The Best Banking ERP Software

ERP software for the banking industry can help institutions of all sizes comply with regulations and consolidate finances. We analyzed top options for features like planning, analytics, and global support.

- Strong financial management tools

- Multi-language and currency support

- Complies with international regulations

- Brainstorms from community suggestions

- Configuration flexibility

- Powerful frameworks

- Advanced cross-platform analytics

- Integrates with Microsoft products

- Extensive customization options

Banking is one of the most tightly regulated industries in the world. Investors, stakeholders, and clients must be assured that they can trust the company overseeing their money. Financial institutions must also utilize a back-end system to manage the operational aspects properly. Here’s our top ERPs for the banking industry.

- Infor SunSystems: Best for Global Financial Institutions

- Workday: Best Planning Tools

- Dynamics 365 Finance & Operations: Best for Analytics

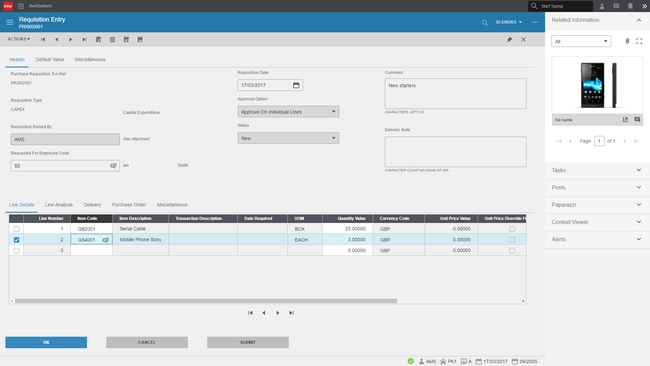

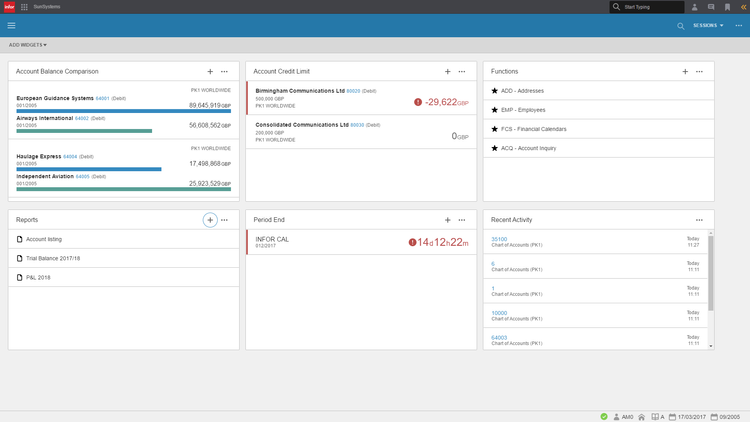

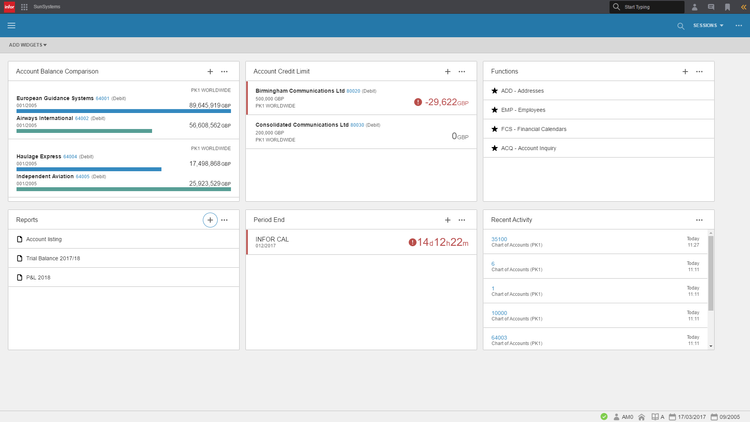

Infor SunSystems - Best for Global Financial Institutions

Infor SunSystems’ comprehensive financial management module is effective for banks operating across several countries. It supports multiple languages, currencies, and entities, ensuring that every location is accounted for. This helps you close your books and consolidate more efficiently instead of waiting weeks to see financial insights.

The system also supports several different compliance standards. Specifically, it allows you to comply with international financial reporting standards (IFRS), ensuring that your books are consistent and transparent across every location. On top of international regulations, Infor SunSystems also helps you comply with local standards, like US or UK GAAP.

Infor SunSystems is best suited for large commercial banks that are operating with multiple currencies and locations. Unfortunately, Infor does not publicly disclose pricing, so you’ll need to reach out for an exact price quote.

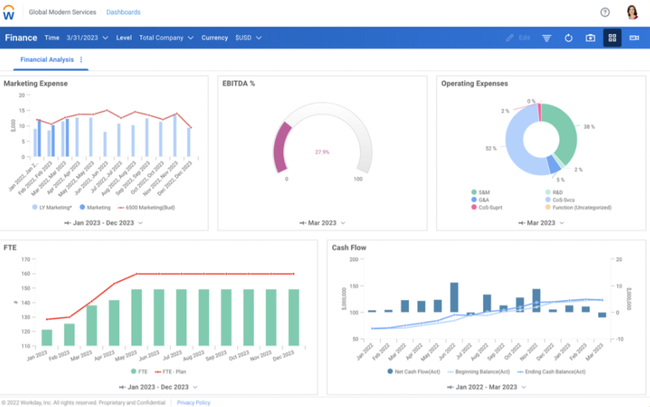

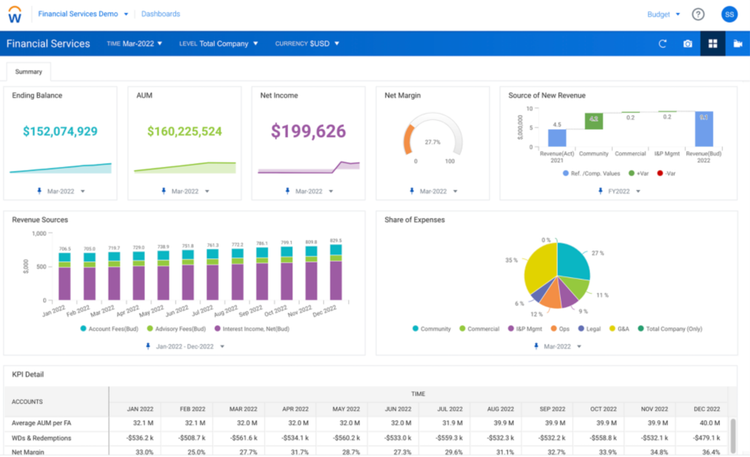

Workday - Best Planning Tools

Workday ERP’s companywide planning suite enables banks to ensure financial growth. You can drill down and monitor individual branch performances to identify problematic locations from one location. Easily allocate costs, adjust budgets, and track expenses of each branch to help maintain stability throughout the company. It’s a great tool for regional or commercial bank chains to analyze specific or company-wide data.

Additionally, Workday includes loan planning capabilities to save you time on revenue modeling and data collection. By analyzing credit quality, economic conditions, and even industry trends, you can assess risk and proactively track profitability across all of your loans. Workday consolidates every transaction and automates the reconciliation process, giving you all the data you need in one source. This way, you can better control risk and create portfolio plans to optimize returns.

The planning capabilities go even further with its expense planning. You can plan for non-interest expenses—like salaries, occupancy costs, and professional services—which affect your efficiency ratio and overall profitability. By segmenting these costs, you can better understand areas of overspending and allocate resources for growth. Once your plan is created, you can easily reconcile it with actuals to track performance.

Workday is widely used across the banking industry, especially in larger organizations requiring HCM capabilities. Because of the breadth of features, the system does have a steep learning curve for new users. Also, the three-year total cost of ownership will be over $100,000.

Read more about Workday.

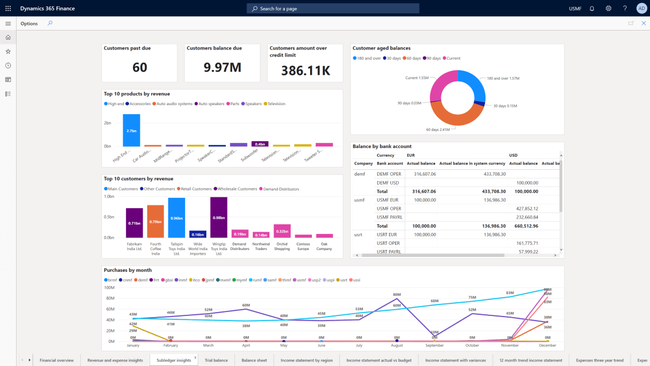

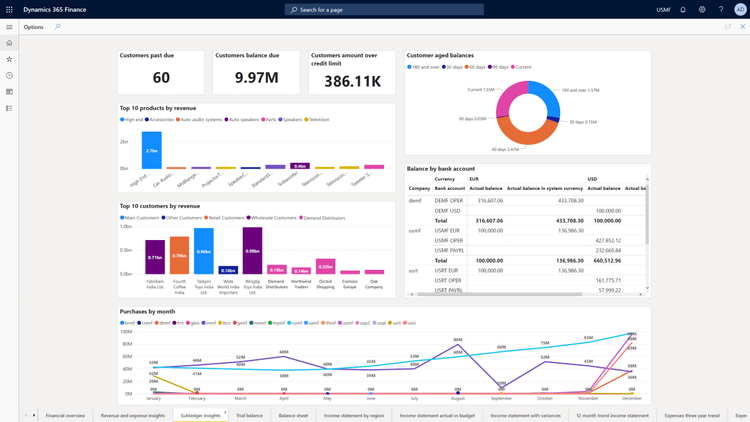

Dynamics 365 Finance & Operations - Best for Analytics

Microsoft Dynamics 365 Finance & Operations is a great option for integrating with a core banking system because of its strong analytical capabilities. You can easily create custom dashboards with tailored KPIs to track your company’s most important data. These can be loan growth rates, net interest margins, or return on equity, helping you see overall analytics from one location.

The system also features an account reconciliation AI Copilot agent to help close your books faster with more accuracy. The agent automatically matches transactions between ledgers, helping reduce manual processes. All exceptions are flagged, which you can manually review to remain in control of the process. You can even set custom rules to help the AI learn your specific workflows, which can really help more complex banks automate the tedious closing process across multiple branches.

Dynamics 365 Finance starts at $210/user/month billed annually. It’s best suited for mid to large-sized financial institutions that need consolidated data and analytics.

What is Banking Software?

Banking software is a back end system designed to help financial institutions manage their core bank functions like analysis, reporting, sales, trading, and loans management. Designed for banks and credit unions, this software allows for the automation of banking services.

This software serves the two main categories of banking: Commercial or retail banking:

- Consumer or personal financial services intended for the general public

- Investment banking: trading: Corporate finance services on behalf of individuals or companies

Credit unions and banks alike can provide a better customer experience by using banking software to streamline operations. In particular, cloud-based banking platforms improve services by offering real-time access to financial services.

Key Features

- Online banking: Access financial services and records from anywhere in the world

- Financial accounting: Analyse and report on all financial transactions performed by your institution

- Security, fraud, and risk management: Cloud-based banking platforms need extra security measures to remain safe

- Transaction tracking: Keep records of transactions and prepare statements for possible audits

- Payment transfers: Accurately move money between different accounts

- Compliance tracking: Ensure your financial institution remains compliant with all state, federal, and international financial regulations

- Multi-currency transactions: Handle financial transactions which involve multiple types of currency

- Customer portal: Allow customers to access their basic banking information and select services online

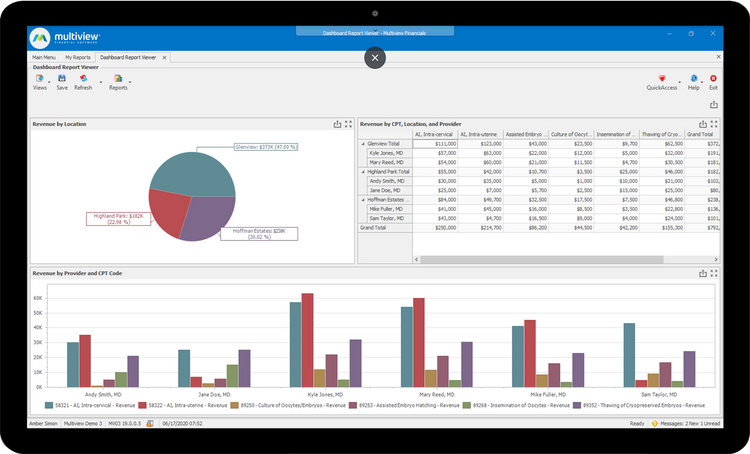

Banking Software by Industry

Two of the most highly regulated industries are finance and insurance. As such, their banking software needs to be incredibly secure and reliable. New restrictions are continually being placed on financial institutions to ensure proper management. With the right banking software, your business can properly manage the finances for each legal entity or branch office while creating budget plans and forecasting revenues. Banking software tools provide an auditable solution to help you properly track all finances with audit trails showing transactions, reversing transactions, and user actions.

Banking Software for Financial Institutions

Back office solutions for financial institutions can be broken into two main segments: deposit software and loan management software. Banks rely on deposits to make loans. They use interest income from the loans to operate and expand, so having these two systems closely intertwined is very important.

Banking software with accounting tools is designed to track customer deposit accounts (checking, savings, bank IRA’s, etc.), as well as monitor transactional data and interest awarded to the customer. This forms the “Core Banking” system as it is the core to the operations of the institution.

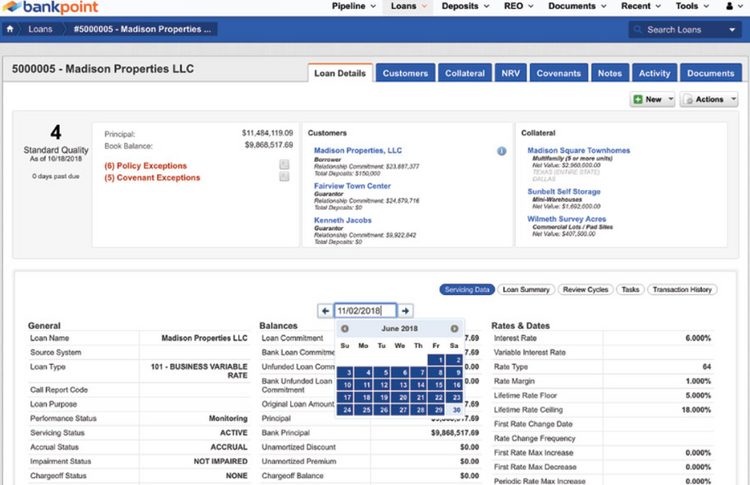

Loan management modules are designed to track loans from application to lien release. Create an application, underwrite the loan, mark for approval, collect signatures and finally fund the loan. The software will then help manage additional transactions related to servicing. For those institutions keeping servicing, the loan management software will send invoices, track payments, manage spread of payments (principal, interest, escrow, fees, etc) until it is paid in full and process a lien release.

Banking Software for Broker and Dealers

Broker-dealers need to maintain two sets of books: a general ledger and securities records, which makes it all that more important that a strong financial system is in place. The right software will allow brokers and dealers within the organization to:

- Underwrite or participate in the underwriting of publicly offered securities.

- Assist in the private placement of securities

- Provide investment research and advice

- Provide loans and financing, including equity and mortgage loans

- Provide the means for companies to hedge foreign currency, interested rate and other risks

- Act as a depository for securities owned by customers, disbursing dividends and interest received

- Inform customers about calls, tenders, and other reorganization activities pertaining to their securities

Finally, baking software helps to track broker commissions, licenses, and performance. Companies can review and monitor their brokers and dealers on a regular basis to remain compliant and avoid mistakes.

Insurance Companies, Agents, and Brokers

As with financial institutions, the insurance industry is ever changing with more regulations increasing the importance of proper financial management. Management of multiple entities, management of policies (including collection of premiums and payment on claims), prospecting new clients and offering more and better products to existing clients, are all important aspects of an industry specific solution.

Insurance agents and brokers are often the face of insurance companies and, while they do not actually manage the policies from an operational standpoint, they help create the policies to track commissions in addition to management of their own firm’s finances. Insurance brokers also need strong customer management tools to track current and prospective contact information, to reach out to customers with specific needs and perform general follow up. The best banking solutions will have accounting functionality that interfaces with CRM to manage all aspects of the business.

How is Banking Software Different from Personal Finance Applications?

Core banking software differs from personal financing software which allows individuals to control their personal bank accounts. A personal finance application allows the consumer to control some of their own banking services, such as transferring funds between a personal checking and savings account.

Banking software is meant for the financial institution itself, so brokers, dealers, and tellers can provide more advanced services. There are more thorough security checks to prevent fraud, along with remaining compliant with tightening industry regulations.

Software Integration Options

Unsurprisingly, different financial institutions have different software needs. The difficult part is finding the right solution to meet your specific needs which is compatible with your other software products, like:

- Accounting software

- Customer relationship management (CRM) software

- Human resources software

- Financial services software

- Financial management software

- And more

In such a highly regulated industry, you want to make sure you are properly tracking your finances. Whether you are looking for a complete ERP system or specific functionality to augment existing software, through a brief phone call, our software specialists will look to better understand your business and software needs to help you locate the most relevant solutions for your requirements. Get started today by requesting banking software recommendations from Software Connect!