Purchase Orders vs. Invoices: Key Differences and Similarities

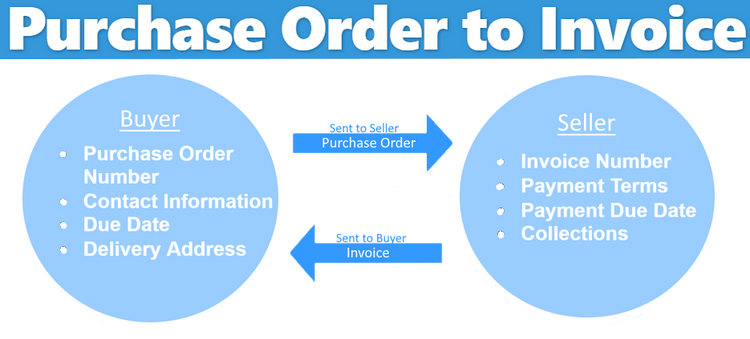

A purchase order is used to place an order, listing what the buyer wants to purchase. An invoice is sent after the order is fulfilled, asking for payment for what was delivered.

| Feature | Purchase Order (PO) | Invoice |

|---|---|---|

| Definition | An internal document that details what the buyer is purchasing. | A document issued to request payment for a sale. |

| Purpose | To initiate the procurement process and define order details. | To collect payment for the delivered goods/services. |

| Created By | Buyer | Seller |

| When Created | At the start of the procurement process | After the order is fulfilled |

| Main Use | To set expectations for delivery, quantity, and customization | To outline payment terms, due dates, and amounts |

| Financial Details | May include basic cost estimates, but not full payment details | Includes detailed cost breakdowns and payment terms |

| Department Responsible | Sales/Procurement | Accounting |

| Legally Binding | Yes | Not typically |

| Tracks | Inventory and order fulfillment | Money owed and payments received |

| Examples of Information | Delivery dates, quantity, product type | Total amount due, payment methods, and schedule |

What is a Purchase Order?

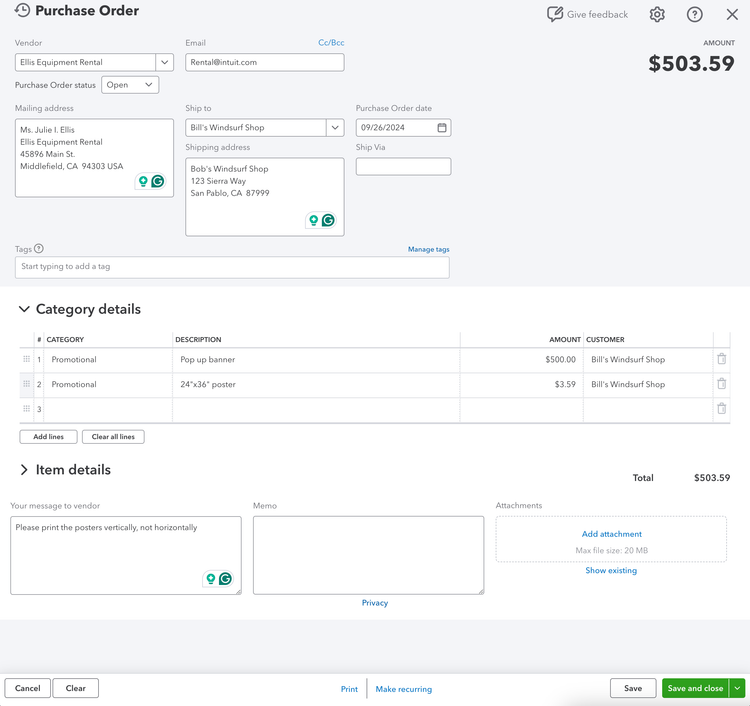

A purchase order or PO is an internal company document that details what a customer or client is purchasing, such as quantity or product type. Technically, the PO is made by the buyer, as it indicates what it is they are purchasing, although most companies have their own set forms to ensure consistency once a PO is received.

For example, it’s common for companies to digitize POs to preserve the original document and have easily accessible electronic versions that can be instantly shared with various departments. Some even rely on purchase order software to automatically generate identical POs once an order has been started. Each order will be labeled with a purchase order number for both sides to reference in future interactions.

Whether the purchase order is made manually or with software, this binding document officially begins the procurement process and the relationship between buyer and seller. It will detail features like the quantity of goods, anticipated delivery date, customization options, the labor necessary, and occasionally the total amount due.

When Do You Use a Purchase Order?

A purchase order is made once a customer or client has started the sales process with your company, whether for a good or service. The customer’s accounting department is responsible for designing the initial document. The PO follows the order as it passes from the sales team to everyone involved in fulfillment, from warehouse staff in charge of inventory management to delivery drivers who will get the goods to the customer.

An initial purchase order can also be used to set the terms for recurring orders without the need to create new documentation each time.

What is an Invoice?

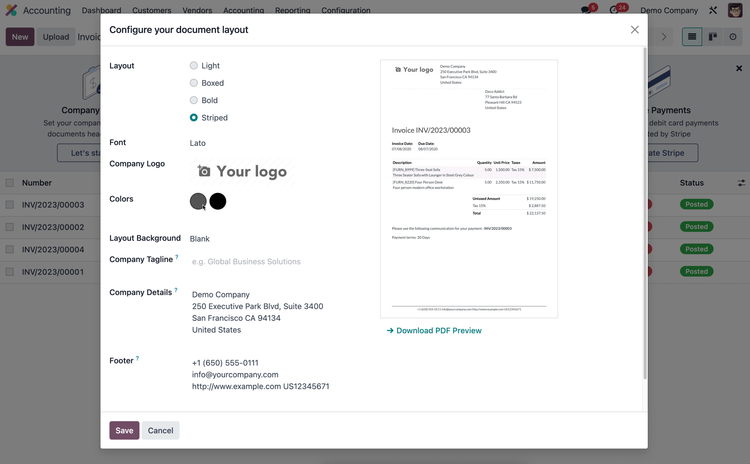

A sales invoice is a document showing payment terms, such as how much a customer or client owes a company for purchased goods and services. In its most basic form, it is an official way to request payment for a business transaction. This may include details about how the order was fulfilled in order to explain the finalized costs. For example, a company might differentiate between the cost of materials and labor in an itemized bill. An invoice number, usually generated automatically based on the date created, allows the accounting department to review outstanding invoices.

Additionally, the invoice process is designed to inform the buyer of when payment is due and how it is to be paid. Depending on the order, payment might be expected as a single lump sum by a certain due date, or there may be recurring payments over a set period of time until the full amount is paid off. Most of these details will be worked out when the purchase order is made, though sometimes the exact payment schedule will depend on other factors set by the buyer or seller. Finally, the invoice may specify if payment can be made electronically with credit cards or through other means.

When Do You Use an Invoice?

Generally, an invoice is issued after a sale, although some businesses create invoices alongside purchase orders to speed up the payment process. Regardless of when the financial documents are generated, the PO number links the two documents to help identify potential inaccuracies.

One reason invoices are usually made after POs is so they can include the latest information listed in the purchase order. For instance, if the accounting department uses billing and invoicing software, they might automatically generate invoices before purchase orders are fulfilled. However, if a customer requests a late change order, the change in price might not be included on that initial invoice. By waiting until the order is finished, an accountant finalizing the invoice can check the updated PO for accuracy, see the change order, and adjust the total costs accordingly.

The finance team might send out additional invoices on a set timetable to serve as payment reminders as due dates approach. They might also include additional charges from late or missed payment requests.

How Are POs and Invoices Similar?

Purchase orders and invoices are important parts of your business’s overall procurement process. As seen above, both record information on the buyer, such as the details of the purchase, along with important dates in the sales order timeline. To maintain consistency, they might be designed using PO and invoice templates.

The greatest similarity comes from the use of PO and invoice numbers to keep track of each purchase and payment. Each provides a convenient way for both parties to review order details, including the following information:

- Client or customer contact information

- Budgeting details (ie if there is a price range)

- Sourcing details (if necessary)

- Delivery date and shipping address

This info is useful for tracking orders as they are completed and provide an audit trail for the future.

Purchase Order vs Invoice: How are They Different?

There are several key distinctions between POs and invoices, some of which have already been detailed above. The main difference is in the purpose of each official document: one is to ensure an accurate order for the customer, and the other is to guarantee the vendor payment for the order. For this reason, POs might not include as many financial terms as an invoice and will instead only include the most necessary information related to fulfilling the order.

Another difference is when each is created: the PO is made as the sales process begins in order to set clear expectations for the buyer and seller at each step of fulfillment. In a legally binding contract, the invoice is generally made after the sale is completed and the goods are delivered.

Finally, POs tend to be used to help track inventory as sales are made to prevent product shortages. An invoice only tracks money owed and collected from confirmed sales. The former might fall under the purview of the sales team, while the latter will be controlled by the accounting department. Last, the purchase order is a legally binding document, while the invoice is not, although this can vary based on the purchase.

How to Pick Between POs and Invoices

For most businesses, both purchase orders and invoices are necessary to operate smoothly, particularly when it comes to procurement. If your company needs to order something, you’ll do so with a PO. If something is purchased from you, you’ll need an invoice to set payment terms or act as a receipt. However, there are some situations where one document may be able to cover both.

A small business might have a single purchase order process to build invoices based on purchase orders. In these cases, a PO would mostly be an internal document for your employees. Although it might also be shared with vendors or suppliers, then the invoice would be sent to a customer or client after or as a sale is made.

If you are a small business owner struggling with the time-consuming practices necessary to make purchase orders and invoices, software can streamline the process. Purchase order solutions can include invoice matching tools if you want a single system. However, billing and invoicing software is more standalone and usually lacks purchase order tools unless you select extra modules with that functionality. Some general accounting software includes both.