The Best General Ledger Software

General ledger software can help you track, manage, and report financial transactions. We tested the best systems, which focus on features like multi-entity support, advanced reporting, and customization.

- Multidimensional reporting capabilities

- Scalability for multi-entity support and user growth

- Simple and responsive user interface

- Flexible chart of accounts

- Customizable reporting

- Unique cryptocurrency accounting module

- Hundreds of third-party add-ons available

- Feature sets for multiple industries

- Highly customizable

We compiled a list of the best solutions for freelancers, growing companies, and multi-entity corporations.

- Sage Intacct: Best Overall

- SoftLedger: Highly Customizable

- NetSuite: Great for Global Consolidation

- CustomBooks: Best Reporting Engine

- Xero: Most User-Friendly Option

- QuickBooks Online: Most Scalable Solution

- Zoho Books: Best for Automated Bank Feeds

- FreshBooks: Great for Freelancers

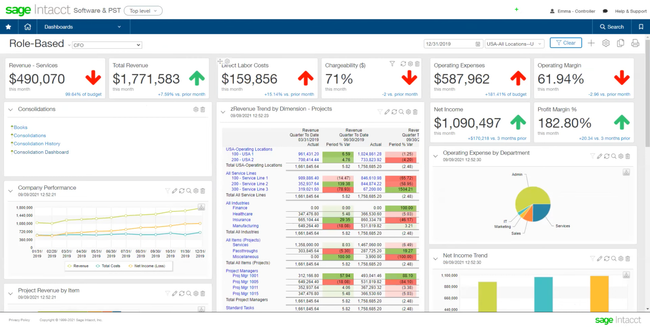

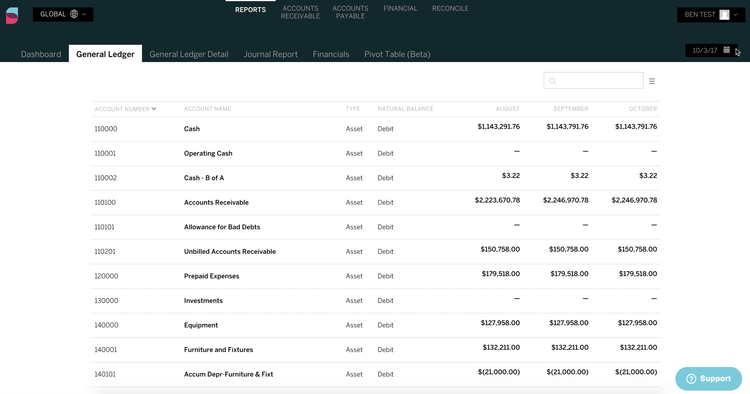

Sage Intacct - Best Overall

Sage Intacct’s multi-entity, multi-currency support can help you streamline complex financial operations. For instance, if you’re a part of a multinational corporation with offices in the U.S. and Europe, you can utilize Intacct to manage the financial operations of each subsidiary that operates in different currencies.

Intacct’s multi-dimensional chart of accounts allows you to track finances across different ‘dimensions,’ such as location. It tags data using standard attributes like vendors, with the option to add custom ones. When a transaction occurs in euros, the system automatically converts the amount to the corporate currency using the latest exchange rates. This helps reduce manual effort and the risk of errors.

Sage Intacct enables you to define your own workflows and set guardrails for accuracy and consistency with user-defined transactions and approvals. The system captures, posts, and reports transactions in real-time, providing multidimensional insights with dashboards and drills down to the source of transactions.

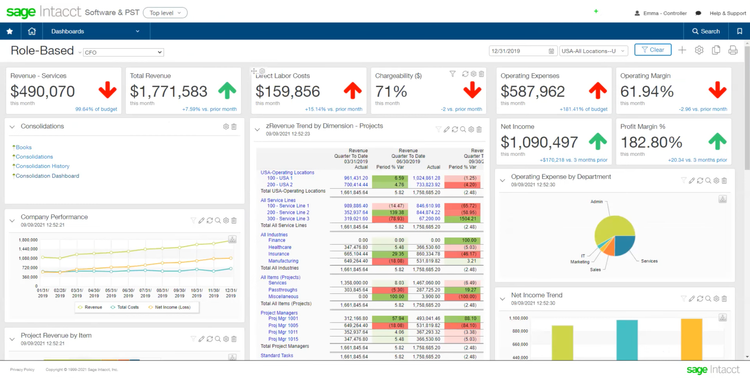

SoftLedger - Highly Customizable

SoftLedger offers a highly configurable general ledger for multi-entity businesses. Each ledger includes one main type and custom subtypes, making routing to financial statements easy. You can also assign locations and home currency for each, which is useful if you operate a global business. And as a bonus, it’s all on a modern interface that makes it easy to navigate.

Additionally, the system’s chart of accounts supports several industries. These include nonprofit, retail, and professional services like CPA and financial service firms. A major bonus is that SoftLedger lets you upload your own, which is a huge time saver when transferring from a different system or spreadsheet. Whether you need different revenue streams for your consultants or specific sales categories for your retail business, you can add them without problems.

SoftLedger is built for larger businesses with multiple entities, and the pricing reflects this. Plans start at $750/month, with the base Standard package including three users and unlimited entities. While it’s on the pricier side, its flexibility and depth of accounting features can be worth the price for growing operations.

NetSuite - Great for Global Consolidation

NetSuite is a cloud-based ERP platform with a strong general ledger that supports mid-sized and large organizations. It handles multiple subsidiaries, currencies, and tax jurisdictions to help companies close books quickly and accurately across global markets.

NetSuite’s real-time global consolidation engine pulls financial data from each subsidiary and instantly adjusts for currency exchange, tax rules, and intercompany eliminations. Combined with role-based access controls and a complete audit trail of every journal entry, it ensures that financial data is both compliant and fully transparent with GAAP, IFRS, or other country-specific accounting rules.

Pricing for NetSuite reflects its enterprise capabilities and scales based on user count and business complexity. It typically costs more than mid-market GL solutions like Sage Intacct, but for companies operating at scale, the time saved on global consolidations and compliance monitoring can justify the higher entry cost.

CustomBooks - Best Reporting Engine

CustomBooks, as a general ledger accounting software, offers an Analyze view built into every core financial report. This transforms your ledger from a static list of entries into an interactive workspace.

When you run a balance sheet, the system first renders the entire structure. From there, you can control the level of detail you want through level indicators. Level one collapses the report into a high-level summary, while level four drills down into every sub-account. This means you can instantly move between a board-ready overview and a detailed audit of what changed and why.

Double-clicking an account opens its general ledger report immediately, with filters already applied and ready for review. Because it supports both cash and accrual modes in all reports, CustomBooks reveals every transaction that contributes to that balance. So if something looks off, you can trace it within seconds.

The Analyze view also provides flexible reporting options, so you don’t have to wait for your finance team to build templates. You can easily set date ranges, switch periods, and move between summary and detail all in the same window. Because navigating financials feels more like exploring a model than running static reports, you pull data much faster on cash, margins, and volatility.

Pricing ranges from $29/month for core accounting to $99-$349/month for full purchasing, sales, and advanced inventory. Overall, CustomBooks is a strong fit for CPAs, smaller companies with 5-50 employees, and mid-level distributors with 50-500 employees that need real-time ledger insights.

Xero - Most User-Friendly Option

Xero has a user-centric design, making it easy to learn its features and functionalities. The software supports unlimited users, enabling real-time collaboration among employees, accountants, and financial advisors.

Xero is fast, responsive, and updates dashboards in real time after users add bills and invoices. It also integrates with over 1,000 third-party applications, such as Shopify and Square, which only increases Xero’s usability.

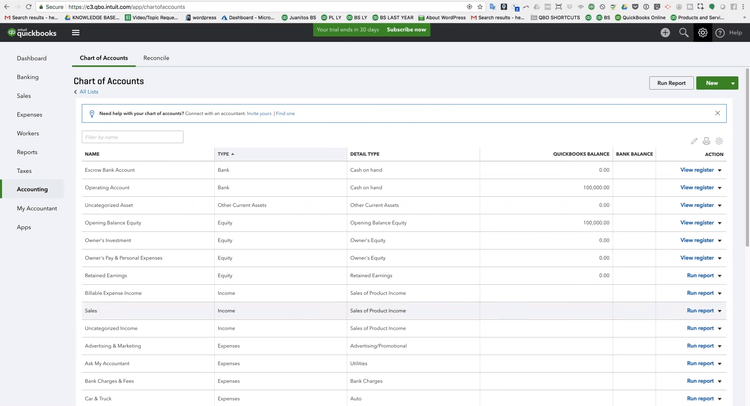

QuickBooks Online - Most Scalable Solution

QuickBooks Online is highly scalable because it offers over 750 integrations with popular apps like Shopify and WooCommerce. Additionally, it has different subscription plans, ranging from those designed for self-employed individuals to larger businesses. As a business grows and its needs evolve, it can upgrade to a more advanced plan without having to migrate to an entirely new system.

The platform also allows additional features like payroll to be added as needed. This means a business doesn’t have to invest in functionalities they don’t currently require but can add them as they grow.

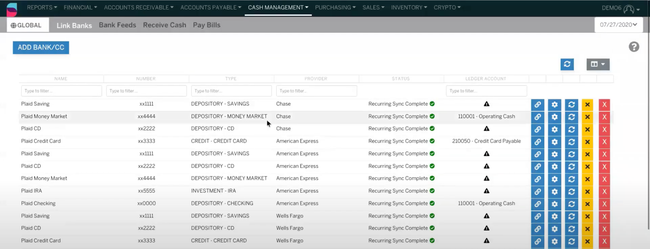

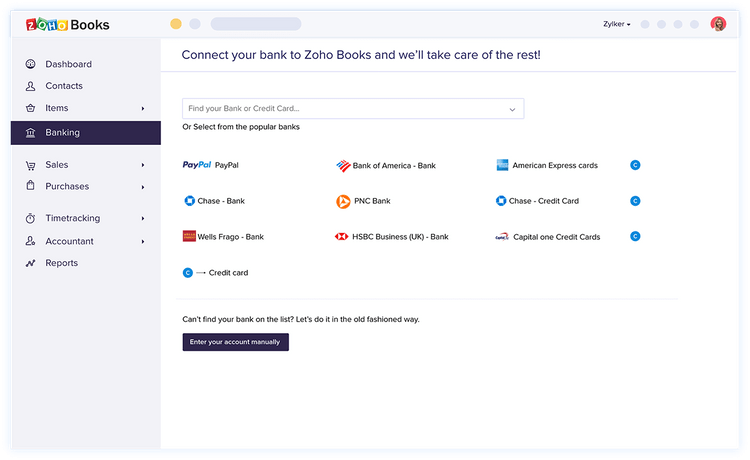

Zoho Books - Best for Automated Bank Feeds

Zoho Books is a cloud-based accounting software with straightforward financial management tools. For small businesses trying to juggle multiple apps, Zoho combines invoicing, bank reconciliation, and reporting in a single platform.

Its automated bank feeds and reconciliation tools take much of the manual work out of managing your general ledger. The system imports bank and credit card transactions daily and applies your defined rules to classify and post them to the correct accounts. This not only saves hours of work uploading bank statements, but also keeps GL balances accurate and up to date in real-time.

Zoho Books offers competitive pricing for small businesses with tiered and free plans for microbusinesses. For automatic bank feeds, you will need to upgrade to one of the high-tier packages, but with Standard Plans starting at $20/month, the jump is manageable for most organizations.

FreshBooks - Great for Freelancers

FreshBooks offers a streamlined approach to invoicing and billing. Freelancers often have recurring assignments or ongoing contracts with clients. FreshBooks’ recurring invoicing feature streamlines the billing process.

Its simplicity and user-friendliness make it easy for freelancers who may not have a background in accounting to navigate and use the software. Without deep financial knowledge, freelancers can understand their business’s financial health through clear and straightforward reports.

What is General Ledger Software?

General ledger software provides a complete record of the financial management of a business, including the transactional records and the account structure used to organize these entries into meaningful financial information. A general ledger is the core of your accounting ledger, as all entries from other applications flow into the general ledger. This financial information becomes critical to your business decision-making.

In many cases, general ledger functionality is part of broader accounting or ERP systems. Often, the general ledger integrates seamlessly with modules like accounts payable, accounts receivable, and payroll.

Review Methodology

We ranked our top general ledger software based on the following considerations:

Pricing:

- Initial Costs: Upfront costs, licensing fees, or setup fees.

- Monthly/Annual Subscription: Recurring costs and included features.

- Scalability: Software scales with business growth without a drastic price hike.

- Additional Costs: Fees for extra features, integrations, or additional users.

Key Features:

- User Interface: Offers a user-centric, intuitive design.

- Customization: Provides customizable reports, charts, and dashboards.

- Multi-currency Capabilities: Essential for businesses operating internationally.

- Automated Reconciliation: Helps save time by automatically matching transactions.

- Tax Compliance Tools: Assists in ensuring all transactions are tax compliant.

- Budgeting and Forecasting Tools: Predicts and plans future financial activities.

- Audit Trails: Tracks changes and ensures integrity and compliance.

Integration Capabilities:

- Accounting Software: Such as QuickBooks, Xero, or Sage Intacct.

- Payment Gateways: PayPal, Stripe, etc., for handling transactions.

- eCommerce Software: Shopify, WooCommerce, Magento, etc.

- CRM Software: Salesforce, HubSpot, etc., to align sales with financial data.

- Payroll Software: To streamline employee payments and financial records.

- Bank Feeds: Direct integration with banks for real-time updates and reconciliation.

Difference Between General Ledger Software and Accounting Software

General ledger functionality is also a primary function in accounting software. The general ledger summarizes the organization’s financial accounts, including accounts payable and accounts receivable. Some main accounting items tracked in a general ledger include assets, liabilities, capital, revenues, and expenses. General ledger software allows your business to create the company’s financial statements, such as income statements and balance sheets.

Bookkeeping at small businesses can be accomplished with general ledger software for simple data entry, basic financial reporting, or a desire to add sub-ledgers to their Excel spreadsheets. CPAs and accountants may use general ledger software developed for accounting firms to create trial balances. Larger businesses may look to an ERP program that provides a full business management suite, including a general ledger accounting module within its financial management section.

Key Features

- Chart of Accounts: Create a list of the organization’s accounts. Define items for which money is spent or received.

- Financial Statements: Create reports about your company’s financial results, position, and cash flows. Examples of reports include sales, cost of goods sold, gross profit, administrative overhead, taxes, and depreciation.

- Journal Entries: Organize and classify business transactions in the order they occur. Transfer debit and credit accounts from the journal to the ledger account.

- Audit Trails: Trace financial data to the source document and view the full process of the transaction.

- Budget vs Actual Reporting: Estimate revenues and expenditures and compare them against the actual recorded income and expenses once they occur in real-time.

- Import/Export via Spreadsheets: Use a spreadsheet program such as Excel or Google Sheets to import or export data into your general ledger solution

- Multi-Entity Consolidations: Consolidate the financials of separate entities within your organization, such as centralizing payables, receivables, and reports.

- Multi-Currency Conversion: Manage accounts in different currencies depending on the bank account currency.

Benefits

A general ledger software will help control your accounts and better organize your sub-account structure. It will also enhance your reporting and streamline any necessary company consolidation. Some of the other key benefits of general ledger software include:

Technological Benefits

Using general ledger software over manual processes keeps you more organized and makes your information more readily accessible. It will also transform how you record information into your general ledger. One example is the use of electronic data interchange (EDI), which can help update inventory general ledger records in conjunction with sales order transactions as they occur. In fact, automatic updates in your general ledger work best when your general ledger is connected to other functions in your accounting software, such as accounts payable or accounts receivable.

Financial Benefits

Because the GL provides a wide variety of functions related to a company’s core financial records, automation and efficiency features (reversing entries, intercompany transfers, drill-down, report scheduling, etc) can create significant financial savings by reducing costs related to executing administrative tasks.

Access to meaningful financial data (as provided by a proper chart of accounts, departmentalized records, and budget vs. actual numbers) provides the foundation for managing a company “by the numbers”, and allows for better business development decision-making (what to invest in, performance evaluation, decisions on product lines, distribution methods, marketing decisions, expansion, etc.).

GL optimization provides the clarity and controls necessary to reduce tax burdens. GLs also provide the core financial health reporting that banks or other investors may need to secure capital.

Other Benefits

- Increase overall profitability by enabling access to meaningful financial data from company records via improved financial categorization and monitoring tools to improve decision-making on key issues such as what to invest in, individual/team/department performance evaluation, product line decisions, sales channels, distribution methods, marketing decisions, business expansion, and beyond

- Increase access to bank financing by being able to provide key company financial performance reports

- Lower tax burden by supporting tools to optimize strategic accounting and prevent accounting errors

- Decrease labor costs related to task-oriented financial tasks via automation features (for example, for reconciliations, reversing entries, transfers) that enable reductions in payroll for the financial team or free up time to spend on more strategic work more likely to improve company performance

General Ledger Financial Statements

General ledger software generates four main financial statements:

- Balance sheet

- Income statement

- Cash flow statement

- Statement of equity

- Statement of comprehensive income

One of the largest benefits of general ledger software is the ability to create custom financial statements and reports for up-to-date information on the company’s well-being. Some of these statements include:

Income Statements

Income statements explain your current company performance by monitoring debits and credits, bank account balances, and, most importantly, how much income has been made during a set period. They can help decision-makers understand various revenues and expenses during the selected period. They also include metrics such as total income, the total cost of goods, gross profit, total expenses, and net income.

The income statement can help answer the following questions:

- How much was sold? (Net sales)

- What were the costs of the items sold? (Cost of goods sold)

- What were the overhead costs? (Total operating expenses)

- What was the income before taxes? (Net income before taxes)

Financial Ratios

Financial ratios are relationships created from your financial information in the general ledger software and used for comparison purposes. In short, they help make sense of your financial data. They take a large amount of data and turn it into a performance indicator that your company can analyze.

A common size analysis is an example of a financial ratio that can be created with general ledger software. This type of report translates each line item into a percentage of net sales. Thus, each line in the income statement becomes its own financial ratio, using net sales as a common denominator.

The benefit of these reports is their attention to each line item and the ability to benchmark performance against other companies of different sizes.

Trend Analysis Reports

Comparisons can help your business determine if your company is better or worse off than previous periods. Trend analysis is important in business so decision-makers know if their actions are working or if changes need to be made.

An income variance report breaks down income and expenses during the current period and a selected period, showing the difference and the variance percentage. These reports can let you know when sales are up or down, what type of sales are overperforming or underperforming, and to take better control of your product costs.

Pricing Guide

Pricing for general ledger software can range from as low as $19/month to $1,200/month, depending on the number of users and required features.

For example, FreshBooks and CustomBooks are more affordable options that start at $19/month. SoftLedger starts at $750/month, while NetSuite is closer to $1,200/month.