The Best Trucking Accounting Software

Tracking fuel expenses across multiple vehicles and routes is complex and time-consuming. We tested and ranked the best software for owner-operators, trucking companies, and freight carriers with expense tracking, driver management, and compliance features.

- Simple and intuitive interface

- Provides bookkeeping functionality to manage load payments

- Integrates with QuickBooks, ProMiles, Samsara, etc.

- Multi-dimensional reporting capabilities

- Scalability for multi-entity support and user growth

- Simple and responsive user interface

- Multiple sales and expense form types

- Time-tracking

- Client portal with sales and purchase approvals

Here’s a rundown of our top picks based on our internal review process and user reviews.

- TruckLogics: Best IFTA Reporting

- Sage Intacct: Best Multi-Entity Support

- Zoho Books: Most Affordable Pick

- Q7 Trucking Software: Best End-to-End Solution

- Rigbooks: Best for Small Fleets

- AXON: Best Payroll Functionality

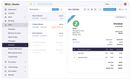

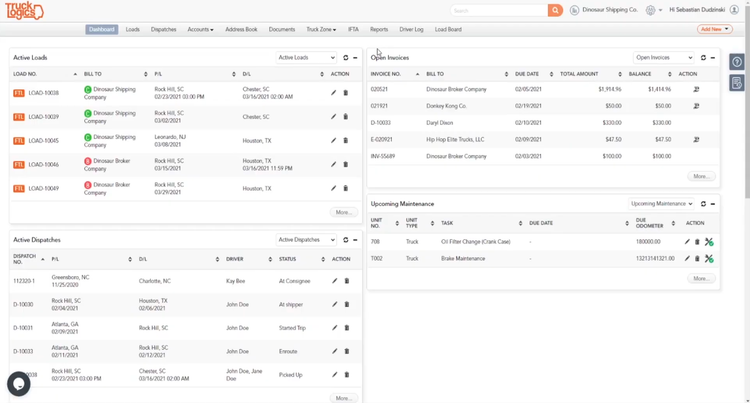

TruckLogics - Best IFTA Reporting

TruckLogics offers an International Fuel Tax Agreement (IFTA) reporting feature that’s designed to simplify and automate the process of reporting fuel taxes for trucking companies that operate across multiple jurisdictions in North America.

With this feature, you can input details of each trip, including routes taken, mileage, and fuel purchases. The system can also import data from GPS and telematics systems for more accurate tracking. TruckLogics processes this information and will automatically calculate the fuel tax for each jurisdiction based on the miles driven and fuel used.

At the end of each month, TruckLogics will generate an IFTA report that outlines the fuel tax owed to each jurisdiction. You can view it for accuracy and ensure that all your trips are accounted for. As the deadline for submitting the report approaches, the system will send you a reminder. You can then submit the report electronically to state authorities to avoid any potential late fees.

Automating the IFTA process can save time and enhance accuracy and compliance, allowing you to focus on more strategic tasks throughout your warehouse.

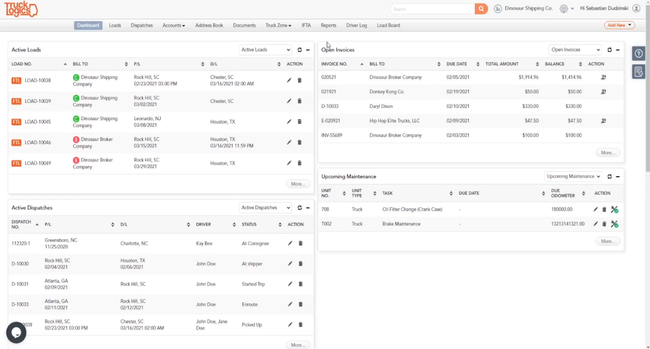

Sage Intacct - Best Multi-Entity Support

Sage Intacct offers strong multi-entity management capabilities. These allow trucking companies to easily manage financials across different divisions, locations, or separate business entities within a single system. This is useful for companies operating in various regions or with multiple subsidiaries, simplifying consolidation.

Sage Intacct automates inter-entity transactions, including transfers and eliminations. Freight carriers can create customizable reports and dashboards tailored to their specific needs, providing insights into the performance of each entity and the business overall. This feature allows for deep financial analysis and performance monitoring across different levels of large trucking companies.

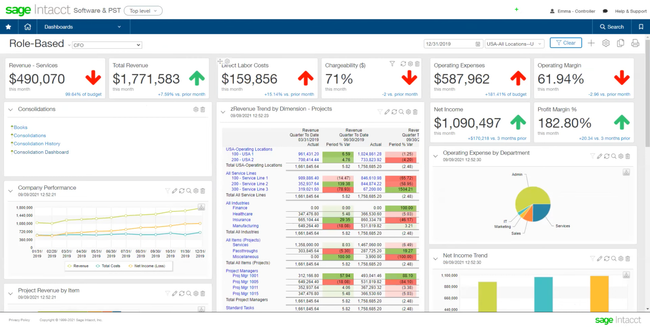

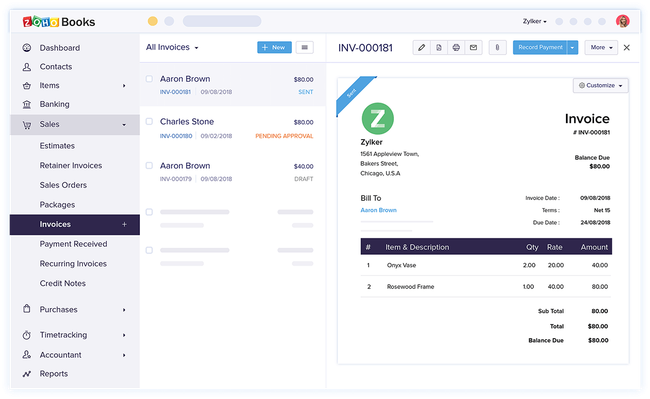

Zoho Books - Most Affordable Pick

Zoho Books is an affordable option for trucking companies, starting at $15 monthly for three users and up to 5,000 invoices. We found its pricing structure flexible, including a free tier for businesses with annual revenue below $50,000. For carriers that exceed this revenue threshold, Zoho Books still offers competitive pricing with a range of plans for various business sizes and needs. This makes it an accessible choice for both small and growing trucking operations.

Zoho Books facilitates online payment acceptance through integration with over ten third-party payment gateways, such as Stripe and PayPal. This simplifies transactions for trucking companies dealing with numerous clients or vendors. Another advantage of Zoho Books is its provision for additional users at an affordable rate. This feature and its scalable plan options ensure owner-operators can adjust their Zoho Books subscription as their business evolves.

Q7 Trucking Software - Best End-to-End Solution

Q7 Trucking Software is a solid end-to-end solution that integrates trucking-specific features with accounting capabilities. Its strengths lie in its ability to streamline operations across multiple facets, from order and dispatch management to fleet maintenance and safety compliance, ensuring detailed financial tracking and reporting.

Q7 provides a full suite of accounting tools for trucking businesses, including payroll, general ledger, accounts receivable, and accounts payable. Its payroll features are notably comprehensive, handling tax-exempt deductions and employer contributions. Additionally, Q7 offers both direct deposit and customizable checks. The system allows for batch payroll processing and customizable reporting, which includes summaries, tax audits, and W-2 printing for year-end.

Rigbooks - Best for Small Fleets

Rigbooks is an affordable, easy-to-use system for small trucking businesses. Rigbooks is noted for its straightforward UI, making it accessible for those who may not have extensive accounting or software experience. Rigbooks allows users to create and email invoices from existing trip records. However, it offers limited customization for invoices, such as adding a company logo or changing the color scheme.

The software enables manual expense logging with categorization options and the ability to set up recurring expenses. It tracks fixed and variable costs but lacks the functionality to track the checking or credit card account used. Profit and loss reports are available and can be customized for multiple trucks, showing key financial metrics such as total loaded miles and revenue per truck. Rigbooks supports IFTA compliance by tracking mileage per jurisdiction and providing detailed information for tax reporting.

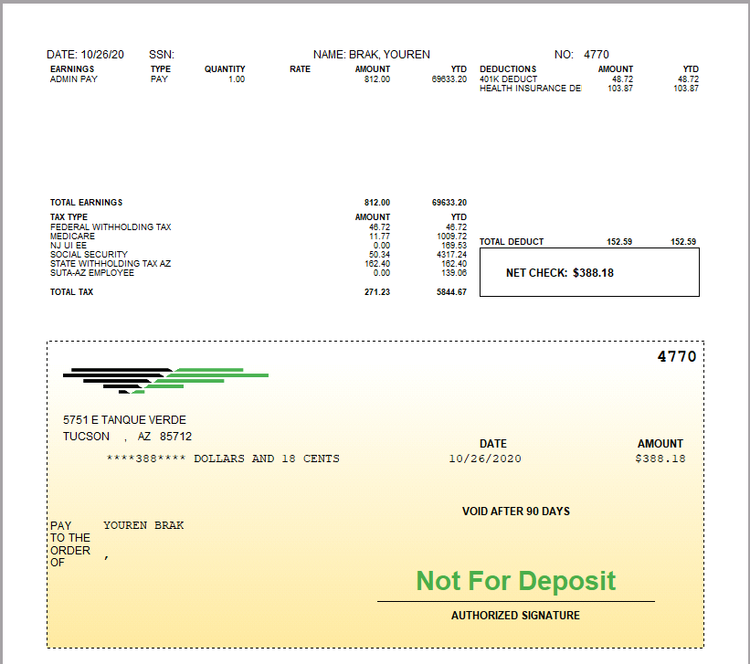

AXON - Best Payroll Functionality

AXON offers a strong payroll functionality explicitly tailored to meet the complex needs of the trucking industry. The system helps simplify compensating drivers, office staff, and other personnel across different pay structures.

AXON’s payroll system handles various compensation models, including mileage-based pay for drivers, hourly wages for office staff, and salary-based compensation for management. It also syncs with dispatch and operations modules. This integration automatically calculates driver pay based on completed trips, distance covered, or hours logged. Overall, AXON streamlines payroll operations, from timesheet verification to fund disbursement.

What is Trucking Accounting Software?

Trucking accounting software combines back-office bookkeeping functionality with industry-specific features necessary for fleet management. In particular, the accounting services cover invoice processing, receipt generation, and general expense management. With software, trucking companies can also balance accounts, payables, and receivables in a general ledger to ensure their financial statements add up.

Sometimes part of larger transportation management software (TMS), standalone trucking accounting systems are often more practical solutions for small fleets of Qualified Motor Vehicles (QMV). However, these business accounting systems can fulfill the needs of independent owner-operators, carriers, and fleets of all sizes.

Key Features

- Income and expense tracking: Gain visibility into the costs associated with each service or project by keeping records of when and how expenses were incurred

- Accounts payable (AP): Build a general ledger managing money owed by your trucking organization to creditors

- Accounts receivable (AR): Automate the cash flow and funds owed to your business for goods or services provided; handle various forms of payment, including credit card

- Invoice management: Generate accurate invoices to send to customers, then use various communication methods to perform follow-up when payment is due

- Payroll: Manage all elements of executing employee compensation, including wage calculation, check printing or direct deposit, and payroll tax management.

- Mileage tracking: Get real-time details on truck and vehicle mileage by specific load or through each state

- Fuel purchase recording: Track fuel purchase and truck mileage to receive proper tax reimbursement or other compensation

- Bank reconciliation: Import your bank records to auto-match against accounting records

- Profit and loss statements: Make accurate reports detailing any profit or loss your company makes

- International Fuel Tax Agreement (IFTA) reports: Correctly file IFTA reports to meet tax compliance requirements

Benefits

Business owners utilizing trucking accounting software can streamline back-office operations and enjoy many more benefits:

Streamline Billing and Invoicing

For your fleet to make money, you need to get paid on time and in full. Yet many clients drag their feet and draw out the billing process as long as possible. With accounting software, you can ensure accuracy when sending itemized invoices to your customers, showing exactly what they owe and why. The clearer you are about mileage and fuel purchases, the harder it will be for customers to debate the cost.

Trucking accounting software also provides tools for expense reporting. Whatever costs your fleet encounters, you can keep track for potential reimbursement or repayment. By paying close attention to your profit and loss statements, you can find better ways to make money. For example, you may realize certain routes or loads are not as profitable as they should be and make adjustments to increase your bottom line.

Meet IFTA Compliance

Filing International Fuel Tax Agreement (IFTA) reports for interstate or international trucking jobs can take time. First, you must create the necessary fuel and mileage reports for your fleet. Throughout the entire process, you need to track receipts, manage mileage logs, and match fuel to taxes in each state or province. Streamline your IFTA reporting by using software to automate the process each fiscal quarter so that you can focus on other elements of fleet management.

Tax reporting gets more difficult if you have to figure out importing rules. Fortunately, trucking accounting software can automate most tax filing based on your relevant financial data and base jurisdiction. Maintaining a general ledger allows you to monitor all your profit and loss reports in real-time to avoid expensive surprises during tax time. Mobile apps on iOS and Android devices can make it easier for you and drivers to hold onto receipts on the go.

Accurate Driver Pay

Paying trucking staff is not always easy. While in-office personnel can be paid in person regularly, truckers might be on the road when payday rolls around. Manage your payroll with trucking accounting software to address the often complex process of paying drivers. For instance, you can implement direct deposit so your drivers get paid on time no matter where they are.

Truck driver pay errors happen constantly, especially when you’re trying to balance different pay scales based on mileage and loads. Many drivers forget to include important reimbursement details on their trip reports. Too many mistakes can lead to high turnover and staff shortages. Optimize your payroll with trucking accounting software that accounts for mile-by-mile expenses, loads, and other driver settlements.

Pricing

SaaS prices range from $19 per month up to $700 per month on average, but there are also higher-cost options. For example, TruckLogics starts at $39.95/month for owner-operators, whereas Axon falls between $100-$500/month.

Some plans charge per user or include a set amount, anywhere from one to 25, limiting who can use the system at any given time. There may be separate types of user accounts to differentiate between back-end workers and drivers on the road.

Price differences will also depend on the size of your fleet. Operating a small fleet can save considerably more on software, though some plans offer discounts for enterprise-level trucking operations. Others require a minimum number of qualified motor vehicles (QMV) per fleet.