The Best Accounting Software For Amazon Sellers

Get the best software for your business. Compare product reviews, pricing below.

The right accounting software should improve your overall financial management and cash flow related to Amazon sales. Since accounting software is something your business will use everyday, it’s important you choose one that is easy to use, easy to implement, and falls within your budget.

To help you find the best accounting solution, we’ve conducted research on a wide range of management software and put together a collection of our best accounting software.

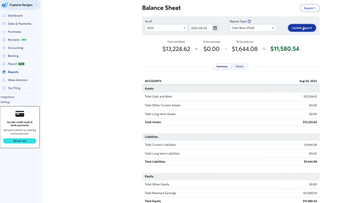

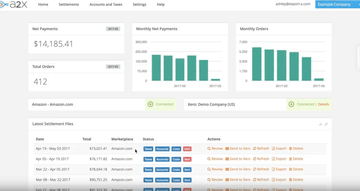

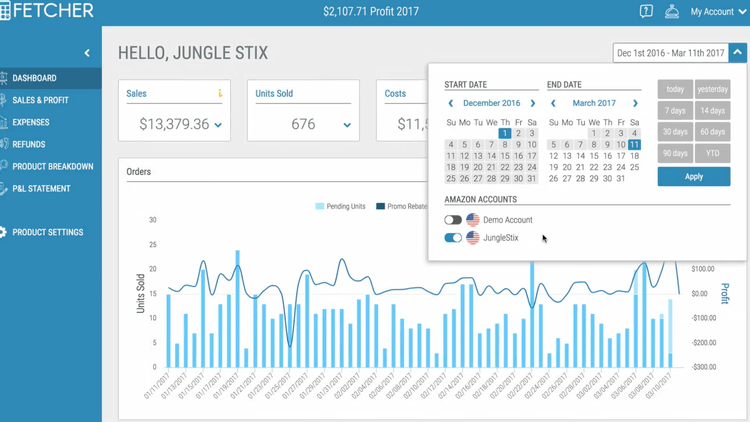

Jungle Scout, which replaced Fetcher in late 2021, provides Amazon profit analytics through increased control of your FBA finance data. Its goal is to better execute your Amazon business through better bookkeeping on your sales/deals/offers and other benefits you may offer customers.

Once synced with your Amazon account, Jungle Scout will “fetch” your historical data, calculate business metrics from your profit, PPC, refunds, and fees, and provide detailed financial metrics. Jungle Scout starts at $49 per month for the Basic plan.

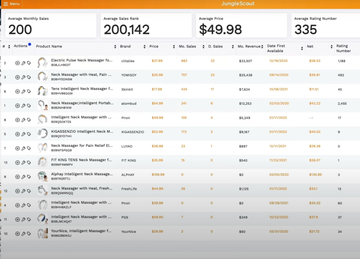

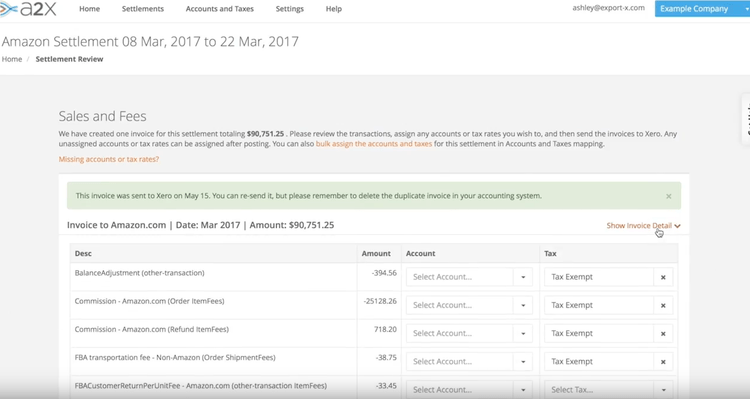

A2X Accounting is used by Amazon sellers and eCommerce accountants to automate the accounting process involved with managing Amazon marketplace sales, cost of goods sold, and FBA inventory. It displays Amazon settlements automatically and provides you a clear summary of revenue, expenses, and more.

A2X integrates directly with QuickBooks Online and Xero, meaning you don’t have to stop using your existing accounting software in order to get the analytics you’ve been needing. A2X posts these transactions and generates invoices directly into these solutions. A2X starts at $19 per month for businesses with under 200 orders each month.

Wave is free to use and provides needed tools such as invoicing, expense tracking, basic accounting, and more. This means you can create and send invoices for products sold on Amazon, receive payments from customers who have ordered goods from your Amazon store, import receipts of your business expenses, and produce accurate financial reports. For many Amazon sellers just getting started out, Wave has been the software of choice.

While Wave’s base accounting software is free, add-on services such as credit card payment processing will cost extra. Credit card processing starts at 2.9% plus 30 cents per transaction.

What is Accounting Software for Amazon Sellers?

Accounting software for Amazon sellers helps small business owners and startups manage their eCommerce sales by grabbing Amazon settlement transactions and posting transactions automatically to your general ledger. Additional capabilities of accounting software for Amazon sellers include monitoring Fulfillment by Amazon (FBA) inventory, calculating the cost of goods sold, tracking sales tax, and invoicing customers.

The number of small businesses surpassing $1 million in annual sales grew by 20% over the previous year, much in part to Amazon’s capability of selling 4,000 items per minute across their digital storefront. Many Amazon businesses have helped increase the number of orders they sell each month through proper integration of Amazon Marketplace with a user-friendly accounting system.

Features of Accounting Software for Amazon Sellers

- Core Accounting: Tracks eCommerce revenue and related expenses. Includes bookkeeping modules for accounts payable, accounts receivable, and a general ledger. Match the balances in your accounting records with your bank accounts.

- Invoicing: Creates invoices for goods sold and sets up recurring billing via credit card payments if applicable. Allows for online payment collection and automated notifications through automatic payment reminders and notifications.

- Sales Tax: Contains a database of all applicable sales tax rates, updated to ensure accuracy, to ensure customers are charged appropriately. Automates the preparation and filing of state tax returns.

- Cost of Goods Sold (COGS): Match the cost of getting a product to market with the sale of that product to discover revenues, margins, and profitability. Decrease the amount of business taxes you have to pay by reducing your tax liability.

- Sales Tax and Fees Management: Calculates your seller fees based on your selling plan (individual or professional). Manage per-item fees, referral costs, variable closing fees, and shipping rates. Helps budget for additional fees due to increased sales and provides for “what-if” analysis.

- Amazon FBA Sellers Inventory Tracking: Manage your Fulfillment by Amazon (FBA) inventory levels. Track inventory to monitor which items have been sent to, delivered from, or are currently being stored at Amazon’s fulfillment centers.

Best Accounting Software for Amazon Sellers Benefits

Accounting software for Amazon sellers can save eCommerce businesses time and money through quick data entry, speeding up your sale to invoice process, automatic reports, and reducing error through manual methods. Below are some of the top benefits of accounting programs for Amazon sellers:

Manage Cost of Goods Sold for Amazon Sellers

Many accounting solutions for Amazon sellers will automatically determine your cost of goods sold(COGS), which will let you load your product costs with additional expenses such as procurement costs, production costs, taxes, listing fees, and inventory storage fees. Accounting software can easily determine your COGS by syncing with your Amazon Seller Central account and downloading all relevant sales data, which eliminates the need to manually match sales to costs.

For many online retailers, calculating the cost of goods sold can be a time-consuming process, as you’ll have to look at all costs involved in producing or buying the products you’ve sold. Businesses that sell or manufacture a variety of options will find this process even more involved than others.

Having an accurate COGS lets you better manage your inventory, as it will count product inventory as an asset until you sell it. Once sold, the cost of the product is reduced from the value and applied against the revenue from the sale to determine profit. For online retailers, business tax returns require that you supply the COGS.

Real-Time Insight into Your Amazon Business Performance

If your business only has a grasp of their financials when taxes are due (at the end of the year or at the end of each quarter), or perhaps uses a manual method such as Excel for sales tax calculation, you’re a candidate for accounting software for Amazon sellers. Implementing a software solution will be the first step towards knowing what your income and expenses are at any given moment, rather than at periodic points of operation, where you may be unexpectedly operating at a loss.

Cloud-based accounting software will give you a real-time look into your current financial picture. Many solutions can integrate directly into your Amazon FBA account to provide you an accurate look at your inventory levels, what has been sold, how much is spent on supplies, labor costs, and more. This information can help you stay near your budget, and identify issues before they arise.

Keep Business and Personal Finances Separate

Amazon sellers using accounting software will be able to keep data on their business income and expenses separate from their personal finances. Amazon sellers will want to avoid mixing their business and personal finances to avoid confusion around tax time or when trying to evaluate profitability. This can be difficult to do for new Amazon sellers that are just starting their business, who may be making business purchases with their personal credit card.

Without proper bookkeeping, these business transactions can get lost in the sea of your own personal expenses. If your business is audited, you’ll need to disclose accurate information about your income and expenses. Keeping two separate accounts will reduce your legal liability and better manage your taxes and business bills.

Best Accounting Software for Amazon Sellers

Many Amazon sellers are looking for a complete solution that tracks income and cash flow, has FBA inventory management, manages expenses, and helps organize your Amazon selling fees. Having a fully-integrated solution can help you manage your cash flow better and minimize expenses, all under one solution. This can eliminate the headache of using multiple systems and remembering to import data.

What is the best all-in-one accounting software for Amazon Sellers? It all depends on what key features you want:

Integration with Software

You may be a business that already has an accounting software, such as QuickBooks, Xero, or Freshbooks. These online accounting software options are great for your basic accounting, but lack in syncing with your Amazon marketplace sales, which can create issues when calculating the cost of goods sold.

For a business looking to keep their existing accounting software, but find a solution that integrates QuickBooks Online and other systems into their Amazon account.

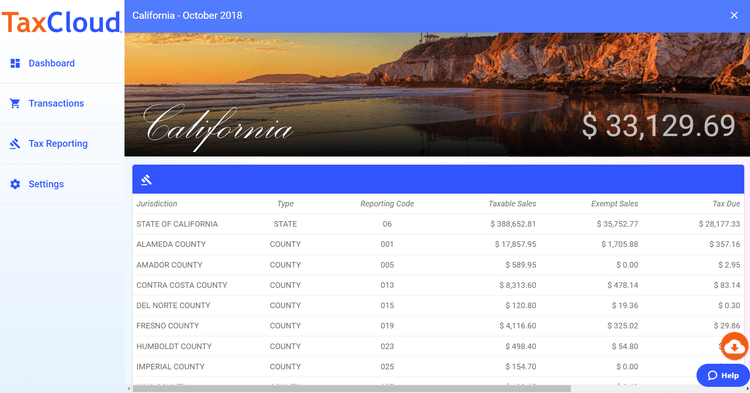

Sales Tax Compliance

Amazon sellers will need to calculate a sales tax rate based on the product being sold and the state the buyer is located in. Collecting sales tax during checkout is the first step to file the appropriate return on the collected sales tax to the proper state or local jurisdiction.

Entry-Level Accounting Software for Amazon Sellers

If you’re one of the many new businesses looking to sell their product on Amazon, your biggest need should be getting your business up and running and not testing out 30-day trials to find the right fit. If you can ensure your invoicing, expense tracking, order tracking, and reporting needs are covered, you can focus on providing your products to your customers on-time.

New businesses and startups looking for easy-to-use software which does not require an accounting background can find several entry-level appropriate systems to meet all their needs.

Best Free Accounting Software for Amazon Sellers

Many new Amazon businesses with limited funds may start doing their accounting via spreadsheets. For those looking for forever free software to provide a level of automation in their accounting business decisions, there are a few free options available. These solutions usually offer you limited functionality to entice you to pay for add-on services such as credit card processing, reporting, and more.

What is the best free accounting software for Amazon sellers? Start looking to find out which is best suited for your operation.