The Best Apparel ERP Software

Apparel ERP software optimizes workflows for the entire supply chain, from initial production to final sale. We’ve analyzed the top platforms on the market for manufacturers, distributors, fashion brands, and wholesalers.

- Serves all soft goods

- Scalable for mid to large-size companies

- Advanced EDI management and reporting

- Multi-channel sales and multi-warehouse inventory

- PLM and CRM included

- Offers integrated accounting

- Manages apparel and textile manufacturing

- Synchronizes data

- Browser-based software

Whether you operate an eCommerce store or produce multiple apparel lines, these solutions help streamline workflows and automate your processes. Using our review methodology, we evaluated and ranked the top apparel ERP systems.

- BlueCherry ERP: Best Overall

- ApparelMagic: Best for Apparel Manufacturers

- Aptean Apparel ERP Full Circle Edition: Best for Wholesalers

- A2000: Best PLM Module

- AIMS360: Best for Distributors

- Infor CloudSuite Fashion: Best for Global Operations

BlueCherry ERP - Best Overall

The demand planning and forecasting module in BlueCherry ERP is purpose-built for the apparel and fashion sector. It pulls live data from several sources, including multi-channel sales history, seasonal patterns, supplier lead times, and inventory levels across warehouses. From there, BlueCherry uses algorithms to project demand for each SKU at various levels, from style and color to size and location.

It can model trends at:

- Weekly or monthly intervals

- Store-level or distribution centers

- Product lifecycle stages, like new launches and markdowns

You can even run simulations to see how a spike in eCommerce demand might impact your warehouse stock or how a price promotion could boost unit velocity. Overall, this apparel software is adept at helping you pivot production and sourcing plans as trends shift.

While BlueCherry doesn’t disclose pricing publicly, it’s ideal for mid-sized to large apparel and fashion companies. Our research indicates that medium-sized businesses can expect to pay between 4,620 and $5,160 per month for an ERP system.

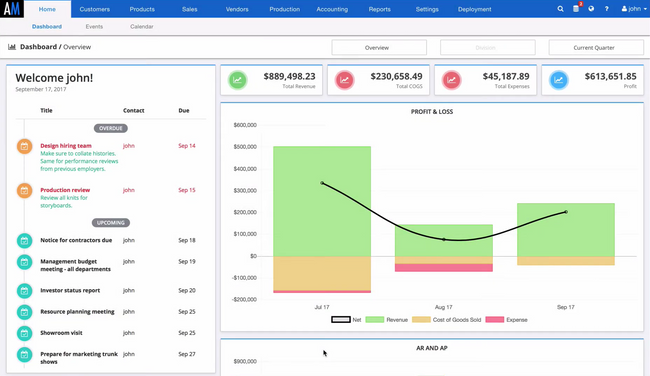

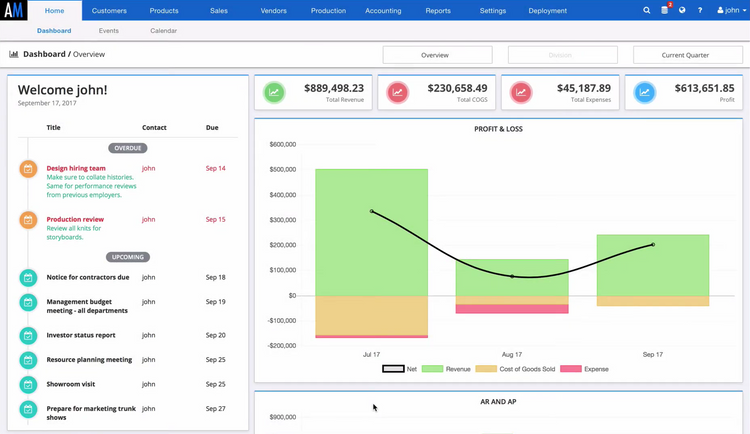

ApparelMagic - Best for Apparel Manufacturers

ApparelMagic offers strong features specific to manufacturing. Its smart purchasing tools shift with the needs of consumer demand to allow companies to source the correct amount of materials. With demand-driven purchase orders, manufacturers can keep up with new customer trends.

Additionally, its order management system supports wholesale, B2C, B2B, and eCommerce, as well as multiple sales channels. It also has a built-in CRM module, ideal for companies wanting to build strong customer relationships. However, ApparelMagic’s manufacturing module is only available in its Professional plan at $255/month.

Aptean Apparel ERP Full Circle Edition - Best for Wholesalers

Aptean Apparel ERP Full Circle Edition’s built-in inventory management system streamlines operations and optimizes stock levels. Specifically, its sales forecasting tool helps predict future demand by analyzing sales histories. This helps wholesalers prepare for seasonal fluctuations or unexpected trends.

The inventory module is also ideal for large wholesalers with its multi-location tracking. Companies using several channels and warehouses can track detailed item lists across them all, helping monitor movements in real time. Plus, when managing diverse product lines, the system includes a style-color-size matrix, so all variations are accounted for and accurate.

Aptean Apparel ERP Full Circle Edition is best for large to enterprise wholesalers with significant inventories. However, because of its breadth of features, implementation requires a significant time investment.

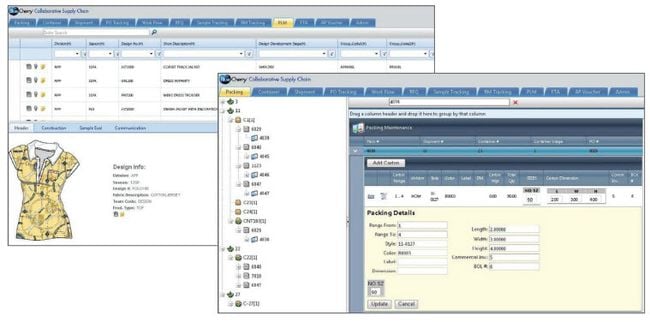

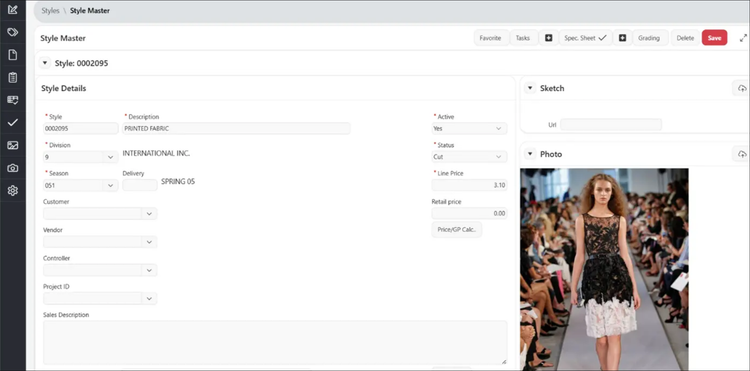

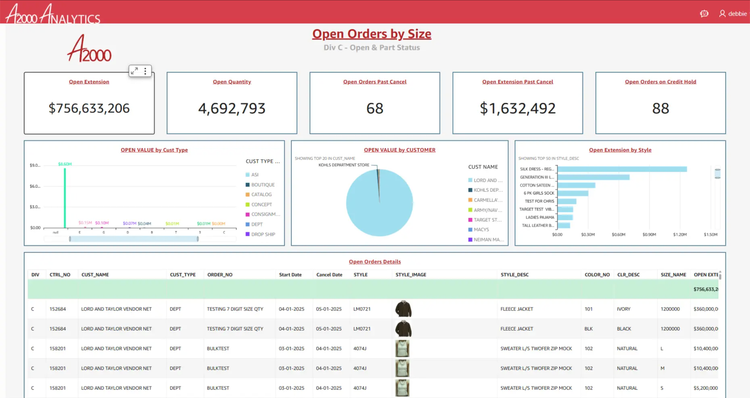

A2000 - Best PLM Module

A2000 boasts an effective PLM module for apparel and footwear companies. Its PLM module lets you import sketches and images, access a personal library of fabrics, and create lookbooks within the system. It even includes a vendor portal for easy requests and approvals, helping designers save time on tedious tasks.

A2000’s other modules, like MRP, EDI, and WMS, also streamline the other aspects of apparel processes. The combination of financial and production lifecycle control allows you to streamline your operations across the entire supply chain. However, we found the UI a bit dated, which could impede users looking for a more modern system.

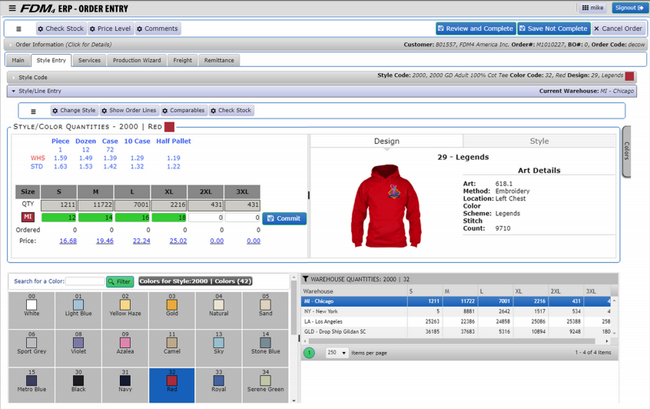

AIMS360 - Best for Distributors

AIMS360 is an ERP system specifically for fashion manufacturers and distributors. Its styles module lets you organize all of your offerings with specific information like color, size, and images. Plus, the Style matrix and price sheets help reduce time spent on data entry and organizing different price points for customers, letting you target a wider audience.

AIMS360’s UPC barcode management and pick ticket system are also effective for distributors. These features can optimize product organization and accurate order picking, ensuring that the correct product is selected and shipped. The system integrates with UPS, FedEx, and USPS, as well as eCommerce platforms like Amazon and eBay, creating an effective multichannel system.

Infor CloudSuite Fashion - Best for Global Operations

Infor CloudSuite Fashion is designed for large fashion and apparel companies managing complex, multi-site, and international operations. It supports manufacturing, distribution, and regional compliance all from a single platform.

The system is built on the Infor M3 ERP platform and provides core finance, procurement, inventory, and production functionality. CloudSuite Fashion then layers on industry-specific capabilities like style-color-size matrices and seasonal planning to help companies manage complex product variants and shifting trends. It also includes tools for warehouse management, e-commerce, and order processing, enabling support for a wide range of fashion business models such as:

- Produce-on-demand

- Circular fashion

- Direct-to-customer(DTC)

The wide breadth of features makes CloudSuite Fashion well-suited for brands needing to coordinate production across regions and manage multi-tiered supply chains. Its cloud deployment makes the platform scalable with faster updates and easier access for international and large teams. One tradeoff is that advanced tools like PLM and enterprise reporting are not included by default and may require additional licensing. For pricing details, Infor recommends requesting a demo or speaking with a representative.

What is Apparel ERP Software?

Apparel manufacturing ERP software manages the ordering, inventory, and assembly of clothing and textile products. A type of manufacturing software, apparel ERP systems utilize industry-specific features such as product label management, cutting ticket management, season and line planning, and size and color matrices–features that help coordinate their supply chain efficiently and reliably.

Apparel business management software can cater to retailers, manufacturers, and wholesalers by integrating applications for supply chain and logistics, design and product development, manufacturing, and electronic data interchange (EDI). Depending on the solution and your company’s needs, apparel management software can also be used for things like product design and development, customer relationship management, and capacity requirements planning.

The best apparel enterprise resource planning software will combine traditional features such as financial accounting and purchasing along with eCommerce, warehouse management, and customer relationship management (CRM).

- Real-time transactions can automatically generate G/L postings.

- Purchasing can forecast future needs and centralize vendor information related to vendor performance

- Order processing includes style-based entry screens that promote accuracy

- Inventory helps ensure goods are available to complete customer orders

- Manufacturing helps lower operating costs while improving inventory turns through work orders and raw material assembly

Key Features

Apparel ERP solutions often feature:

- Order Management: Includes the creation of shipping notices and invoices for customers, address verification, order status monitoring, backorder management, invoice creation, order cloning, sales tax management, and generation of pick tickets and pack lists for order fulfillment.

- MRP: Streamlines production processes to increase productivity and efficiency. Includes master production planning and scheduling, purchase planning, demand forecasting, shop floor control, and equipment maintenance scheduling.

- Inventory Management: Includes inventory costing, location tracking, and stock count tracking, so you know what you have and where to find it, as well as when to re-order more products for proper inventory control.

- Product Lifecycle Management (PLM): Develop new products faster by aligning data and processes from conception to the design and manufacturing stage.

- Apparel Matrix: Lets you set size, color, and style variations and tracks each product as a separate SKU.

- Planning Apparel Lines and Seasonal Products: Tracks products by season and provides notifications when a specific line or style should be put on clearance or produced for an upcoming season.

- Logistics: Coordinate, calculate, and maintain shipments, shippers, and vehicles.

- Quality Control: Analyze quality-related risks, set quality objectives, implement workflows to achieve standards, and audit for optimal performance.

- Accounting: Tracking of revenue and expenses including accounts payable, accounts receivable, and a general ledger.

Primary Benefits

Apparel business software can help source raw materials, manage manufacturing and quality control, control warehouses, and manage distribution and accounting. By organizing these capabilities into a single centralized platform, users can experience a number of benefits to increase profitability.

Improved Delivery Times

Apparel management systems streamline business processes like inventory management, project management, and logistics so items can be quickly picked, sorted, packed, and shipped to customers efficiently. Having organized processes will help get your products out to customers faster.

Improved Customer Relationship Satisfaction

Faster delivery times improve overall customer satisfaction. Another way to improve that is to use issue ticketing, which will help you keep track of comments or complaints, allowing you to reply quickly and address their concerns. Having an average turnaround time of 1 day (or less, if possible) will give your customers greater satisfaction than making them wait multiple days, weeks, or months for a response.

Decreased Machine Downtime

Equipment maintenance scheduling keeps your machine downtime low. You can schedule, organize, and track regular preventative maintenance and unforeseen critical maintenance tasks.

Language and Currency Translation

Some apparel ERP software can automatically translate languages and currency based on your customer’s location and preferences, so you can cater to a wider client base in various regions and locations.

Improved Data Security and Management of Digital Documentation

Documents, emails, forms, and other key company data can be stored securely and shared with specified users throughout your organization. Manually entering important information can lead to errors and slow your operations. Digital documentation management allows you to securely store or retrieve customer contact or order information, product design documents, and confidential information like credit card info.

What Should Your Business Look For?

Depending on the size of your business, your business will need varying levels of optimization and decision support. Will a simple accounting system work? Or does your business require heavy integration via APIs? Do you need to manage purchase orders, or do you handle a large volume of manufacturing in-house with a bill of materials?

New Buyers and Small Apparel Businesses

Startups and smaller apparel and textile companies are often satisfied with off-the-shelf software that handles basic accounting and inventory management. There are some ERP solutions catered towards small businesses that give you the flexibility of adding modules (such as point of sale or production management) down the road. Many businesses invest in these small business apparel ERP options if they foresee growth and company expansion in the future.

Existing ERP Users

If you’re using something like QuickBooks Enterprise or a small-business ERP system, you’ll want to upgrade to a solution that provides functionalities tailored to your growing business.

Look for an ERP with features like payroll, POS, and production management that offer scalability. When you become a medium-sized business, you’re more likely to need a fine-tuned, apparel industry-specific option instead of industry-neutral software to assist with things like product design and manufacturing, interaction with suppliers, customer service, and order tracking.

Large Companies

Large, enterprise-level businesses use management solutions to automate and manage nearly all of their business processes and management capabilities. Multinational retailers especially need powerful software that can reliably convert currency and taxes and manage multiple warehouses around the country (or even around the world). Apparel sizing also differs from country to country, so if you ship worldwide, you’ll need a solution that provides sizing definitions or conversions based on the customer’s location.

Pricing

Apparel ERP is typically sold on an annual or monthly basis. The pricing depends on a handful of factors such as company size, feature complexity, and license or deployment model type. Below are estimated apparel ERP pricing ranges:

| Tier | Company Size | Annaul Cost | Examples |

|---|---|---|---|

| Low-Tier | 1–50 employees | $10,000 – $40,000 | Odoo, ERPNext, AIMS360, ApparelMagic Essentials |

| Mid-Tier | 50–250 employees | $40,000 – $175,000 | ApparelMagic Professional, BlueCherry ERP (Essentials), NetSuite w/ apparel bundle |

| High-Tier | 250–1,000 employees | $175,000 – $600,000 | BlueCherry ERP (Enterprise), Infor CloudSuite Fashion, Aptean Apparel ERP, |

| Enterprise | 1,000+ employees | $600,000+ | SAP S/4HANA for Fashion, Oracle Cloud SCM (Apparel), Infor CloudSuite Fashion |

Additional Costs

Beyond base licensing, total cost of ownership can increase due to implementation services, custom development, user training, and third-party integrations. Expect added costs for premium support, APIs, and integration, or any advanced modules like WMS or forecasting.