How to Make a Balance Sheet: Step-by-Step Guide

A balance sheet is a snapshot report that details a business’s worth or value in assets, liabilities, and shareholder equity. It captures the health of a business at a specific time.

Follow the guidance in this post to help you calculate, create, and format your balance sheet to stay on top of your company’s financial and operational health.

- Step 1: Choose a Reporting Date

- Step 2: Add your Assets

- Step 3: Add your Liabilities

- Step 4: Calculate Shareholder Equity

- Step 5: Review for Accuracy

Formula to Calculate a Balance Sheet

The goal of a balance sheet is to confirm that your total assets match your combined total liabilities and shareholder equity. The formula for calculating a balance sheet is:

Assets = Liabilities + Shareholder Equity

You can make a balance sheet by using a spreadsheet tool, like Microsoft Excel, or accounting software.

5 Steps to Create a Balance Sheet

Follow these four steps to create a balance sheet.

Step 1: Choose a Reporting Date

Set your balance sheet reporting date for the end of a fiscal quarter, month, or year. The reporting date marks the end of the reporting period you choose. Because a balance sheet can take weeks to complete, set an initial cutoff date for the data you want to include.

The frequency of running these reports depends on the size and scale of your business. Be consistent with your reporting periods so your balance sheets compare financial statements over time.

Example: You select June 30 as the reporting date for a balance sheet. This date can reflect your company’s finances at the end of the second quarter or the first half of the year.

Step 2: Add Your Assets

An asset is anything your company owns, such as equipment or property. List all your company’s assets — both long-term and short-term assets — as of the reporting date.

Short-term assets are your current assets, such as accounts receivable, cash and cash equivalents, and inventory your company will use within a year. Long-term assets combine your fixed assets, intangible assets, and long-term securities. Fixed assets include real estate or office equipment.

As you add these assets, remember to adjust for accumulated depreciation. Add all current and non-current assets to get your total assets. Ideally, your trial balance or general ledger will list these numbers.

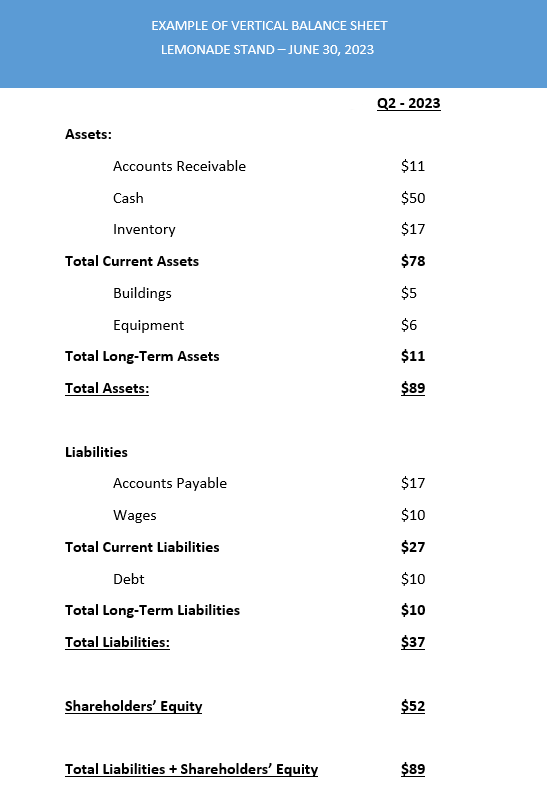

Example: Imagine a lemonade stand. The young owner spent $5 on the stand (property), $6 on a mixing spoon and pitcher (equipment), and $17 on fresh lemons and sugar (inventory). The stand made $61 in total on June 30 — a combination of $50 in cash and $11 in IOUs (accounts receivable (AR)). Therefore, total assets are $89.

Step 3: Add Your Liabilities

Now add your liabilities, or what your company owes. Start with the current liabilities, like accounts payable, utilities, and taxes. Then, add the long-term liabilities, such as bonds and debts.

The sum of your short-term and long-term liabilities equals your total liabilities.

Example: The lemonade stand owner owes a neighbor $17 for making a decorative sign (accounts payable (AP)). They paid a friend $10 to help (wages) and promised another $10 to their parents to make up for not doing chores (debt). The total liabilities come to $37.

Step 4: Calculate Shareholder Equity

Shareholder or owner equity is determined by any stock (common, preferred, or treasury), reserves, and retained earnings your company has. Equity includes your revenue and expenses. For these reasons, the equity section can be quite complicated for many organizations.

As a shortcut for calculating shareholder equity, subtract your total liabilities from your total assets:

Equity = Total assets - Total liabilities

This equity formula works only if you don’t have any shares or surplus to consider.

Example: Since the lemonade stand doesn’t have any stock, the owner subtracts the total liabilities from the total assets: $89 minus $37 equals $52.

Step 5: Review for Accuracy

Double-check the balance sheet for accuracy using the following equation:

Assets = Liabilities + Shareholder Equity

If the numbers don’t add up, you must find the source of the inconsistency. If the total is correct, save and share the company’s balance sheet with your relevant stakeholders, lenders, and investors.

Example: The sum of adding the equity and liabilities for the lemonade stand reveals total assets are $89, as expected.

Balance Sheet Formatting

Generally accepted accounting principles (GAAP) require certain formatting for the balance sheets of public companies. Present your accounts in order of liquidity, from most to least, for example:

- Current assets

- Non-current assets

- Current liabilities

- Non-current liabilities

- Shareholder’s equity

Always list your current and non-current entities separately, according to GAAP.

3 Balance Sheet Examples

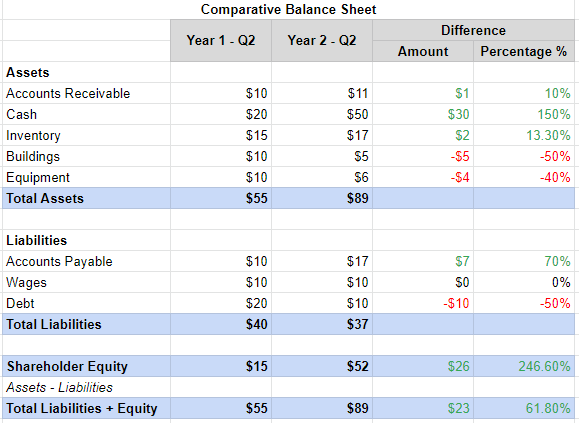

How you choose to present a balance sheet is a personal preference. The following three balance sheets correspond to our lemonade stand example.

These balance sheets overlap in several ways. For example, a vertical balance sheet can show comparative data for a moment of time. Similarly, you can format a horizontal sheet vertically for easier reading. What matters most is the information you include.

1 Basic Balance Sheet

| Assets | $89 | Liabilities | $37 |

| Equity | $52 | ||

| TOTAL | $89 | TOTAL | $89 |

Basic balance sheets show only the total numbers for assets, liabilities, and equity without delving into other included numbers to get the final sum. Some businesses create balance sheets after creating a more comprehensive vertical or horizontal balance sheet.

2 Vertical Balance Sheet

Vertical balance sheets list financial information from top to bottom. Their format looks like a financial report and includes more in-depth data than a basic sheet. They often incorporate individual line items for assets and liabilities.

3 Horizontal Balance Sheet

Horizontal balance sheets use columns to compare data from different dates. Also known as comparative balance sheets, these financial reports show how numbers have changed in actual dollar amounts and percentages.

Horizontal balance sheets are popular because they can show historical trends between distinct moments of time. In our lemonade stand example, the owner compares two balance sheets made on June 30 for different years. The owner can use the percentage difference to forecast how much more they will make during the second quarter of the following year.

FAQs

What needs to be on a balance sheet?

A balance sheet should list your total assets, liabilities, and shareholder equity. How detailed the sheet gets depends on the size of your business. Some businesses want individual line items, but others just want the final balance.

How is a balance sheet different from an income statement?

Income or profit and loss (P&L) statements record revenue and expenses to show total profitability. A balance sheet shows a snapshot of financial health for a selected time, often coinciding with the end of an accounting period.

How is a balance sheet different from a cash flow statement?

A cash flow statement shows the movement of cash and equivalents within a company. You can use this prepared statement when adding current assets to a balance sheet. These two documents, along with income statements, summarize a company’s financial health.

What causes a balance sheet to be wrong?

Balance sheet totals can be wrong for various reasons, of which the most common are:

- Missing or incomplete asset or liability data

- Incorrect calculations when adding assets and liabilities

- Currency exchange rates

- Loan depreciation

- Human error

Check all these possibilities to find the error and try again. A balance sheet should always balance. If errors still occur, you might need an accountant to find the solution.

Balance Your Books

Balancing your books can be a challenging process. Between tracking your assets, liabilities, and equity and getting them all to balance, you need to ensure that all the information lines up and calculates correctly.

To streamline your accounting processes, choose an accounting software that accurately captures the health of your organization. For starters, see our experts’ top picks for the best accounting software and follow our buyers guide. See our Best Accounting Software Guide.

Further Reading

- How to Read Income Statements

- Bookkeeping vs. Accounting: Key Differences

- Financial Management Systems