7 Best QuickBooks Add-Ons

When small business owners look for the best accounting software, they will routinely find QuickBooks Pro and QuickBooks Online at the top of most website ranks. It is also a commonly used solution for CPAs and accountants. Because of this, many businesses may use it as their primary accounting software. When their business grows or they require functionality not offered by QuickBooks, it can be hard to give up on software you’ve grown accustomed to.

Since QuickBooks is more of an industry-neutral software, it may lack certain features you desire that are unique to your line of work. This can include advanced inventory, manufacturing management, and time tracking. Luckily there are hundreds of QuickBooks apps and add-ons available that turns your basic QuickBooks into a software better suited to your business–at the fraction of the cost of buying an industry-specific ERP software.

All desktop versions of QuickBooks (Pro, Premier, and Enterprise) include inventory as a feature. This also goes for two of the four online versions of QuickBooks (Plus and Advanced), with the exceptions being Simple Start, Essentials, and the Self-Employed (Freelancer) version. So why does a small business need to look elsewhere for inventory?

A simple explanation would be that the inventory included with most base versions of QuickBooks can be rather limiting. At their core, the included inventory modules will be able to tell you what is in stock and what is on order, as well as provide you with real-time updates and reports. But in order to grow your business, you’ll want to think in terms of offering new products and finding new marketing channels.

Implementing a dedicated inventory management system that can integrate with your QuickBooks can help turn your simple inventory into more of a supply chain management tool that helps save time, cut costs, and budget/forecast for demand (purchasing and sales). These inventory add-ons usually complex needs that can’t be handled by the base inventory module included with QuickBooks, including products with expiration dates, color/size matrixes, and seasonal inventory levels.

Our Inventory Pick: FishBowl Inventory

FishBowl Inventory is an automation solution for QuickBooks users–advertising itself as a way to fill in the gaps within QuickBooks offerings. Some of the key features it offers include barcode scanning, part tracking, and advanced manufacturing tools.

The solution aims to help businesses “compete with the big boys” who either can’t afford a full manufacturing/distribution software or feel like they are too ingrained within their QuickBooks processes to switch to an integrated ERP software. FishBowl was one of the very first third parties to receive Gold Developer status from Intuit, and today remains one of the most popular choices for manufacturers and warehouse operations looking to expand their business while keeping the accounting program they love.

Because of Fishbowl’s long history integrate with QuickBooks, their configuration wizard is one of the easiest ways to transfer your existing inventory data. The inventory software will automatically import customer data, vendor data, part data, and quantities–meaning you’ll spend less time implementing and more time getting to know the ins and outs of the solution. On top of QuickBooks, FishBowl integrates with a number of other options to help speed up and centralize your manufacturing and warehouse operations. Examples include Amazon, eBay, Shopify, FedEx, UPS, and more.

Manufacturers need a bill of materials that can specify raw materials, parts, and sub-assemblies needed to manufacture each specific product. They also need their inventory levels to increase and decrease depending on production. Some versions of QuickBooks can be used to manage manufacturing processes, but it does require a high level of understanding and experience with the software, and having to use workarounds is unavoidable.

While the cost savings of just having one software can be refreshing, the increased time spent managing your software to work the way you want may effectively negate any perceived value. Even then, QuickBooks still falls short in tracking the cost of labor and the factory overheads used in manufacturing. Luckily there a wide variety of QuickBooks apps both in their app store or as standalone solutions that can be implemented–turning QuickBooks into a makeshift manufacturing ERP software.

Our Manufacturing Pick: xTuple

xTuple is an inventory solution built just for growing manufacturers. xTuple is helping manufacturing and inventory-centric companies use management software and best practices to grow their business profitably. The manufacturing software automates and integrates all manufacturing and back-office processes into a single business system. If you take sales orders, schedule production, maintain inventory shipping/receiving records and ensure all financial data is synced, then xTuple solutions can deliver huge improvements in the effectiveness of your organization.

Combining xTuple and QuickBooks Desktop allows your business to experience the full functionality of xTuple ERP, which includes inventory management, MRP, manufacturing, planning, and scheduling–all without having to learn new accounting software. In short, xTuple fills in where QuickBooks falls short in the world of manufacturing–most notably in material requirements planning and distribution.

QuickBooks on its own does offer time-tracking features that let your employees log their time spent on specific tasks. Employees can be given time entry-only access which prevents them from accessing other parts of the system. This level of access does not count against the total number of QuickBooks licenses allowed–meaning your business won’t pay more. Businesses that track time look for time tracking capabilities to automate calculations, create invoices (for billable time), and process payroll more efficiently. It can also be used as an employee management tool–helping the business keep track of time employees, contractors, and vendors are spending on specific projects.

For many small businesses starting out, this initial level of time tracking works for only a short while. May desire better ways to automate their business processes, create schedules, let employees clock in and out from multiple devices, or even allow for GPS capabilities. These advanced functionalities will need to be handled in an add-on.

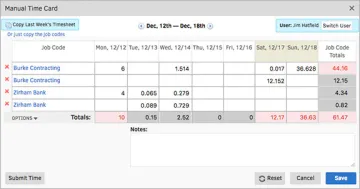

Our Time Tracking Pick: TSheets

TSheets is a cloud-based time and employee tracking solution that was acquired by QuickBooks in 2017. Due to this acquisition, TSheets is one of the simplest time tracking options to integrate with your QuickBooks, and is what Intuit would officially recommend for use with their flagship accounting software.

Employee hours are instantly accessible by admins and business owners. You can also get instant notifications about who is working and where they are located through GPS tracking. This is a much-desired feature for a mobile workforce.

TSheets also provides online timesheets, geofencing, project tracking, and job costing tools that bolster what is already offered through QuickBooks. Reports can easily be created to see where employees tend to put most of their time each week, how much labor costs will be for a specific project, and which clients are being served each week.

One of the most affordable time tracking options on the market, TSheets starts at only $10/user/month (on top of a $30/month base fee). The user charge only includes administrative users and doesn’t count employees who are simply logging hours–meaning you can freely let employees enter their own time without having to worry about a per-employee fee.

Project-based businesses make up a large portion of the small businesses in the world and can span over a dozen industries including accounting firms, consultants, and construction. Project management apps for QuickBooks allow these businesses to better organize their jobs, track costs related to them, monitor project budgets, and deliver estimates.

In construction, project management is the core of your business operations. These tools with help cut costs, generate more revenue, and improve collaboration within your team–all while staying under budget. Construction is also an industry where many workers may always be on a job site and never coming into the physical office. This mobile workforce requires an advanced way to track important project details, submit purchase requests, and log their hours.

While QuickBooks may allow for basic job costing on it’s own, it won’t begin to scratch the surface when it comes to managing projects. Luckily, many add-ons exist that turn your QuickBooks accounting software into a construction management tool that handles everything from bidding and vendor quotes all the way through to project management and accounting.

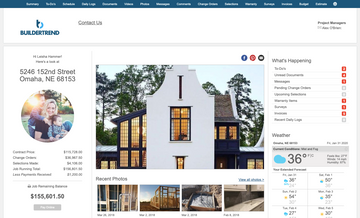

Our Construction Project Management Pick: Buildertrend

Buildertrend is construction project management software for home builders, specialty contractors, home remodelers, and commercial contractors. The software covers all the bases from the pre-sales process, through project management, financial management, and customer management.

With an integrated QuickBooks and Buildertrend, you’ll be able to eliminate double entry with cost code integration, convert change orders to invoices, convert purchase orders to bills, cost codes to items, and integrate contacts. While QuickBooks will continue to handle bill payments, receiving customer payments, and track expenses not recorded in Buildertrend, Buildertrend itself will store information on customers and jobs, vendors, bills and expenses related to projects, bills against purchase orders, owner invoices, and approved timesheets.

Users of QuickBooks and Buildertrend may find some crossover in the integration of the systems. For example, job costing can be handled in both programs. The integration will allow you to enter the data in whatever program you are most comfortable and have it update and correspond appropriately to the other. Businesses using Buildertrend and QuickBooks also have the ability to take job-specific expenses that originated in QuickBooks and send them back into Buildertrend budgets for more accurate job costing across all jobs.

PO payments and invoicing from subcontractors can easily be entered by managers in the field and sent to QuickBooks. Managers can also do this with material purchasing–creating a PO and sending it to QuickBooks and eliminating the need to key in this data later and reconciling with your bank transactions. When you integrate with QuickBooks, you will have the ability to send over bills from unpaid Buildertrend expenses. When those bills are paid in full within QuickBooks, the related expenses in Buildertrend will also be marked as paid, cutting down on duplicate entry.

As an accounting solution, QuickBooks has a native billing application that allows you to prepare, organize, and send bills to your customers so that you get paid on time. The module lets you send invoices and bill customers complete with a Pay Now button. Features include the ability to track when they are sent, viewed, and paid–offering a simplistic way for your business to receive the money it’s owed.

Professional invoices can also be created within base QuickBooks packages. This allows you to add your company logo, adjust the font sizes and colors, and more. You’ll even be able to sync with other office applications you may use, such as Google Calendar, which allows you to import billable hours and help automate the creation of recurring invoices.

With the ability to accept payments online, create recurring invoices, and notify you of unpaid invoices, why would a business consider a billing add-on to their QuickBooks? Simply put, the billing features included with QuickBooks can be seen as basic or not enough to meet your needs. If your business produces a large volume of invoices or requires a large number of customizations, it may be wise to look into a billing integration.

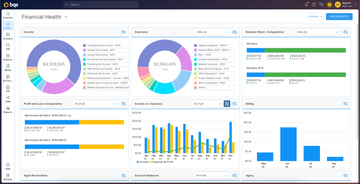

Our Billing Pick: BQE Core

BQE Core from BQE Software is a flexible and powerful business management software that provides everything from time and expense tracking, billing, project management, and even accounting capabilities. The solution was designed specifically for professional service firms to provide streamlined collaboration among team members working on projects.

Integrating BQE Core and QuickBooks Online provides your business with an incredibly strong time billing, accounting, and financial management option. While BQE Core is already full-featured business management and accounting software, they recognize that many businesses will desire to continue using QuickBooks for their general accounting, their online banking, or even their payroll. Since BQE Core offers a project-based accounting approach (hierarchical structure), QuickBooks can continue to provide the client-based accounting structure that many businesses have become accustomed to.

BQE Core provides a strong extension to billing and includes many features QuickBooks does not include in their base software. The software includes over 20 standard invoice templates, offers custom invoice templates if needed, and invoices for hourly, fixed fee, unit cost, and % contract types. With a direct connection to time and expenses, the billing option becomes a true single solution for your billing needs and includes fee schedules to ensure your invoices are always correct.

Other billing features include automatic billing, recurring invoices, split billing, workflow approval, and billing schedules.

One thing all government contractors have in common is the high level of oversight and the increased importance of financial transparency. The goal of implementing accounting software includes the ability to stay compliant with the Defense Contract Audit Agency (DCAA) requirements, which is the governing body responsible for auditing government contracts. These solutions have been tested again and again and should improve your chances of both passing an audit from the DCAA and staying compliant with the Federal Acquisition Regulations (FAR).

While no software is officially approved by the DCAA, the term “DCAA compliant” just means the software providers organize their procedures in a way better suited for compliance. This means any accounting software that can pass the system audit can be classified as DCAA compliant. However, some software providers specialize in working with government contractors as clients and thus are able to provide assistance in ensuring the software follows any government recommendations.

While QuickBooks Online can be compliant with the DCAA, you’ll need a third-party application to align your QuickBooks with the regulations, which include proper time-keeping posted daily, policies and procedures oriented toward FAR compliance criteria, consistently applied labor dollar distribution and more.

Our Government Contractor Pick: GovCon Connect

GovCon Connect is designed to give government contractors using QuickBooks Desktop or Online the ability to pass DCAA audits. Like all software that claims to be “DCAA compliant”, in truth this means the software is better suited for passing DCAA accounting system reviews. GovCon has helped hundreds of contractors pass their audits since 2004–becoming one of the leading options for government contractors.

The system helps provide more opportunities to qualify for firm-fixed-price, time and material, cost-plus-fixed-fee type contracts, and subcontract awards. On top of the standard accounting features QuickBooks includes, GovCon Connect adds timesheets, improves chart of accounts, job costing, labor distribution, CLINN/task reporting, indirect rate calculation, contract management, and budget and provisional indirect rate development.

GovCon offers a standard edition for those just starting out, a business edition that includes advanced reporting features, and a premiere edition for those who need to establish labor rates and company indirect rates.

QuickBooks does provide payroll services themselves, so why look elsewhere? Your business may have a number of reasons. You may simply enjoy QuickBooks as an accounting software but not as a payroll software. You may find a payroll software that is easy to use and want to integrate that with the accounting software you know and love. Whatever your reason may be, there is a large number of payroll add-ons for QuickBooks.

As most small businesses know, handling payroll yourself is a large time investment, so finding the best payroll software that can help save you time and effort on processing payroll is a big challenge.

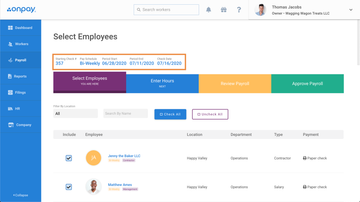

Our Payroll Pick: OnPay

OnPay integrated with QuickBooks will provide you with full-service payroll with automated tax filings and payments. It includes benefits and human resource capabilities not offered by QuickBooks’s own payroll services–allowing you to offer the best services to your employees.

OnPay provides payroll tax calculations for all 50 states and offers the ability to create 1099s and W-2s. You can handle unlimited monthly payruns, manage multiple pay rates, and offer payment to your employees via check, debit card, or direct deposit.

Synced with QuickBooks, the software can easily bring in employee-level details right into QuickBooks, set up custom reports, and let you view your finances the way you want. You’ll also be able to track wage expenses by department, pay type, class or location–allowing you to create custom reports in QuickBooks.

Looking for software for your organization? Get free recommendations from one of our software advisors.