Types of Construction Billing & Best Practices

Construction accounting is undeniably complicated and unwieldy, yet you need it to ensure your construction business gets paid accurately and on time. Fortunately, you can improve your cash flow processes by learning about the best construction billing methods.

The top construction billing methods are:

- Lump Sum

- Progress

- Arrears

- Time and Materials (T&M)

- Cost-Plus

Lump Sum

Lump sum billing occurs when both parties agree to the price of an entire project before construction begins. Lump sum payments provide several advantages to contractors since they know they will have the necessary funds before a project begins. Also known as advanced billing, it is a method used by construction companies to protect themselves from unforeseen expenses that might arise during the project. It can also create wide profit margins for jobs that finish ahead of schedule or under budget.

However, there can be several disadvantages to using the lump sum method. In large jobs, for instance, there are several milestones and phases that can take months or even years to complete. Often, the fixed price is invoiced to the owner at set intervals during the project. This can cause issues if there are unanticipated expenses, as contractors can be left covering the costs themselves since the client has already paid. Because of this, a lump sum contract is best used in small projects where the workflow is more certain.

Progress Billing

Progress billing process occurs alongside the project, either based on a payment schedule (e.g., weekly, monthly) or project milestones. Your company may want to bill based on progress for several reasons, including more direct funding of project costs such as equipment, labor, and subcontractors during work-in-progress.

Most contractors prefer this method when dealing with large, long-term projects to ensure that some form of payment is regularly received. In addition, you gain some protection against clients who may pay late or not at all.

Since this payment method depends on a project’s progress, it is also beneficial to clients who can make their payments as they see changes in progress at the job site. They can enjoy greater flexibility by breaking up lump sum payments into more manageable, periodic payments over the course of the project. However, late payments impact this billing method the most, as contractors can halt construction jobs until the funds are received.

Arrears Billing

Arrears billing occurs after a project’s completion and, like lump sum billing, is often collected as one total payment. Construction contracts will indicate what counts as “completion,” as this may vary based on the project type.

This method allows contractors to adapt job costs as the project progresses. Invoice markup can indicate exactly why more payment is expected at any point, such as the scope of work increases since the start of the project or increased material costs. While not used as often as other methods like progress, it can still be used for small projects or work for trusted clients.

Time and Materials (T&M)

The time and material billing method allows the contractor to bill the client for the number of labor hours and the equipment and materials used. To use this method effectively, the contractor must keep highly detailed records of the man-hours and materials used so the client receives an accurate bill.

This method best suits projects that need an open-ended timeline, have an unclear end goal, or have an uncertain end cost. When using the time and material method, multiple changes to the order can be made during the construction process. Depending on the contract, a contractor may choose to mark up the cost of the materials to increase their profit margin. This method is best for small subcontractor jobs and self-perform work.

Cost-Plus Billing

A cost-plus contract involves the owner paying the contractor for the cost of a project plus a fee to cover the contractor’s profit margin. It requires a detailed list of direct expenses for the project as well as indirect costs like administrative expenses. Because of the detailed invoicing for all costs, it is a good option for contractors with large projects that have constant changes and rising costs. It also helps the owner know exactly what they’re paying for through itemized invoices. Plus, the contractor is nearly always guaranteed to make a profit.

On the other hand, the cost-plus billing method may pose some risks for the owner. In some cases, owners are unaware of the overhead costs associated with the project and have to pay for expenses they weren’t prepared for. The method is also extremely detailed, so contractors must spend time preparing expense reports to ensure the owner knows exactly what they’re paying for.

Which Method is Best?

The method you use will largely depend on the scale of your projects. Both arrears and lump sum billing methods are preferred for short-term construction projects since there is a shorter turnaround between completion and payment. Progress billing and cost-plus are usually reserved for larger projects, which will need a regular influx of cash to cover all expenses.

Other than the scope of the project, the billing method primarily depends on your preferences. For example, a cost-plus contract would indicate both expenses and potential profits. With the progress billing or arrears methods, contractors can measure changes in their profit margins as the project continues.

Fortunately, each method can handle various payment types, including traditional checks, credit cards, electronic fund transfers, and online payments. Even cash can be accepted, though, for legal reasons, there are usually limitations on how much can be given and in what context.

There are also financial regulations to consider when selecting a billing method. For instance, the American Institute of Architects (AIA) created a standardized methodology of progress billing. Construction accounting software that conforms to AIA billing standards includes two key forms: G-702 and G-703.

How to Improve Payments

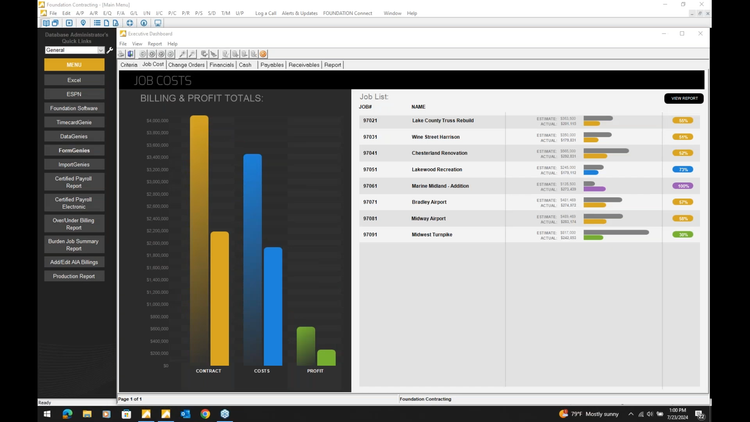

1. Generate Job Costing Reports

Accurate job costing is a must when dealing with construction billing. Before a project begins, you need a clear idea of what labor, equipment, and material costs you’ll encounter along the way. Ongoing projects benefit from job cost reports, which will track expenses and help you generate accurate estimates and bills.

Other important factors to consider with your billing process include:

Construction billing should cover all of the above.

Construction billing should cover all of the above.

2. Create Detailed Invoices

Billing disputes can happen, but you can avoid them by ensuring that your invoices offer as much detail as possible. Detailed invoices start with maintaining detailed records of the money spent on labor and materials. Online and digital tracking tools can help you to keep clear, consistent, and legible records instead of doing them manually on pen and paper, which are subject to the writer’s handwriting and can cause discrepancies.

3. Establish Clear Payment Terms

To ensure you receive payment on time and in the right amount, include payment terms in your contracts and give these details in your invoices. Establish consistent payment terms such as fees, costs of labor and materials, the timing of invoices, proof of expenses, payment method, and the timeframe of when the client must make the payments.

4. Follow up on Invoices

Invoices can get lost or forgotten, and following up with an email or a quick phone call helps remind clients of upcoming or missed due dates. Software with invoicing tools can help you track payment due dates, which will help you determine the best times to contact clients to remind them to make payments.

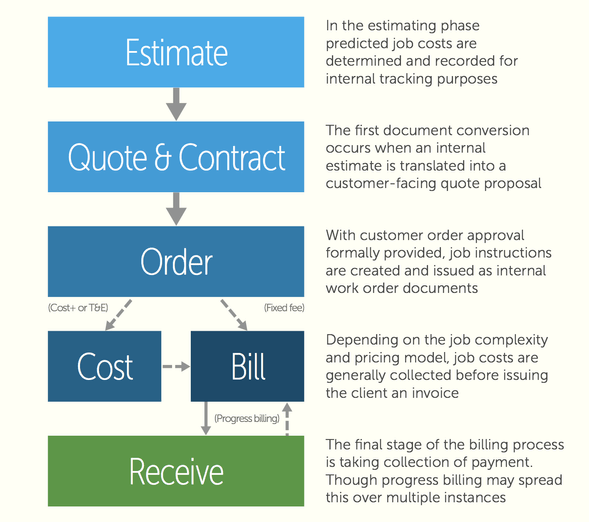

5. Use Construction Billing Software

If you struggle with your construction billing processes, you may be driving up costs and hurting your ability to satisfy customers. Construction accounting software can automate your billing process, from the initial estimate and job costing to the final invoicing and payment collection. Invoice templates allow you to send professional, customized bills to clients with precise cost details and payment due dates.

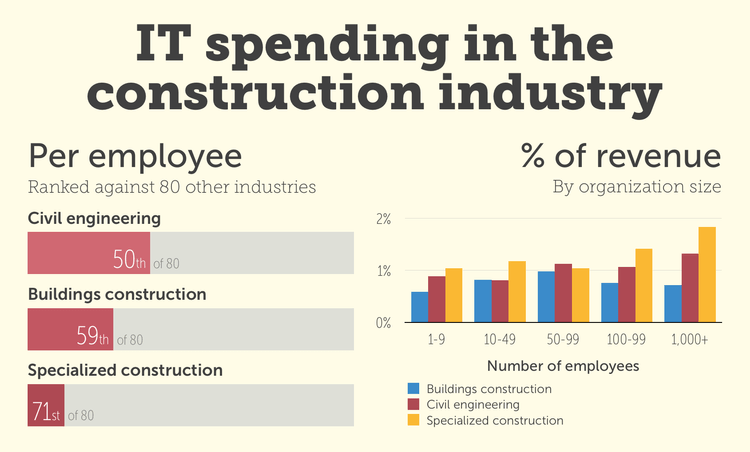

Fortunately, once you’ve tackled your billing practices with the right construction software, you’ve acquired a significant competitive advantage, especially when considering the general reluctance among your industry peers to invest in IT strategically. Software makes it possible to meet critical business objectives:

- Save administrative time

- Reduce errors

- Decrease AR cycle time

- Eliminate scheduling delays

- Coordinate better resource access

- Improve communication with customers and subcontractors

- Provide more accurate job estimating.

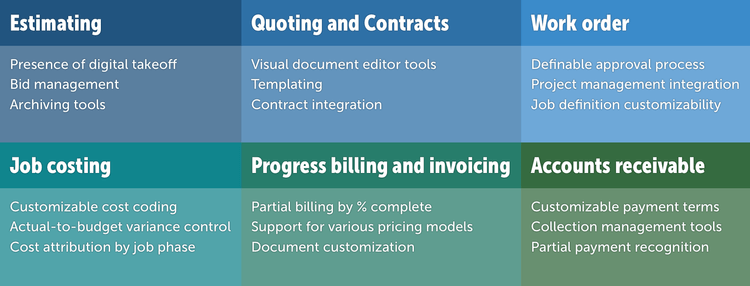

Take control of your construction billing cycle with the right construction accounting software and reap the business benefits that come with automation with several different functional modules: