The Best Insurance Accounting Software

Insurance accounting software can help your firm stay financially compliant while streamlining processes like invoicing and reporting. We’ve reviewed top options for companies of all sizes, from independent agents to multi-entity firms.

- Multidimensional reporting capabilities

- Scalability for multi-entity support and user growth

- Simple and responsive user interface

- Customizable payment terms

- No setup costs

- Recurring invoicing

- Combined ERP and CRM

- Similar interface to MS Word and Outlook

- Integrations with Microsoft applications

Insurance accounting software can help agencies and firms of all sizes streamline and optimize their accounting processes, such as invoicing, reporting, and regulatory compliance. We examined over 20 systems and selected the top options using our advanced review methodology.

- Sage Intacct: Best Overall

- FreshBooks: Best for Independent Agents

- Dynamics 365 Business Central: Best Forecasting Tools

- NetSuite: Best for Large Insurance Firms

- Xero: Best for Small Insurance Agencies

- QuickBooks Enterprise: Best Reporting Functions

- Multiview: Best Security Measures

- CustomBooks: Another Good Option

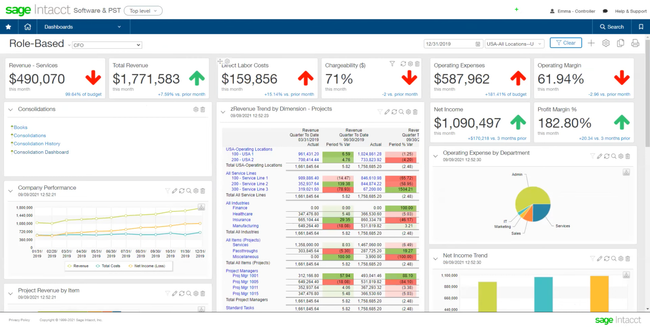

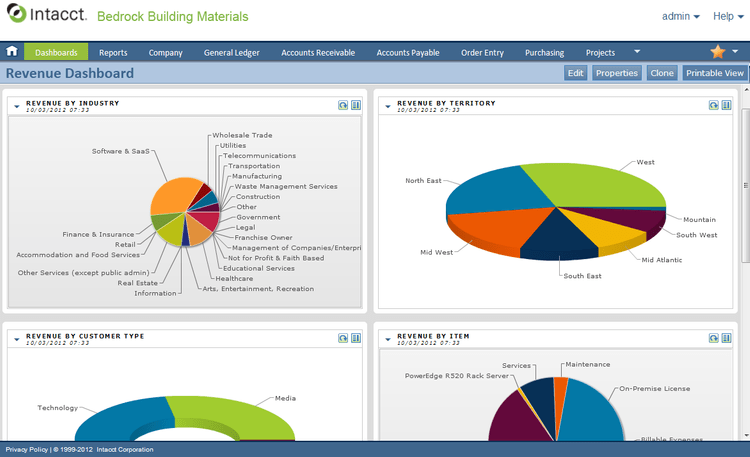

Sage Intacct - Best Overall

Sage Intacct offers multi-entity support and advanced accounting features. Multi-entity functionality is crucial for growing insurance agencies with several agents and locations requiring bookkeeping. The system consolidates all entities in one place, allowing total financial visibility for all locations and agents.

Sage Intacct’s reporting dashboards allow broad and detailed financial reports using real-time data. Agencies can examine specific locations, compare performances, or roll entire company data into one consolidated view to evaluate overall financial health. Metrics like goal tracking, net income, revenues, and expenses are available to help management make better-informed decisions.

One drawback is Sage Intacct’s pricing is not available to the public. We also wouldn’t recommend the system to agencies with under 15 employees, as the software can be costly for small businesses. In these cases, try Freshbooks or Xero.

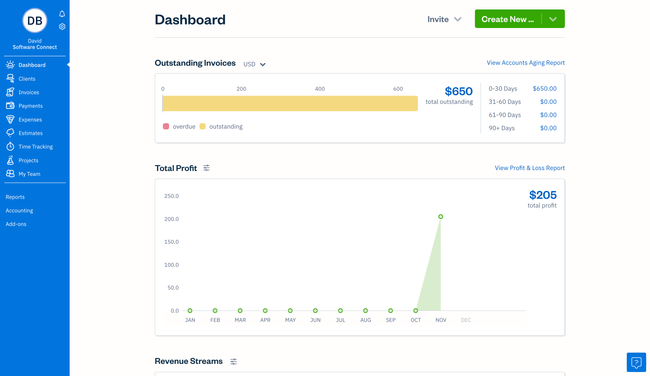

FreshBooks - Best for Independent Agents

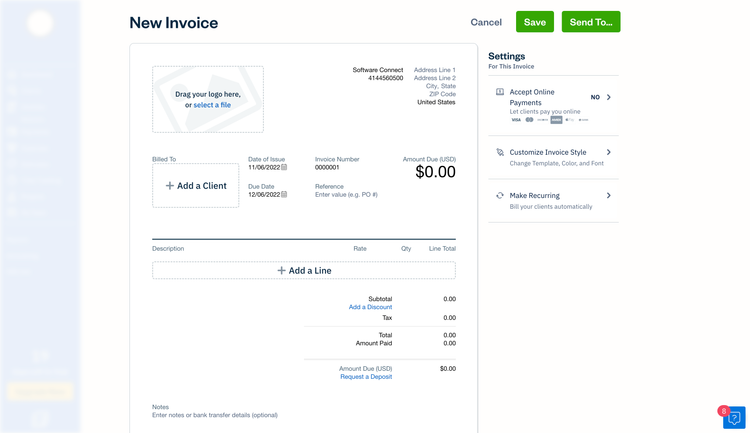

FreshBooks is a good choice for independent insurance agents because of its strong invoicing and payment capabilities. These allow agents to create professional invoices, track online payments, and ensure they are paid on time with the correct amount. It also includes automatic reminders and the ability to accept credit cards directly on invoices, making it easy for customers to pay.

Further, FreshBooks’s core accounting features streamline bookkeeping processes for independent agents. The double-entry system keeps financial data organized and accurate, helping users comply with regulations and taxes. Its key features include a general ledger, balance sheet, accounts payable, and journal entries, eliminating a manual filing system.

FreshBooks’s most popular Plus plan is $38/month, allowing users to set up recurring invoices and run financial reports. However, we don’t like that it only supports up to 50 clients, so users with more will need to upgrade to the $65/month Premium plan.

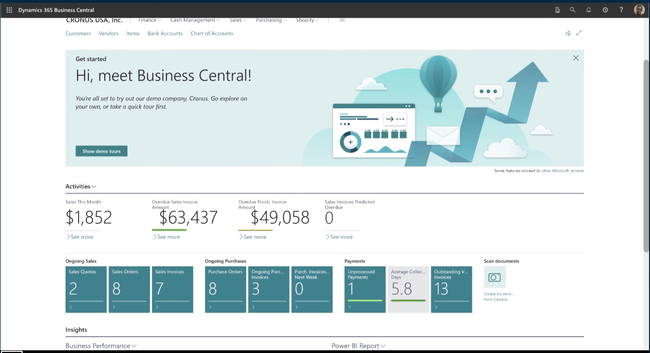

Dynamics 365 Business Central - Best Forecasting Tools

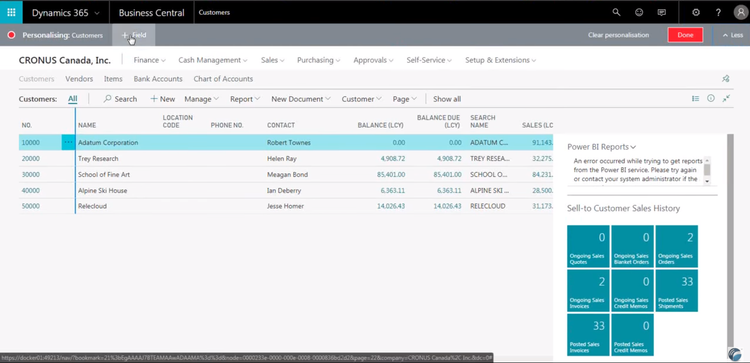

Dynamics 365 Business Central is a cloud-based ERP that can help mid-sized insurance agencies streamline their accounting through advanced tools. After demoing the system, we like its cash flow forecasting feature, which allows companies to create projections using AI to make more informed decisions. Its multi-currency and language support also benefit mid-sized agencies that are operating internationally.

Dynamics 365 Business Central is also easier to use than other ERPs like NetSuite due to its familiar Microsoft interface. Agencies already acquainted with Microsoft Office products like Excel will already be accustomed to its layout, shortening the onboarding process. This works well for midsize insurance agencies with large amounts of data, such as claims, policy, and customer information. One drawback is that while it integrates well with Microsoft apps, third-party applications can be clunky.

NetSuite - Best for Large Insurance Firms

NetSuite is all in one solution for large firms. The comprehensive ERP includes accounting, financial, and global business management modules, so companies don’t require a third-party insurance system. NetSuite can track commissions both paid to the company and those owed to agents, ensuring nothing slips through the cracks.

Additionally, NetSuite’s enterprise performance management module offers planning, forecasting, and budgeting features. Specifically, its corporate tax reporting feature is strong for large firms with complex financial data that require streamlined and compliant filing. This helps with inefficient account reconciliations, as it automates the entire process. Because of the many features, NetSuite has a high learning curve for new users.

Xero - Best for Small Insurance Agencies

Xero is best for small insurance businesses with 10-50 employees because of its easy-to-use bank reconciliation module. Even at this scale, firms handle a high volume of premium collections, claims payouts, and commissions, making bulk reconciliations vital. Xero streamlines this process by letting you sort, group, and code all the transactions to save time.

The reconciliation module also easily integrates with popular insurance agency software like Financial Services Cloud, so small businesses can keep their existing system. This integration can also help you comply with strict insurance regulations while enabling two-way data sync with your books.

Xero is also affordable for more budget-conscious firms. Xero’s mid-tier Growing plan is only $47/month with unlimited users, so you don’t have to break the bank. However, expense tracking and analytics features are only available in the Enterprise plan at $80/month. Still, it’s still a lower cost than alternatives like QuickBooks Online, which has per-user pricing that drives up the price.

QuickBooks Enterprise - Best Reporting Functions

QuickBooks Desktop Enterprise is ideal for midsized insurance agencies due to its effective reporting capabilities. The system offers over 200 customizable reports, encompassing almost any metric a company wants to analyze, such as entity-specific revenue, commission per agent, and expense ratios. Based on the information gained, management can create budgets and forecasts, all within the same system, for easy access and real-time data usage.

Additionally, QuickBooks Enterprise includes built-in payroll, so agencies don’t need a third-party system. Companies can store employee W-2s and 1099s through this module and offer a 401(k) plan. The software has more features overall than QuickBooks Online, making it an ideal choice if you’re outgrowing the smaller system.

One downside of QuickBooks Enterprise is that it requires annual contracts, which could be a sticking point for companies looking for more flexibility in monthly subscriptions. Pricing starts at $2210/year, but depending on the number of users, it will cost most businesses over $3000/year.

Multiview - Best Security Measures

Multiview is a cloud-based ERP that best suits medium to large-sized agencies aiming to enhance financial operations and keep their data secure. Its security features are ideal for insurance companies that deal with sensitive customer information. The system procures third-party services to help find vulnerabilities within its security to prevent data breaches as much as possible. You can also deploy user authentication for logins and role-based access to secure specific data.

We also like Multiview’s scalability, as it can handle growing agencies that require more storage as new agents and insurance plans are added. It also features Viewpoint business intelligence, an integrated reporting feature with BI and drill-down capabilities. This lets owners extract granular insights on metrics like policy count, claims ratios, and retention rate. However, Multiview lacks an integrated payroll module, so businesses must integrate a third-party system.

CustomBooks - Another Good Option

We included CustomBooks because of its strong accounting capabilities suited for small insurance agencies. It includes features such as budgeting, reporting, and a client dashboard, allowing businesses to evaluate all aspects of their financials. These tools are included in the Business plan at $99/month, making it an affordable option for small businesses.

Also, CustomBooks’s audit log feature helps agencies optimize their auditing process by allowing them to view all past transactions with details, including date, time, and any changes. This helps businesses become more transparent in complying with regulations. However, the system does not have a mobile app, which can dissuade owners looking for on-the-go accounting.

What is Insurance Accounting Software?

Insurance accounting software is a tool agencies and firms use to streamline accounting processes such as invoicing, billing, payments, revenues, and financial reporting. The systems are designed to handle complex accounting processes specific to the insurance industry and comply with strict laws and regulations.

Insurance agencies’ accounting systems must also integrate with existing insurance agency software to process complex processes like premium recognition and claims management. The integration ensures accurate data filing and syncing so businesses can have a cohesive system.

Key Features

- Automated Accounting: Streamline processes like general ledger balancing, revenue and expense tracking, and AR/AP.

- Compliance: Comply with strict insurance laws and regulations that vary widely between states. Streamline auditing processes with electronic receipts and document filing.

- Billing and Invoicing: Generate and send accurate and timely professional invoices. Pay bills on time with automated reminders. Collect payment directly from a credit card through the invoice.

- Commission Management: Calculate commissions based on different product rates and due commissions to agents.

- Claims Management: Facilitate the tracking and management of claims from initiation to settlement, including automated workflows to speed up processing.

- Customer Management: Tools to manage customer data, policy details, and interaction history to enhance customer service and retention.

- Multi-Entity Support: Consolidate financial data from all company entities into one central location.

- Reporting: Create financial reports on key insurance metrics, such as policy count and revenue by entity, to help the business make more informed decisions.

- Payroll: Manage employee payroll, commissions, and direct deposits.

Primary Benefits

Increased Automation and Productivity

Tedious back-office tasks can create time-consuming tasks like general ledger balancing, spreadsheet updating, and manual invoice creation. One of the main benefits of insurance accounting software is its ability to make companies more efficient. With accounting systems, companies can automate these tasks to free up more time for their employees to be productive elsewhere.

Document organization is another way that agencies can become more efficient. Specifically, agents can quickly retrieve past payments, submissions, and quotes without sifting through stacks of paper files. Systems can also store templates for new policy packages, making it easy for new customers to get the information they need.

Budgeting and Projections

Insurance agencies and firms can use accounting software to better manage their budgets and create revenue and expense projections. The system consolidates data across all entities and creates one central financial report, which can drill down as needed. Businesses can then easily create budgets for each entity or company. Additionally, systems with business intelligence can use this data to project future financial revenues.

Security

Insurance agencies deal with extremely sensitive customer information, so keeping that secure is a must. Accounting systems for agencies are encrypted and secure cloud-based systems, so the risk of data breaches is minimal. Large agencies can set permissions for certain information, ensuring only certain employees can access it.

Pricing

Insurance accounting software can cost anywhere between $20 and $10,000/month. This wide variation is due to basic accounting systems and full ERPs. Software like FreshBooks is great for independent agencies that only require accounting automation, and the price reflects that, with their starting Lite plan being $20/month. ERP systems like NetSuite and Multiview are much more expensive due to the more complex and large number of features they have to offer. These prices are usually quote-based and depend heavily on the size of your business and desired features.