The Best Procure to Pay Software

Procure-to-pay software streamlines all stages of the procurement cycle, from the requisition of goods and services to final payment. We tested the best systems with industry-specific functionalities, like financial tracking and compliance.

- Offers light budgeting, project, and inventory features

- Integrations for most accounting systems e.g. QuickBooks, NetSuite, Sage, Xero

- Free procurement software for 1 user

- Consolidated one-page checkout screen

- Auto-conversion of requisitions to emailed purchase orders

- Offers auditable record of all purchases

- Mobile app for on-the-go access, particularly useful for reimbursement

- Monthly subscriptions offer low per user cost

- Offers insights into spending patterns

Using our in-depth review methodology, we found the best systems for procurement, finance, and IT teams.

- Tradogram: Best Overall

- Coupa: Best for Services Procurement

- Fraxion: Best for Budget Tracking

- Procurify: Strong Spend Control and Visibility

- Tipalti: Strong Security and Compliance

- Precoro: Best Free Open API

- PairSoft: Strong Integration Options

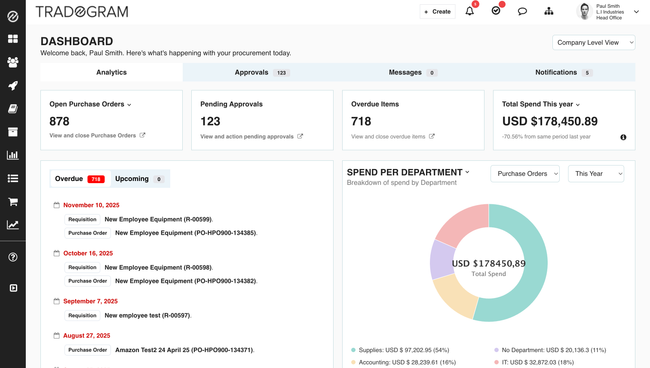

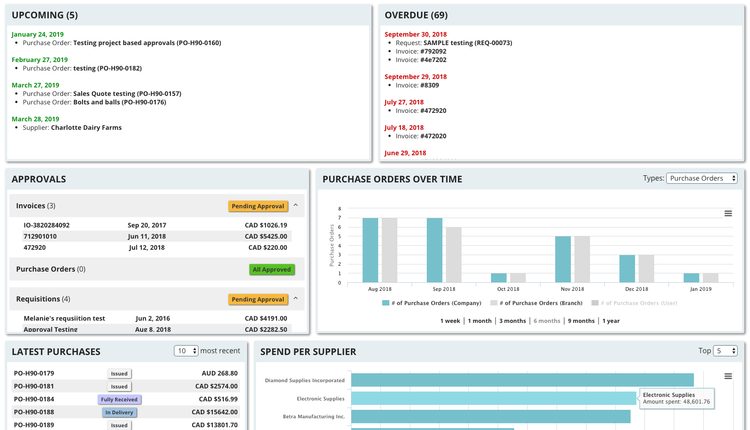

Tradogram - Best Overall

Tradogram offers a supplier management tool that enhances procurement efficiency by streamlining vendor interactions and optimizing performance evaluations.

With Tradogram, you can create detailed profiles for each supplier, capturing their contact information, financial data, and transaction history. This can help you make informed decisions and maintain a clear understanding of your supplier base.

As orders are fulfilled, you can evaluate the vendor’s performance using predefined scorecards that assess delivery timelines, product quality, and adherence to contract terms. These evaluations allow your team to track how well suppliers meet expectations and make adjustments when needed. You can also categorize your vendors based on their geographic location or product type, which can help you quickly filter and generate reports.

Tradogram simplifies the supplier onboarding process with an automated system that guides new vendors through compliance checks and documentation submission. The system also has a built-in messaging system that allows your team to communicate with suppliers, ensuring that all discussions are centralized and can be easily referenced.

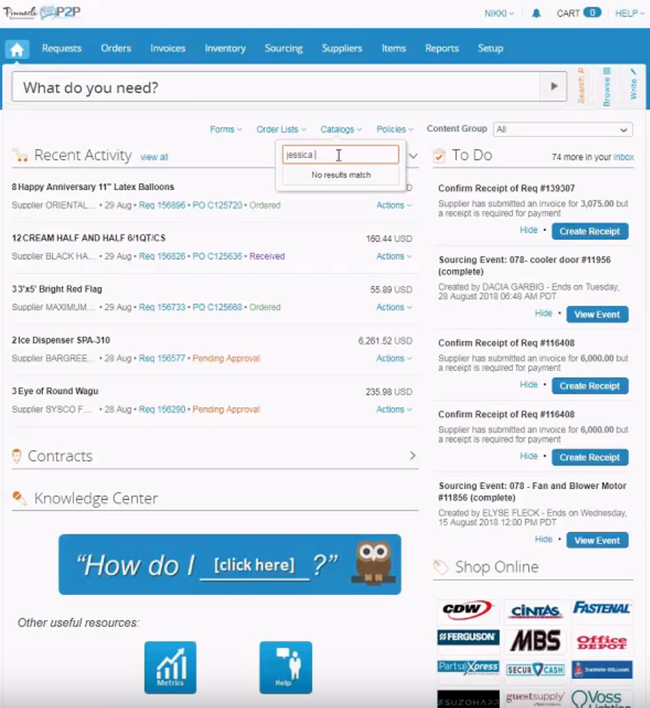

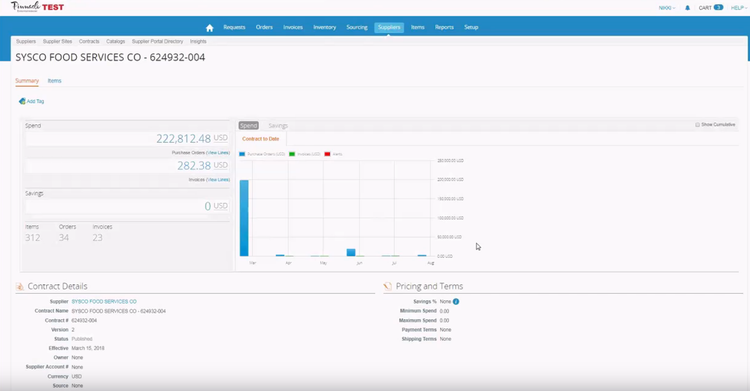

Coupa - Best for Services Procurement

Coupa’s services procurement module allows you to control project-based expenses at scale. When writing requisitions, the system displays supplier rates upfront and carries them through the PO and supplier timesheets. This allows you to compare orders vs. the actual cost of work and identify areas of overspend.

The services procurement module also has built-in rate compliance for greater spending control. You can create automated approvals for time sheet charges that weren’t previously negotiated. Appropriate stakeholders and management can approve any ad-hoc rates before they are charged. This lets you stay flexible for service billing while still maintaining control.

Additionally, Coupa’s service procurement is consistent with items, so the process and UI are the same. You can easily pay invoices directly through Coupa Pay, so you don’t have to jump between platforms to send payments. The system automatically matches negotiated rates with your invoice, so you only pay for completed work.

Coupa is best for midsize companies with 50-1,000 employees in industries like pharmaceuticals and financial services that rely heavily on external labor for project-based work. Small businesses that need more basic features may want to opt for a system like Tradogram. Also, Coupa does not list its prices publicly, so you’ll need a custom quote for exact costs.

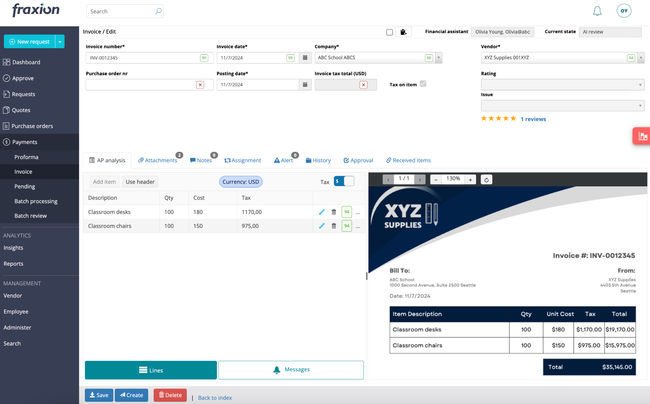

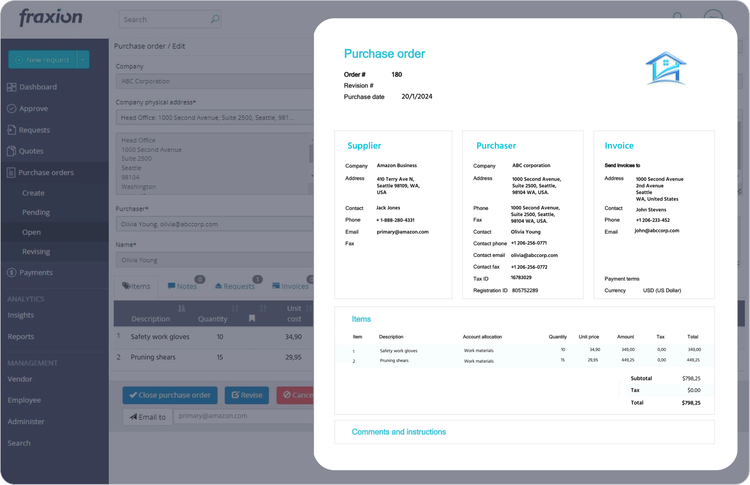

Fraxion - Best for Budget Tracking

Fraxion’s real-time budget tracking module helps you manage expenses company-wide. Create custom limits for all departments, companies, or projects and consolidate them on one dashboard. You can add unlimited budgets per line item on a PO or requisition, with up to 12 segments per structure for flexibility. And when your team is making a purchase, the system shows the potential impact to help them make smarter spending decisions and confidently approve or reject requests.

The dashboard also allows you to drill down to see the total spend by vendor and employee for any given period. For each, you can inspect related documents and purchase orders to flag potential fraud or mitigate risk. This view is also helpful before approvals to avoid over-reliance on one supplier. The data also appears in an easy-to-read graph, so you don’t have to dig through spreadsheets.

Fraxion is best for small to midsize organizations across several industries, like biotech, financial services, and government agencies. For small businesses (10-25 employees), pricing starts at $399/month for the procure-to-pay suite. For mid-size businesses, it starts at $749/month.

Read our full review of Fraxion to learn more.

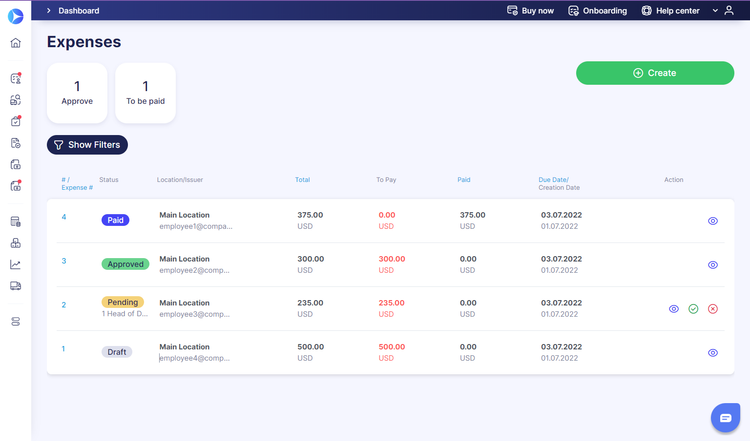

Procurify - Strong Spend Control and Visibility

Procurify is a cloud-based platform built for organizations that need stronger control and better visibility into their spending. It brings purchasing, approvals, and AP automation together, so every transaction is tracked from request to final payment. It’s a single platform that finance and procurement teams can work from while automatically syncing with your existing accounting or ERP software.

Procurify stands out for its spend control and visibility capabilities. Every purchase request is routed through custom approval workflows that you can create based on your unique process. The requests are then tied to the budgets and departments, ensuring that spend stays aligned with your company’s goals before any funds are committed. Managers can review how each request impacts the overall budget, while employees can use the built-in virtual or physical spending cards to make payments and track pre-approved limits. And once approved, finance teams have a clear, auditable trail to follow as all bills, POs, and payments are linked, from procurement to final payment.

Procurify is best suited for mid-sized and growing organizations that need greater accountability and transparency across their company spending without the complexity of more enterprise packages. It integrates with all major accounting systems like QuickBooks, NetSuite, and Sage Intacct, and supports ACH, wire, and check payments in the U.S. and Canada.

Pricing for Procurify requires reaching out for a custom quote that scales based on features and support needed. You should expect one-time setup fees for the initial implementation and setup. And if you don’t need the complete package, you can start with only the procurement or spend management platform and add more as your team requires.

Tipalti - Strong Security and Compliance

Focused on enhancing spend control, Tipalti integrates seamlessly with ERP systems and is known for its security and compliance standards. Its strengths lie in automating manual processes within the procure-to-pay sphere and efficiently maintaining electronic records of procurement activities.

Precoro - Best Free Open API

Precoro offers a free open API and integration with accounting systems like QuickBooks and Xero, emphasizing real-time budget tracking and centralized supplier management. Its cloud-based nature and adaptability make it suitable for businesses seeking tailored procure-to-pay solutions.

Read our full review of Precoro to learn more.

PairSoft - Strong Integration Options

PairSoft, the combination of PaperSave and Paramount WorkPlace, is another top recommendation for managing purchase tracking and approval workflows. It includes comprehensive procurement, AP automation, fundraising automation, and document management solutions. PairSoft integrates with several ERP systems like Microsoft Dynamics, Blackbaud, Oracle, SAP, Acumatica, and Sage.

Read our full review of PairSoft to learn more.

What is Procure to Pay Software?

Procure-to-pay or P2P software manages all aspects of the procurement process for a business, which includes requisitions, purchasing, receiving, paying, and proper accounting for received goods and services. While related to procurement software, a procure-to-pay system goes a step further by helping the purchasing department link with the accounts payable department to ensure a streamlined purchasing supply chain for your company. This can provide deeper insights into the buying habits of your company, improve cash flow, and reduce financial commitments overall.

Procure-to-pay is more of a subset of the procurement process. It manages the supply of needed purchases, enables product requisition and creation of purchase orders, handles receiving and invoice reconciliation, and finalizes the proper recording within accounts payable. The procure-to-pay process can be very complex for some companies. This has led to the development of end-to-end software suites that can automate each step.

Some ERP applications will include core parts of a procure-to-pay process, such as accounts payable and a general ledger module. These ERP systems can have a built-in procure-to-pay process, while some procurement solutions are marketed as a complete procure-to-pay tool that can integrate with your existing ERP solution.

Common Features

- Supplier Management: Manage supplier relationships. Onboard your suppliers into the system, collect outstanding information, attach invoices or receive POs to specific suppliers, monitor supplier risk, and optimize your partner companies.

- Vendor Database: Research vendors and choose the ones to purchase from. Sort vendors by risk score, prices, location, and more.

- Approvals: Manages your purchase requisition process. Users can submit purchase requests for products. Requests are sent to management for approval, and approved requests are sent to vendors.

- Purchase Orders: Create purchase orders and detail product orders. Ship to the appropriate supplier for speedy delivery.

- Inventory Management: Manage receiving and shipments from purchase orders. Once they arrive, enter orders into your inventory. Record any remaining costs to pay vendors and suppliers.

- Invoicing: Create invoices for your accounting department to pay and pair them with purchase orders. Code charges correctly and link them with any organizational budgets.

- Contract Management: Automate contract workflows and extract necessary purchase and financial details.

Primary Benefits

Some of the top benefits of these systems include:

Unified Purchase Management Platform

Procure-to-pay software provides one location for all purchase-related activities, including requests for goods, services, components, tools, and travel expenses. The more uses you find for your procure-to-pay software, the larger the percentage of users who will need access. This can provide better analytics on your spend and hold employees more accountable for any business expenses they incur (or are looking to incur).

User-friendly views on both the back and front end should be considered. Today’s options offer shopping experiences for users, which let them request purchases on goods and services they need to perform their jobs well. These requests flow through the proper channels to management, who have better insight into how purchases affect the overall budget.

Eliminate Errors, Lower Risk, and Prevent Fraud

The automation provided within procure-to-pay software will help reduce the time spent on manual processes, which will reduce the risk of human error. The software will also help keep your supplier information organized in one easy-to-access location. This can eliminate any barriers to communication between buyers and suppliers.

P2P Software vs Spend Management Software

The software is commonly associated with spend management software. A business looking to implement either has the same end goal; to automate their purchasing processes. While marketed under separate names, procure to pay software and spend management software will provide you with the same desired functions.

P2P software focuses on automating the entire procure-to-pay cycle by giving control at each level in the procurement system. This means the flow of data can move along from the department making the request, to the purchasing department to approve, and finally to the accounting department to record.

Spend management software is also used to handle the beginning-to-end management of a company’s purchasing cycle. However, spend management software has a stronger focus in analytics. The solution is best used to analyze spend, categorize your transactions, and look at the performance of your purchasing department. This, in turn, will provide greater efficiency, lower supply costs and risks, and make for more effective collaboration between your purchasing department and the rest of your organization.

Contract Management

Contract management plays a big role in procure-to-pay software as it helps connect spending to individual contracts. This will help turn negotiations into savings for you and your suppliers. Contract management modules usually handle the entire lifecycle of a contract, from request to creation, approval, negotiation, compliance, management, and more.

To better your company’s financial portfolio, contract management functionality within procure-to-pay software will allow access to all necessary financial data included in the contract language. This information can be captured during the contract creation process, or for outside or third-party contracts, some procure-to-pay software will provide OCR capabilities or extract features that can scan any relevant data.

Contracts can be stored and prioritized based on their procurement needs, compliance needs, and ease of ongoing management. Ultimately, this will help maximize the value of your contracts and ensure your suppliers stay happy as they continue to do business with you.

Control Budgets

Budgeting functionality within your procure-to-pay software helps you implement a proactive way to track expenses and invoices and manage your budget before spending occurs. This prevents reactive measures of using old historical data to make future budget decisions.

Budgets can be driven off many pieces of data and created for whatever department, project, or capital you want to drill down into. A budgeting and forecasting tool within a procure-to-pay software can create a full budget adjustments ledger. This ledger will show expense reports, non-PO invoices, and PO creation, giving you line-items details to know what has been approved for your budget.

If the procure-to-pay software has an enhanced end-user shopping experience (complete with a shopping cart that employees/users can add items to), users can be given budgetary details directly in the shopping cart. Prior to any “checkout”, users will be able to see how the purchase of these items may affect their budget.

Budgeting capabilities are built directly within procure-to-pay software to help users feel they own their spending before it is committed to a vendor. Employees and managers may think twice before submitting purchase requests if they can see the potential effect on their project, department, or company’s financial goals.

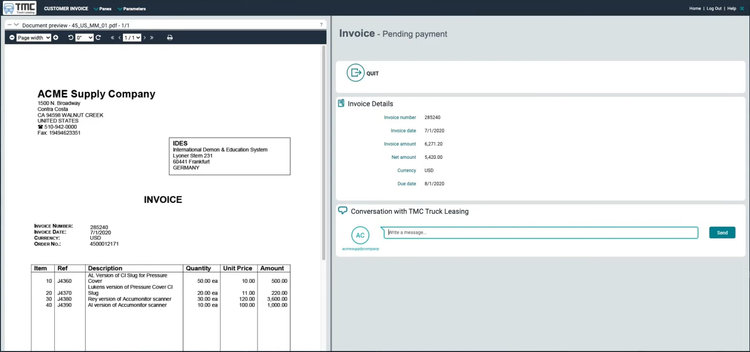

Invoicing

One of the quickest ways to streamline work in your accounts payable department is via improved cash flow via invoicing. Implementing invoicing capabilities via procure-to-pay software will help reduce paper invoices, limit your cost-per-invoice, and improve working capital management.

Within procure-to-pay software, suppliers can send electronic invoices immediately. This capability is offered via a supplier portal, which lets a supplier receive an email and click a button to send an invoice, with no registration or sign-up. These invoices can be handled automatically without the accounts payable department having to do any work at all, except for the occasional invoice approval.

Pricing Guide

Pricing for procure-to-pay systems varies depending on factors like your company size, user count, and desired features. Here’s a breakdown based on company size for the average yearly cost of P2P software:

- Small: $1,000-$10,000 per year

- Growing: $10,000-$30,000 per year

- Large: $30,000-$100,000 per year

- Enterprise: $100,000+ per year