The Best Enterprise Performance Management (EPM) Software

We’ve reviewed the top EPM software for companies across various industries, such as retail and financial services. Our top picks evaluate features like financial planning and consolidations to help you generate budgets and meet financial goals.

- Customizable dashboards

- In-memory data model for faster and more scalable processing

- Supports multiple forecasting models

- Automates planning, reporting, and consolidation

- Integrates with QuickBooks, Sage Intacct, etc.

- Cloud and on-premise implementation

- Spreadsheet-style interface

- Supports all types of financial and non-financial budgeting

EPM software can help your enterprise company meet its financial goals and plan budgets and forecasts more accurately. Our picks evaluate support for various industries, such as retail, and specific functionalities like financial close processes.

- Workday Adaptive Planning: Best Overall

- Planful: Best for Retail

- Prophix: Best Financial Close Tools

- Anaplan: Best for Real-Time Planning

- OneStream: Best for Consolidations

- Vena: Best AI-Powered Analysis

Workday Adaptive Planning - Best Overall

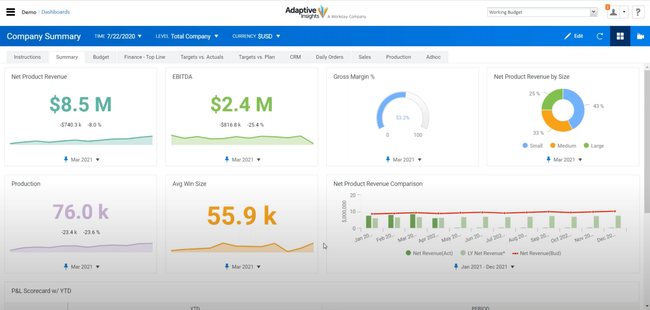

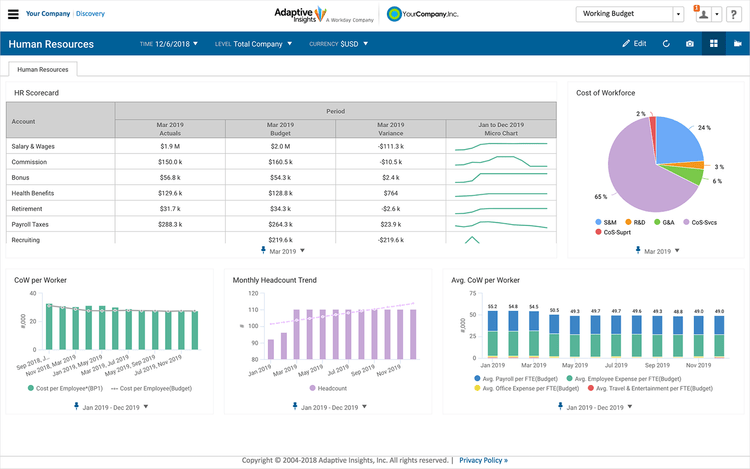

Workday Adaptive Planning’s budgeting and forecasting module is effective across various industries, from banking to retail. You can generate multiple what-if scenarios for different metrics like expenses, workforce, and revenue. When a scenario is made for a potential increase in expenses, you can see how it will affect the entire company, giving you a comprehensive impact of that potential outcome.

The system integrates with leading ERP and financial systems to create accurate rolling forecasts using real time data. You can easily import data manually with just a couple of clicks or automatically on a schedule. The module uses the data combined with the year’s working budget to create monthly forecasts efficiently. Once generated, all dashboards and reports can use the forecast data for quick reference throughout the month.

In Workday Adaptive Planning, you can edit all scenarios and budgets to incorporate new actual data. Say an insurance company has an unexpected increase in sales. They can update their working budget for the year to increase spending and reflect the actual revenue. This flexibility can allow enterprises to adapt their spending throughout the year and not be bound by a fixed yearly budget.

Planful - Best for Retail

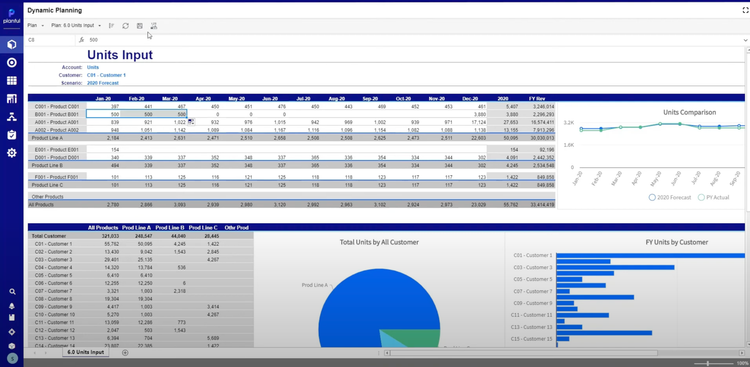

Planful offers a contribution margin analysis tool specifically designed for enterprise retailers. The initial dashboard gives you a broad overview of key metrics, such as:

- Cash flow trend: View your net cash flow and cash balance at the end of a period week-by-week across an easy-to-view chart.

- Operating expense comparison: Quickly see your total operating expenses per quarter to compare performance.

- Revenue by channel: See which channels like brick-and-mortar stores and eCommerce sites gain the most revenue for your retailers.

Using the contribution margin analysis tool, you can create and edit detailed assumptions tables. These help retailers fine-tune revenue projections by forecasting customer sales and product performance. After editing assumption tables, you can refresh P&L statements to update the data, letting you analyze real time impact.

Planful is built for medium to large enterprises, so its price is slightly steeper than competitors like Prophix. We estimate the 3-year total cost of ownership to be between $50,000 and $100,000. That said, it’s worth the investment for retailers looking for comprehensive financial planning and revenue analysis.

Prophix - Best Financial Close Tools

Prophix’s financial close module streamlines and automates the closing process for enterprise companies across various industries. The tool quickly consolidates all financial data across your company, automatically adjusting for global currencies and reporting standards. This helps automate the consolidation process and creates more accurate closing figures.

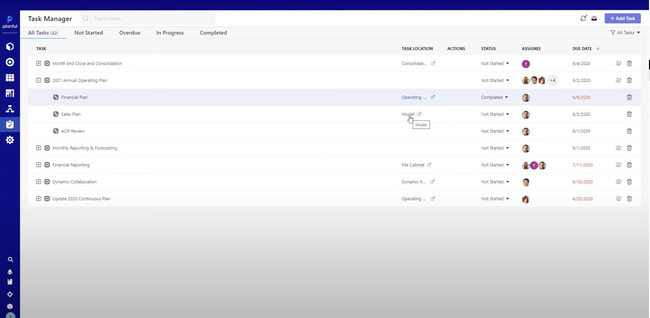

The financial close module features a dashboard that provides an overview of the entire close process. The to-do task list shows each closing process task for each account and its current status. Details like the preparer’s email, due date, and approval status help you manage tasks and complete the close process before deadlines.

Additionally, Prophix’s financial close module has built-in auditability. You can quickly create fully customizable audit reports whenever you need them, helping you verify the reliability of financial statements. This helps your company expedite internal and external audits to ensure the accuracy of finances.

Anaplan - Best for Real-Time Planning

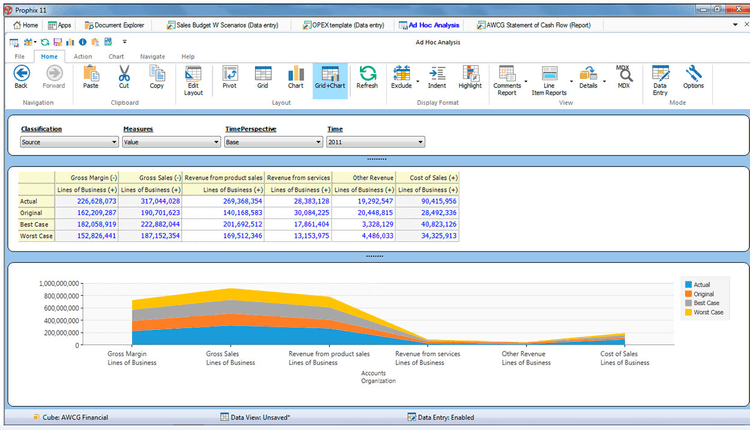

Unlike traditional EPM solutions that rely on batch processing, Anaplan’s Hyperblock technology offers an in-memory calculation engine. It continuously adjusts only the parts of a model that change rather than reprocessing all unrelated data. Instead of locking you out while running updates, Hyperblock works in the background so you can react faster to economic shifts without waiting on system delays.

With Anaplan, you can run what-if scenarios instantly and see how changes in revenue, costs, or cash flow can affect your company. Financial leaders can access live data on capital allocation, while CFOs can gain insights into how inflation and interest rates influence your profitability.

Hyperblock also makes demand forecasting more agile. If supplier shortages hit, leaders can quickly visualize how procurement delays can impact your production schedules and revenue forecasts. Additionally, HR and finance teams can model labor costs and workforce needs to make smarter hiring decisions.

Anaplan’s spreadsheet-like modeling interface combines with Hyperblock to let you easily build and change financial models without needing engineering or IT expertise. This makes it particularly useful for large enterprises in sales, operations, and finance.

OneStream - Best for Consolidations

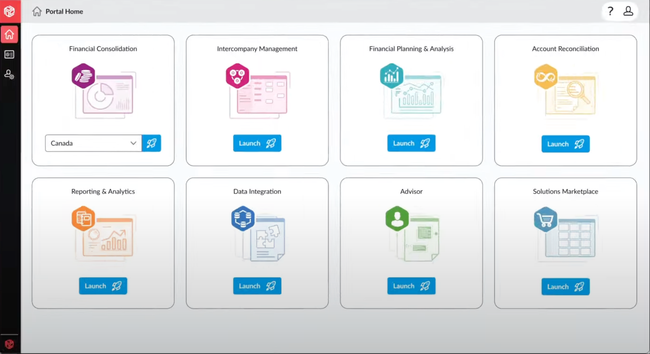

OneStream’s consolidation tools allow enterprise companies to view financial data from disparate systems on one set of statements. The engine supports multi-entity and multi-GAAP reporting from one data model, so you don’t have to maintain separate ledgers or individual point-to-point integrations. It even automates intercompany transaction matching and eliminations, reconciling at local and group levels to reduce your team’s manual workload.

For full transparency, every consolidation adjustment, elimination, and translation entry is traceable. They each have drill-back capabilities from the consolidated statement to the individual ledger or ERP source, so you know exactly where all your data originates. These are presented in clear audit trails, so if there are any suspect entries, you can quickly get to the source. It’s effective during financial close, as your team doesn’t have to spend hours sifting through ledgers and spreadsheets for specific data.

OneStream works best for large companies that have financial information across multiple entities and systems. In addition to consolidation, the platform includes planning, budgeting, and forecasting modules. However, many users have reported issues with its Excel add-on, which could be a problem for teams that still rely heavily on spreadsheets.

Vena - Best AI-Powered Analysis

Vena’s Insights module, powered by the embedded Optics tool and built natively on Microsoft Azure, runs machine learning algorithms across your entire data model. Interactive visuals like decomposition trees let you see what’s behind the numbers, by account, department, or time period, without waiting for custom reports. You can drill down from global metrics to GL-line levels and see breakdowns by dimension, from region to product line to cost center.

Dashboards refresh in real time with smart narratives, using natural language generation to explain trends, seasonality, and outliers. Your staff can understand what’s driving results in seconds in plain English. Because these AI tools are embedded within Vena, you don’t even need to switch systems or configure separate Power BI instances.

Vena continuously scans your data to surface patterns or spikes. Rather than combing through endless spreadsheets, your team sees auto-flagged anomalies and their most likely causes. It shows why something is off, like operational lag or a real market shift, and where to act, instead of relying on user-driven queries. Though Vena doesn’t share costs publicly, it’s generally best for larger businesses and enterprises, putting it in our pricing range from $100,000 to over $200,000/year. Implementation, consulting, and system administration can add significantly to the overall spend.

What Is Enterprise Performance Management (EPM) Software?

Enterprise Performance Management software, sometimes referred to interchangeably as corporate performance management (CPM) software or shortened to EPM, helps monitor key performance indicators (KPIs) and other data sources to track your company’s progress towards whatever metrics your business is working towards.

Traditionally, business processes analyzed through EPM systems are related to a company’s financials, but over time this software has turned into an enterprise-wide option to streamline forecasting, budgeting, scorecards, and dashboards for numerous departments, including sales, marketing, operations, and human resources (HR).

Key Features

| Feature | Description |

|---|---|

| Budgeting and Forecasting | Use real-time data to drive your operations and make both short-term and long-term decisions dealing with financial forecasting, budgeting, scenario modeling, and more. |

| Financial Consolidation | Combine real-time financial data on all assets, income, and expenses generated by your company. |

| Financial Reporting | Create reports on a daily, monthly, or any other time span you’re looking to monitor. Provides real-time financial statements, spreadsheets, management reports, and a level of automation for stronger data analysis. |

| Performance Management | Use personalized dashboards, key performance indicator (KPI) monitoring, profitability analysis, OLAP Analysis, and benchmarks to analyze key metrics in a context your corporation understands. |

| Strategic Planning | Configure your EPM solution with specific methodologies being used by your business, such as Balanced Scorecard, Strategy Map, Six Sigma, SWOT Analysis, and more, whichever is most relevant to your goals. |

| Tactical Planning | Add user-specific initiatives that can combine different goals and members into a clear pathway of movement needed to achieve said goal. This can include a requisition system where users can approve or deny certain initiatives from being changed. |

| Risk Management | Ensure the integrity of your reports through proper audit trails. |

Benefits

Businesses looking to improve their financial planning process and their overall organizational strategy will find EPM software highly beneficial:

- Streamline your financial forecasting and budgeting: By analyzing financial data with an EPM solution, your company can better plan ahead when forecasting and budgeting.

- Set your own key performance indicators: The metrics which indicate success or failure for your company will vary depending on your industry, market share, and more. Measure only those KPIs which matter most.

- Clarify your company goals: By analyzing your financial data and KPIs, you can ensure your company is on track to meet stated goals.

- Increase visibility and transparency: Remain compliant when reporting on real-time data from multiple departments.

Pricing Guide

EPM tools are typically geared toward mid-sized to enterprises, often with more than 250 employees. Costs range from $50,000 to over $200,000 per year.

| Tier | Annual Cost Range | Typical Use Case |

|---|---|---|

| Low | $50,000–$100,000 | Basic planning and reporting for a few departments. |

| Mid | $100,000–$200,000 | Multi-department use with ERP integration and forecasting. |

| High | $200,000+ | Enterprise-wide planning with advanced modeling and analytics. |

Pricing of enterprise performance management software can vary based on several variables. The total cost of an EPM solution is dependent on the size of the business, the number of functionalities or modules required, the number of concurrent users needed, and the overall size of the company.

You’ll also want to consider additional costs that will be important to factor in when evaluating purchasing a solution, such as implementation, training, data migration, and ongoing support with annual updates.

Latest EPM Trends

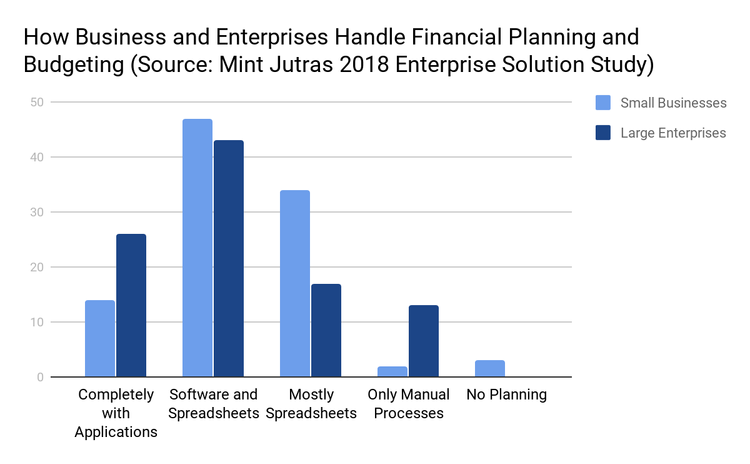

Some of the latest trends in EPM are related to how financial planning and budgeting are being done at differently-sized businesses today. For instance, Mint Jutras put out an enterprise solution study which found a majority of both small businesses (under $250M in annual revenue) and large enterprises were using a combination of software, apps, and Excel spreadsheets to get their financial planning done (47% and 43% respectively):

According to the 2025 AFP FP&A Benchmarking Survey Report: Technology & Data, businesses are primarily using EPM tools for consolidation, not for advanced planning and forecasting. In fact, spreadsheets continue to be dominant for this use case, despite 71% of the survey respondents saying they have EPM tools. While EPM continues to be a growing market, financial teams continue to rely on Microsoft Excel spreadsheets, despite investing heavily in software that was intended to reduce their reliance.

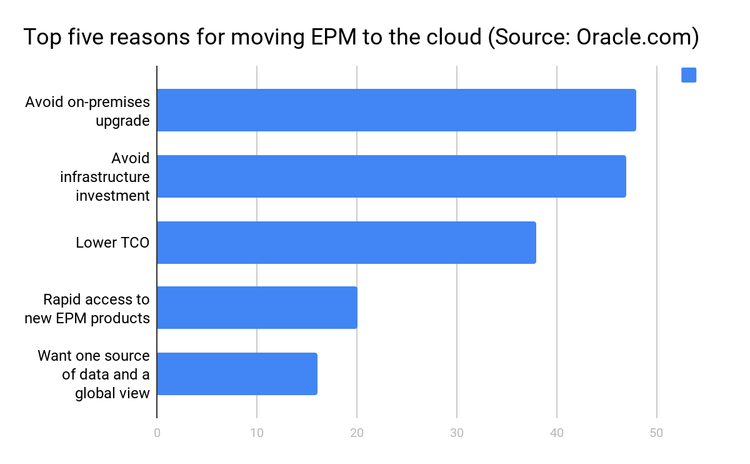

Further, cloud-based BI tool availability is set to increase. A previous market research report by MarketsandMarkets predicted cloud analytics will grow from $35.7 billion in 2024 $118.5 billion in 2029. Oracle’s 2018 EPM Trends Report found that 62% of companies have or had plans to implement a cloud EPM solution within 12 months. That number grew to as high as 79% if you expanded the goal date to 24 months (2 years). Some of the biggest drivers of growth are the emergence of big data and the ease of installation for cloud-based options. The same Oracle report found that the primary reason for moving EPM to the cloud was equally split between being able to avoid upgrades and avoid infrastructure investment.

The final trend is integration with existing and legacy systems. The rise in popularity of cloud EPM solutions has seen an increase in the number of connections or integrations available with third-party on-premises solutions. Popular integrations include enterprise resource planning (ERP), BI tools, and project management software.

Pain Points

While EPM is popular, it’s not without its drawbacks. For starters, organizations seeking software may be misled on what some EPM solutions can and can’t do. This can lead to a company implementing one software for strategy management, another for collecting departmental budgets, and a third to provide the reporting. In reality, finding a complete EPM option from the start could prevent this integration nightmare.

Another common issue with the evolution of SaaS EPM software is the need for better accuracy in planning for the future of a business. The second most common is the delay from data entry in a financial system to when this data is in decision-makers’ hands, which can have some businesses making decisions on older data.

As such, it’s important to know what functionality is included before you select the software. Fortunately, EPM systems can also integrate with popular ERP and business intelligence software systems to cover additional workflows.

EPM vs CPM and BI Tools

Wondering what the difference is between EPM software, a CPM system, and BI tools? There is a lot of overlap to the point where EPM and CPM are often used interchangeably when seeking software. Most of the time, it’s safe to treat them all as synonyms, yet there are times where a distinction is necessary, such as financial planning and analysis (FP&A) services, which should be seen as a subset of EPM rather than a synonymous term.

EPM vs CPM

Enterprise performance management (EPM) software can sometimes be referred to as corporate performance management (CPM) software or even business performance management (BPM). The main difference here is scope: a corporate solution may focus on just one financial department at a company, while an EPM can incorporate finances, sales, supply chain, and more at every level of the organization.

EPM vs BI Tools

When it comes to differentiating EPM from business intelligence, simply put, BI tools help provide the visualizations needed to make decisions, while EPM uses the data accumulated with BI and links that data to the critical goals of the organization. BI functionality can only go so far and typically has an endpoint, while EPM solutions generally pick up the slack where a BI tool has left off.

BI tools traditionally collect data to present in a manner that lets your key decision makers easily decipher it, either on a dashboard or through a visualization of some sort. What BI tools lack is where EPM comes in, as EPM systems can help take the metrics BI tools find and pair them with the vital goals of the company. Essentially, EPM options help a business plan towards business objectives.

Some companies argue EPM will eventually split into a strategic category and an operational category, but until then, EPM software vendors will attempt to meet any and all needs an organization may have.