Xero Accounting Software Review: Pros, Cons

We like Xero for its strong invoicing capabilities, multiple add-ons and integrations, and basic inventory management capabilities.

We don’t like that Xero does not provide a customer service phone number. Instead, you can reach out via email to create a support ticket or request that an agent call you. It also doesn’t have multi-company support.

- Basic inventory management capabilities

- Free trial available and no setup fees

- Navigable, user-friendly interface

- Strong invoicing capability

- Integrates with Shopify, Square, etc.

- Hard to get phone support (email is more frequent)

- Limited to 2,000 transactions per month

- No "paid" notification alerts

- One company per subscription

- Developer Xero

- Client OS Web

- Deployment Cloud Hosted

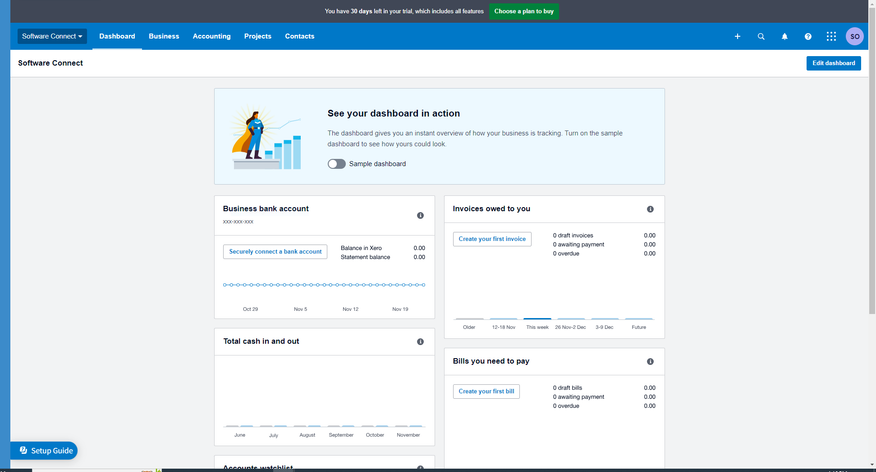

What is Xero Accounting?

Xero is a cloud-based, double-entry accounting software for small businesses not exceeding 2,000 transactions a month. It aims to improve bookkeeping processes like bank reconciliation and financial reporting. Xero bookkeeping can customize sales tax rates, automate calculations, and prepare sales tax returns.

It provides a comprehensive view of a company’s cash flow by presenting upcoming bills and outstanding invoices in a clear, tabular format. Whether you have its basic or most advanced plan, the Xero app supports unlimited users for real-time collaboration between your employees, accountants, and financial advisors.

Our Ratings

| Usability - 10 | Has a navigable, user-friendly interface and core accounting functionalities; uses clear, non-jargon language for better accessibility; bulk reconciliations are unavailable in the Early plan. |

| Support - 7 | Offers extensive guides and videos on basic accounting practices and software-specific questions; email support is available with a 24-hour response time; customers cannot contact support via phone. |

| Scalability - 8 | Simple invoicing and billing functionality for small businesses; offers in-app guidance for accounting beginners; mobile app lacks some functionalities, such as viewing income statements and cash flow reports; does not offer multi-currency at basic plan level like other software. |

| Security - 8 | Offers multi-factor authentication through the app Xero Verify; exports financial reports into PDF, Excel, and Google Sheets formats; experienced a minor data breach in 2015 but has since remained secure. |

| Value - 7.5 | Similar accounting software offers more functionality at lower price points. |

| Performance - 10 | Fast and responsive with no performance issues or lag; dashboards updated in real-time after adding bills and invoices. |

| Key Features - 10 | Basic and consistent templates for generating invoices, bills, and purchase orders; account reconciliation presents a side-by-side layout to spot discrepancies easily. |

Who Uses Xero Accounting Software?

Xero often serves as an initial stepping stone for solopreneurs transitioning from error-prone manual spreadsheets to a more streamlined system. It’s also great for small businesses. However, Xero is not suitable for all types of business, particularly those with very high transaction volumes.

How to Create an Invoice in Xero

Creating an invoice in Xero is quick and simple:

- Click the + icon in the top nav.

- Next, select the Invoice option under the Create New dropdown menu.

- Customize your invoice with fields for recipient(s), invoice numbers, and tax information.

- Add product-related information, such as item, quantity, and price.

- Click the Approve & email button to preview a text version of your invoice.

- Select the Send button to email your recipient.

- Recipient will receive your message and an attached PDF automatically generated by Xero with the total amount, bill due date, and a link to pay online.

We liked that Xero gives you the option to attach files and preview the final look of your invoice at any point in the process.

Quick note: Xero will not auto-save your entries; you must click the “Save” button to commit your invoice or bill to drafts.

Mobile Xero Invoicing

Creating an invoice in the mobile accounting app follows the same process, though it’s broken into more steps:

- Click the + icon on the dashboard screen.

- Select the Create Invoice option.

- Customize your invoice with fields for recipients(s), invoice numbers, and tax information.

- Select the Add an item button.

- Click Select Products or Services.

- Choose the item(s) and specify their quantity.

- Click Add another item or Done.

As on desktop, you can then choose to save the invoice as a draft, approve it, or send it via email.

How to Add and Approve Bills in Xero

Adding a bill mirrors the invoicing process – we like Xero for its consistent and accessible interface.

- Click the + icon in Xero’s top nav.

- Select the Bill option under the Create New dropdown menu.

- Customize your bill with fields for the seller, due dates, and tax information.

- Add product-related information, such as item, quantity, and price.

- Click the Approve button. Xero will now indicate that the bill is Awaiting Payment.

- Go to Make a payment and fill in Amount Paid, Date Paid, etc. fields.

- Click Add Payment to move the bill to Paid.

How to Reconcile Transactions in Xero

We like Xero for its clear, one-to-one comparison layout when reconciling bank line items against your Xero transactions. Here’s how to do that:

- Select Accounting from Xero’s top nav.

- Click on Bank accounts to view all accounts connected to Xero.

- Click the Reconcile xx items button.

- Select the OK button to verify a match.

The software simplifies this process further by providing written and video guidance on what to do if you encounter differing balances. It also flags Xero transactions that appear to match bank statement lines, making reconciliation more straightforward.

What we don’t like: bulk reconciliation isn’t possible unless you have the Growing or Established plan. Manually reconciling individual line items could be time-consuming for businesses with a larger volume of transactions.

What Features Are Missing?

Though Xero provides core accounting functionality in a streamlined interface, it lacks a few key features integral to small businesses:

- Limited Phone Support: Xero does not offer a support phone number. This poses setbacks for users who prefer real-time, interactive guidance when learning new software or resolving issues. In some cases, Xero can reach out to users via one-way calls. On the other hand, Xero offers free unlimited support seven days a week via email, which guarantees a response within 24 hours.

- Features Restricted to Established Plan: Businesses requiring project tracking, expense claims, multiple currencies, and in-depth analytics must upgrade to the Established plan at $70/month. Furthermore, Xero requires third-party add-ons to run payroll, which is common for basic financial software of its kind.

Xero Pricing Plans

| Plan | Pricing (No annual billing options) | Features |

| Early | $25/month | Designed for new businesses and the self-employed.

|

| Growing | $55/month | For growing small businesses. Includes all Early features, plus:

|

| Established | $90/month | For established businesses. Includes all Growing features, plus:

|

How long does it take to learn Xero?

The average time to become proficient in Xero varies widely, depending on users’ prior knowledge and experience. Xero reports that you can receive certification, free of charge, in approximately 6-8 hours. However, the average time is likely closer to 3-4 weeks as users become more familiar with the software through consistent use.

Is Xero accounting software free?

Xero is not free, though it does provide a free trial of the software for 30 days. Afterward, plans start at $20/month. Wave, Zoho Books, and ZipBooks are a few of our top picks for free accounting software.

Is there a Xero payroll?

Xero does not have built-in payroll capabilities. Instead, you can integrate a payroll add-on called Gusto, recommended for up to 100 employees. It’s a full-service option with unlimited, automated payroll runs and direct deposit. In addition, Gusto pay runs sync seamlessly as Bills in Xero.

Is Xero good for small businesses?

Due to its scalability and cost-effectiveness, Xero is a great choice for growing businesses. Because it supports unlimited users, it facilitates employee collaboration and allows them to quickly submit expenses and send invoices. Xero also grows with your company, integrating with your email, customer relationship management (CRM), or point-of-sale platforms to help streamline operations even further.

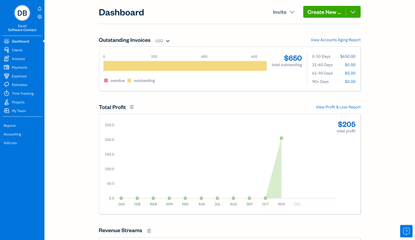

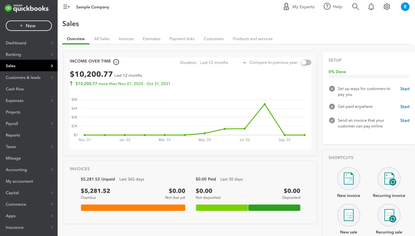

Is Xero better than QuickBooks?

We’ve seen many people switch from QuickBooks Online recently, and Xero is one of the top options. Thanks to its unlimited user plans, it’s more affordable than QuickBooks. We also found it to be more user-friendly, with simpler reports and streamlined invoices. So, Xero could be better if you’re a startup or a growing small business. But if you want more feature depth and reporting options, QuickBooks has it beat. Check out our QuickBooks vs Xero comparison page, or our YouTube video for a more detailed analysis.

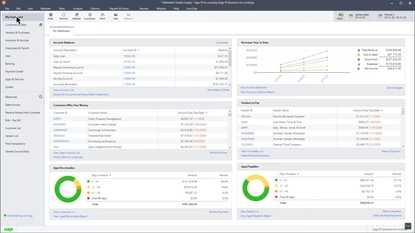

Alternatives

Summary

We recommend using Xero if you’re a small-to-medium-sized company that values affordability, collaboration, and user-friendly design. Because Xero doesn’t charge more as you add users to your plan, it offers a cost-effective way to provide employees access to real-time financials. Furthermore, you can scale it up as your company grows; Xero integrates with over 1,000 third-party apps for payroll, time-tracking, and more.

Keep in mind that support is only available via email or one-way call. If you’re a larger company with multiple bank accounts, go for a more robust accounting system like QuickBooks Enterprise. For heavily inventory-based businesses, we suggest an ERP like NetSuite ERP or Sage Intacct.

Xero offers plans starting at $13/month. All and all, it’s an excellent option for sole proprietors and growing companies requiring an inexpensive way to manage finances and basic inventory.

User Reviews of Xero

Write a ReviewXero Review

It’s a beautiful accounting software. They keep the language simple which is great for users who don’t know accounting terminology.

The customization capabilities are probably the best out of all online accounting software

I think Xero has a lot of power and flexibility, which gives it a bigger learning curve to get used to the features available. I recommend finding a bookkeeper who is experienced who can show you the ropes.

If you’re a beginning, Xero has a whole set of videos available to help teach you the software. It’s very similar to QuickBooks Online. I recommend using this software probably as much as QBO, Wave, and Kashoo.

Despite some criticism I have about Xero, I feel they are a strong billing and invoicing software. The customization capabilities is probably the best out of all online accounting software. It’s best to judge accounting software based on what you need it to do, rather than what it can be capable of doing.

The support is heavily weighted to “email” and it can be hard to get people on the phone. However, I feel email does give me better answers.

Xero Review

Easy to use program.

Pros

It includes lots of options to customize the software.

Cons

I found some sections are complicated to get started.