The Best DCAA Compliant Accounting Software

Tracking labor and separating direct and indirect costs in line with DCAA guidelines can be complex. We tested and ranked the best software for government contractors and consulting firms that comply with these strict regulations.

- Easy to use with government contracts

- iOS and Android apps

- Multiple payment methods

- Gain visibility into projects and finances

- Streamline processes, including BD, source to pay, and manufacturing

- Utilize built-in compliance controls and remain audit-ready

- Connects to bank accounts

- Easy to close and reopen accounting periods

DCAA compliant accounting software improves the financial management of your government contracting business. We used our advanced review methodology to select the top options for features like indirect cost management and project accounting.

- JAMIS Prime ERP: Best Overall

- Deltek Costpoint: Best Indirect Cost Management Tools

- PROCAS: Best Project Accounting Module

- Aspire GovCon Accounting: Best Financial Tracking Tools

- BigTime: Best Timekeeping Tools

- WrkPlan: Best for Small Federal Government Contractors

- Unanet ERP GovCon: Best for Subcontractor Management

- eFAACT: Best for QuickBooks Users

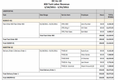

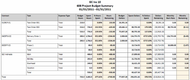

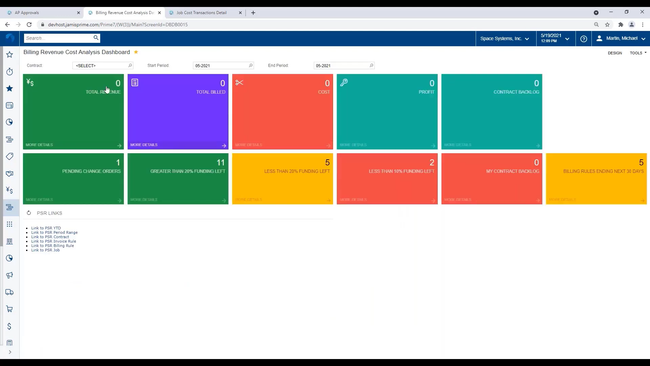

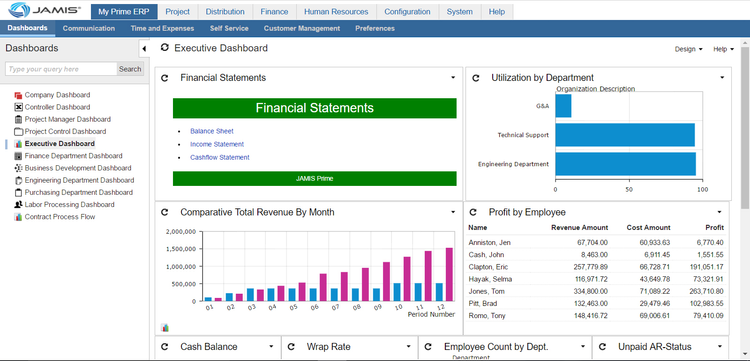

JAMIS Prime ERP - Best Overall

JAMIS Prime ERP offers a finance and project accounting suite for government contractors and project-driven organizations. The suite provides detailed cost information and controls billing and revenue.

The module includes a project cost management tool that tracks all project-related expenses, including labor, materials, and overhead. This can help you budget, forecast, and monitor your expenses against budgets. Time and expense tracking lets your team submit their timesheets and expense reports to ensure accurate billing and project costing.

It supports various billing methods, including:

- Time and materials: Often used when the scope of work or project duration isn’t fully defined or could change over time.

- Fixed-price: Typically used for projects like product deliveries when the requirements, timelines, and deliverables are well understood and unlikely to change.

- Cost-plus: Often used in research and development contracts where outcomes are uncertain and costs can fluctuate. They can also be used in complex and long-term contracts such as large-scale infrastructure developments and technology upgrades.

However, its multi-currency support is lacking, as companies can only have one “home-based” currency, even with multiple entities in different countries. If you need multi-currency support, Deltek Costpoint might be a better option.

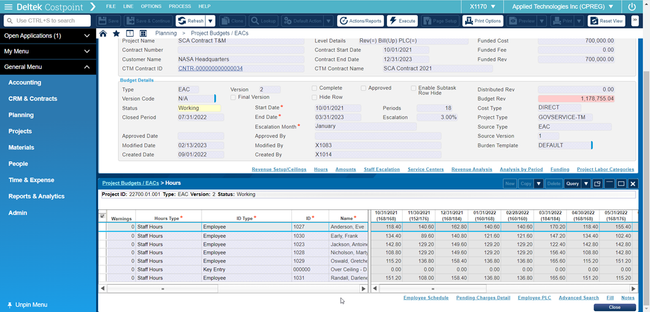

Deltek Costpoint - Best Indirect Cost Management Tools

Deltek Costpoint enables users to accurately define and allocate indirect costs, such as overhead and general and administrative expenses. It also provides the flexibility to set up multiple indirect rate structures for various government contracts.

We also like that Deltek Costpoint provides accurate and detailed timekeeping. The platform allows for precise tracking of employee hours against specific projects or tasks. Its ability to handle complex labor distribution and report these costs in detail is a significant advantage for maintaining DCAA compliance. Despite these features, users have noted that its UI is unintuitive, as some basic tasks require multiple clicks to accomplish.

PROCAS - Best Project Accounting Module

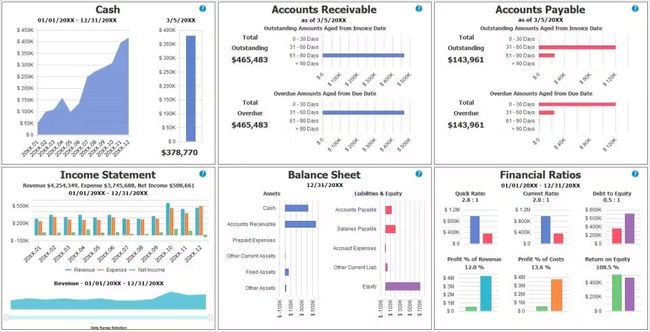

PROCAS offers advanced project accounting for government contractors. It enables detailed tracking of costs and revenues at the project level, including direct and indirect costs, bill rates, and funding limits. This allows companies to access real-time data on crucial data, helping them gain insights into financial ratios, balance sheets, and cash flow.

PROCAS maintains automated audit trails, ensuring all financial transactions are documented. It records who entered or changed information and the dates and times of these actions, helping provide the transparency and accountability needed to pass DCAA audits. We like that it also includes detailed mobile time tracking, enabling contractors to log hours on the go. PROCAS is primarily an accounting software, so it does lack more comprehensive features such as payroll and HR.

Aspire GovCon Accounting - Best Financial Tracking Tools

Aspire GovCon Accounting lets you consolidate financial information across every fund and project in one dashboard. Add specific fields like total value, incurred costs, billed, and status. You can also add filters to see exact periods or project types, giving you the flexibility to extract data quickly.

From there, drill down into a single view for greater detail. For every project, Aspire GovCon generates granular reports required for DCAA audits, including incurred costs, provisional billing rates, and other compliance-specific data. It even keeps a clear audit trail for all financial transactions and changes, helping non-profits and governments facilitate audits efficiently.

Beyond accounting, the system integrates several essential functions like timekeeping, payroll, billing, and invoicing, all of which support DCAA compliance. It’s also very affordable, starting at $25/user/month with a five-seat minimum.

BigTime - Best Timekeeping Tools

BigTime is a PSA software that includes an effective time and expense tracking module for DoD and government contractors. With personalized entries for each timecard, you can easily log every employee’s time and expenses. You can attribute each to a specific project, so all billable hours are visible to clients and project timelines are more visible. It’s great for complying with strict federal timekeeping requirements by logging accurate records.

Additionally, the system maintains a detailed audit trail that keeps your timesheets transparent for further DCAA compliance. You can configure manager-specific review and approval processes to reduce errors. Further, it has built-in timecard audit checklists to make sure your employees and managers follow every guideline.

BigTime is an official Intuit-Integrated Application, meaning it is built to sync data with QuickBooks Online for cohesive accounting. We also like its affordability, with its lowest-tier Essentials plan being $20/user/month. However, multi-level approvals aren’t available until the Premier plan at $45/user/month.

WrkPlan - Best for Small Federal Government Contractors

WrkPlan is best suited for small federal government contractors because of its fast implementation and strong ERP package. Its government contract management module helps businesses enter key details like subcontractor assignments, rates, costs, and funding status. This allows for accurate information storage for easy reference and auditing.

We also like WrkPlan’s automatic invoicing features, which allow contractors to create government-formatted invoices to stay compliant with DCAA. The document covers fixed price, time & materials, cost plus contracts, and funding status tracking, ensuring accurate billing. Using these metrics, companies can also create reports to visualize overall financial performance and identify trends. While these features are effective, we don’t like that WrkPlan doesn’t have payroll integration.

Unanet ERP GovCon - Best for Subcontractor Management

Unanet ERP GovCon is ideal for businesses managing a high volume of subcontractors. It offers an employee portal and mobile app for streamlined onboarding and timekeeping, ensuring subcontractors are up and running fast. Users can create timecard rules that are automatically enforced to improve efficiency and accuracy.

Unanet ERP GovCon has an analytics module that helps companies manage their financials and extract insights from real-time data. This is achieved through custom reports that can be used to analyze key metrics like performance, job costs, resource allocation, and profit margin. We also like that Unanet ERP GovCon includes CRM integration, allowing for a more unified system. However, the software has been difficult to learn for some users because of the large number of features.

eFAACT - Best for QuickBooks Users

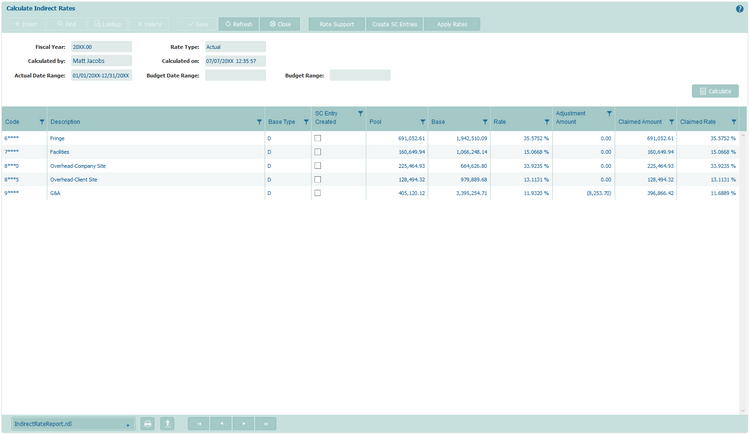

eFAACT offers an effective project management system built for QuickBooks integration. The software includes built-in user checkups to evaluate performance and helps users prepare for DCAA audits. It also generates indirect rates and ICE schedules at the end of each fiscal year, streamlining the closing process and making these tasks efficient.

eFAACT’s project and executive management modules are noteworthy for government contractors. These allow full coverage of project and contract performance from one central location, making cost and activity analysis more efficient. eFAACT also features real-time indirect rate calculation. This allows contractors to monitor their indirect costs continuously and make informed decisions about project pricing and cost control.

What is DCAA Compliant Accounting Software?

DCAA-compliant accounting software is any financial solution adhering with the Defense Contract Audit Agency (DCAA) requirements. It refers to the adherence of a company’s accounting, financial, and timekeeping systems to the recommendations and guidance provided by the DCAA. This federal government agency is responsible for auditing DoD contracts, ensuring that organizations’ business processes and systems seeking or holding government contracting work align with DCAA requirements.

Since these contracts can be worth hundreds or even billions of dollars and are funded by taxpayers, DCAA audits are crucial for maintaining transparency and accountability. A compliant system should be able to track various costs, such as direct and indirect costs, accounting, billing, and labor costs, and fully integrate with its timekeeping system. This way, the company can efficiently produce all necessary reports required by the DCAA during an audit.

One thing to note is that no software is officially “DCAA approved,” as the term itself is an inaccurate designation. Instead, the DCAA audits a company’s financial systems to determine their compliance with government Job Cost Accounting regulations found in the Federal Acquisition Regulation (FAR). Any ERP platform or accounting software could be classified as DCAA compliant if it passes the required accounting system audit based on Government Auditing Standards from the "Yellow Book.”

Key Features

- Expense Reporting: Measure financial data in a general ledger to balance Accounts Receivable (AR) and Accounts Payable (AP) and report all direct and indirect costs.

- Cost Accounting: Accurately report on allocating funds to produce goods and services during government-contracted projects.

- Contract Management: Manage the creation, negotiation, signing, and renewal of legally binding government contracts, including subcontracts.

- Project Management: Coordinate and streamline the execution of project tasks to optimize direct and indirect costs related to labor and equipment utilization.

- Timekeeping System: Use timesheets for employee time tracking on all DoD contracted work assignments to ensure accurate hours are reported.

- Audit Trail: Provides transparency for all financial records and timesheets to prevent fraud and be audit-ready.

The scope of the different project accounting practices available to government contractors is as varied as the types of businesses that perform government contract work. Some small businesses will need to perform their own accounting in-house, while others can afford Certified Public Accountants (CPAs) to handle the work for them.

With so many possibilities, accounting software packages designed to meet DCAA requirements for government contractor companies must offer a full range of financial management tools. Accounting features include tracking real-time expenses, managing payroll from labor distribution, estimating job costs, performing bank reconciliations, and creating top-level financial reports.

Additionally, there is a huge variety of applications available for your specific DCAA compliant accounting system. For example, manufacturers will find MRP, inventory control, and bill of materials modules, while food services firms can benefit from point of sale solutions. Other typical applications can include time and billing, job costing, CRM, eCommerce, and work order management to name just a few.

One common need for government contractors is functionality to assist with bid and proposal processes. Applications are readily available that will help manage a portfolio of projects while assisting in developing bids and managing ongoing work for specific projects.

Primary Benefits

Accounting software designed for your government contracting business can help you manage costs, revenues, and profits while allowing you to view information on a per-project basis. With the right accounting tools, you can easily establish auditable financial records.

Manage Unallowable Costs

A common issue companies face when dealing with government agencies is determining allowable and unallowable costs. The former can be reimbursed or fully covered by a contract’s terms, while the latter can leave your business footing the bill. Generally, allowable costs are those necessary for the completion of a project: expenses related to manufacturing, delivery, or service.

Unallowable costs, as defined by FAR 31.205, are those that do not meet these criteria:

- Reasonable

- Allocable

- Cost Accounting Standards (CAS)

- Contract terms

- FAR subpart limitations

For instance, imagine a small business wins a government contract and requires transportation for its workers to get to and from a job site. Purchasing one or two vehicles would be reasonable and an allowable cost under DCAA regulations. On the other hand, buying a fleet of luxury cars would be considered unreasonable and thus unallowable.

It’s important to note that many indirect costs fall under the unallowable umbrella. With DCAA compliant accounting software, your employees can remain aware of whether their work is or isn’t covered.

Maintain Government Contractor Accounting Compliance

Government contractor organizations are among the most frequently audited businesses in the world. Compliance with assorted regulations is part of doing business as a government contractor. Especially for smaller government contractors, there may be little expertise in dealing with audit agencies and the wide variety of different regulations. Approved accounting systems specifically designed to promote regulatory compliance can be of enormous assistance in helping your organization meet DCAA, DCMA, DOL, IG, and GAO standards.

Pricing

DCAA-compliant accounting software is typically ERP systems, which costs small to midsize businesses between $1,700 and $10,000/month. The cost largely depends on the size of your business and how many users will utilize the system.

Companies can also choose less expensive DCAA-compliant PSA systems like BigTime, Aspire GovCon, and eFAACT, and integrate them with QuickBooks Online. For example, Aspire GovCon pricing starts at $25/user/month but requires a five-seat minimum.

Here’s a general breakdown of what you can expect to pay based on your company size:

Entry-Level Tier

- Company Size: 1–20 employees

- Average Yearly Cost: $6,000–$12,000 per year

- Product Examples: eFAACT, BigTime, Aspire GovCon Accounting

Mid-Tier

- Company Size: 20–100 employees

- Average Yearly Cost: $12,000–$40,000 per year

- Product Examples: WrkPlan, Unanet GovCon, JAMIS Prime ERP (standard edition)

High-Tier

- Company Size: 100–500 employees

- Average Yearly Cost: $40,000–$150,000 per year

- Product Examples: Deltek Costpoint, JAMIS Prime ERP (professional edition), Unanet

Enterprise Tier

- Company Size: 500+ employees

- Average Yearly Cost: $150,000–$500,000+ per year

- Product Examples: Deltek Costpoint, Oracle Fusion Cloud ERP, SAP S/4HANA