The Best Financial Consolidation Software

We’ve reviewed the best systems for consolidating your company’s financial data to create unified forecasts and reports. Whether you operate globally or manage multiple entities, we’ll help you find a solution.

- Capable of handling complex consolidations

- Cloud-based platform is very stable

- Expands to meet changing regulations

- Effective consolidation and roll-up capabilities

- Strong in financial reporting and trend analysis

- Unlimited users

- Versatile platform with unique data management capabilities

- Streamlined financial close and consolidation process

- In-depth reporting and analysis capabilities

Adding financial consolidation software to your business helps automate financial close with real-time processes. Using our review methodology, we’ve created a list of the top financial consolidation software on the market:

- CCH Tagetik: Best Overall

- Quick Consols: Best Intercompany Eliminations Tool

- OneStream: Best for Account Reconciliations

- Prophix One: Best for Business Intelligence

- Vena: Journal Entry Automation

- Limelight: Best for Financial Modeling

- DataRails: Best for Excel Users

- Planful: Best EPM Suite

- Workday Adaptive Planning: Best Integrations

- Anaplan: Best Collaboration Tools

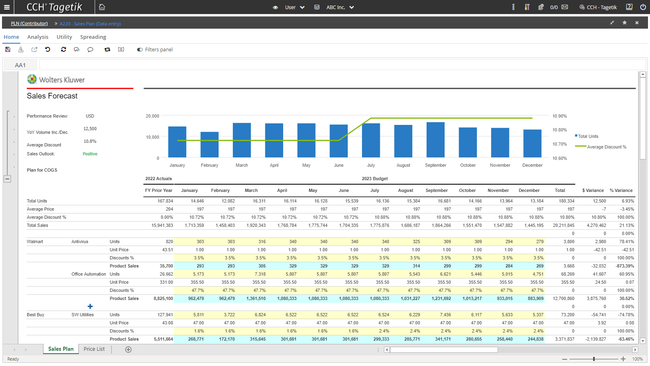

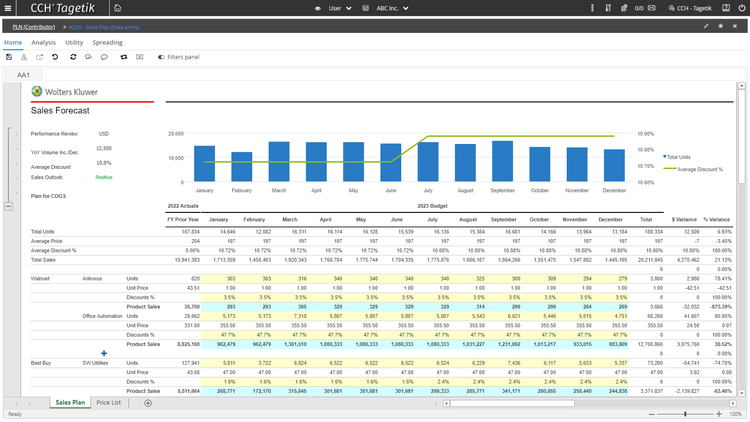

CCH Tagetik - Best Overall

CCH Tagetik is an enterprise performance management software that includes financial consolidation tools. It unifies all of a finance organization’s processes, including budgeting, forecasting, consolidation, and performance reporting. This means the software stores disclosure management data in the same database as consolidated actual and plan data, allowing for a full audit trail of all changes from consolidation through disclosure.

CCH Tagetik integrates with other software, including Excel, which allows for additional reporting options. However, this system can be highly complex, requiring users to undergo training to meet the steep learning curve.

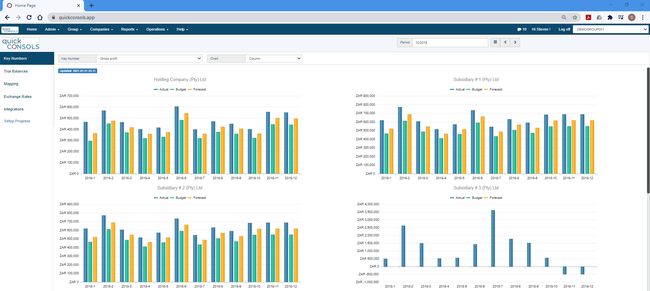

Quick Consols - Best Intercompany Eliminations Tool

Quick Consols’s automated intercompany eliminations module is ideal for companies with multiple subsidiaries, helping you maintain IFRS-compliant group statements.

This financial consolidation tool maps intercompany accounts across entities, linking related accounts. Then, you can define custom elimination rules based on specific needs, like matching transactions by value, entity, or date. Quick Consols then detects intercompany transactions—such as loans, expenses, revenues, and cost allocations—and eliminates them to prevent double counting in financial reports.

Additionally, if you operate in numerous currencies, Quick Consols auto-applies foreign exchange translations before processing eliminations. This ensures accurate Foreign Currency Reserve (FCTR) adjustments for seamless currency consolidation.

Quick Consols can import actual, budget, and forecast trial balances from different systems like QuickBooks Online and Xero. You can perform eliminations directly on the imported data, with built-in validations to prevent imbalances. Quick Consols starts at 450/month but can vary depending on your company’s complexity and size.

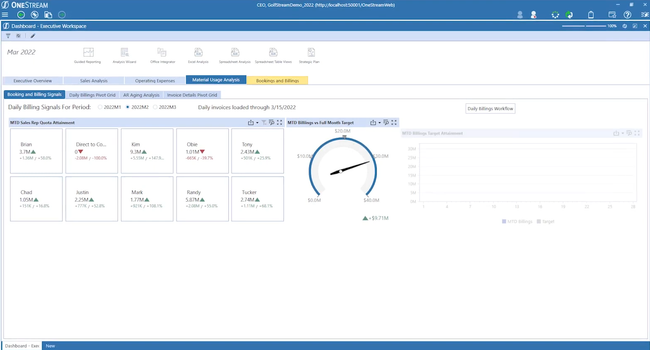

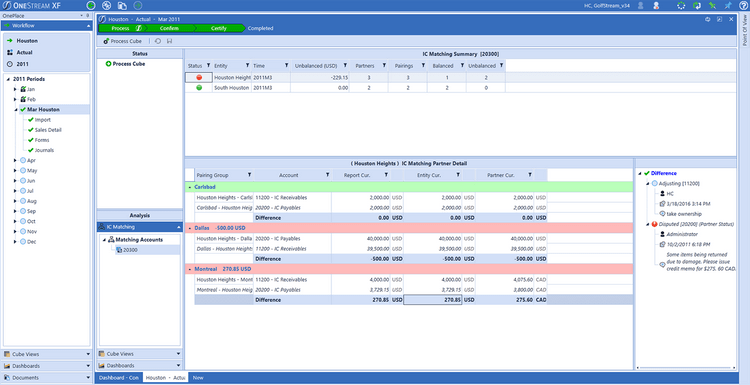

OneStream - Best for Account Reconciliations

OneStream’s account reconciliation tools help enterprises manage complex processes. Specifically, the built-in transaction matching system enables efficient financial closing. You can configure custom rules that enable the system to auto-match transactions from all of your sources. It’s a great way to reduce write-offs and unexpected differences.

The transaction matching feature also supports the streamlined account reconciliation process. Through the quick auto-matching, you can deliver accurate financial statement overviews with risk-adjusted balance sheets. Further, OneStream generates audit trails that identify who performed the reconciliations for more visibility and accountability. This allows you to mitigate risk from manual spreadsheets and ensure you account for all data.

Available in both cloud and on-premise formats, OneStream’s modular design allows for gradual software enhancements, reducing initial costs and complexity. It also has recently implemented several new AI features to push the automation even further.

Prophix One - Best for Business Intelligence

Prophix One is a BI and financial software application widely used for budgeting, planning, analysis, and financial consolidation. It uses a familiar spreadsheet-style interface yet is designed to overcome the limitations of traditional spreadsheets. The result is a familiar, end-to-end solution that includes budgeting, forecasting, consolidation, data mining, reporting, personnel planning, and scorecarding.

This software is particularly tailored for large organizations, offering powerful budgeting and financial reporting features. Prophix’s flexibility allows for both simple and complex data presentation, adapting to varied company requirements.

Vena - Journal Entry Automation

Vena’s journal entry automation streamlines accruals, reclassifications, minority interest calculations, and currency translation adjustments (CTAs). With automated rules and real-time data syncing, this system ensures you consistently apply and accurately post all journal entries, closing your books faster.

You can create journal entries manually or set up pre-built templates that pull live data from systems like QuickBooks Online and NetSuite. The system supports dynamic data mapping to ensure each entry aligns with the correct general ledger accounts across entities.

Set business rules to automate common adjustments, such as:

- Reclassification to move transactions to the correct accounts

- Accrucals based on revenue recognition policies

- Eliminations to remove intercompany transactions from consolidated reports

Before posting, Vena runs checks to flag entry imbalances, duplicate adjustments, and compliance issues based on IFRS or GAAP. If something doesn’t add up, you’ll get a notification to review and fix it, ensuring accuracy without the extra hassle.

Limelight - Best for Financial Modeling

Limelight’s financial modeling tool enhances data analyzation. The tool is no-code, so you can add custom dimensions and hierarchies to create models without knowing how to code. This eliminates the need for complex Excel formulas, as the system easily consolidates the data from your ERP into your model for accurate analysis.

Additionally, the modeling tool streamlines multi-entity consolidations with complex structures. It automatically collects data from various departments or entities within a company with predefined calculations and adjustments. This allows for efficient data reporting across the company, helping you gain important insights from every level.

Limelight integrates with several leading ERP and accounting systems, like Sage Intacct, Infor, NetSuite, and QuickBooks Online. This allows for easy data consolidation and lets you visualize real-time data when applying your models, resulting in more accurate projections.

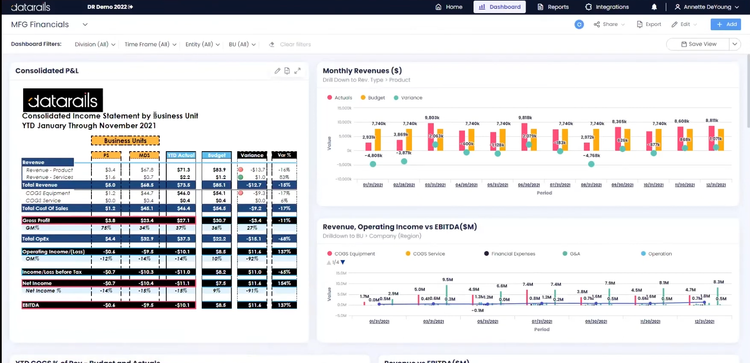

DataRails - Best for Excel Users

DataRails allows your company to continue working in Excel because of its native Excel integration through DataRails Flex. This tool automatically consolidates data from multiple sources, including an accounting, BI, or ERP system, and pulls the data directly into your spreadsheets. This eliminates manual Excel data input, which often leads to costly errors.

Datarails Flex also allows you to generate live Excel reports. These reports let you drill down into financial details to gather insights on specific department or product performance and make better-informed decisions. When consolidating data for reports, it automatically performs processes like currency conversion, intercompany eliminations, and adjustments to streamline the Excel reporting process.

DataRails Flex takes it a step further by adding more functionality to Excel in addition to consolidating financial data. Advanced functions like variance or contribution analysis to evaluate shifts in company revenues and expenses. You can even export graphs and charts out of Excel and into the DataRails main platform for one centralized view. This helps you get more from the Excel program while maintaining its familiar interface.

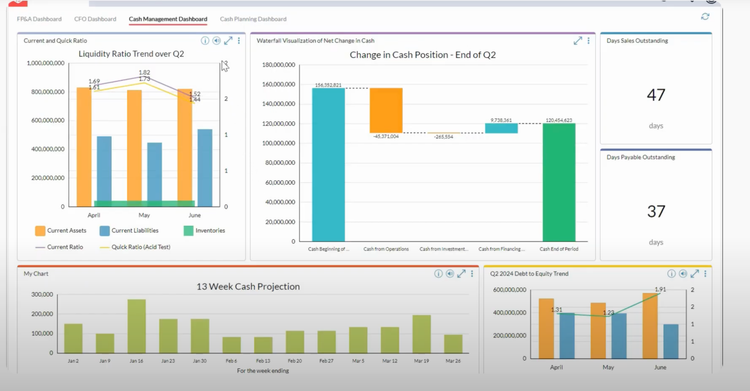

Planful - Best EPM Suite

Planful is a cloud-based FP&A platform designed for continuous planning and financial consolidation. It forms part of an EPM suite that integrates web-based applications, including budgeting, planning, forecasting, score-carding, dashboarding, and financial consolidation. This integration allows businesses to streamline FP&A and financial close processes by automating and accelerating planning, reporting, and consolidation processes.

Planful’s approach to consolidation, driven by accounts and dimensions, simplifies the process and assures data integrity. Its powerful OLAP calculation engine enhances data analysis and consolidation accuracy.

Workday Adaptive Planning - Best Integrations

Workday Adaptive Planning integrates with other applications such as SAP and Oracle to better consolidate data for accurate and efficient processing and analysis. This integration is crucial for companies working with Excel spreadsheets, as it enhances the accuracy of reports and simplifies data management.

Workday is particularly suited for medium to large scale companies, providing an array of features that streamline the financial planning process. Its capabilities include customizable dashboards, in-memory data models for faster and more scalable processing, and support for multiple forecasting models. The platform also boasts a user-friendly interface with advanced reporting features for diverse financial management needs.

Anaplan - Best Collaboration Tools

Anaplan, primarily focused on business intelligence, offers another option for companies seeking software for financial consolidation. This cloud-based platform incorporates the Hyperblock modeling and calculation engine to enable speedy consolidation across different locations and facilitates effective monitoring of precisely defined KPIs.

As a Connected Planning platform, Anaplan is designed to support collaborative planning, allowing various stakeholders within a business to participate actively throughout the process.

What is Financial Consolidation Software?

Financial consolidation software helps speed-up the act of making consolidated financial statements for larger, more complex companies. These companies face the issues of decentralized accounting, inter-entity transactions, dealing with multiple currencies, and more. Financial consolidation software generates financial reports and improves the audit trail of your organization through intercompany matching and eliminations.

Consolidation software automates your financial close with real-time financial consolidation processes and intercompany eliminations. It’s best used in conjunction with ERP systems and other business management systems as part of a greater corporate strategy. When consolidating finances for budgeting or financial planning purposes, financial consolidation software provides a unified approach for reporting and strategizing.

Key Features

- Reclassifications: A financial statement reclassification is a journal entry that transfers an amount from one general ledger account to another. Account for debits vs credits and currency conversion.

- Workflow: Streamline your close process by viewing a snapshot of completed work and work that is yet to be done. Monitor which entities have unfilled tasks and still need to send their financial data to the primary financial consolidation software user.

- Management Roll-up: Map all general ledgers into a single chart of accounts for a unified and consistent global report among your entire organization.

- Financial Reporting: Create reports that let you view trends pertaining to company financials and sales. Use varieties of hierarchies, location/level/department combinations, and more to validate business performances and make key decisions for the future of the business.

Primary Benefits

The automation offered by financial consolidation software will help you shorten your month-end closing time by eliminating manual processes or workarounds from using spreadsheets like Excel. Using software reduces the hours needed to handle these tasks manually. Other benefits of financial consolidation software include:

Streamline Financial Consolidation Methods

Consolidation software tools provide an easy-to-use method of automating your journal entries, eliminations, and adjustments. Most solutions automate conversions in real-time and do not require batch jobs or any other sort of long-running process, to be performed.

When it comes to international organizations, larger companies who deal with more complex multi-currency financial consolidations can take comfort knowing that currency can be automatically converted and translated into the appropriate formats upon receipt.

Compare Financials Among Varying Organization Levels

Another key benefit comes from the ability to create comparative views between different time periods or locations. Consolidation software makes it easy to bring in the financial data of each location and create comparative trial balances, receivables/payable reports, or balance sheets.

Being able to get a real-time view of reports and analytics across all your companies will let you know who is meeting goals and expectations set forth by upper management. This lets you reward locations that are performing admirably or create benchmarks for underperforming branches.

GAAP and IFRS Support

Financial consolidation software will help you conform to all activities and workflows within your financial statements in line with the latest accounting standards. The benefit of doing so is to ensure you have a more structured and streamlined way of creating balance sheets, income statements, and cash flow statements that combine data from multiple sources.

GAAP stands for generally accepted accounting principles, which is the accounting standard set by the U.S. Securities and Exchange Commission. Accountants in the US will use the guidelines set forth by GAAP in their financial reporting. Multiple entities that abide by GAAP will have an easier time being able to transfer data with each other, as it will not require a large amount of legwork to reformat data into a unified set of details that can be turned into a financial report.

The European Union has a different set of guidelines called the International Financial Reporting Standards (IFRS). These standards are issued by both the IFRS Foundation and International Accounting Standards Board (IASB) with the goal of providing a common language for business affairs. In consolidation software, this helps make finances comparable across a variety of boundaries, borders, and geographical locations.

Many consolidation software options will claim to be both GAAP and IFRS-compliant. This simply means the software can present financial statements and statements of cash flows in a manner that would be approved by these reporting agencies.

Pricing Guide

The cost of pricing consolidation software varies based on factors like your company size, desired features, user count, and deployment method. Here’s a general breakdown of the average expected cost based on your company size:

Entry-Level Tier

- Company Size: 1–20 employees

- Average Yearly Cost: $2,000–$10,000 per year

- Examples: Fathom, Zoho Books with Zoho Analytics, QuickBooks Online Advanced with consolidation add-ons

Mid-Tier

- Company Size: 20–100 employees

- Average Yearly Cost: $10,000–$40,000 per year

- Examples: Vena Solutions, Planful, Prophix One, Fluence Technologies

High-Tier

- Company Size: 100–500 employees

- Average Yearly Cost: $40,000–$150,000 per year

- Examples: Oracle Fusion Cloud EPM, SAP Group Reporting (S/4HANA Cloud), CCH Tagetik, OneStream (starter package)

Enterprise Tier

- Company Size: 500+ employees

- Average Yearly Cost: $150,000–$500,000+ per year

- Examples: Oracle Hyperion Financial Management (HFM), OneStream XF (enterprise license), SAP S/4HANA Group Reporting, Workiva