The Best Farm Accounting Software

Agriculture accounting software became its own niche in the technology world, helping you stay current with industry trends. Whether you manage livestock or crops, these tools streamline financial management and planning.

- Easy setup with no internet required

- Supports multiple farm owners or entities

- Includes billing/invoicing, payroll, and enterprise analysis

- Simple, user-friendly interface.

- Detailed financial reporting capabilities.

- Offers both cash and accrual accounting.

- Cost accounting system with per acre and per yield analysis

- Customizable invoicing and statements

- Includes budgeting tools

Whether you’re an organic farmer, a rancher, or a dairy farmer, you’ll always need a way to organize the financial transactions you deal with. This software offers features like multi-entity support, cost management, and double-entry accounting.

- Ultra Farm: Best Overall

- PcMars Farm Accounting: Best for Small Farms

- The Farmer’s Office: Best for Crop Farming

- TransAction Plus: Best for Livestock Enterprises

Ultra Farm - Best Overall

Ultra Farm features a multi-entity management and checkbook system, making it ideal for complex ranch and farm operations. The system can accommodate up to five checkbooks/owners to help handle unique situations, like income distribution among family members or separate checkbooks for livestock, feed costs, and landowners.

Since each checkbook represents a distinct entity within one accounting system, it’s much simpler to track expenses and generate reports for each checkbook. Consolidate transactions for whole-farm financial analysis or keep them separate for entity-specific insights.

Overall, Ultra Farm excels in reducing manual processes, like automatically reflecting all transactions in balance sheets and profit and loss statements. The system auto-increments check numbers from the last used, saving you from repetitive check writing. It can also memorize and pre-fill frequently used vendor transactions and even link fixed assets, crop yields, and livestock to specific checkbooks, syncing your inventory and financial processes.

Ultra Farm is on-premises farm accounting software purchased upfront. It starts at $550 for a one-time purchase, and you can even load it on multiple computers at no additional charge. While some users note that the interface is old-fashioned, they also say it’s easy to use and affordable.

For more on Ultra Farm, check out our profile page.

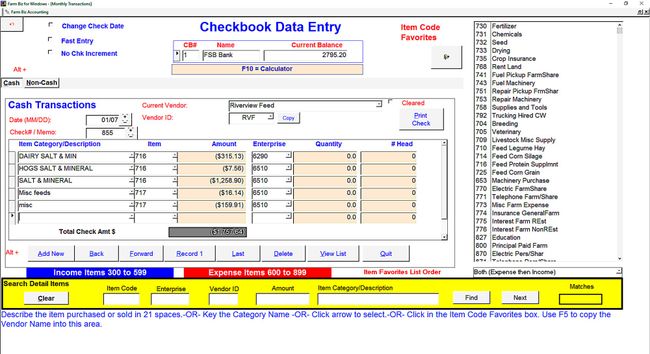

PcMars Farm Accounting - Best for Small Farms

PcMars offers a cash basis and accrual double-entry accounting system that lets small farms manage their finances at varying levels of complexity. For example, you can start with cash basis for straightforward expense and income tracking. As your farm scales in size, you can toggle to accrual accounting for more advanced financial reporting and tax preparation.

The software offers a variety of sub-capabilities, including:

- Payroll: Supports simple and advanced payroll needs; ensures compliance with tax laws and labor reporting standards, including IRS W-4.

- Bank Reconcilation: Match bank statements with recorded transactions for more accurate financial tracking.

- Inventory Management: Manage crops, supplies, and feed to gain stronger insight into farm assets and cost management.

- Multi-Year Reporting: Compare financial performance across different years to analyze profitability trends.

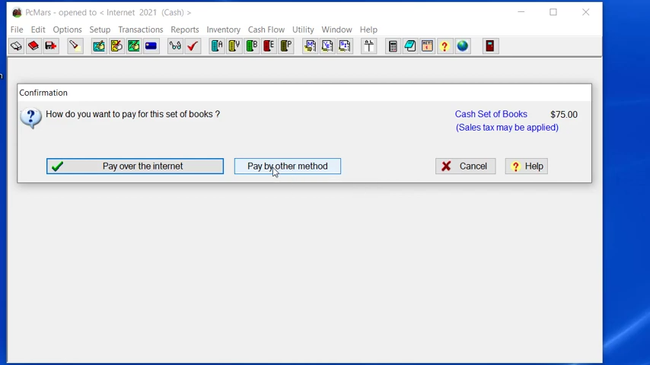

Starting at $75/year for a full set of books, PcMars is also highly affordable for the level of functionality it offers. While it’s ideal for small to medium-sized farms, larger agricultural enterprises are likely to need more advanced features than it can provide, like depreciation tracking.

Learn more about pricing details, pros, and cons on our PcMars profile.

The Farmer’s Office - Best for Crop Farming

The Farmer’s Office includes a detailed cost accounting tool so you can track profitability by crop, variety, field, and crop year. The system allows you to assign expenses like equipment usage and chemicals to specific fields or crops. This attributes every cost, including payroll, to the correct area of production on your farm.

Additionally, The Farmer’s Office allows you to divide expenses across multiple fields or ranches based on predefined allocations or even acreage percentages. This helps automate invoice breakdowns and, more importantly, saves you loads of time on administrative tasks. The software also tracks income per crop, so you can easily compare budgeted and actual performance by field, variety, or entire crop year. Determine which fields generate the highest returns for better land-use planning and crop rotation strategies.

The Farmer’s Office provides a yield analysis feature so you can analyze equipment usage and labor by crop, factoring in indirect costs like maintenance or overtime into your total cost of production. Overall, the system offers a total package of capabilities that reduce time spent on cost allocation, freeing you up to focus more on operations and less on bookkeeping.

See our review of the The Farmer’s Office to learn more.

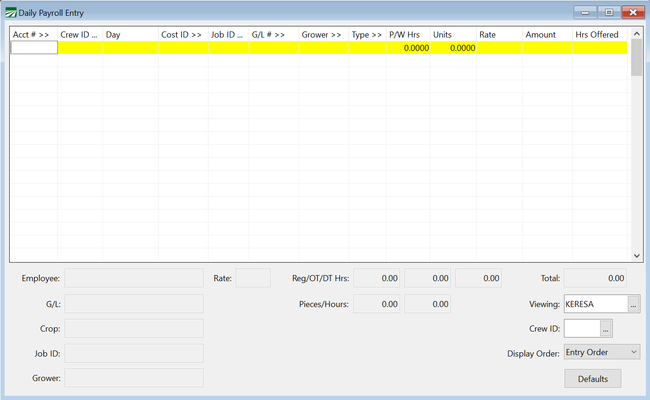

TransAction Plus - Best for Livestock Enterprises

TransAction Plus’s multi-dimensional coding system lets you track each transaction across different segments of your business. These include:

- Center: Specific to livestock groups or types, like breeding herd, dairy operation, or feedlot cattle.

- Ledger Account: Manages categories like veterinary services, labor, feed, or equipment.

- Division: Separates operations by ownership entity or location.

- Description: Includes additional details like type of feed, batch number, or treatment applied.

By tracking costs down to specific herds or animal groups, you can determine which segments of your company need adjustments or drive the most profit. You can then use the system’s multi-dimensional tracking to generate reports by farm location or herd. This leads to data-backed decision-making across the complex revenue streams and expense structures that often come with livestock operations.

What is Farm Accounting Software?

Farm accounting and agriculture software provides financial management for farms, farmers markets, ranches, abattoirs, and large-scale ag operations to help them turn a profit. The software can be as simple as keeping an electronic checkbook ledger or spreadsheet and be as complex as an agricultural ERP solution to manage orders, crop inventory, plan expected harvest quantities, and more (See: Best Farm Management Software).

While many generic accounting software options can meet a farm’s needs, farm accounting software handles managing the specific needs of farmers and agricultural businesses. The solutions are developed with farmers in mind and can provide features, functionalities, benefits, and reports specific to the industry.

For example, while a manufacturing company may buy many raw materials to create finished goods in a set amount of time, farmers buy seeds, fertilizer, and tools to help their products grow, which can only be harvested after a long period of time. The business becomes more seasonal in that aspect, and the accounting needs to take those situations into account.

Key Features of Farm Accounting Software

| Functionality | Description |

|---|---|

| Accounts payable | Provides the ledger for expenses such as livestock, feed, seed, and more. Includes invoice processing, payables approvals, and executing payments. |

| Accounts receivable | Tracks money owed to you and manages customer debt collection. Invoice customers/clients for materials such as seeds or chemicals you produce and adjust the price owed easily. Create customized invoices with your logo for a professional touch. |

| General ledger | Prepares a net worth statement and cash flow statement, compares budgeted versus actual costs, creates a chart of accounts to track seed, chemicals, and fertilizer, and reviews income/expenses by these categories. |

| Payroll | Manages all elements of executing employee compensation, including wage calculation, check printing or direct deposit, and payroll tax management. Enter payroll records and record employee hours on timesheets. |

| Equipment/structures/land/livestock asset management | Keep track of depreciation on any and all assets the farm uses for its day-to-day operations. Monitors when equipment has lost value and allows for smarter decision-making when a potential replacement needs to be found. |

| Agricultural inventory management | Manages supplies used and crops harvested. Collect field records, purchases made for new items, and sales made of finished goods. |

Pricing

The cost of farm accounting software will depend on which modules you need. Some farms can get by using an industry-neutral solution such as Freshbooks which starts at $19/month. Others with increased needs may need to start looking at agriculture software developed specifically with a farm in mind, such as Ultra Farm, which starts at a flat rate of $550.

The key questions to ask when determining how much you can budget for software is:

- Are you looking to purchase software outright (higher upfront costs) or pay on a subscription-based pricing model (lower upfront costs)?

- How many user licenses will you need?

- Do you need ongoing support?

- Do you need assistance in setting up the software?

- Do you and/or your staff need to be trained on the software?

Benefits

Below are some hand-selected benefits of farm accounting software:

- Better understand profitability. Farm accounting software will give your accountants better metrics specific to the industry involving economic farm surplus or something similar. You can also look at the working costs of milk solids, which are popular in the dairy farm industry. Keeping these figures up to date based on current milk solid prices will ensure you have the most accurate picture of month-to-month profits.

- Make decisions based on comparable product costs. Agricultural companies don’t have the luxury of being able to keep constant prices on the products they sell, as they are always at the will of market volatility. Because of this, it’s important farmers specialize in their most profitable products. Having adequate farm accounting software will let you see all of the direct and indirect costs that are consumed in the production of various products and let you beat the margins each year. You can also look into finding better deals on various fixed expenses, such as rent on facilities used.

- Protect the future of your operation. Better farm accounting helps you prepare your taxes, find margins, and measure your profitability more easily. Keeping accurate records of your production levels will ensure you are complying with your insurance. Having real-time inventory records will let you sell your products much more easily.

What Does Your Business Need?

- Small farms need to cover their core financials by tracking income and expenses and are probably looking into some level of reporting to review their overall numbers and perhaps check the profitability of certain areas of the operation. Farms of smaller size can usually get by with simple accounting software such as QuickBooks or another small business accounting or entry-level accounting system with a low initial cost. Whether single-entry or double-entry accounting, this type of software should, at its core, let your bookkeeper create a balance sheet and allow for better record-keeping.

- Mid-sized farm operations need to consider industry-specific reports to examine the margins of using specific types of seeds and fertilizers or the volume of certain crops produced. Medium-sized buyers will also need more software to handle their inventory control or more in-depth accounting features such as payroll. They may also want to consider implementing budgeting and forecasting features to get a better idea of their bottom line.

- Large farms and agricultural enterprises likely need to consider ERP systems to meet their increased needs. They may have a more complex payroll for paying seasonal employees. They also may have multiple locations that handle specific types of agricultural operations and thus may want to keep separate sets of accounting records or even operate as separate entities. Larger farm operations are also more likely to have different inventory types and compare their numbers with industry-standard ratios.

Examples of Products

Choosing the best farm accounting software product isn’t easy, but today’s farmer has more choices than ever. Below are some of the options that are very commonly found in the industry and can help your operation with any tasks at hand.

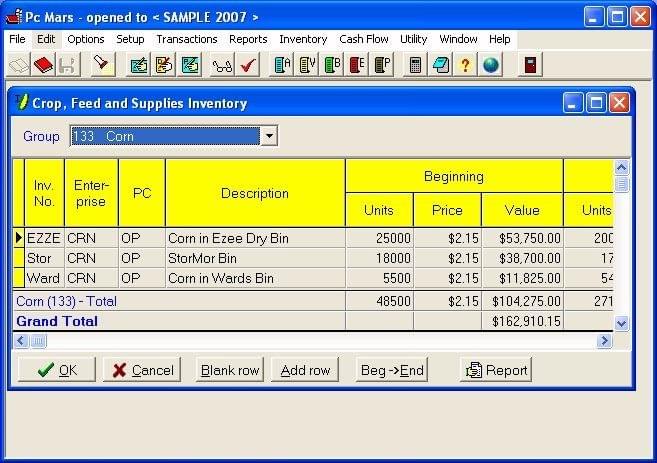

PcMars (pictured above) is a “farmer-friendly” solution developed with farmers in mind. The Iowa Farm Business Association recommends using the software, which offers customized inventory for tracking crops, seeds, and supplies.

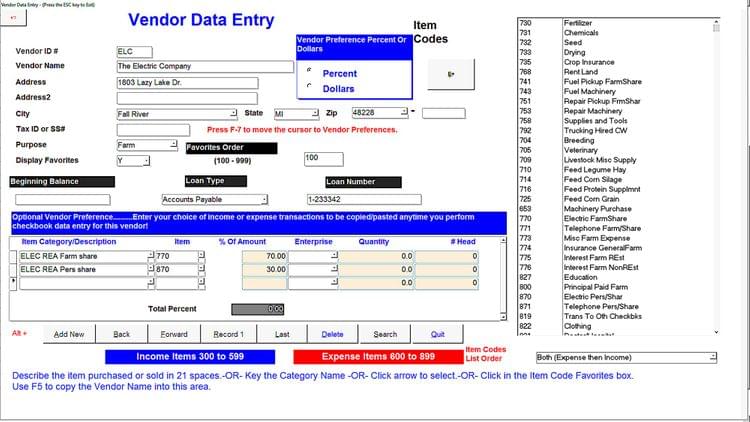

Farm Biz Software (pictured above) allows custom vendor data to be entered with preset categories related to the farm industry. These expense categories include fertilizer, seeds, chemicals, machinery costs, and more. The solution requires zero setup and includes a standardized farm chart of accounts.

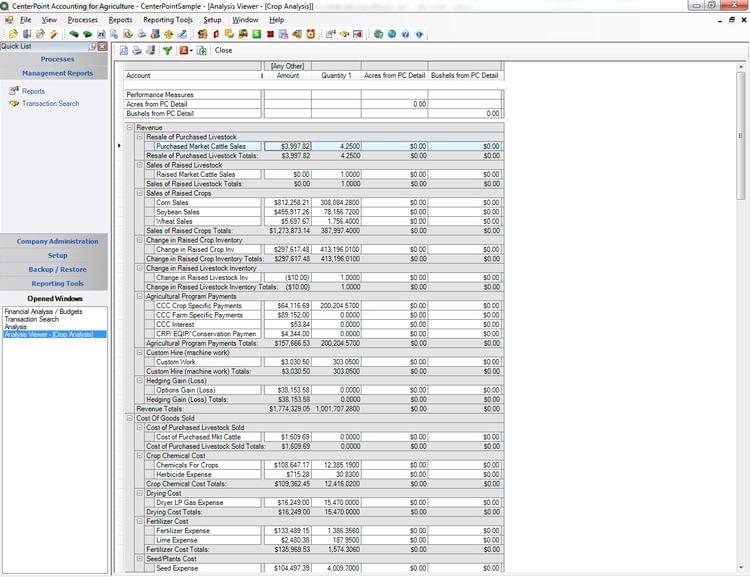

CenterPoint Accounting Software for Agriculture (pictured above) is a full agricultural suite for businesses with more complex accounting needs. The software includes a wide variety of farm industry standard ratios recommended by the Farm Financial Standards Council and provides detailed reports, such as crop analysis.

Is QuickBooks A Farm Accounting Software?

QuickBooks Pro is a very popular farm accounting software option. In fact, it was likely the top choice for farmers at one time. This is due to its low cost of entry and overall affordability compared to other options, which are attractive to many first-time software buyers.

With time, more software developers noticed a gap in the market and developed their own solutions created specifically for agricultural businesses. However, QuickBooks still works great for farms or agricultural organizations looking to keep track of their income and expenses and create basic reports.

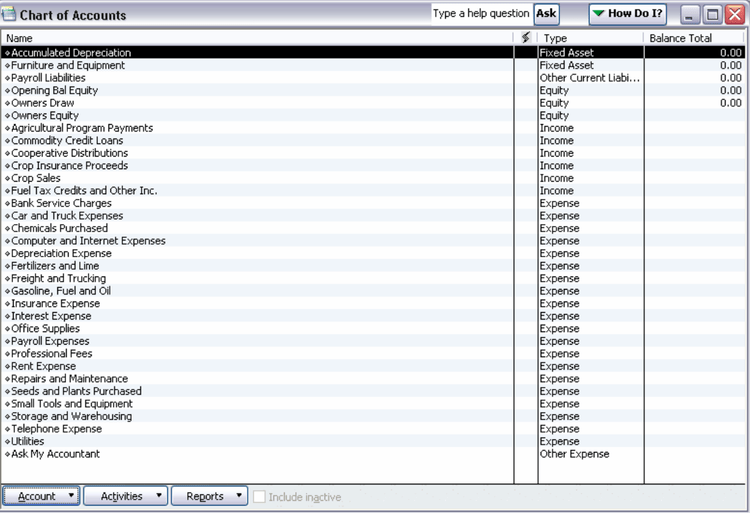

As detailed in the image above, QuickBooks can be used in various industries. However, it does have a preset chart of accounts available, including one for “agriculture, ranching, or farming.”

The key to using QuickBooks (or any other industry-neutral solution) for farm accounting will be how the program is set up. This will require some level of knowledge of how to use the program to ensure you can master difficult farm transactions, such as tracking grain or livestock inventory in different locations. You’ll also need to learn the “dos” and “don’ts” of accounting for a farm and ensure your reports are showing the type of information you need.

Many helpful books and online guides have been written on how to successfully implement QuickBooks as a farm accounting option, such as this PDF from FarmAnswers.org, which emphasizes how to record farm specific business transactions in a solution that wasn’t developed with farm and ranch businesses in mind.

Technology Trends

Movement into the cloud. Given the rural location of most farms, many may have struggled to acquire a reliable internet connection. If a dependable connection was available, they may have faced hefty costs in order to receive it (such as using satellite internet). Because of this, farms, ranches, and the agricultural industry overall may have been some of the last to transition to the cloud and have historically tended to avoid online accounting systems.

Many software developers are starting to market the benefits of cloud software for farms, such as a lower initial cost of investment. Cloud-only solutions such as Xero are attracting farmers by pointing out what farmers can take advantage of, such as having direct feeds in place for their supplies or checking milk solid prices.

Increased Operating Expenses. The United States Department of Agriculture keeps a close eye on commodity costs and returns, and the trends show that costs for farmers are constantly on the rise. When the price of needed materials goes up, a business usually has to look at other areas of their business they can scale back or cut costs on, which may mean being more strict in their software budget.

Precision Farming, also called precision agriculture or site-specific farming, uses GPS and GIS systems to provide real-time tracking of farm machinery. Its use in the field allows for planning, field mapping, soil sampling, tractor guidance, crop scouting, and more.

Pain Points

Knowing what to do with data. Farmers are starting to adopt farming applications, but they are now facing the problem of knowing how to decipher the information that they are collecting. They know the goal of using new technologies (such as software) will be to help them make more informed decisions, but many farmers may not be prepared to understand the data or simply not have the time to do so.

Having a strong relationship with your software vendor will ensure your software is up to date and provide you with all the tools you need to make sense of your data. A vendor is also available for training to ensure you know more than just how to create a report but understand it as well.

Isolated locations providing poor internet connections. Many in the agriculture business may discourage pursuing cloud-based systems if they feel they can’t depend on their internet connections. They may also be hesitant to utilize new GPS technology that can track where their larger piece of farm machinery are and how much ground they’ve covered. Farmers want to worry less about their technology uptime and spend more time producing.