The Best Online Payroll Software

Get the best software for your business. Compare product reviews, pricing below.

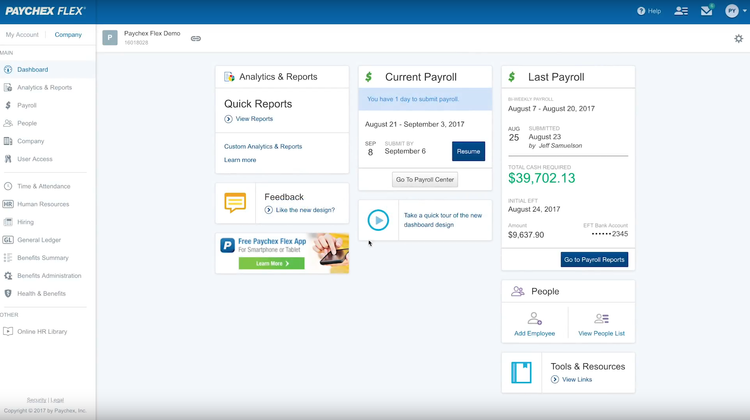

Every business has to deal with some degree of payroll. From check printing to tax filing, payroll software is designed to streamline operations by calculating employee salaries, wages, bonuses, tax withholding, and deductions while also running payroll on weekly, biweekly, or other schedules.

What is Online Payroll Software?

Running payroll can be a labor-intensive process, which is why online payroll software was developed to streamline wage-related workflow. Like on-premise solutions, this cloud-based payroll software functionality includes calculating compensation, withholding taxes, and much more as securely and accurately as possible.

Online payroll solutions may also include elements of human resource (HR) software, such as time and attendance tracking, in order to accurately perform wage calculation. Yet one of the main roles of full-service payroll software is to facilitate the transition from batch check printing to direct deposit payment. Included or optional add-on modules even cover general accounting tasks necessary for balancing payroll and other financial services.

Features of Online Payroll Software

- General ledger integration: Summarize your financial transactions and balance payroll with accounts payable (AP) and accounts receivable (AR)

- Salary and wage calculation: Calculate employee paychecks based on hours worked, overtime rates, or custom salary requirements

- Deductions management: Withhold funds from paychecks fortaxes, benefits, wage garnishments, health insurance, 401(k) or retirement contributions, and other reasons while remaining compliant with local and federal regulations

- Check printing and direct deposit: Batch print physical employee paychecks for distribution instead of writing individual payroll checks; automatically deposit funds to employee bank accounts

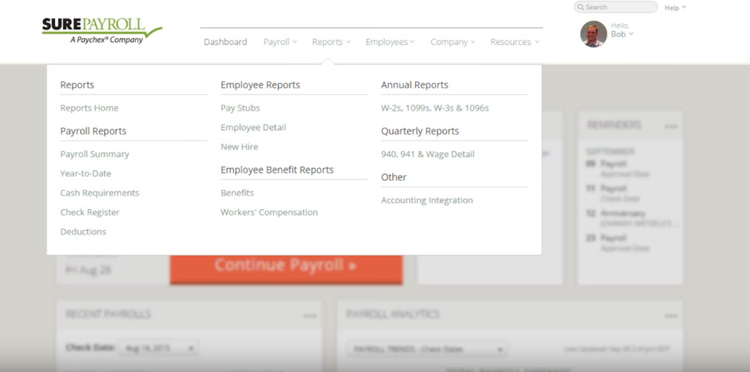

- Pay stubs: Create copies of physical and digital paycheck stubs for tax filing records, each stub provides detailed payroll information such as salary, wage earned based on hours worked, deductions, tax withholdings, etc.

- Overtime management: Calculate alternate pay rates based on the accrual of overtime hours

- Electronic tax filing: Digitally submit direct deposit payroll returns, including W-2 and 1099 tax forms, without paper-based documentation while meeting compliance standards

- Time and attendance tracking: Report employee time worked, paid time off (PTO), and absences for wage calculation purposes

- Employee self-service portal: Create customized employee portals accessible via desktop browsers or mobile apps; allow employees to check on their own paycheck data such as withholding settings, vacation accrued, tax forms, or edit account information

- Certified payroll: Verify wage payments and confirm compensation is in accordance with prevailing wage standards based on local, federal, or international regulations

Best Online Payroll Software Benefits

Online payroll software offers many benefits to businesses looking to adapt how they run payroll:

Faster Payroll Services

Of course, the first benefit of online payroll software is the ability to perform payroll services anytime, anywhere. Just log in, check your totals, and grant approvals. Financing and HR departments can even run payroll automatically through cloud-based systems. Just select paydays in advance or plan for weekly or biweekly payroll based on what payment plan your company prefers. Same-day direct deposit also means more money in the bank for your company, helping to keep accounts balanced as long as possible.

Online payroll software can also benefit your company by consolidating all historical data into one accessible location. Check was past employees earned and how workers’ compensation was handled to get a better understanding of acceptable offers for new hires. No more digging through old pay stubs and adjusting for inflation: just let the software automate the work.

Self-Service Options for Employees

Self-service portals give employees the tools they need to do anything from submitting time off requests to managing their retirement and 401(k) contributions. Intuitive mobile app designs ensure ease of use even for employees who are less than tech-savvy. This is useful for small businesses who cannot have a dedicated financing or HR department in charge of running payroll. Online payroll services can be accessed by any approved employee from anywhere.

Did an employee vacation overlap two pay periods? Employees can go into their account to mark their PTO themselves. If they make a mistake scheduling their time off, user-friendly software makes it easy to enter adjustments after the fact and ensure payroll is accurate in time for payday. And the workers themselves can use mobile apps to review their payroll data for accuracy or change their preferences for employee benefits at any time even if working remotely from home.

Expand a Global Enterprise

Another benefit of online payroll software is the ability to expand your services as your company grows. If you plan on opening new locations around the world, having an online payroll software can help you keep up with the more complex payroll processes or tax payments required by those local government entities. Or you can calculate the exchange rate between different currencies to correctly pay international employees.

Online payroll software is capable of keeping you up-to-date on the latest minimum wage laws in areas you operate. You can also access periodic reporting on government regulations to ensure continued compliance with wage laws. Automatically download the latest versions of tax forms, like the W-2 or 1099, to supply your employees at tax time. These forms are also useful when filing payroll taxes or undergoing IRS audits by creating a digital papertrail of all your employee pay stubs.

There are a number of local, state, and federal laws your business must consider when processing payroll. Each of these laws are used to calculate how much tax is withheld and are affected by the number of employees your company has, their full or part time status, and a few other factors. Save time running complicated payroll with easy to use software. Along with organizing payments, automatically generated payroll reports can provide regular updates on how much is withheld and how employee benefits are being compensated.

Online Payroll Software Pricing

Control costs at your company by finding affordable payroll software to fit your needs. Cloud-based payroll software can lead to more cost savings from all your future payroll runs. Most online software as a service (SaaS) products range from $5 per month per user up to $45 per month. Others are based on the total number of employees covered by your payroll.

A few solutions may offer a perpetual license instead for a one-time fee, though training, updates, and maintenance may cost extra. Whether you’re a small business owner or accountant for a global corporation, you can find the best payroll software packages priced for your budget.

Online Payroll Trend: Direct Deposit

The switch to online payroll software has led to a lot of useful benefits for businesses looking to streamline payroll services. As described above, running payroll online with direct deposit is one of the biggest payroll trends worldwide. How it works is simple: employees provide a bank routing number to your HR or accounting department. When payday rolls around, the funds allocated to them are directly transferred to that account.

New hires across every industry are starting to demand direct deposit since it streamlines compensation. Understandably, no one wants to wait for batch printing or physical mail to get paid. While it’s useful to keep your payroll options open by still offering paper paychecks, it doesn’t hurt to also have direct payments ready to go. Keep your company up-to-date with cloud-based direct deposit payroll as soon as they start onboarding.