The Best HIPAA Compliant Accounting Software

In this guide, we’ve reviewed the best HIPAA-compliant accounting software to help clinics, medical practices, and healthcare organizations manage billing, financial reporting, and compliance.

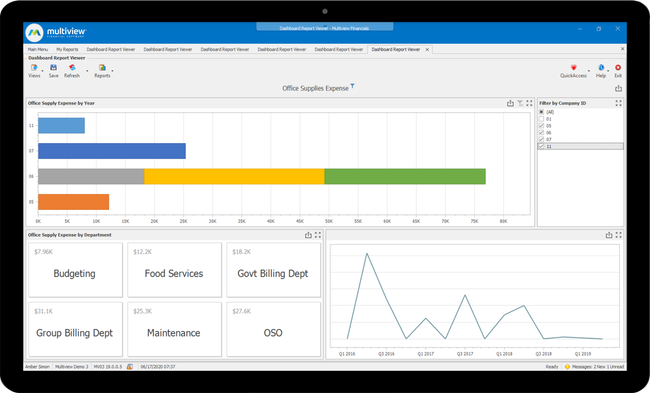

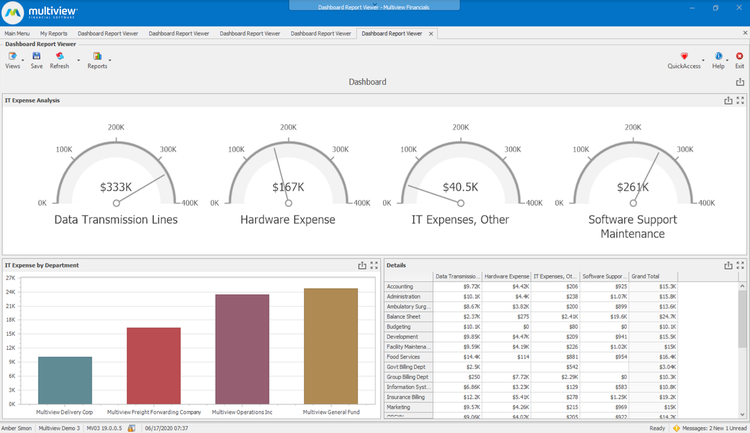

- ViewPoint tool offers strong reporting and analytics

- Scalable, user-based pricing model

- Includes 18 fully integrated modules for different industries

- Multidimensional reporting capabilities

- Scalability for multi-entity support and user growth

- Simple and responsive user interface

- Hundreds of third-party add-ons available

- Feature sets for multiple industries

- Highly customizable

We’ve researched the best HIPAA-compliant accounting software for medical practices, clinics, and healthcare organizations. These systems help manage billing, compliance, and financial reporting—without risking protected health information (PHI) security violations.

- Multiview ERP: Best Overall

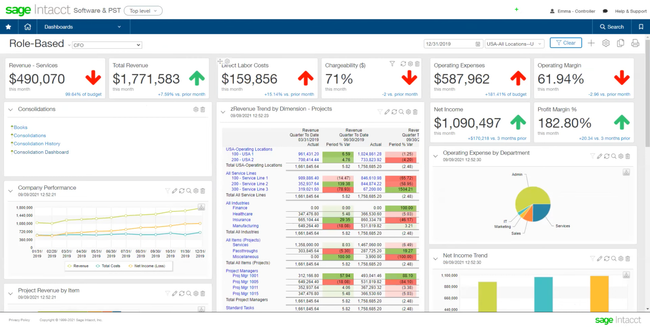

- Sage Intacct: Best Reporting Tools

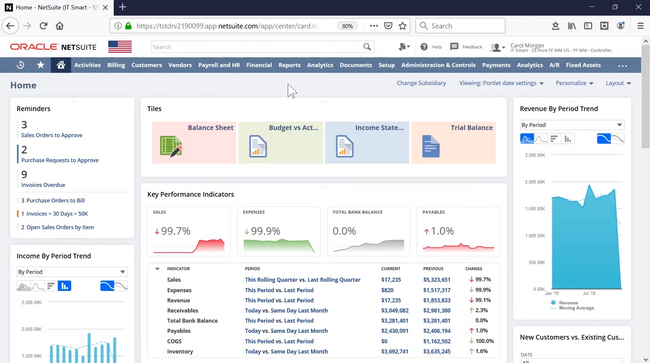

- NetSuite: Best Compliance Module

- Striven: Best for Integrated Practice Management

Multiview ERP - Best Overall

Multiview’s EMR360 integration syncs your electronic medical records, billing, and financial processes in one system—helping you minimize compliance headaches. Patient billing data transfers automatically from the EMR to the accounting system. This helps ensure HIPAA compliant data handling and prevents unauthorized access to protected health information (PHI).

By syncing diagnoses and billing codes with financial records, Multiview reduces manual data entry errors that could lead to compliance violations down the line. The moment a patient visit is completed, EMR360 transfers treatment and billing details to the financial system for invoicing.

Your billing team can process payments faster, and any adjustments in the financial system reflect back into the patient’s medical records. This ensures data consistency and adherence to HIPAA’s integrity and security standards. Plus, detailed audit trails account for every transaction to help keep you compliant.

Multiview also takes the stress out of audits by automating reports on patient revenue, outstanding claims, and reimbursements. Instead of scrambling through paperwork or second-guessing your data, you can access up-to-date financial records at any time. It’s great for mid-sized to large healthcare organizations and scales easily with 18 integrated modules.

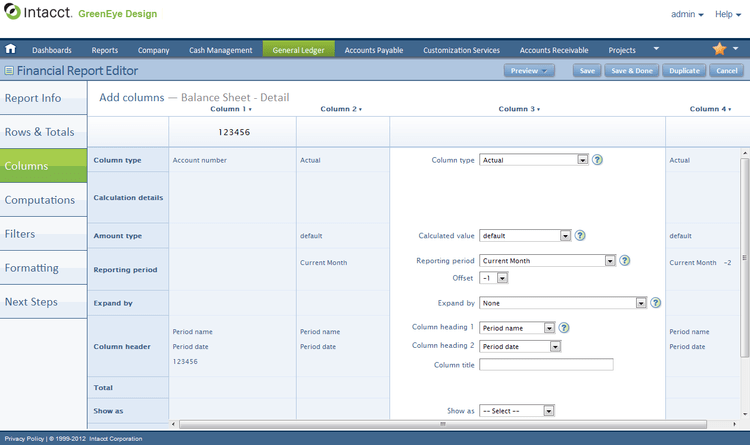

Sage Intacct - Best Reporting Tools

While Sage Intacct is, first and foremost, a comprehensive financial management solution with no target industry in mind, the solution boasts robust accounting features and multi-dimensional reporting capabilities that can adhere to HIPAA regulations.

Sage Intacct’s biggest advantage over solutions built with the healthcare industry in mind is its powerful reporting capabilities. These let healthcare providers gain a deeper insight into their financial information by analyzing trends and identifying opportunities for improvement. For example, Sage Intacct can segment revenue by department, location, or physician, providing valuable insights for resource allocation and budgeting.

By providing strict data security measures, Sage Intacct ensures the protection of sensitive patient information. Since any software that avoids HIPAA violations is technically HIPAA compliant, Sage Intacct has marketed itself as a top choice for medical practices looking to securely store protected health information (PHI).

Sage Intacct’s user experience is bolstered by its intuitive interface, responsive support team, and seamless integration with other systems.

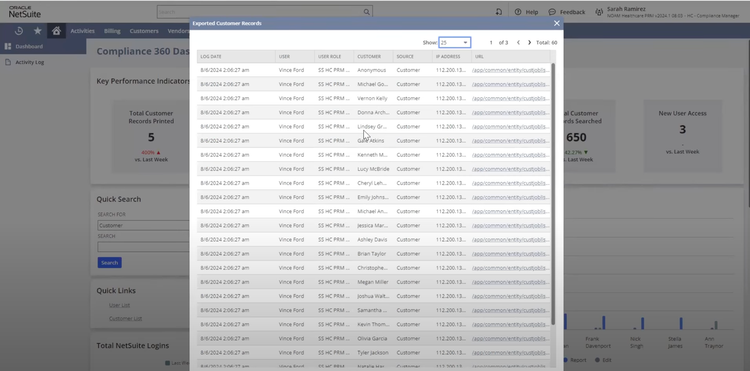

NetSuite - Best Compliance Module

NetSuite’s Compliance 360 module helps protect sensitive patient data and accelerates HIPAA-related investigations. Key functionalities include:

- Strong Data Security: Leverages encryption protocols and access permissions to protect PHI from unauthorized access.

- Audit Trails: Logs every user action and generates reports on who accessed what data and when to highlight potential security risks.

- Role-Based Permissions: Allows you to restrict sensitive data only to authorized users.

- Automated Compliance Monitoring: Dynamically tracks compliance-related activities and sends alerts when HIPAA violation risks are detected.

NetSuite starts at around $2,000 per month; most organizations can expect to pay between $3,000 and $5,000 monthly depending on setup complexity.

Striven - Best for Integrated Practice Management

Striven is an accounting and practice management software designed for medical organizations that want an all-in-one platform in compliance with HIPAA. Regular SOC 2 Type II audits and role-based permissions ensure Striven handles PHI in accordance with federal requirements, so organizations can oversee finances worry-free.

And unlike other systems that focus only on accounting and financial management, Striven brings features that support daily operations for medical clinics and practices. With the calendar and scheduling tools, organizations can manage provider availability, book appointments, and reduce missed visits with automated reminders. Patients can also schedule directly through the online portal, which feeds appointments straight into your practice’s calendar. This unified approach means fewer integrations to maintain and less risk of PHI being mishandled.

Pricing for Striven starts at just $35 per user per month for its standard plans. The enterprise plan, starting at $70/user/month, provides more customization options and additional storage space for higher-volume medical organizations. This affordability and all-in-one nature make it a great fit for smaller and scaling medical practices – we wouldn’t recommend it for multi-location offices or larger health networks.

What Is HIPAA Compliant Accounting Software?

HIPAA-compliant accounting software provides audit trail capabilities for PHI, sets user permissions, and includes a Business Associate Agreement (BAA) from a vendor that guarantees compliance with HIPAA standards. To maintain HIPAA compliance in an accounting system, it needs to adhere to HIPAA rules for handling protected health information (PHI) and withstand a third-party audit for adherence to HHS’s OCR audit protocol.

Many software programs can be used compliantly. By definition, any software that avoids HIPAA violations is technically HIPAA compliant. However, no governing body will officially stamp software as HIPAA compliant. Applications found in HIPAA-compliant accounting software will ensure compliance and allow you to provide accurate and timely medical billing. This includes end-to-end claim tracking, checks and balances, patient scheduling, insurance billing, and ICD-10 compliance.

HIPAA compliant accounting software can be medical accounting software (either on-premise or cloud-based) created for the healthcare industry and can handle any liabilities involved in managing protected health information. It can also be a generic accounting solution that has been successfully implemented into medical environments and has vendor backing that reassures its ability to handle PHI in a compliant manner.

Accounting features found in HIPAA-compliant accounting software are typical of those found in standard accounting systems, such as accounts payable (AP) for buying medical supplies, accounts receivable (AR) for medical billing (billing both insurance and patients), and a general ledger to evaluate the company’s income and expenses in real time.

HIPAA-compliant accounting systems are mostly used by small to mid-sized medical practices, clinics, and allied health professionals. These systems may be marketed as medical practice management solutions or medical billing software. To decide which one will work best for your organization, you’ll need to decide which additional features beyond core accounting are important to you.

What is HIPAA?

The Health Insurance Portability and Accountability Act (HIPAA) is a federal law that regulates the privacy and security of protected health information (PHI). This legislation has far-reaching implications for accounting and financial systems, requiring organizations to implement stringent data protection measures to ensure PHI data is secure and not accessible. Key elements of HIPAA compliance in accounting software include robust encryption, access controls, and audit trails to ensure the confidentiality, integrity, and availability of sensitive data.

Key Features

- Medical Billing: Includes claims management, handle remittances, patient payments, insurance payments, payment processing via credit card or ACH.

- Audit Trail Management: Monitor when members log in, failed login attempts, software update history, downloads of records, password management, information accessed, what ePHI was changed and by whom, and more.

- User Permissions: Limit the roles of specific users so that only the correct personnel have access to sensitive medical data. Make sure any data that is received, processed, or transmitted is only accessed by the correct users.

- Accounts Payable: Invoice processing, payables approvals, and executing payments made by the organization for medical office supplies or other business expenses

- Accounts Receivable: Manages customer debt collection. Includes customer database management, invoice creation, interest and late fee application, recurring billing support, and more.

- General Ledger: Reports on the company’s assets, liabilities, revenue, and expenses.

- Medical Practice Management: Includes scheduling and appointment management and tracking patient communication.

Benefits

Some of the top benefits of HIPAA-compliant accounting software include:

Meet New Regulatory Standards

Health regulations and standards are constantly changing. On top of that, new accounting challenges may appear within your organization that leave you curious about how you can stay compliant while still providing the financial management your practice deserves.

You’ll want to have a strong relationship with your HIPAA compliant accounting software vendor. Anytime a new software functionality is developed or an update occurs to your accounting system, you know you’ll have a dependable person you can rely on to explain how it affects your compliance concerns.

Stay Within The HITECH Act Guidelines

The Health Information Technology for Economic and Clinical Health (HITECH) Act was signed into law back in 2009 after the American Recovery and Reinvestment Act of 2009. In the health industry, the Recovery Act, or ARRA, works as a stimulus package to invest in infrastructure. Its purpose is to promote the use of technology, which led to many health organizations looking to improve their current EHR systems.

The goal of HITECH is to promote meaningful use, which in part established some rules and regulations:

- It set up four categories of violations

- It set up four tiers of penalty amounts that increase with each violation

- It capped the maximum penalty at $1.5M for all violations of an identical provision

In terms of HIPAA compliant accounting software, HITECH sets forth punishment that organizations can face for wilful neglect when it comes to handling sensitive medical information. Many organizations look to make sure they are HIPAA compliant to avoid having to deal with any imposition of penalties as laid out in the HITECH Act.

Who Is Responsible for HIPAA Compliance?

The software vendor and the medical practice share HIPAA liability and responsibility. The software company is considered a business associate if it stores, processes, or transmits patient health information (PHI) on your behalf. Your medical practice remains the covered entity responsible for ensuring PHI is handled in compliance with HIPAA. The HIPAA Omnibus Rule of 2013 strengthened this requirement by making business associates directly liable for compliance failures.

This is where a Business Associate Agreement (BAA) comes into play. A BAA is a legally binding contract that outlines the vendor’s responsibility to safeguard PHI according to HIPAA standards. Without a signed BAA, using software to handle PHI may put your practice at risk of noncompliance even if the system has the right security features in place.

Key points to understand about HIPAA and BAA:

- Vendors must provide a BAA if their software interacts with PHI in any way. This includes cloud-hosted providers, accounting platforms, and medical billing systems.

- Covered entities (medical practices) must enforce compliance by only working with vendors that sign a BAA and can demonstrate HIPAA safeguards.

- Compliance is ongoing. Both the software vendor and the practice are subject to audits and penalties if PHI is compromised.

Ultimately, HIPAA is a shared responsibility. The software company provides the tools and contractual guidelines through a BAA. At the same time, the medical practice must implement the correct policies, limit employee access, and train staff to use the system in a HIPAA-compliant manner.

Accounting vs. Medical Billing Software

In the medical community, there is much debate as to whether you should pursue HIPAA-compliant accounting software or go with medical practice management software that includes medical billing as a primary feature. Some software professionals argue that any confidential patient information relevant to HIPAA should not be stored in accounting software and even go as far as to suggest using specialized software developed specifically for medical billing.

Without a dedicated accounting system tied into your medical practice management tool, standard accounting workflows may be difficult to accomplish at your organization. Health offices need to bill both insurance agencies and the patient or even collect co-pays with cash in hand. All of your patient information can be stored in a practice management solution, but how do we easily transfer their billing info into the accounting program? This situation can lead to many cases of duplicate entries, which can cause a loss of time for your organization.

Many software programs can be used in a compliant manner. By definition, any software that avoids HIPAA violations is technically HIPAA compliant. There is no governing body that will officially stamp a software as being HIPAA compliant. Whether the software is marketed as HIPAA compliant accounting software or as medical billing software, you can rest easy knowing they are providing you with the same functionality.

You’ll want to make sure your accounting software provider is a covered entity, which means they are handling your ePHI in a compliant manner. This means any invoice you are sending out to your patients or the insurance companies will not be in any sort of violation.

Is QuickBooks HIPAA Compliant?

While QuickBooks Online does provide adequate online security on par with GAAP accounting industry standards, it is not compliant with HIPAA standards for privacy.

Many smaller medical practices may find comfort in QuickBooks’s familiarity, ease of use, and low price. When it comes to patient billing and refunds, it’s natural to want to use your core accounting program, QuickBooks. However, patient names, addresses, and medical record numbers are PHI and should not be used within QuickBooks.

While QBO can do invoicing, it was not designed to handle medical billing. Your HIPAA compliant accounting software or medical billing solution is best suited for handling insurance invoices, cash payouts, deductibles, and co-pays.

Can QuickBooks Online Be Used At All In My Medical Office?

If you are creating an invoice for a customer that includes their name, address, and account number with a non-HIPAA compliant cloud-based solution, that can be considered to be violating HIPAA regulations under federal law. But there are workarounds that you can utilize to prevent your pratice from facing HIPAA violations.

These include:

- Using a unique identifier for a patient: Rather than using the medical record number or their account number, you can use a unique customer ID. Your staff will have to do a bit of extra work to match the unique customer ID with their medical record number, but as long as anything considered PHI is not recorded in QuickBooks, you won’t be in violation of HIPAA.

- Avoid account numbers altogether: If you are printing a refund check or an invoice that will be mailed to your patient, you can simply choose to include their name and address. The issue isn’t even about the information on the invoice or refund check. The issue lies in what information is stored digitally in your QuickBooks program itself. As long as no PHI is stored in the program (mainly their medical record numbers) then you won’t be in violation.

- Summarize your revenue: By using sales summary receipts or invoices to record revenue by service, by the insurance company, or by patient type, as long as you avoid using any PHI, you are free to categorize this information into QuickBooks Online.

While you may not be able to look up patient records and check their personal care history in QuickBooks Online, you can still monitor the ongoing financial performance of your clinic on a month-to-month or year-to-year basis. You can break down revenue that is brought in from insurance companies and cash-paying patients and monitor expenses that were specifically for performing treatments.

The bottom line is while it is possible to use QuickBooks Online in your medical practice, patient health information must be de-identified and protected.

What Does My Medical Practice Need?

No matter what size your healthcare organization may be, you’ll want to make sure you have the right set of functionalities to meet your most pressing needs.

- Small medical practices will want to be able to handle their medical billing, have notifications for patients that are late on payments, track which suppliers require payment, and monitor the contact attempts to collect on these debts (or pay on your own debts). Usually, a system with only one user license is sufficient if you will only have one accountant or bookkeeper accessing the software.

- Mid-sized medical practices will want to look into software that lets you set user permissions. These practices likely have more users needing access to the software, so you will want to limit what type of access they have and the information they can readily view. With increased users in the system, you’ll also want a quality audit trail that records log-in times, changes made to files, who made these changes, etc. In the case of any information breach, you should be able to track down any involved individuals.

- Large medical practices may need to integrate with electronic health record systems (EHR software) or look into fully integrated hospital management software to ensure they have all of their functionality under one solution. This can limit the exchange of information between programs and ensure all of your data is secure within one system.