionalities for home or small business use. However, you are limited to only 25 SmartScans per month if you want to track and submit expenses. Expensify’s Track and Submit plans can be upgraded to include unlimited SmartScans and automatic mileage tracking. These plans are ideal for home expense tracking, self-employed, and small business owners. Larger companies are better off with the Collect or Control plans that automate expense categorization and export to accounting software. The Collect and Control plans have a 6-week free trial.

Expense Tracking Software with Free Trials

- FreshBooks offers various expense-tracking solutions for freelancers and small businesses. The Lite, Plus, Premium, and Select plans offer a 30-day free trial. The Select plan is available for bigger firms with custom pricing and a demo.

- Xero has three plans for Early, Growing, and Established businesses. The 30-day trial gives you unlimited access to the software so you can see which features you need and decide which package best fits your business.

- Rydoo Expense offers three expense tracking packages. The Team and Growth packages have a 14-day trial. The third package, Enterprises, is customized to fit your business and does not offer a free trial.

What Does Your Business Need?

-

Startups and small businesses: Seeing where expenses come from is critical for small businesses and startups. Look for expense-tracking software with good reporting functionalities and receipt management. SAP Concur Small Business is a popular lower-cost expense tracking software for companies with a tight budget.

-

Medium-sized businesses: Automating some expense tracking processes gives your staff more time to focus on other tasks like sales and customer service. Expense tracking software will record and report expenses, streamline the reimbursement process, and monitor corporate spending. Some popular expense tracking software solutions for medium-sized businesses include Deltek Replicon Time and Deltek Maconomoy.

-

Large businesses: Reducing fraud is often a priority for large companies. Expense tracking software will automate the approval process, keep electronic records of expenses, and monitor corporate credit card activity. If your company is a professional services business, look into a full PSA software solution that handles expense tracking in addition to tracking billable hours and other real-time data to ensure your services or projects are profitable. Upland PSA is a popular PSA software solution for large businesses that will also integrate easily with existing enterprise software.

Common Expense Pain Points Solved

Without expense management software, your company could be at risk of audits or fall behind on employee reimbursement. Use an expense solution to avoid these common issues:

Expense Fraud

A survey by Chrome River found that employee expense fraud costs $2.8 billion per year in the United States. While only approximately 6% of employees commit expense fraud, the average amount of false claims are $2,448 per year. A few individuals even claimed $25,000 per year. Expense management software will automatically deny or flag invalid expense requests and monitor corporate credit card usage so you can spot fraud and take action to prevent it.

Misplaced Receipts

Keeping track of paper receipts is a significant pain point for businesses of any size. Expense tracking software lets you store images of your receipts, so you can keep electronic records and easily access them anytime you need them.

Delayed Employee Reimbursement

Expense tracking software can approve or deny reimbursement requests quickly, improving the turnaround for reimbursements.

Industry Trends

Expense management processes are constantly evolving, especially with the rise of real-time business transactions. Here are some of the industry trends:

Global Travel & Expense Management Software Market Growth

According to a report by Yahoo Finance, the global travel and expense management software market is expected to grow steadily to $15.7 billion USD by 2032. The report found that more businesses are adopting the software due to an increasing need to control and monitor travel and other employee expenses.

Mobile Capabilities

A report from Capture Expense projects that by 2025, 75% of businesses will predominantly rely on mobile applications for managing their expenses. This shift is primarily attributed to the increasing adoption of remote work and the need for more flexible work arrangements. As companies continue embracing these modern work environments, the demand for mobile-friendly solutions to track and report expenses surges.

Artificial Intelligence

Artificial intelligence is rapidly becoming a staple in software development, particularly in expense management systems. AI technologies, including machine learning and automation, are being integrated to enhance functionalities such as detecting policy breaches, automating expense categorization, and digitizing paper receipts through Optical Character Recognition (OCR).

Capture Expense’s data indicates that as of 2024, 60% of businesses have already incorporated AI to enforce policies within their expense management frameworks, showcasing the growing reliance on intelligent software solutions to streamline financial processes.