The Best Small Business Accounting Software

We’ve reviewed the top small business accounting software for all industry needs. Whether you’re tracking expenses for a professional services firm or need streamlined invoicing for an eCommerce store, we’ll help you find the best system to streamline your bookkeeping.

- No setup costs

- Discounted intro pricing

- Simple and intuitive

- Use multiple modules at once via tabs

- Includes inventory management and time tracking

- No costs beyond the subscription fee

- Unlimited bank accounts and credit cards

- Unlimited income/expense transactions

- Multi-currency invoicing

To help you find the best small business accounting solution, we’ve researched a wide range of management software and compiled a collection of our best picks for small business accounting software. We evaluated products based on invoicing, reporting, and ease of use to find the best fit for your business.

- FreshBooks: Best Overall

- CustomBooks: Best for Growing Businesses

- Wave: Best Free Option

- Kashoo: Best for Invoicing

- Xero: Best Online Software

- QuickBooks Online: Best Reporting Module

- Striven: Best ERP Option

- NolaPro: Most Customizable

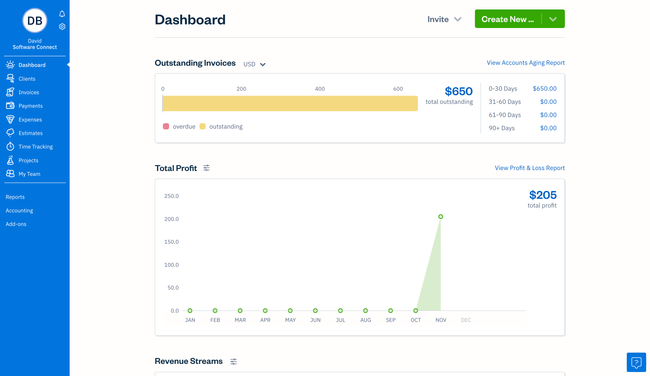

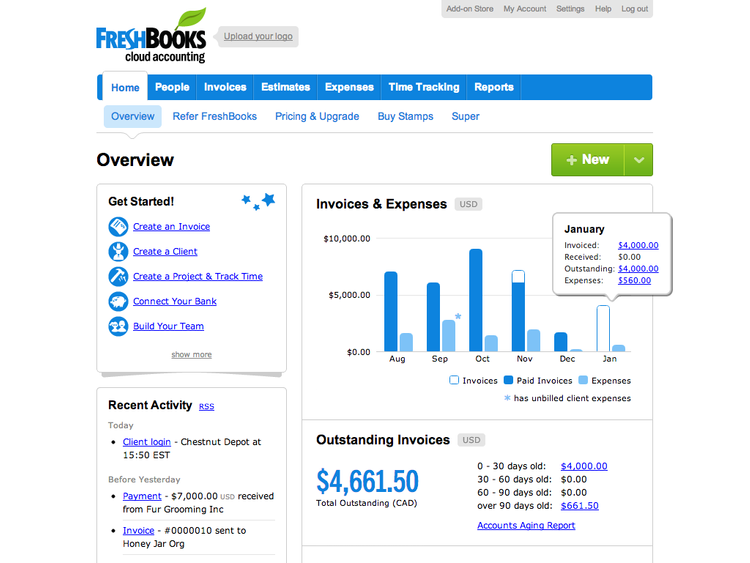

FreshBooks - Best Overall

FreshBooks is a true all-in-one small business accounting software that improves cash flow and automates your administrative tasks such as basic invoicing, organizing expenses, and tracking your time worked on projects. It also offers a large quantity of reports that help monitor the finances and financial health of your business.

The biggest benefit of FreshBooks is what you get included in the price. Rather than offer a limited base version of their software (such as only invoicing), their “Lite” package includes a full suite of unlimited invoices, expense entries, estimating, and time tracking. It can also accept credit card payments and ACH bank transfers and has an automated bank import feature built in.

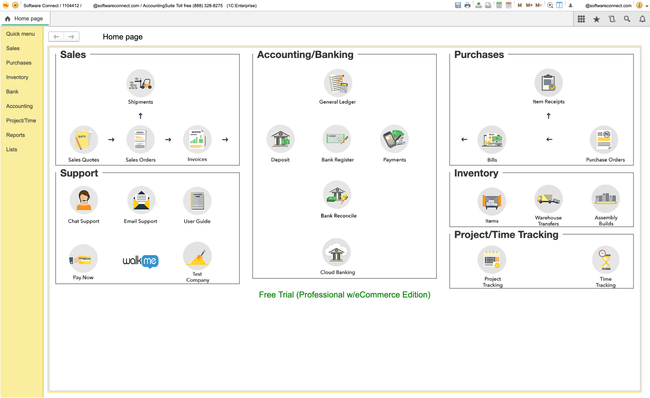

CustomBooks - Best for Growing Businesses

CustomBooks is a basic option intended for the growing small business. Due to offering an integrated suite of banking, sales, purchasing, inventory management, and accounting in its base package, the solution encourages you to continue to use it as you grow and does not require 3rd party add-ons or outside stand-alone options.

CustomBooks includes as many CPA/bookkeeper seats as needed so your accountant can help you use the program. The solution starts at $19/month for 1 user, and the cost is mostly dependent on the number of users.

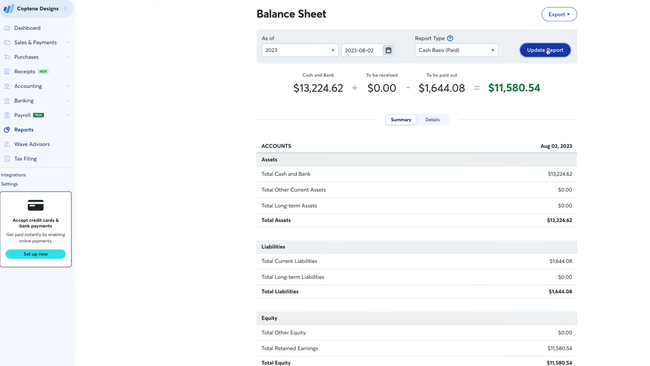

Wave - Best Free Option

Wave is a forever-free accounting solution that offers accounting, invoicing, payments, payroll, and receipts. Wave is very transparent into their pricing structure. The accounting, invoicing, and receipt scanning is 100% free. Collecting payments via credit card or bank transfers, or running payroll for your employees, does come at a price, however.

Wave is not only one of the most popular free accounting solutions, it can also be thought of as one of the most popular accounting solutions period. Because of this, it’s a great choice for freelancers and start-ups who are strapped for cash.

Kashoo - Best for Invoicing

Kashoo is a complete bookkeeping solution for small business owners, providing invoicing, income/expense tracking, and credit card payment processing. However, Kashoo has it’s roots as primarily a powerful invoicing tool, which provides unlimited invoices and unlimited users. You can brand your invoices with your company logo, include payment instructions, and send invoices on a recurring basis.

Billing and invoicing capabilities in in Kashoo will help customers make payments on-time through automatic payment reminders and notifications. Kashoo’s dashboard was designed to quickly enter income and expense transactions. There are some key metrics found on the right-hand side, but the home screen is mainly a form for entering income and expenses, which shows you where it’s priorities lie.

Want more results? Check out our list of best small business invoicing software.

Xero - Best Online Software

Xero is very scalable online accounting software, meaning many small businesses continue to use Xero as they grow into larger enterprises and upgrade to more advanced versions. Because of this, over 1.3 million users have chosen Xero as their primary accounting software.

Online accounting solutions (also known as cloud accounting software) such as Xero provide a “log in from anywhere” approach, which is intended to increase usage given the ease of access. On top of being able to access your financial information from anywhere you have access to a web browser, Xero has a mobile app for iOS devices, which can provide accounting features such as receipt scanning.

Xero learns and categorizes each transaction to help save your business time. Xero also has a large customer support network and an online “checkup tool” that lets the customer support team run some system checks to identify issues and handle issues via chat support.

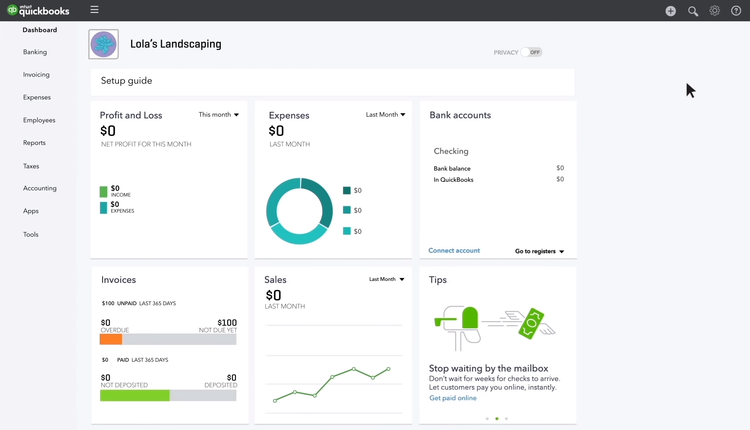

QuickBooks Online - Best Reporting Module

QuickBooks Online is the most popular accounting software on the market, offering an easy-to-use reporting module. The system includes several built-in reports to help you view your business’s financials. You can generate statements with real time data on profit and loss, expenses, and balance sheets with only a couple clicks. This helps small businesses upgrade from Excel spreadsheets to quickly view accurate financial data in digestible tables and charts.

QuickBooks Online’s reports are also customizable. You can edit multiple different fields that are specific to the report you’re running. For example, you can customize a profit and loss report by adding percentages of income and expense or comparisons to the previous period or year. Once you’ve customized it, you can save the report as a template for easy future use.

While QuickBooks Online’s reporting module is effective, many users have cited rising costs and a forced subscription-only model as challenges for small businesses. Its lowest “Simple Start” plan is $35/month, which is steep compared to other systems like Freshbooks or Xero.

Striven - Best ERP Option

Striven is a small business ERP system with strong accounting at its core. The system covers core accounting features like AP, AR, general ledger, revenue tracking, invoicing, and online banking. But, Striven doesn’t stop at the basics, its accounting tools are fully connected to the rest of the system, syncing financials with operations.

The accounting module is designed to drive smarter business decisions. You can tie income and expenses directly to projects, automate financial updates across departments, and generate reports that reflect your entire business. Whether you’re tracking job costs, managing billable hours, or monitoring cash flow, accounting is at the center of everything you do in Striven.

This makes it a great fit for small businesses that need more than QuickBooks but aren’t ready for larger full-featured ERPs like NetSuite. Striven is best for small businesses in construction, manufacturing, field services, and distribution. It starts at just $35/user/month for the basic plan and goes up to $70/user/month for its Enterprise plan.

NolaPro - Most Customizable

NolaPro’s accounting module is highly customizable, making it accessible to businesses across several industries. In the general ledger, you can import your own chart of accounts, or use an industry-specific model that the system provides. You can even compare your current income statement with other accounting periods, ensuring your small business is financially healthy.

Additionally, you can modify existing reports upon request to help them fit your needs. While most accounting systems are built with out-of-the-box functionality, NolaPro is a good alternative for businesses with unique workflows or industries. Each pricing plan includes at least 70+ financial reports, all of which can be altered. For example, a retail store could alter its sales reports to add gross margin and inventory turnover. Or, a construction company could use percentage-of-completion accounting to align financials with long-term project cycles.

NolaPro offers affordable pricing packages for small businesses. Its lowest single-user plan is free to use and locally installed, offering basic core accounting tools. For small businesses, the Starter plan is only $6/user/month, with an optional payroll module for $3/employee/month.

What is Small Business Accounting Software?

Small business accounting software manages financial transactions at a lower cost of entry. By tracking income and expenses and determining profit and loss, businesses can improve their cash flow through an affordable and easy-to-use platform that allows them to spend the least amount of time entering data.

Small businesses will usually only require core accounting features such as accounts payable for tracking expenses, accounts receivable for creating customer invoices, and a general ledger that creates profit and loss statements and balance sheets.

A growing small business may also look beyond basic income and expense tracking, desiring additional functionalities such as payroll services, inventory management, and fixed asset management. Some solutions are scalable and will let you add these functionalities on at a later date.

Key Features

- Accounts Payable: Track expenses by monitoring the money you paid or owe.

- Accounts Receivable: Track income by monitoring the money you received or are owed from invoicing.

- General Ledger: Records financial activity including transactions and account structures. Creates reports such as profit and loss statements and balance sheets.

- Payroll: Manage employee compensation including wages, check printing, ACH deposits, and compensation tax reports.

- Inventory Management: Inventory is recorded as current assets on your balance sheet. The cost of goods sold is also tracked on the income statement.

- Fixed Asset Management: Automates the calculation of depreciating asset value with standard or custom decay models.

Types Available

Small businesses need an affordable, easy to use solution. A company will understandably want to save on their first software purchase and will need a user-friendly option that someone without an accounting background can learn quickly.

Small Business Accounting Software for Mac

Finding a reliable small business accounting software for Mac platforms can be a challenge. This is because the vast majority of solutions are built with PCs in mind. Accounting solutions developed for Macs often have limited functionality compared to similar options on PC.

Developers tend to focus their efforts on PCs because PCs are more common. Net Applications found that only 10% of active personal computers were Macs. PCs are considerably cheaper than Macs, which plays a big part in their popularity. Businesses also find PCs to be a more cost-effective option for running accounting software.

Because of the prevalence of PCs in the workplace, software developers looking to capture both PC and Mac users will create full-featured online and cloud-based options that run easily on both. For example, Xero is a popular online accounting software that is optimized for PC and Mac.

Online Small Business Accounting Software

Online (also known as cloud-based), small business accounting software lets you access real-time financial data from anywhere with an Internet connection. Online software has a low cost of entry, making it a popular option for smaller companies with limited funds.

Cloud-based software is typically lower-cost because it is billed on a subscription model. You will pay a small monthly or annual fee to get access to the software. The developer also handles all of the hosting and you won’t need to spend extra money on additional hardware to download the solution.

Our 2018 Accounting Software Buyer Trends Report surveyed 3,000 software projects and found that 21% of smaller businesses want cloud-hosted software only. Smaller companies were also more receptive to cloud solutions than larger companies.

Free Options

Startups and very small businesses can get away with using free accounting software, but free software will be limited in functionality. You will also be limited to one user, and will usually have a small threshold when it comes to how many customer/vendor accounts you can store information on.

Features typically include income and expense tracking, invoicing, and receipt scanning. Additional fees usually apply to credit card payment processing and ACH transfers (per transaction).

Examples of free small business accounting software include:

Cloud-Based vs. On-Premise Software

| Cloud-Based | On-Premise | |

|---|---|---|

| Payment Model | Monthly payments with smaller upfront costs for setup | Upfront charge for license with annual maintenance fees |

| Deployment | Hosted by developer | Installed on your server or computer |

| Accessibility | Accessible from anywhere with an Internet browser | Accessible from the system it’s installed on |

Cost

Cloud-based accounting software is usually more popular among small companies due to a generally lower monthly cost compared to the upfront prices of an on-premise solution. However, some companies prefer the one-time purchase of on-premise, because they feel more comfortable owning the software or don’t want to worry about ongoing monthly payments.

After years of paying for a subscription-based software, you might end up paying more than if you bought a solution outright. However, many smaller companies don’t have immediate funds to pay for a solution upfront.

Adding users

Online accounting software makes it easier to add additional users as your business grows. Some systems give you a range of users or even unlimited users that you can set up with an account in just a few minutes. Desktop software typically requires you to purchase additional user licenses for each computer you want to install the solution on.

Accessibility

Cloud-based solutions allow you to log into the software from any computer or mobile device. With on-premise software, you would only be able to access your financial data from the computer where the software is installed. A smaller company might need the convenience of cloud accessibility. If an employee is traveling for business or working from home for the day, they will have easy access to the data if needed.

Data backups

Online software generally allows automatic cloud data backup. Depending on the package, there may be a storage capacity limit. Desktop software requires data to be backed up manually.

Security

Some business like the idea of having their data secured on designated computers within the company instead of storing data on the cloud.

Frequently Asked Questions

Why do small businesses need accounting software?

Small businesses use accounting software to save time, reduce manual errors, stay tax compliant, and maintain clear records of income and expenses. It helps improve cash flow management and makes financial reporting easier, especially for tax filing and loan applications.

What features should I look for in the best small business accounting software?

Key features to look out for include invoicing, bank reconciliation, expense tracking, reporting, tax calculations, and integration with other business tools like CRMs and payment processors or add-ons like payroll. Look for cloud access, ease of use, scalability, and customer support.

What is the best accounting software for small businesses?

The best options include FreshBooks, CustomBooks, Wave, Kashoo, Xero, QuickBooks Online, Striven, and NolaPro. The best choice depends on your budget, business size, industry, and required features like inventory tracking or payroll.

Is free small business accounting software reliable?

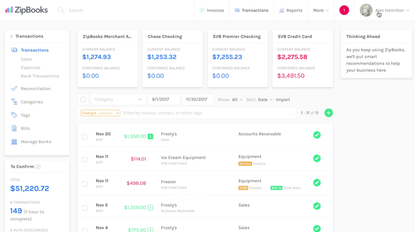

Yes, many free tools like Wave and ZipBooks offer essential accounting tools like invoicing, expense tracking, and basic reporting. They are reliable for freelancers or micro businesses. However, free options will only get you so far before it’s time to upgrade.

Can I use accounting software without an accountant?

Yes, most small business accounting software is user-friendly and built for non-accountants. However, it is still recommended to consult an accountant for setup, tax advice, or complex reporting requirements.

How much does small business accounting software cost?

Costs can vary widely. Free plans exist for basic needs. Paid plans range from $25 to $400 per month, depending on the scope of features desired.

What’s the difference between bookkeeping and accounting software?

Bookkeeping software records daily transactions. Accounting software includes broader tools for financial reporting, tax filing, payroll, and invoicing.