The Best Fixed Asset Management Software

Fixed asset software helps you automate depreciation schedules and generate audit-ready reports. We ranked the top solutions with accounting standards for assets like machinery, buildings, equipment, and vehicles.

- Comprehensive depreciation calculations including multiple bases

- Integration with ProSeries tax programs

- Over 35 predefined reports

- Exclusive discount for nonprofits and municipalities

- Ensure compliance with IRS and GAAP regulations

- Supports 445 Accounting

- Consolidation and reporting capabilities

- Asset type method simplifies user training

- Granular control over asset depreciation

To help you choose the right solution for your business, we’ve ranked the best fixed asset management software on the market today.

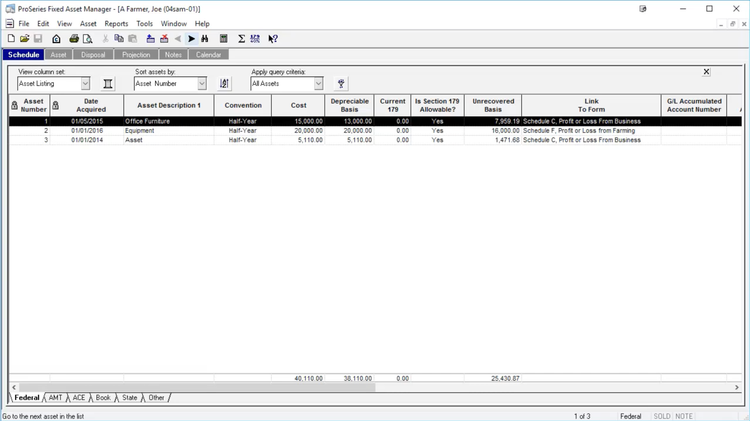

- ProSeries FX: Best for Multi-Client Accounting Firms

- Bassets eDepreciation: Best for Governments and Municipalities

- Bloomberg Tax Fixed Assets: Best for Tax Automation

- Sage Fixed Assets: Strong Depreciation Engine

- EZO: Most Intuitive UI

- Fixed Assets CS: Best for Customization

- AssetMAXX: Best Tracking Capabilities

- WorthIt Fixed Assets: Strong Compliance Management

- FMIS Fixed Assets: Best Asset Lifecycle Management

- CenterPoint Depreciation: Precision Asset Valuation

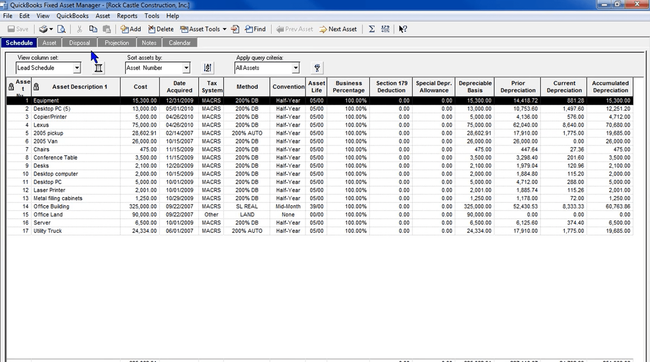

ProSeries FX - Best for Multi-Client Accounting Firms

ProSeries FX is a good tool for asset managers who need an efficient way to manage and track the depreciation of assets across multiple portfolios. Its depreciation module offers a streamlined approach to calculating, tracking, and reporting on asset depreciation, which is vital for maintaining accurate financial records and ensuring compliance.

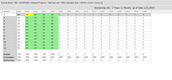

With this module, asset managers can input and track comprehensive details for each asset, including purchase date, cost basis, asset type, and asset class. Once the necessary data is entered, the system automatically calculates depreciation for both financial reporting and tax purposes, covering federal and state depreciation requirements.

The platform also supports a variety of depreciation methods, allowing asset managers to tailor depreciation calculations to different asset types:

- MACRS (Modified Accelerated Cost Recovery System): Commonly used for depreciating tangible assets such as machinery, vehicles, and office equipment used in business operations.

- Straight-Line Depreciation: Ideal when an asset like office furniture is depreciated evenly over its useful life.

- Declining Balance Method: Best for assets like technology equipment or vehicles that lose significant value in their early years.

By using ProSeries FX, asset managers can ensure they are optimizing asset depreciation strategies while staying compliant with tax regulations, leading to better financial planning and reporting.

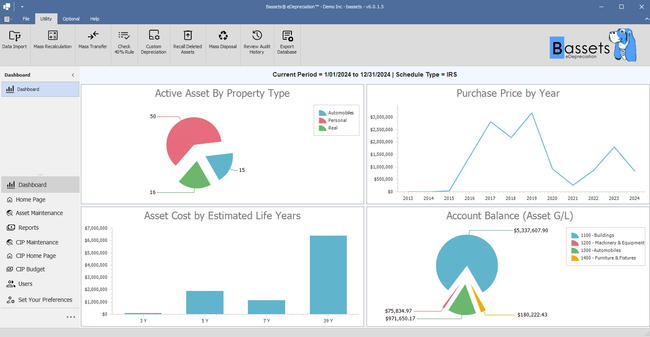

Bassets eDepreciation - Best for Governments and Municipalities

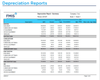

Bassets eDepreciation’s reporting module helps state and local governments comply with the Governmental Accounting Standards Board (GASB) statement 34. It mandates that government entities report the value of their capital assets, like infrastructure, vehicles, and buildings. Through Bassets’ reporting module, you can produce annual depreciation reports for every asset to ensure you meet compliance standards.

Additionally, you can use accrual accounting to prepare your financial statements. This is crucial for GASB 34 compliance, as governments must convert fund-based information into accrual-basis accounting for all statements. Bassets eDepreciation simplifies this conversion, as it automatically tracks expenditure recognition and depreciation tracking to maintain audit compliance.

Bassets eDepreciation is easy to use, as you can make reports with just a few clicks. For large entities, the Enterprise edition supports an unlimited number of fixed asset records, so state governments can track depreciation with hundreds of thousands of items. Unfortunately, the vendor does not release prices publicly, so you must request a custom quote.

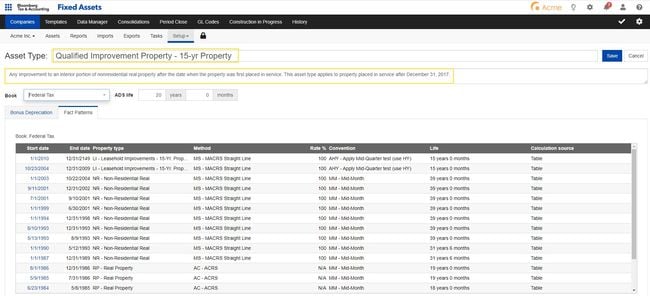

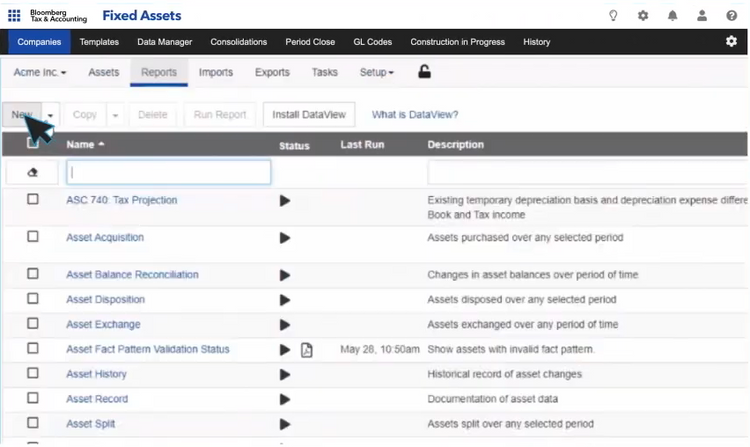

Bloomberg Tax Fixed Assets - Best for Tax Automation

Bloomberg Tax Fixed Assets’s accounting module includes built-in tax codes and GAAP rules for your fixed assets. Also, it automatically validates your taxes by checking ID numbers against specific criteria to ensure compliance and accuracy. When laws change, the system updates, so you never use outdated guidelines. This helps you meet complex tax requirements for your entire fixed asset portfolio.

Additionally, it offers extensive state depreciation modeling. It automates state tax law changes for companies with fixed assets across multiple locations to help streamline compliance. Plus, it includes built-in calculations for states that don’t adhere to federal depreciation methods. This helps accountants and tax professionals reduce manual calculation errors and time-consuming processes.

Bloomberg Tax Fixed Assets is best for large to enterprise-level companies managing a diverse portfolio. While it doesn’t disclose prices publicly, its breadth of features may be too extensive for small companies managing only a few fixed assets.

Sage Fixed Assets - Strong Depreciation Engine

Sage Fixed Assets is a software system that manages the entire asset lifecycle from initial acquisition to final disposal. Its strong depreciation engine gives accountants and financial teams the precision and control to handle large and complex asset portfolios under GAAP and IRS rules.

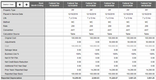

This depreciation engine supports over 50+ calculation methods, including MACRS, ACRS, Declining Balance, and Straight Line, with the ability to add custom formulas if needed. Businesses can manage up to 20 books per company covering internal, federal, state, AMT, and ACE requirements. With multiple books, organizations can maintain different depreciation schedules for financial, tax, and internal reports, ensuring data is synced without manual reconciliation.

Sage Fixed Assets is best suited for mid-sized to large organizations with complex tax reporting or multi-entity accounting requirements. Very small companies with basic asset schedules or limited reporting obligations may find other options, like WorthIt Fixed Assets, more fitting. The system is offered on-premise or in the cloud through third-party hosting. And pricing is quote-based, depending on the modules and user count required.

EZO - Most Intuitive UI

EZO has one of the most intuitive depreciation tracking interfaces on the market today. It delivers clear workflows, click-based setup, and smart automation, making it approachable for mid-sized companies needing strong depreciation features without the learning curve of enterprise accounting tools.

Getting started is pretty simple. Just enable asset depreciation under Settings, then select your preferred method: straight line or declining balance. You can toggle these on or off with a checkbox or run both methods simultaneously if needed. This means added flexibility if you work in a mixed-asset environment, all without the need for accounting expertise or complex configurations.

You can apply depreciation settings in bulk at the Group level, so you don’t have to set up assets individually. For example, you can set a 20% annual depreciation rate for all heavy machinery and a different rate for office equipment. Plus, bulk import tools make it easy to upload assets via Excel. Just map depreciation-related fields like useful life, salvage value, and purchase date. From there, you can auto-calculate salvage values for retired assets. This makes it easier to manage large uploads without manual entry errors.

EZO starts at $40/month, billed annually for 250 items and unlimited users. It’s designed to track assets rather than manage products for sale, making it a solid fit for service-based businesses like IT teams and maintenance crews.

Fixed Assets CS - Best for Customization

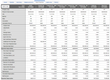

Fixed Assets CS by Thomson Reuters is an extremely customizable system. You can create custom sorting parameters and templates to save time while performing calculations. It includes filters like treatment, net book value, disposals, group, and more. Also, it comes with 147 predefined associations, or you can create your own. Either way, the software makes it easy for you to find the assets you need without having to scroll through the entire list.

Additionally, the software has a custom report builder for viewing granular asset data. It also combines with client profiles, allowing you to generate client-specific reports at their request. It’s great if you’re managing multiple portfolios at once, so you can organize data without having to remember which client needs which reports.

Fixed Assets CS is best for accounting firms managing fixed assets for multiple clients or entities. The system supports an unlimited number of items, so you don’t have to worry about limits or price hikes as you scale. However, the UI is pretty dated, so if you want a modern interface, you’ll need to look at a system like EZO.

AssetMAXX - Best Tracking Capabilities

AssetMAXX by AssetWorks includes strong tracking tools for enhanced organization. For example, you can automate the asset transfer process with approval routings and email notifications, eliminating the need for lengthy processes. Also, the system lets you assign custodians to every asset, so you always know the chain of custody.

AssetMAXX’s accounting module also helps track accounting information. It supports multiple depreciation methods to configure each item to the correct calculation. Also, you can manage full or partial disposal amounts and reconcile them from one location. This makes it simple for governments and municipalities to ensure accurate data and know when to replace outdated equipment.

Unfortunately, AssetMAXX’s prices are not publicly available, so you’ll need a direct quote for exact figures. It’s best for large public sector organizations managing diverse asset portfolios across multiple locations.

WorthIt Fixed Assets - Strong Compliance Management

WorthIt Fixed Assets’s compliance management features are extensive. The platform adheres to various accounting standards, making it ideal for companies needing to maintain compliance with regulations such as IFRS, GAAP, or tax rules.

WorthIt Fixed Assets automates complex depreciation calculations, reducing the risk of errors and saving time for accounting teams. Its comprehensive reporting capabilities also allow businesses to generate detailed asset reports for auditing and strategic planning purposes.

WorthIT Fixed Assets is best for small to midsize companies in various industries that are upgrading from Excel spreadsheets. Pricing starts at $1,075/year for the primary user, plus $210/additional user per year. The desktop version has a 15-user limit. It can be installed on-premises or hosted in the cloud.

FMIS Fixed Assets - Best Asset Lifecycle Management

FMIS Fixed Assets is a fixed asset management platform built to help organizations manage the accounting, depreciation, and tracking of a company’s assets. The system is typically implemented alongside an ERP and provides finance teams with greater flexibility and control than the fixed asset modules found in many accounting systems.

FMIS does more than just manage depreciation and amortization schedules; it supports fixed assets from initial purchase planning through final disposal. Add-on procurement tools help track equipment budgets and purchasing history, giving better visibility and control over asset acquisition. Asset records then follow items as their value changes over time or as ownership moves between cost centers or departments. FMIS captures maintenance and service activities throughout equipment lifecycles, providing insight into whether an asset should be retired, repaired, or replaced. This makes the system especially useful for managing long-term assets such as manufacturing equipment, IT hardware, vehicles, or buildings.

FMIS Fixed Assets is best suited for finance teams managing complex asset portfolios that require deeper lifecycle control beyond what their existing ERP systems provide. FMIS is also a great fit for manufacturers, government contractors, and professional service firms that are using platforms like Deltek and AccountMate, with deep, long-standing integrations for each. That said, FMIS requires a custom consultation for a quote, though pricing typically depends on factors such as user count, required modules, and deployment method.

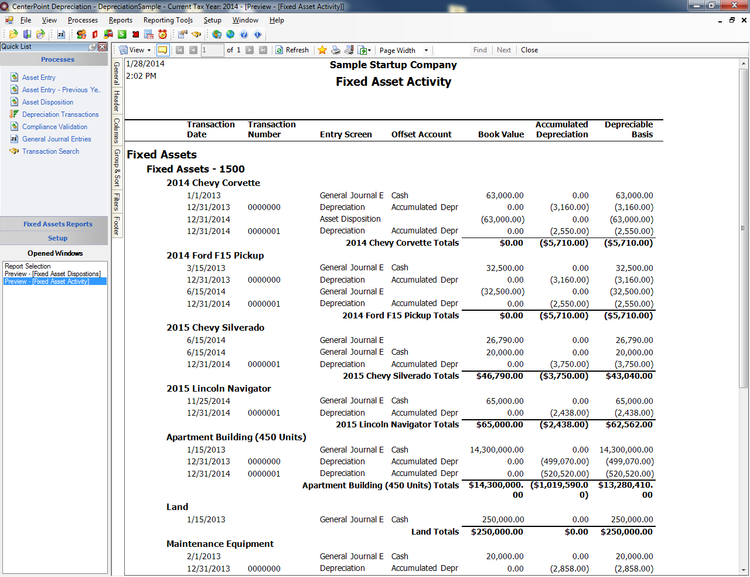

CenterPoint Depreciation - Precision Asset Valuation

CenterPoint Depreciation provides a range of depreciation methods and allows for in-depth asset analysis, making it suitable for businesses looking for accurate and detailed asset valuation.

The software’s flexibility in handling different types of assets and its user-friendly interface make it accessible to manufacturing, construction, and other sectors. It integrates with CenterPoint Accounting to streamline the overall asset management process.

What is Fixed Management Asset Software?

Fixed asset management software helps you track purchase cost, valuation, depreciation, and gain or loss on your assets. Because the financial calculations are complex, using automated software can save hours of time otherwise spent on traditional, manual fixed asset management practices.

Unlike general asset tracking systems, which focus on physical tracking of asset location and usage, fixed asset software handles financial ledgers, tax books, audit readiness, and reporting standards such as GAAP, IFRS, and GASB.

Fixed asset management can often be found as an application within a larger accounting software for straight-line depreciation calculations. However, businesses with a large volume of assets need a standalone solution to scale with growing production. Fortunately, fixed asset management software provides automation features for depreciating asset value, letting you identify optimal strategies and act accordingly.

Fixed Asset Management vs. Asset Tracking

While there is some overlap in features, fixed asset systems and asset tracking software are two distinct categories with different features.

| Category | Fixed Asset Management | Asset Tracking |

|---|---|---|

| Objective | Financial accounting, depreciation, compliance | Physical location, usage, lifecycle status |

| Users | Finance, tax, and accounting teams | IT, facilities, operations managers |

| Key Features | Depreciation methods, tax forms, audit trails | GPS/barcode tracking, maintenance scheduling |

| Compliance | GAAP, IFRS, IRS, GASB | Often not compliance-driven |

| Examples | ProSeries FX, Sage Fixed Assets, Bassets | Asset Panda, GoCodes, AssetSonar |

Need help with asset tracking instead? Check out our asset tracking software roundup.

How to Choose Software

1 Assess Business Needs and Objectives

- Inventory of Assets: Understand the types and quantities of assets your company manages.

- Business Scale and Complexity: Consider the size of your business and the complexity of your asset management needs.

- Regulatory Compliance: Identify the regulatory requirements relevant to your industry for asset management and reporting.

2 Setup and Implementation

- Streamlined Setup: Consider systems with helpful tools to import existing data or a setup wizard.

- Implementation Packages: Some systems offer implementation packages to configure the software to your workflows.

- Onboarding Support: Look for expert onboarding assistance from your vendor when purchasing a system. This will get you up and running faster with live support.

3 Feature Evaluation

- Depreciation Calculation: Look for software that offers diverse and accurate depreciation methods.

- Integration Capabilities: Ensure the software can integrate seamlessly with your existing ERP software or accounting software.

- Customizability: Evaluate if the software can be tailored to your specific business processes and reporting needs.

- Reporting and Analytics: Check for customizable reporting for depreciation, asset valuation and lifecycle, location tracking, usage and performance, and compliance and audits.

- Asset Tracking and Auditing: Consider the software’s ability to track assets through RFID, GPS tracking, QR codes, or barcode scanning. Confirm that the platform supports audit processes.

4 Usability and Accessibility

- User Interface: Opt for a platform with an intuitive and easy-to-navigate interface.

- Training and Support: Assess the availability and quality of customer support and training materials.

- Mobile Accessibility: Confirm a mobile app is available for iOS and Android with built-in scanner capabilities for barcodes or RFID tags.

5 Cost-Benefit Analysis

- Pricing Structure: Analyze the pricing model (subscription, per-user, etc.) and ensure it aligns with your budget.

- ROI Consideration: Evaluate the potential return on investment by considering time and resource savings.

Key Features

- Asset Accounting and Depreciation Management: Calculate costs for managing assets as they depreciate to stay within your operating budget

- Multiple depreciation methods: Automated calculation of asset depreciation based on customizable depreciation methods such as straight-line, declining balance, and others

- Tax form support: Ability to create required tax forms for asset depreciation, including forms 3468, 4626, 4255, 4797, 4562, and T2S8

- Cost center assignments: Management of corporate cost codes with the ability to allocate assets to the correct department or cost code

- Asset grouping: Reporting capabilities allowing assets to be grouped by type, cost center assignment, or location

- Asset retirement planning: Forecasting of all future costs considering maintenance and asset value depreciation to provide asset retirement scheduling recommendations

- Lease vs buy analysis: Lifetime cost calculations considering asset depreciation value for providing lease versus buy recommendations

Benefits

The top benefits of fixed asset management software include:

Improve Tax Compliance and Reduce Liability

FAM software helps you adhere to GASB, IFRS, and GAAP requirements with built-in rules and documentation tools. You can create compliant reports and tax forms, which makes audits much faster and more accurate. Tools like Bloomberg or Bassets also auto-update with new tax regulations.

Prevent Depreciation with Up-to-Date Asset Valuation

A fixed asset management software can automate depreciation calculations along the asset lifecycle and keep financial reporting processes compliant. Yet calculating proper depreciation is only a starting point for today’s fixed asset management software systems. In addition, almost all systems compute gains and losses on the sale of assets and often provide more advanced features. With tax laws constantly changing, you need automated software to take advantage of all available tax savings.

Unfortunately, many companies overpay in taxes and insurance due to ineffectively managing their fixed assets. A fixed asset software application can help your firm maximize the payoff from capital investments by clearly identifying each investment, its value, location, purchase details, depreciation method, and accumulated depreciation.

Centralize Asset Data

Instead of relying on scattered records and spreadsheets, all financial data lives in one system. This includes:

- Salvage values

- Disposal status

- Asset classes

- Depreciation books

- Acquisition details Using these details, you can customize reports specifically for stakeholders, tax filings, or external auditors in a few clicks.

Support Long-Term Capital Planning

Depreciation software can help you understand when assets require replacement or are fully depreciated. This can help you plan your budgets more effectively by predicting future capital expenditures and preventing unexpected costs down the line. Advanced systems like Sage Fixed Assets or Bloomberg Tax Fixed Assets even support forecasting tools to model gain/loss scenarios or evaluate lease vs. buy decisions.

How to Calculate Fixed Asset Depreciation

There are five main depreciation calculation methods:

| Method | Description | Formula |

|---|---|---|

| Straight Line Method | Evenly spreads an asset’s value over its useful life. | (asset cost - expected salvage value) / useful life (years) |

| Declining Balance Method | Distributes its loss in value more heavily in the early years of its useful life. | (Current book value - salvage value) × depreciation rate % |

| Sum-of-the-Years’ Digits (SYD) Method | Accelerated method factoring economic usefulness instead of ownership period. Example: 3 years left → (3+2+1)=6 SYD. | (remaining lifespan / SYD) |

| Units-of-Production Method | Based on units produced or hours of service over the asset’s lifespan. | (asset cost - salvage value) / units produced OR hours of service over useful life |

| Revaluation Method | Assesses an asset’s value at the start and end of the year and takes the difference. | beginning value + additional purchases - assets sold - ending value |

Learn more about each method, how to choose, and best use cases on our Guide To Calculating Fixed Asset Depreciation.

Pricing Guide

Fixed asset management software costs vary depending on the size of your organization, ranging from $85 to $4,200+/month. Here’s how it breaks down:

Small Businesses (1-25 employees)

- $85-$415/month ($1,000-$5,000/year)

- Includes basic depreciation tracking and limited reporting

- Examples: EZO, AssetTiger

Growing Businesses (25-150 employees)

- $415-$1,250/month ($5,000-$15,000/year)

- Includes basic integrations, tax compliance, and multi-book depreciation

- Examples: Bassets, Sage Fixed Assets

Midsize Businesses (150-500 employees)

- $1,200-$4,200/month ($15,000-$50,000/year)

- Includes ERP integration, compliance automation, and advanced forecasting

- Examples: FMIS Asset Management, Bloomberg Fixed Assets

Large Enterprises (500+ employees)

- $4,200+/month ($50,000+/year)

- Includes full audit trail automation, enterprise reporting, global asset books, and custom integrations

- Examples: IBM Maximo, SAP S/4HANA Asset Management

Implementation fees, integrations, and training may add to upfront or annual costs, especially for companies managing tens of thousands of assets or needing support for multiple entities.