Top 100 Accounting Software Features

Accounting software can help your business better manage financial transactions and reporting — if it has the right tools. Read on to discover 100 accounting software features you may want to consider that can benefit your business.

Accounts Payable

1 - Vendor Records Management

Vendor records management organizes, stores, and maintains important information about your company’s suppliers. Advanced functionalities include custom vendor fields and quick vendor creation with record cloning.

2 - Check Printing

Although credit card, ACH, and digital currency options are available, checks remain a staple. Modern check printing functionalities include customization features and batch printing.

3 - 1099 Forms

1099 forms help ensure that your business complies with the IRS reporting requirements. Integrating these features into your accounting system can save significant time compared to manual tracking and provides a centralized record-keeping system.

4 - Payment Date Calculation

Payment date calculation can help plan your upcoming expenses and payments, optimize working capital management, and help avoid late payment penalties. Automatic payment date calculation uses vendor terms data to help you hold payments until required.

5 - Suspicious Payment Alerts

Payment alerts like automatic notifications for duplicate payments can save you the hassle and give you better control over your finances.

6 - EFT Support

With EFT support, your company can initiate electronic payments directly from your system, eliminating the need for writing checks or manual transfers. This support typically covers various electronic payment methods, such as ACH transfers, direct deposits, online bill payments, and more.

7 - Advance Payment Scheduling

Scheduling payments in advance can help you reduce manual work, ensure bills are paid on time, and can help you better forecast your cash flow.

8 - Accounts Payable Purchase Order Reconciliation

Reconciling AP payments to an originating PO adds an important security safeguard.

9 - AP Document Attachment

Internal documents like purchase orders aren’t the only useful way to substantiate AP payments. Attaching vendor invoices fosters transparency and accountability.

Accounts Receivable and Billing

10 - Customer Accounts Management

Integrated customer accounts management offers numerous benefits, such as generating customized invoices, personalizing communication, and reducing manual data entry.

11 - Invoice Creation

Seek flexibility in presenting invoices using the fields you need for shipping, billing, terms, items, and pricing information.

12 - Custom Accounts Receivable Terms

Every accounts receivable record is really a short-term loan. Make sure your business’s bank can easily set the terms and rate of your choice.

13 - AR Aging Reports

With these reports, you can categorize outstanding reports by age and analyze payment trends.

14 - Progress Billing

“If there is no struggle, there is no progress.” The same could be said for the tricky task of progress billing! However, advanced AR features make timing invoices and tracking payments easier.

15 - Sales Attributions

Agent, location, and departmental sales attribution provide performance metrics and a mechanism for enabling incentive compensation.

16 - Cost of Goods Sold Reporting

COGS gives your business a clear picture of its financial health and profitability. With an accurate COGS calculation, you can determine your gross profit, calculate gross margin percentages, and analyze the profitability of individual products and services.

17 - Account Holds

Account hold features prevent delivery of goods to customers unlikely to pay.

18 - AR Comment Support

AR comment support allows you to better communicate with your team and customers. You can ask questions on AR issues, tag teammates to bring their attention to important items, and share account updates.

19 - Recurring Invoices

Eliminate the need for manual entry and save time with automated recurring invoices that are on a set schedule.

20 - Balance-Forward

Easily move old balances into new invoices with balance forward functionality.

21 - Sales Tax Calculation

Alaska, Delaware, Montana, New Hampshire, and Oregon don’t collect sales tax. The other ones do, and so do many municipalities. It’s complicated but easier with automatic calculation tools.

22 - Credit Card Payment Support

Integrating your accounting software with credit card payments can automatically record your transactions, saving you time and reducing manual errors.

23 - Invoice Duplication

When customers have the same recurring order, instead of creating a new invoice each time, just duplicate the original one.

24 - Envelopes, Receipts, Reminders, Credit Notes, Pack Slips

Invoices aren’t the only documents that need to be created to fill customer orders; make sure you have all of these, too.

25 - Estimating and Quoting

Customers typically want to know what stuff will cost before they buy. Save time by automating the conversion of estimates and quotes into orders and invoices.

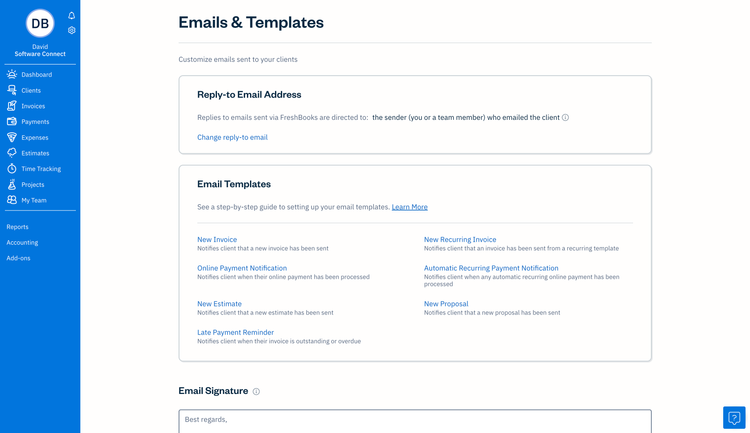

26 - Email Invoicing

Some customers prefer their invoices to be sent over email instead of carrying numerous papers around.

27 - EFT Support

Collect payments faster, reduce uncollected accounts with auto-pay options, and ease reconciliation tasks.

28 - Promotions, Coupons, Rebates

Eligibility, tracking, redemption—there’s a lot to keep up with when it comes to discounting. Strong systems automate much of the administration.

29 - RMA Support

Normalize your returns management record-keeping with built-in features designed to support best practices.

30 - Customer Credit Management

Flexibly managing maximum outstanding balances by customers can help reduce uncollected receivables.

Budgeting and Forecasting

31 - What if Scenarios

What-if scenario support allows you to apply changes to revenue and expense drivers and consider the potential financial impact.

32 - Versioning & Approvals

Is there a bit of back and forth in your budgeting process? Allow for collaboration, approvals, and versioning to create budgets everyone can live with.

33 - Sales Forecasts

To better predict sales revenues, consider previous performance, weighted trends, seasonal patterns, and market changes.

34 - Actual Variance Reporting

Does “what it is” match up with “what it was supposed to be”? Software that links your budgeting tools and general ledger answers that question.

35 - Rolling Budgets

Adding a new budgeting period at the conclusion of a completed period fixes the total length of budgeting visibility.

Cash Management

36 - Bank Reconciliation

Good software imports bank records in real-time. Better software tries to auto-match bank and accounting records. The best options smoothly handle split payments and other tricky situations.

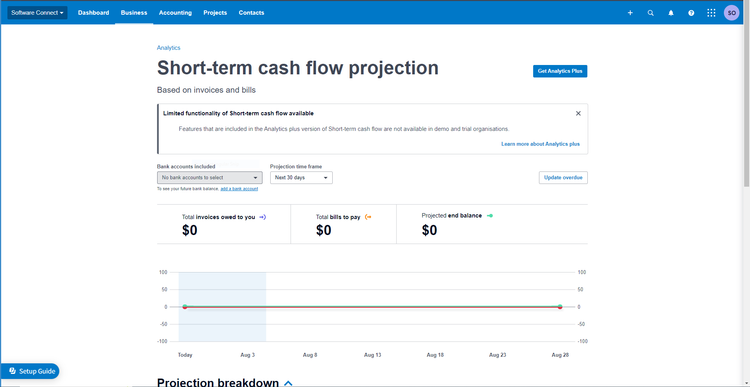

37 - Cash Flow Analysis and Positioning

Are you prepared for upcoming capital events? Do your accounts hold sufficient cash to pay the bills? Is free cash earning optimal interest? Cash flow software supplies the answers.

Fixed Assets

38 - Multiple Depreciation Formulas

Having multiple depreciation methods available allows you to choose the most appropriate method for each asset type. This flexibility can be highly beneficial as different industries having varying depreciation needs.

General Ledger & Financial Reporting

39 - Double Entry, Accrual Accounting

Support for double-entry, accrual-based accounting aligns with GAAP compliance and other regulatory standards. It also ensures debits and credits stay in balance by catching errors and inconsistencies.

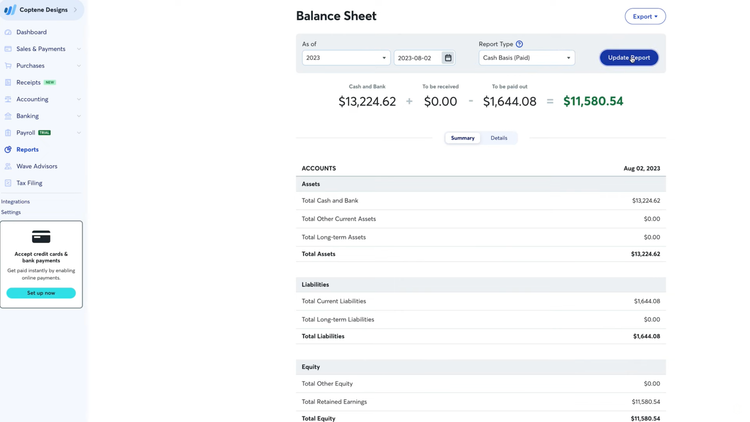

40 - Balance Sheet

Any accounting software supports balance sheets to report on a business’s financial condition. Some offer more control over presentation and detail.

41 - Profit and Loss

Like the balance sheet, P&L varies in different programs based on ease of compilation and visual display.

42 - Chart of Accounts

When establishing a chart of accounts, you can generally choose between pre-defined account codes or import/define your own. Sorting options and navigation tools differ between programs.

43 - Flexible Accounting Periods

4/4/5, 52/53. If those numbers carry meaning for you, support for flexible accounting periods is likely a baseline qualifier for which software will work for you.

44 - Departmental Tracking

Dividing revenues and expenses among departments, locations, and cost centers offers more granular performance visibility.

45 - Inter-Company Transfers

Transactions between commonly-owned businesses quickly multiply the number of required journal entries. Avoid mistakes with automatic posting.

46 - Automatic Reversing Entries

Adjusting and reversing entries are easy opportunities for mistakes. Automation helps move accruals forward without opening the opportunity for human error.

47 - Fund Accounting

When accountability is more important than profitability, fund accounting is indispensable. Many non-profit and government organizations use it when managing grants and allocations.

48 - Flexible Account Codes

Flexible account codes allow you to customize your chart of accounts to fit your specific organizational structure and needs. This can help you organize your financial data and produce more accurate reports.

49 - Financial Statement Consolidations

Merge financials to get a clearer view of the road your business is on.

50 - Statistical Accounts

Track and report on non-financial data alongside your financials to see how your organization performs.

Inventory

51 - SKU Tracking and Stock Counts

Managing SKUs and stock counts represents the fundamental basis of any inventory control system.

52 - Bar-Coding or RFID

When there is a lot of inventory, barcode scanning and RFID technologies can speed up data collection and ensure precise inventory recording.

53 - Serial Number or Lot Tracking

The ability to recognize not just the type of item but the specific unit or batch helps with everything from warranty tracking to avoiding unnecessary recall costs.

54 - Location Tracking & Movement History

GPS tracking helps you know where your products are at all times.

55 - Product Movement History

Track product movement history to optimize handling performance, dissuade potential thieves, and trace breakage.

56 - Price Management

Setting pricing on just a handful of products is straightforward. Managing prices on many items with volume or customer-based discounting requires more sophisticated controls.

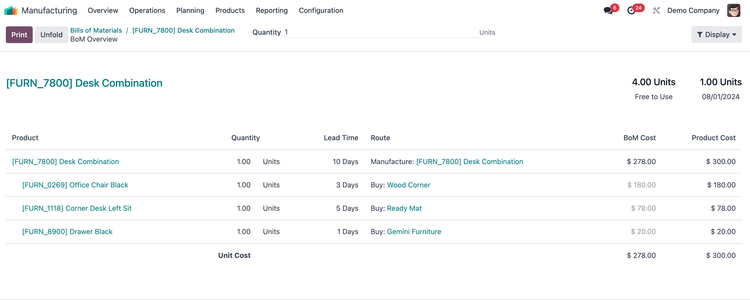

57 - Bill of Materials, Kitting

Integrating BOM into your accounting software allows you to accurately calculate COGS, determine product pricing, and analyze a detailed cost breakdown per unit.

58 - Stock Level Alerts

Stock level alerts help avoid shortages, back-orders, and, most importantly, disappointed customers.

59 - LIFO, FIFO, Average Cost Options

Finding a program with support for flexible costing isn’t hard, but it is important for minimizing your tax burden.

60 - Landed Costs

It’s not just the cost of your products and supplies that matters. It’s also the cost to acquire and store them. Landed costs help you understand product profitability more accurately.

61 - Unit of Measurement Conversion

Gallons to pounds. Pallets to cases. Boxes to units. Whatever your conversions are, pre-defining custom calculations prevents an opportunity to introduce manual errors and saves time.

Job Costing

62 - Estimate vs Actual Reporting

Compare estimated costs to actual figures as a project unfolds, and see where your actual costs exceed your estimates.

63 - Customizable Cost Breakdowns

Isolating each individual cost driver in job performance is the first step to reducing costs. Tracking labor, materials, sub-costs, equipment, and other costs improves job profitability visibility.

Payroll

64 - Check Printing

Customizable stubs and batch printing options differentiate your options.

65 - Federal W2, 940, 941, 944 Forms

Any comprehensive payroll software should be able to create all the forms you need for your payroll tax filing.

66 - Tax Withholding Calculation

Another baseline payroll software capability is automatically calculating withholdings.

67 - Benefits Deductions

The ability to properly deduct for 401k, insurance, or other employer provided benefits is a critical component of any complete payroll program.

68 - Canadian Payroll Tax Support

North of the border? Support federal and provincial payroll taxes with Canadian tax tables and forms.

69 - State Payroll Forms

Every state has its own tax rules. But some payroll solutions don’t support every state–or do so only at increased cost.

70 - Direct Deposit

Do away with lost checks, printing costs, and reconciliation hassles with direct deposit capability.

71 - Time and Attendance

Integrated time-tracking features reduce the time associated with hourly-based paychecks.

72 - Employee Self-Service

Give the power to the people and save yourself some time on common payroll questions.

73 - Electronic Tax Filing

Electronic tax filing. Just one more thing you can have your payroll software do for you, so you don’t have to.

74 - Prevailing Wage and Certified Payroll

Government contractors often need to submit payroll certification reports to verify compliance with labor standards. More capable payroll programs automate the creation of these reports.

75 - Tips, Vacation Pay, Bonuses, Commissions

Incentives are great for employees but a pain for payroll administrators. Custom support features for incentive calculation and application ease the burden.

Purchasing

76 - Purchase Orders

Maintain product order histories, avoid duplicate purchases, satisfy supplier requirements, and create a check and balance for outgoing payments by using purchase orders.

77 - Purchase Requisitions

Purchase requisitions create workflows demanding proper authorization and approval.

78 - Auto-Generated PO’s

The system can pull accurate product details, quantities, and pricing info to create PO’s automatically.

79 - Vendor Management

Keeping up with lead times and consolidating orders to take advantage of discounts are procurement pro maneuvers available to users with the right software.

Security

80 - Role-Based Authentication & User Privileges

Authenticating users and granting privileges as required is a cornerstone of good accounting application security.

81 - Audit Trails

A key to preventing fraud is software that captures all account activity and tags it to the originating user.

82 - Encryption

Protect your customers data and then show off on your website that you’ve done so with fancy logos from compliance orgs.

83 - Automatic Data Back-Up

Lots of options these days: disk, cloud, tape. Automatic backup functionality helps turn potential catastrophes into minor annoyances.

84 - Locked Reporting Periods

Protect the past from the future. Lock down and close accounting periods to avoid issues with accounting irregularities.

System

85 - Search Tools

Capable and efficient search functionality is a hidden time-saver. Find out what fields are searchable when talking to vendors. Give yourself extra credit as a savvy buyer, by asking their existing customers about search speed in a live environment.

86 - Import/export

Import/export allows your accounting data to be easily transferred between different platforms, reducing manual entry and saving time.

87 - Web-Based

Web-based accounting software can save you money more than an on-premise solution. It also enables remote work and is accessible on numerous devices.

88 - SaaS

SaaS allows users to access the latest features and security patches without any additional costs. Users can also access their data from anywhere.

89 - Unlimited Records

Some accounting software options have records or data file size limits. Whether it’s a hard limit or just one that moves you to another price level, it’s something to be aware of.

90 - Custom Reporting

Your accounting software is a rich source of information about your business. Custom reporting tools let you fish out the info you need. Front end reporting GUIs spare you the pain of authoring your own database query statements.

91 - Report Templating

Report templates provide the info you need without repetitive effort.

92 - Multi-Currency

If you’re doing business overseas, you’ll definitely want to be able to store and move between multiple currencies.

93 - Integration

APIs can connect CRM, POS, HR, manufacturing, project management, and many other types of software to your core accounting system.

94 - Mobile Apps

Mobile apps allow you to do business while away from your main business workstation.

95 - Approvals Management

Configurable workflows and approvals let you manage and authorize processes across a range of financial activities.

96 - Keyboard Shortcuts

For repetitive tasks, shortcuts cut the time and labor costs.

97 - Multi-User

Expect to set up individual accounts for multiple users? Expect to pay for multiple-user licenses.

98 - Multi-Entity

Manage multiple locations, branches, and entities with ease when you have multi-entity accounting software.

99 - Graphical Management Dashboards

Quickly share KPI data with top decision-makers via graphical management dashboards.

100 - Configurable Alerts

Make sure you’re tuned in and listening for critical business events with conditional alerting.

For more information on features and functionality, continue reading our software application guide for Accounting software.