The Best Medical Accounting Software

Find medical accounting software that supports complex financial processes, from HIPAA-compliant reporting to insurance reimbursements. Our guide includes top picks for hospitals, private practices, and healthcare networks to help you find the best fit.

- Multidimensional reporting capabilities

- Scalability for multi-entity support and user growth

- Simple and responsive user interface

- ViewPoint tool offers strong reporting and analytics

- Scalable, user-based pricing model

- Includes 18 fully integrated modules for different industries

- Hundreds of third-party add-ons available

- Feature sets for multiple industries

- Highly customizable

Medical accounting software manages and tracks financial operations within healthcare facilities, streamlining billing, payroll, and budgeting processes. We used our review methodology to review and rank our favorites.

- Sage Intacct: Best Overall

- Multiview ERP: Best Patient Level Revenue Tool

- NetSuite: Best for Hospitals and Large Medical Practices

- FreshBooks: Best for Private Practices

- QuickBooks Desktop Enterprise: Customizable Reporting Tools

- Zoho Books: Best for Small Medical Practices

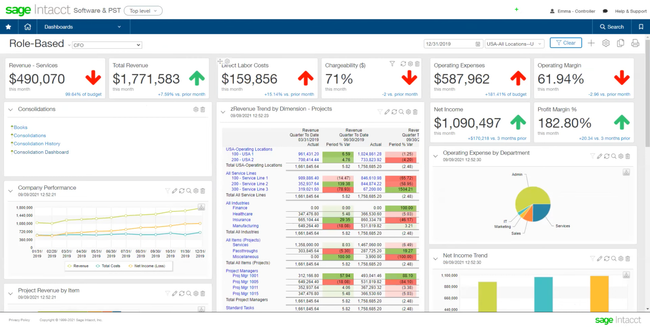

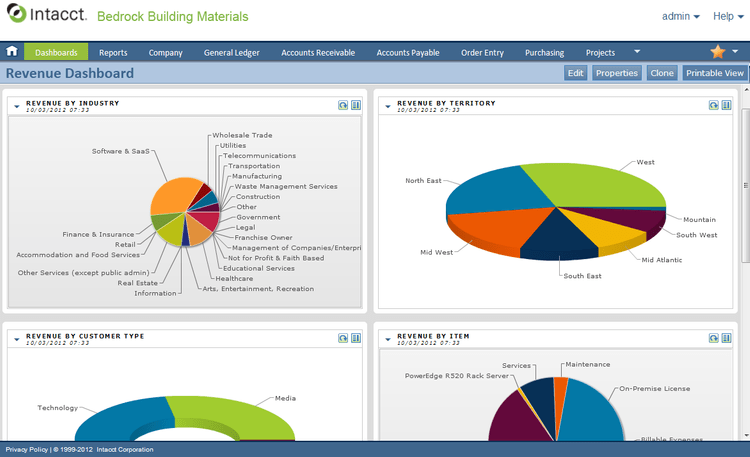

Sage Intacct - Best Overall

If you’re managing several clinics, dental practices, or care homes, Sage Intacct’s multi-dimensional general ledger makes accounting much easier. Rather than building a bloated chart of accounts for every location or service type, you can tag transactions with dimensions like resident, service line, patient, and funding source. This saves you from creating hundreds of accounts for every variation and makes reporting way more flexible.

For example, if you’re running a group of care homes, Intacct tracks each facility as a location under one legal entity. You can pull up dashboards that show you profit and loss by home, cost per resident per day, and even break down staff wages by department. From there, you can instantly filter and compare data to evaluate costs per bed across facilities. You can even zoom out for a high-level view of your entire organization.

Because Intacct shares master data, you can reuse vendors, charts of accounts, reports, and dashboards, so you’re not stuck reentering the same info over and over again for different entities. Click on any blue figure in a report, and you’re taken straight to the source invoice or journal entry. Plus, role-based access means your team only sees what they need to, whether they oversee a whole group or just one division.

Overall, Intacct is highly scalable for healthcare groups. You can spin up new entities fast and avoid the reporting pitfalls often associated with expansion. Pricing generally starts at around $8,500/year, depending on the modules you need. It’s in the same ballpark as other enterprise software like NetSuite, though Sage doesn’t list pricing publicly.

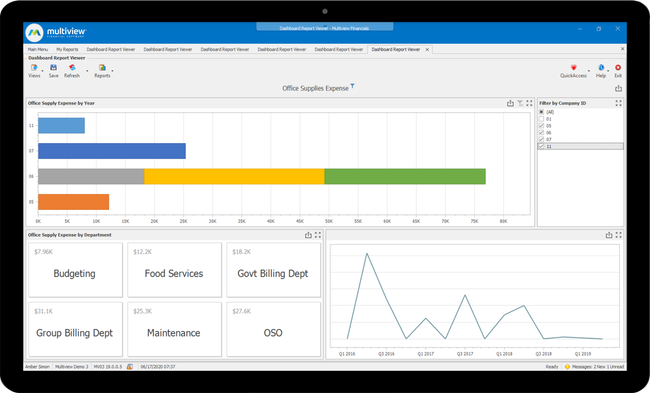

Multiview ERP - Best Patient Level Revenue Tool

Multiview ERP’s EMR360 patient-level revenue tool gives your team instant access to data—no need to jump between separate EMR systems. It pulls patient revenue details directly from electronic medical records, streamlining financial reporting and analysis and ensuring data isn’t siloed within clinical systems.

While traditional revenue reporting often stops at high-level summaries, EMR360 lets you drill into individual patient revenue records. This means faster audits, streamlined reconciliations, and fewer billing or insurance discrepancies. Plus, EMR360 integrates with Multiview’s BI suite, so your finance teams can create pivot tables and graphical reports that break down revenue by procedure, patient, facility location, or provider.

To ensure accurate financial reporting, Multiview auto-reconciles revenue data with the general ledger. It also flags any unposted transactions or discrepancies via push alerts to your accounting team. With all transactions logged and time-stamped, this ERP provides built-in compliance with HIPAA, GAAP, and other regulatory standards. Overall, it’s a solid pick for mid-sized to large healthcare organizations needing an audit-ready financial system.

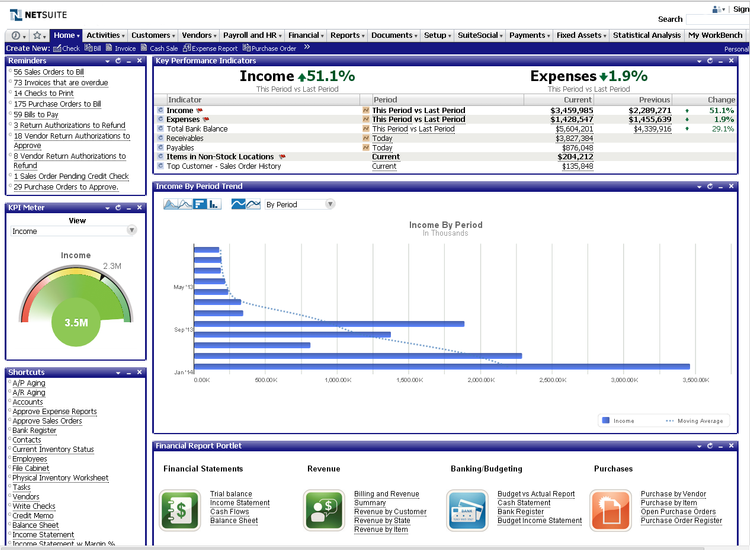

NetSuite - Best for Hospitals and Large Medical Practices

Although NetSuite isn’t marketed as healthcare accounting software, it’s a solid choice for large medical practices and hospitals. Its financial management and accounting tools integrate with other functions like billing, compliance management, and inventory, streamlining clinical, financial, and operational processes for healthcare professionals on a single platform.

NetSuite also complies with accounting standards like GAAP and can help companies meet their requirements with audit trails and real-time compliance monitoring. It can also benefit a company with other international locations by offering global account management, multi-currency support, and language interfaces. However, many reviewers found the software expensive and required multiple add-ons, which increased the overall price.

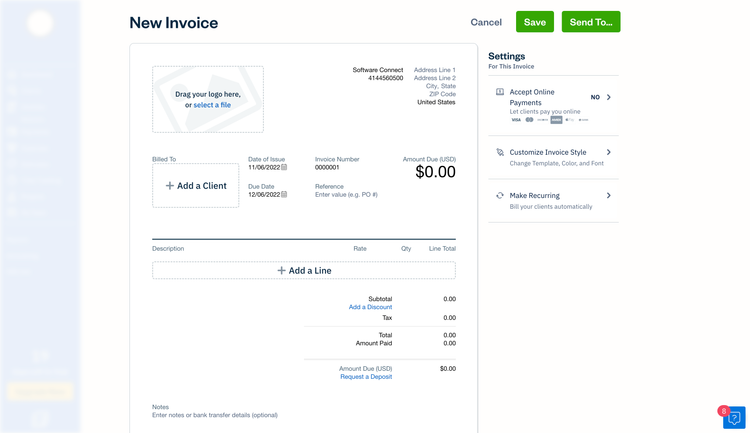

FreshBooks - Best for Private Practices

FreshBooks can manage various bookkeeping needs, such as time and expense tracking, invoicing, and cash-flow management. These features are ideal for mental health practices and consultation-based specialties, especially if they charge by the hour or session.

FreshBooks offers seamless integration options that allow practices to manage payroll and appointment scheduling through the accounting software. Some standard services and apps FreshBooks integrates with include PayPal, Gusto, Salesforce, and Microsoft Office 365. Plus, FreshBooks allows practices to create customizable invoices with their branding and logos. Businesses can then send recurring invoices to ongoing patients, accept online payments, and have recurring billing through templates.

However, FreshBooks may not be the software for you if you have more than one or two people on your accounting team. It limits the number of users in all plans, and it doesn’t offer HIPAA compliance.

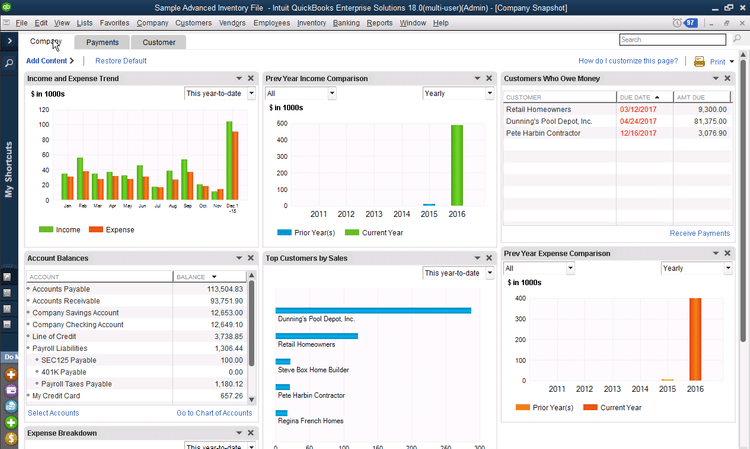

QuickBooks Desktop Enterprise - Customizable Reporting Tools

Due to its scalability, integration, and strong accounting capabilities, QuickBooks Desktop Enterprise is a good choice for small—to medium-sized healthcare organizations with ten to 50 employees. It delivers customizable reporting capabilities to personalize accounts for medical expenses, insurance payors, and procedures.

Additionally, QuickBooks offers tools like accounts payable/receivable, invoicing, and inventory management. This software supports up to 40 users simultaneously and can track multiple locations, which can be especially beneficial if a business has multiple providers or facilities.

However, QuickBooks is not HIPAA-compliant; therefore, organizations can’t create or store any protected health information unless the software is used via a third-party hosting service that supports HIPAA compliance. Another downfall is that once a company expands, QuickBooks Desktop begins to show its limitations by restricting the number of users, chart of accounts, and locations.

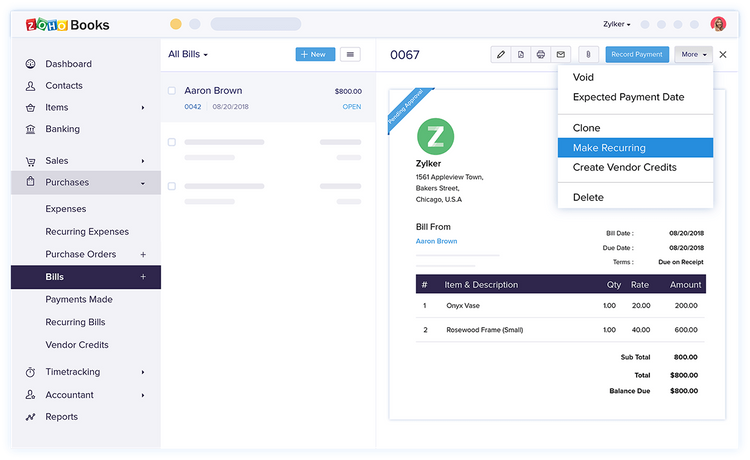

Zoho Books - Best for Small Medical Practices

Zoho Books offers capabilities like invoicing, financial reporting, and expense tracking. This software meets the basic bookkeeping requirements at a very affordable price, with free plans for start-up practices or solo practitioners and paid plans starting at only $15 per month.

For small practices without an accounting team, Zoho Books is a great option. It’s very user-friendly, and its mobile app makes it easy to manage an account on the go. Zoho Books also features integration options that could potentially link to medical billing software.

While Zoho Books could be a good option for small practices and start-ups, it lacks specialized features like medical billing or compliance with healthcare regulations like HIPAA.

What is Medical Accounting Software?

Medical accounting software helps healthcare providers manage their financial operations and accounting needs specific to their industry. This specialized accounting software is designed specifically for healthcare providers, medical practices, hospitals, and other healthcare-related organizations.

The best medical accounting software will feature a variety of traditional and medical-based features, including streamlined medical billing processing, support for multi-location accounting, and compliance with healthcare regulations.

Key Features

- General Ledger (GL): Records all financial transactions like assets, capital, revenue, expenses, and liabilities.

- Accounts Receivable (AR): Manages all debt (asset) collection from patients, insurance, and vendors.

- Accounts Payable (AP): Manages all money owed (liabilities) by your hospital to creditors.

- Payroll: Distributes employee paychecks through direct deposit or check printing. Automates wage calculation based on pay rates and correctly tracks employee tax withholdings.

- Medical Billing: Generates invoices for distribution to patients and insurance companies. Also organizes billing for organizations like Medicare and Medicaid.

- Inventory Management: Tracks all assets like medical consumables, office supplies, and cafeteria food.

- Bank Reconciliation: Matches bank records with your hospital’s general ledger accounts.

Benefits

Here are the best benefits of hospital accounting software:

Streamlined Communication with Insurance Companies

Healthcare organizations regularly deal with insurance companies when collecting payment for services. Medical billing software generates the claim based on the medical codes provided by your hospital. It is up to your staff to start the billing cycle by updating patient files with the correct procedure codes. Once you have a claim, it can be sent directly to the patient or their insurer. Then you just have to wait for payment.

Unfortunately, insurance companies are notorious for dragging their feet when paying out a claim. And that’s only if the insurance company accepts the claim in the first place without denying coverage. Delayed payments can add up in your accounts receivable and make it hard for you to accurately update your hospital budget. Revenue Cycle Management (RCM) applications streamline the claims process by automating payment processing. When those payments finally do come in, you can rest easy knowing your general ledger is up-to-date.

Track Nonprofit Accounts and Charitable Donations

Many nonprofit hospitals depend on donations to operate at the highest possible standard of care. It’s up to you to keep track of how the money is used by your institution. Hospital accounting software makes it easy to record incoming donations to generate receipts for current donors.

For-profit and nonprofit healthcare institutions usually host fundraisers to raise money for specific departments or causes within the hospital. With accurate donation records, your hospital will know when to plan future fundraising efforts.

Easy Accounting Access from Mobile Devices

Cloud-based accounting software lets you double-check your financial data from smartphones and tablets. You could be in the middle of a boardroom meeting and pull up accurate, real-time information from the general ledger.

How Much Does Medical Software Cost?

The typical starting cost for a single user on a basic plan is between $15 and $100 monthly for the service, not including setup or other fees. However, the price depends on several factors, such as the number of providers and users, the practice size, the features and functionality, and the integration needs with other medical software. Depending on which software best suits your practice, prices could quickly increase to the thousands.

What Software Does My Hospital Need?

The type of software your hospital requires will depend on several factors like size, funding, frequency of inpatient vs. outpatient services, and whether you are a for-profit or nonprofit organization.

- General hospitals offer any healthcare institution’s widest range of services. As such, their accounting software needs to be just as comprehensive. Your hospital has to be able to accurately bill all your services, like emergency room visits, labor & delivery, and medical imaging. It also needs inventory management of consumables like gowns, gloves, and other single-use materials. You’ll want an ERP-style software suite which offers as many applications as possible.

- Specialty hospitals always have a specialized function, like serving as a trauma center or only serving pediatric patients. Get specialized accounting software to handle your medical billing. In particular, medical billing and invoicing modules help specialty hospitals stay on top of invoices to patients and insurance companies.

- Teaching hospitals are a great way for medical students to learn about how the healthcare industry operates. If your teaching hospital is affiliated with a university, the school may distribute your funds.

- Government hospitals, as tax-funded entities, need to be totally transparent with their finances. Use a detailed general ledger application to record all accounts for accurate reporting when it’s time to review your annual budget.

HIPAA Compliant Software for Hospitals

Hospitals have to work with a lot of third-party medical businesses. When handling any sensitive patient information, it’s up to your hospital to protect their privacy and electronic health records (EHR), per the Health Insurance Portability and Accountability Act (HIPAA). HIPAA compliant accounting software allows for the safe transfer of medical billing documents, even if they contain electronically protected health information (ePHI).

Regular accounting software solutions that are not designed for healthcare may not meet HIPAA compliance. To prevent fraud and patient privacy violations, you cannot expose patient records to any person or organization that is not qualified. Medical billing software is designed to transfer electronic medical records (EMR), EHR, and ePHI in a compliant manner by using secure codes.

Common Accounting Mistakes

Small mistakes with your accounting can lead to expensive problems for your hospital management. Avoid these common errors:

Missed Medical Billing Mistakes

Medical billing errors are common at hospitals simply because of the daily patient volume. All it takes is one number being entered wrong on a patient chart to lead to an incorrect bill. Patients and insurance companies may fight incorrect charges. Ensure all your claims are as accurate as possible to prevent payment delays.

Another issue comes from upcoding when the medical code entered on a claim does not match the treatment given. In particular, it usually results in a significantly higher bill. Insurance companies will use any evidence of upcoding to try to dismiss an entire claim, so use the right medical billing solution to avoid these costly mistakes.

Denied or Rejected Claims Not Being Collected

Once an insurance company denies or rejects a claim, it’s back on your hospital to handle collections. You need to carefully manage patient communications to ensure you don’t lose money for services rendered.

Denied claims may be appealed, but only if there is a reason for reconsideration. For example, if a procedure isn’t covered by the insurance company in the first place, the claim will always be denied. However, if it turns out the procedure is covered but the wrong code was used, that may have resulted in an accidental denial.

Rejected claims contain some sort of error, such as the aforementioned upcoding or a simple clerical mistake. When an insurance company rejects a claim, your hospital must act fast to resubmit a corrected claim.