The Best Legal Software

Legal software streamlines attorney workflows through the use of time tracking, calendaring, legal billing, and document management.

At the heart of your law firm is an information management challenge. Law firms consume and produce a massive amount of data. The ability to effectively manage your time, case and accounting data is critical to running a successful firm. In fact, it’s a major business opportunity, which is why legal software exists.

Increasing productivity, maintaining compliance, minimizing errors, billing more quickly & each offers a chance to gain a competitive advantage in a crowded market. Selecting the right legal software tools is a key step in tackling the information management challenge facing your law firm.

What is Legal Software?

Legal software streamlines attorney workflows through the use of time tracking, calendaring, legal billing, and document management. Managing your legal practice with legal software offers to lower operating costs and deliver improved service through three distinct functional areas: legal practice management, legal accounting, and time & billing.

Each functional area serves the goal of creating a more efficient and competitive firm. Each can be purchased as an individual program. But, it is common to see all three offered together as a complete legal software suite. Understanding the distinct capabilities and benefits of practice management, legal accounting, and time and billing software options can help you determine which is most beneficial for your firm.

Legal Software Key Features

- Accounting: Covers all basic financial needs and provides a safe place to store billing/invoicing information. Includes common accounting features such as accounts payable for tracking money owed to credits and accounts receivable for tracking outstanding invoices.

- Legal Practice Management: Provides a centralized location for legal case management. Allows quick searches of the database, track notes on cases, view documents, check calendars, and monitor for any conflicts of interest.

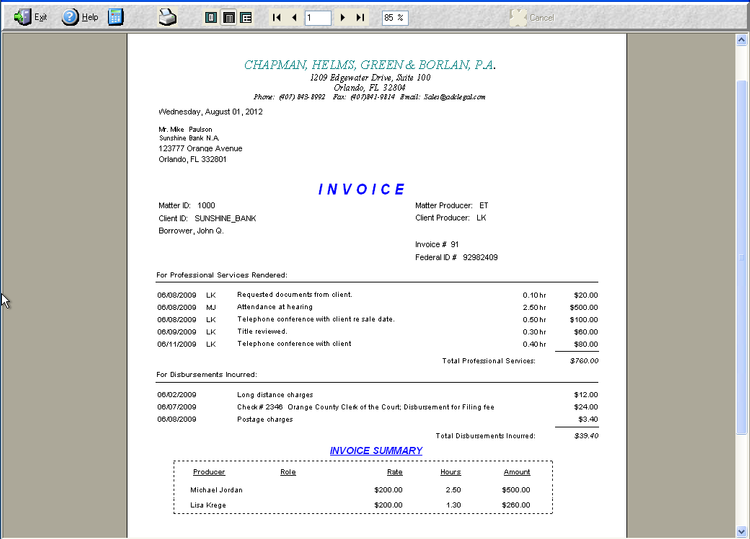

- Legal Billing: Also known as time and billing, these functions track time for the purpose of billing. Assign this time as billable hours and pair it with an appropriate rate agreed upon with your client for work performed, cases worked. Adjust billable rates based on the type of work being performed of the specific employee handling the work.

- Document Management: Handle the storage and management of legal documents electronically. Scan or upload documents into a virtual storage space. Manage your documents by client, case, or employee. Benefits include storing different versions of documents, allowing “check out” functionality to prevent changes from being made, searchable databases, OCR technology, and fax integration.

- CRM: Track customer/client information such as contact details, interactions, due dates, reminders, and more. Law firms can better manage relationships by having client information at their fingertips.

Types of Legal Software

There are many types of legal software available, depending on your needs. Some examples include:

Legal Practice Management Software

Legal practice management software provides contact management functionality to track not only client info but to also let attorneys and other employees record interaction with clients and to associate their related matters. Clients are the lifeblood of any legal firm. An important capability of practice management software is the ability to track client data. An organized approach to client data tracking is critical not only for executing casework but for proper billing and client retention purposes.

Sometimes called case management software, robust practice management software is critical to managing client and case information. A capable practice management program can make a huge difference in promoting visibility and oversight across all of your firm’s clients and matters. In this respect, practice management software offers not only the base functionality to manage client and matter data but the foundation for collaboration across the firm. The right choice in this area can help ensure you are spending less time tracking and searching for information and more time acting on it.

Casework itself is complex. A significant part of this complexity stems directly from the information management challenge. Who owns responsibility for the casework? What information must be databased? What internal resources need to be applied? How will resources be scheduled? Case management features are designed to ease the process of answering these questions.

A critical aspect of tracking client and case information is document management. Practice management programs are designed to minimize the difficulty associated with assembling the relevant client and case data. Common document features include the ability to associate emails and calls with clients and case, easily access related forms, and share data with relevant employees.

Legal Office Accounting Software

Accounting software packages designed for law firms offer a full range of financial management tools, with common features such as check printing, paying bills, tracking expenses, manage payroll, establish budgets, and create top-level financial reports.

Law offices, of course, are not exempt from maintaining accurate accounting records. In fact, law firms face many of the same accounting challenges as other business, as well as some unique ones.

With the right legal accounting software, you are better able to centralize your data. Providing controlled access to resources across your enterprise can help reduce operating costs. Integrated accounting capabilities help prevent data re-entry, minimize errors, avoid penalties or lost business resulting from a lack of compliance, and establish other financial management efficiencies.

Legal firms often have the unique, additional requirement of handling trust accounting. Strong cash management and bank reconciliation capabilities are a must when managing investments across a client portfolio. Assigning which funds can be dispersed, cutting checks, and maintaining proper records are functions supplied by trust accounting software. Generally, basic bookkeeping and more industry neutral accounting packages do not offer the features required for efficient management of trust accounting.

Legal Time and Billing Software

Legal time and billing programs offer the ability to both enter and track hours in real-time, as well as create after the fact time entries, for the purpose of billing.

Your main product, as a legal firm, is the time and expertise of your attorneys. And more specifically, its the application of that time to meeting your client’s legal objectives. Consequently, in most cases, your billing is directly tied to the time spent on your clients’ matters. A capable time and billing program is, therefore, one of the most important information systems for any law firm.

Whether you are billing on hourly rates or flat-fees, time and billing software is designed to flexibly meet your time tracking and billing needs. The ease of which attorneys can track time has a direct relationship with the accuracy of the resulting billing statements. Tedious time-tracking approaches majorly inhibit the ability to accurately track and bill time. The market is rife with companies offering time and billing solutions, though. This competition works to your advantage. Software providers have been continually refining their ability to offer lightweight, accessible, and intuitive time and billing software choices.

What Type of Legal Software Buyer Are You?

Do you require a fully integrated legal software solution? That’s one of the main questions facing you as a buyer. As noted, practice management, legal accounting, and time and billing software can be found as standalone solutions. This sort of standalone approach can be very attractive.

Companies often gravitate toward standalone options in order to leverage existing investments by adding components. Standalone programs may offer more out of the box specialization and the ability to more closely target unique needs.

On the other side of the coin, there are many full systems that offer a complete, integrated approach. This type of approach can decrease ongoing support costs related to maintaining integration.

Complete systems also promote efficiencies related to decreasing the duplication of data that might occur when maintaining multiple systems. Also, a consistent GUI is simpler and quicker to learn. The fact is, there are few industries where the minute-by-minute time spent by users learning software represents as significant of a lost earning opportunity as with law firms.

Another important consideration for legal firms is access to support and services. Implementing a new software program is a major decision not only because of the monetary cost, but the potential impact on time. Data conversion - that is, bringing in your existing data to a new system - is particularly intense for law firms because of the data-centric nature of the business. Additionally, there is a learning curve with new systems. Consequently, for even the smallest firms, it’s almost always advisable to contract with a knowledgeable software partner for implementation, training, and support services.

Is QuickBooks A Viable Legal Software?

QuickBooks advertises itself as being a viable option for your legal accounting needs. While not a “true” legal accounting software (as in, developed strictly for law firms), the software can provide the core functionalities needed to manage your law firm. This includes accounting, billing, and reporting.

There are plenty of resellers of QuickBooks who have experience implementing the solution into law firms, many of whom may have their own custom developed add-ons for QuickBooks that make the software easier to manage or simply provide workarounds where QuickBooks may fall short.

For example, while QuickBooks accounting is likely one of the least expensive ways to track money coming into and out of your firm, you’ll have to record payments from clients by applying “tags” so you know which specific cases or clients they are for. If your caseload or volume is high enough, this may cause a mess if you’re not the type to sift through these.

More industry-specific legal accounting software will likely have a way to create separate files for cases and clients and allow an easier way to flow about your program, review detailed figures (such as expenses incurred for this case for this client in this month), and more.

QuickBooks time tracking tutorial

QuickBooks does have a time tracking functionality, which can be applied towards employees or passed on into an invoice. It provides you with the ability to set preferences to track time and mark those time entries as billable and create invoices from a list of time and expenses, which means you can batch time and expense. Payroll is not required in order to have this time tracking functionality.

For the work performed, you’ll need to create a “Billing Rate Level Name” which you can customize to be a client, or a case, or perhaps certain work performed on a case. Then you can attach a fixed hourly rate for service items performed by “people” with this billing rate level (“people” being used to describe clients, cases, or specific work in a case).

And as always, QuickBooks provides the basic financial statements and reports your business may need in accounting. This includes cash flow, profit and loss, balance sheets, and more. Reports can also run quickly and easily via your phone and be sent to yourself, your clients, colleagues, bank, partners, etc.

Pain Points Solved By Legal Software

- E-billing and OCGs are the most difficult aspect of law firm billing and invoicing. A 2017 report from Aderant found that 54% of respondents said tracking client specific billing requirements and ensuring they were adhered to was the most difficult part of managing legal billing and invoicing.

- Getting employees to submit timesheets on-time. Missing timesheets can mean missing revenue. Luckily, most time and billing applications provide features such as remote access or mobile device support, which should ensure your employees have little to no excuse to avoid submitting timesheets.

- Cybersecurity attacks. Given law firms being in possession of highly confidential client information, it’s no surprise that the legal industry faces increased attacks from hackers. Having proper security measures in place will always be a concern for any law firm as time goes on.

Legal Technology Trends

- Document management provides the most effective benefits. In the above-mentioned report from Aderant, 66% of respondents said document management was the most beneficial tool to today’s law firm, beating out financial/ERP systems (52%) and business intelligence tools (49%).

- Technology is being adapter slowly but surely. As reported by Altman Weil in 2017, 49% of law firms are using technology to replace human resources with the end goal being improved efficiency. That number is expected to grow, as 84% believe this is a permanent trend that will continue to grow.

- Virtual Law Firms. Online legal services have been popping up as of recent. And as you can now find banks that are completely run and operated online, you can find entire virtual law firms. The increase of cloud and mobile applications can let two legal firms on separate sides of the US team up and operate as one fluid organization.