The Best Oil and Gas Software

Oil and gas companies rely on software to manage production, land, equipment, and financial operations. We reviewed the top systems for key features like production reporting, regulatory compliance, and equipment and rental management.

- A free plan is available to individuals and small teams

- In-app training is available

- Provides real-time insights to field workers and assets

- Automated asset tracking

- Real-time monitoring of wells

- Dynamic analysis of well performance

- Supports nearly all industry specific equipment

- Offers several complete modules for inventory and rental management

Using our advanced review methodology, we’ve ranked our best picks for oil and gas solutions based on factors like key features, value for money, and ability to manage oil and gas operations.

- SafetyCulture: Best Customizable Inspection Templates

- Petrofly: Best for Upstream Producers

- PakEnergy: Best for Accounting

- RTMS: Best for Oilfield Rentals

- RigER: Best for Oilfield Services

- Deacom: Best Process Control Tools

- Quorum: Best for Land Management

- SOGAS: Best for U.S. Producers

- W Energy Software: Best for Midstream Energy Companies

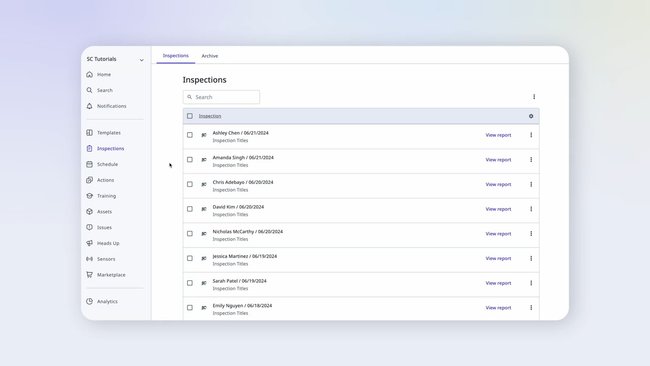

SafetyCulture - Best Customizable Inspection Templates

SafetyCulture’s customizable inspection templates enable you to design digital checklists and forms for your operational needs. You can configure these for various inspection types, including safety audits, equipment maintenance, and incident reporting.

When choosing a template, you can either start from scratch or modify a pre-built one. SafetyCulture provides a full library of pre-made designs tailored for common industry scenarios, which you can customize to suit your requirements.

The software lets you personalize each by adding custom fields such as text boxes, dropdowns, and multiple-choice fields. You can also set rules to hide or reveal specific sections based on input during an inspection, making the process more efficient.

Once you create your template, you can share it with your team and other locations, ensuring uniformity in all inspections. These customizable templates can ensure that inspection covers all necessary regulations, reducing the risk of non-compliance or safety incidents.

SafetyCulture offers a Premium plan that starts at $24/seat/month. The system also has a free plan for up to 10 users.

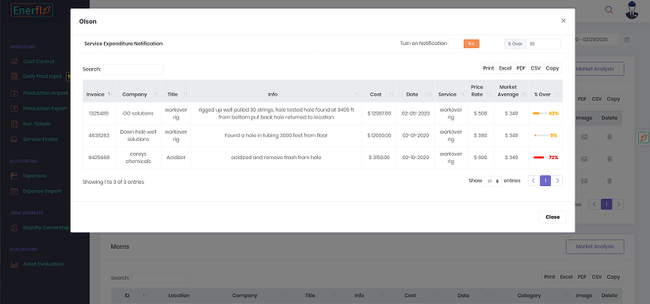

Petrofly - Best for Upstream Producers

Petrofly sets itself apart with its production scenario planning tool. You can use historical data on each well to simulate schedules, factor in workover downtimes, and account for risks that may affect timing and volumes.

Petrofly pulls in live measurement and production data, such as SCADA parameters and readings, from both off-site and on-site equipment. Plus, your field crew can still record numbers offline and sync them later on when they have online access, keeping your base assumptions current when you run a new scenario.

The built-in estimate payout and EUR calculators let you run a case and predict expected recovery; the payout estimation then ties outcomes to when capital is less likely to return. This makes it easy to step across scenarios and see how changes to downtime or workover timing would impact those estimates. Additionally, Petrofly includes operational expenditure and profit analysis, so you can compare production curves and cost burdens tied to the schedule you’re modeling.

Because Petrofly is accessible via mobile devices with production reports available through email and text, you’ll always have full visibility without waiting for end-of-month rollups. This oil and gas software falls in the entry-level pricing range, from $1,500 to $7,500 per year. However, pricing details are not publicly provided by the developer, so you’ll need a custom quote.

PakEnergy - Best for Accounting

PakEnergy (formerly WolfePak) offers complex financial management support. Its core modules include general ledger, accounts payable and receivable, bank reconciliation, deposit entry, and 1099s. It also handles audit trails, transaction histories, compliance reporting, and financial statements.

PakEnergy CDEX Data Exchange feature automates the entry of check stub data, significantly reducing errors and improving efficiency in financial processing. With its comprehensive modules for joint interest billing, revenue distribution, and production reporting, PakEnergy ensures accurate accounting for crude oil purchasers, CPA firms, and investors.

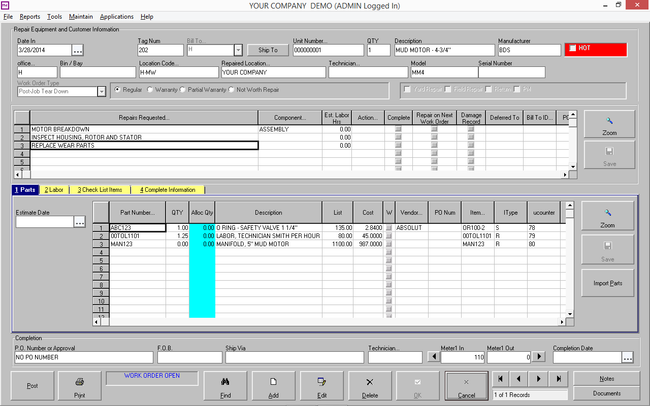

RTMS - Best for Oilfield Rentals

RTMS has industry-specific features for the oilfield rental industry. It can manage a wide range of equipment, including drill pipes, wirelines, land drilling rigs, and any other oilfield rental. RTMS includes modules for tracking repairs and maintenance, fixed asset management, and equipment sales, making it a well-rounded solution for service, sales, and rentals.

RTMS also stands out for its ticket management system. Tickets can be created in the field or the office and allow users to log issues related to their equipment, such as malfunctions, maintenance needs, or service requests. Tickets are tracked from origination all the way to resolution of the issue or a tool was returned. It also stands out for its customer support and comprehensive training on the software. One downside we found was the requirement to talk with the developer for accurate pricing information.

RigER - Best for Oilfield Services

RigER is designed to streamline oilfield service scheduling, fleet dispatching, operational data management, and invoicing. The invoicing module includes Rental Services Agreement (RSA) integration. Each job in RigER starts with an RSA that includes all job parameters, like services, billing terms, rental equipment, and field tickets. RSAs then connect to invoicing by tracking equipment rentals and consumable usage, which means your final invoice will cover all parameters.

The invoicing module supports flexible invoice types for complex billing scenarios:

- Service: Bills for jobs that solely involve services like drilling support, well testing, cementing, or hydraulic fracturing.

- Repair: Records expenses associated with repairing equipment on the job site due to unexpected breakdowns, regular wear, or client-caused damages.

- Rental: Bills for jobs involving rental equipment, like drilling rigs and generators, along with consumables like fuel or chemicals.

- Multi-Well Allocation: Specializes in jobs involving multiple wells, dividing the total costs based on each well’s share of work by usage, time, or percentage.

Additionally, RigERP automates invoicing based on predefined billing cycles, from daily to monthly, and can create bulk invoices in one click. This automated billing reduces delays and keeps your operations financially stable, which is useful for oilfield operations.

RigER is customizable with over 200 features. It also has mobile applications and extensive integrations with ERPs, accounting, billing systems, and business analytics tools.

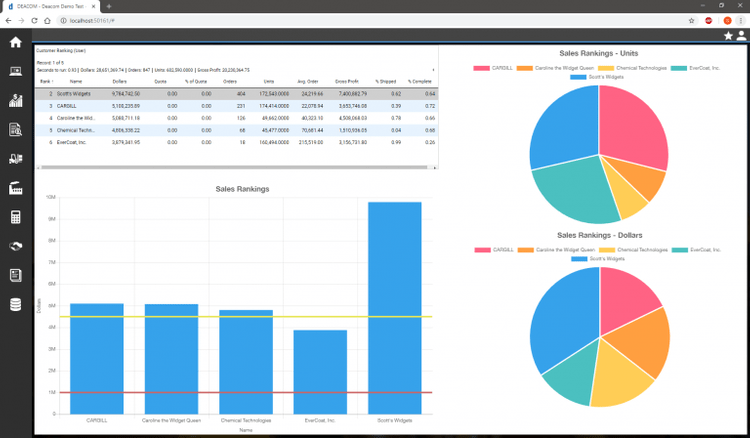

Deacom - Best Process Control Tools

Deacom is best for manufacturing oil and gas products because it enhances process control, financial management, and operational efficiency in the oil and gas sector. The system provides accounting tools and document generation for shipping. The MRP system tracks the availability of materials like drilling supplies, safety equipment, and components for machinery maintenance.

Deacom handles real-time inventory control for crude oil, refined products, chemicals, and spare parts. It also acts as a warehouse management system with lot tracking. Its built-in CRM tools help negotiate contracts, handle orders, and address service needs. Additionally, it integrates with Programmable Logic Controllers (PLCs) for data transfer and regulatory compliance support.

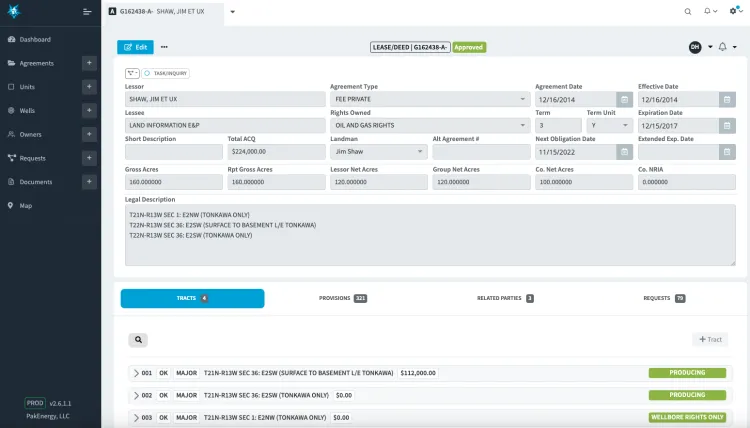

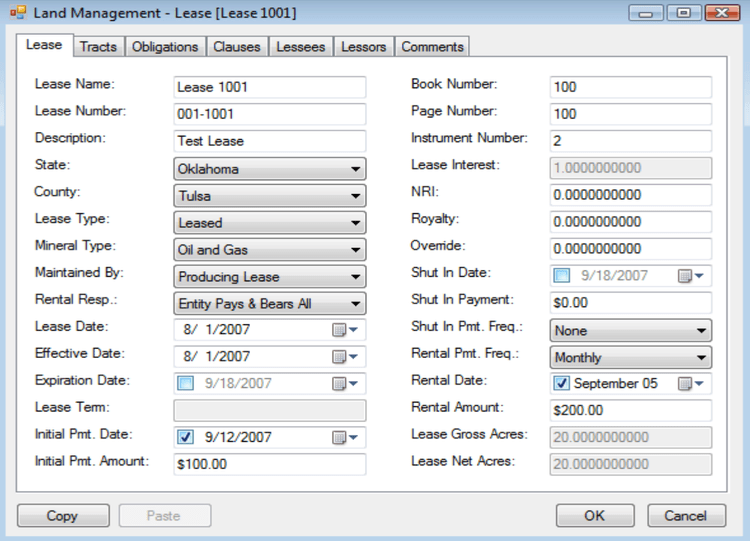

Quorum - Best for Land Management

Quorum Software provides a comprehensive suite of modules that manage operations across the entire oil and gas industry. One of its standout modules is its land management capabilities, which provide tools for managing land assets accurately and in compliance. Quorum allows users to track ownership, make land acquisitions, manage lease payments, and maintain accurate financial records, ensuring oil and gas companies handle their land agreements and operations.

In addition to land management, Quorum Software can also manage oil and gas production, accounting, and supply chain management. It offers BI tools to analyze data in real time and help make companies make decisions. We also found that Qurorum was made to scale with companies accommodating both mid-sized and large oil and gas enterprises. However, Quorum might not be the best fit for very small oil and gas companies as it has features that small enterprises might find too complex or costly.

SOGAS - Best for U.S. Producers

SOGAS offers a streamlined platform designed to meet the operational, accounting, and regulatory needs of smaller U.S.-based oil and gas companies. Its core modules include production tracking, revenue distribution, joint interest billing, and tax reporting, providing the essential functionality needed to manage daily operations without unnecessary complexity.

The system is built around U.S. regulatory and tax compliance requirements, making it well-suited for operators managing domestic wells and lease agreements. With built-in support for state severance taxes, royalty payments, and 1099 processing, SOGAS helps simplify financial management while keeping companies aligned with federal and state reporting standards.

For companies operating with smaller teams or limited IT resources, SOGAS offers a more approachable alternative to larger ERP platforms. Its combination of industry-specific features, straightforward pricing, and lower implementation demands makes it a strong fit for independent operators, family-owned producers, and smaller private equity-backed firms working exclusively in the U.S. market.

W Energy Software - Best for Midstream Energy Companies

Waterfield Energy Software, now known as W Energy, is a solid choice for midstream energy companies. Its land management solutions include customizable land area reports, acreage calculations tailored to holdings, and efficient resource allocation. Companies can also streamline obligation management with a complete review of history workflow.

W Energy’s midstream accounting solutions offer advanced gas processing allocation and contract management. These capabilities are designed to optimize plant accounting processes, enhance financial visibility, and ensure accurate forecasting and budgeting. The platform also supports rapid month-end closings, easy scalability, and customizable formulas for contract terms.

What is Oil and Gas Software?

Oil and gas software is a digital tool that helps automate oilfield operations, including exploration, extraction, production, distribution, or customer sales.

This software covers the entire spectrum of businesses within the oil and gas industry, from the earliest oilfield discovery to end-consumer retail sales. Oil and gas software is commonly used by production, pipeline, and plant operators, equipment manufacturers, inspection services, and oilfield services. Software vendors offer a number of solutions that help streamline operations.

Common software features across most oil and gas business types include accounting to ensure profitability and asset management to maintain equipment. These features are intended to address the industry’s specific workflows.

Key Features

| Feature | Functionality |

|---|---|

| Accounting | Manage accounts payable and accounts receivable. Track joint billing between investors and owners. Manage taxes based on the product and sales location. Track Depreciation, Depletion, and Amortization (DD&A). |

| Oil and Gas Production Reporting | Field data capture systems provide production and operation reports on meter readings, well status, downtime, and more to improve performance management. |

| Asset Management | Track on-hand assets, including materials and equipment. Keep track of preventative maintenance deadlines to improve asset performance. |

| Regulatory Compliance Management | Manage compliance requirements from various state, federal, and international organizations. Examples include the EPA air pollution monitoring, the Bureau of Land Management Oil and Gas inspection and enforcement, and the Global Reporting Initiative oil and gas sector disclosures. |

| Document Management | Store permits, lease information, and other important documents in one system. |

| Quality Management | Perform tests throughout the extraction and refinement process to ensure the oil and gas products meet quality standards. |

| Land Management | Manage land purchases and leases. Land management systems typically include lease master records, land management inquiry subsystems, and contractual obligations systems to keep records organized. |

Top Benefits

- Maintain regulatory compliance: The oil and gas industry is one of the most tightly regulated in the world. Software helps you stay on top of constantly changing global standards.

- Streamline operations from start to finish: Automating processing along the entire process improves efficiency, allowing workers at every level to get more done.

- Improve high-level decision-making: Top decision-makers can determine the most profitable next steps by getting the latest, real-time information about the market.

Software Trends

-

AI-Driven Predictive Analytics

Artificial intelligence and machine learning are increasingly utilized to optimize drilling, production forecasting, and equipment maintenance. As noted in Artificial intelligence in oil and gas upstream: trends, challenges, and scenarios for the future, these technologies help operators reduce downtime, extend asset life, and improve well performance across the energy sector. -

Automation in Back-Office Operations

Automation is transforming back-office functions like land management, joint interest billing, revenue distribution, and regulatory reporting. AI-powered tools can now interpret complex contracts, streamline invoice reconciliation, and reduce manual data entry errors. As highlighted by TROOTECH’s review of oil and gas software trends, automation is also improving financial oversight by flagging anomalies in transaction data and assisting HR teams with scheduling and compliance. -

Cloud-Native Systems

Cloud-based platforms are rapidly becoming the standard for new oil and gas software deployments. According to Straits Research’s oil and gas cloud market analysis, the global oil and gas cloud applications market is projected to grow at 14.4% CAGR, reaching over $22 billion by 2033. Cloud-native solutions allow companies to centralize data, reduce infrastructure costs, and scale rapidly as operations expand. -

Integration with IoT Devices

The growing use of IoT sensors, SCADA systems, and real-time field monitoring requires software platforms that can capture and process high-frequency operational data. This enables predictive maintenance, safety monitoring, and production optimization. As Digi explains in its IoT in Oil and Gas overview, this segment is expected to reach nearly $28 billion by 2032, reflecting the industry’s increasing reliance on real-time connected devices.

Pricing Guide

Oil and gas software pricing can vary significantly depending on the size of your operation, the number of active wells, and the complexity of features required. Below is a general breakdown by business size and system tier:

| Tier | Company Size | Estimated Cost | Example Systems |

|---|---|---|---|

| Entry-Level | 1–20 employees (or <10 wells) | $1,500 – $7,500 per year | Petrofly, FieldCap, GreaseBook |

| Mid-Tier | 20–100 employees (or 10–50 wells) | $10,000 – $35,000 per year | RTMS, Wellsite Report, RigER |

| High-Tier | 100–500 employees (or 50–200 wells) | $35,000 – $125,000 per year | WolfePak, Quorum On Demand, P2 Merrick |

| Enterprise | 500+ employees (or 200+ wells) | $150,000 – $750,000+ per year | P2 Energy Solutions, SAP S/4HANA, Oracle, IFS |

How to Choose

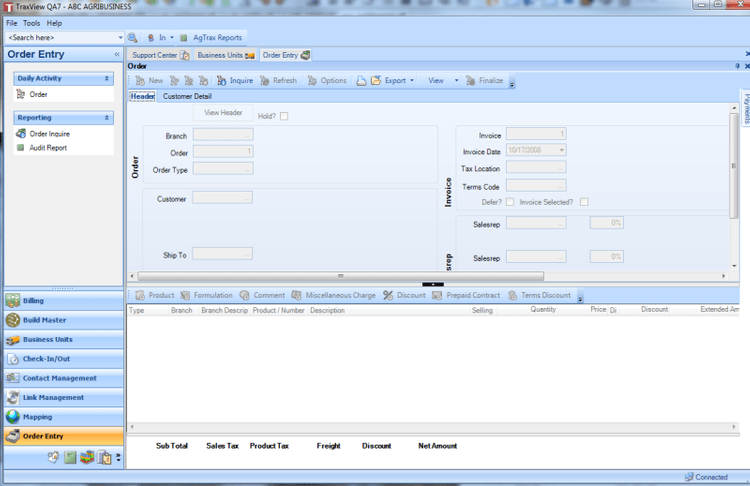

There are many types of systems that can sufficiently support oil and gas businesses. While you could manage operations with a complete ERP system, there are many benefits to using an industry-specific oil and gas solution. Standalone systems geared toward the oil and gas industries help you control costs, promote efficiency, manage royalties, and run a profitable operation. Many full-featured solutions allow you to add modules as your business grows.

Task-specific solutions are also available, allowing you to add functionality to your existing systems. For example, you can integrate your accounting platform with production software to monitor field operations and improve daily reporting. Rental management and equipment management software are other common add-ons, giving you better control of rental equipment tracking, inventory control, and maintenance management of valuable equipment. These tools help companies expand functionality as their needs grow without replacing existing systems.

Integration Options

Full ERP systems can meet your needs, from operations management to back-office business processes. Oil and gas ERP software manages accounting, land leases, and production processes. The system can also handle HR functionality like hiring and onboarding, benefits management, and payroll.

Project management software lets you schedule your crews and subcontractors, ensuring you have the right people on board at all times and performing the work they should be doing. Job costing tools are another important part of construction work. You need to track your labor costs, machine and equipment costs, fuel costs and any contract labor. Tracking these costs will also help you better understand your cash flow.

If you are at the point where you are ready to find out which oil & gas software platform is right for you, we can help. Through a brief phone call, our software specialists will locate a handful of software solutions that can address the issues you are currently experiencing. [Get started today with free oil and gas software recommendations from our specialists.

Natural Resources Exploration Related Software Needs

Before you roll your first piece of equipment onto the property, there are a number of activities that need to take place first and these activities cost you money. Here is how software helps with every step of the process:

Forecasting Revenue and Expenses

Budgeting and forecasting software tools that allow you to quantify likely expenses and potential revenues are particularly important for companies involved in natural resources exploration. Forecasting revenue and expenses improves decision-making.

Obtaining Permits and Managing Documents

The process of obtaining permits for land exploration and extraction is incredibly complex. Document management software makes you more efficient by storing all your permitting documents in one place.

Oil and gas software will also manage other important documents like leases. Keep track of lease terms, payments, expiration dates, and more.

Environmental Impact Studies

Environmental studies are a major cost source. The permitting process can require approval from local, state, and federal agencies. Maintaining compliance and reaching approval is significantly easier and less risky with the help of software tools.

Typical Software Needs for Oil and Gas Production Work

If you are running an oil and gas production business, tracking operational costs is a central concern for your software to address. Managing costs associated with the operation of a mine or well can include labor costs, equipment and repairs, fuel, and transportation. Understanding where your money is going at this point in the process is critical.

Production Planning

If you are not producing enough to meet customer demand, you may need to hire more employees or subcontractors or bring in more equipment. Whatever the case may be, a production planning module will help you understand how much demand you have and how much material you are processing to keep up with customer demand.

Logistics and Delivery

The operational modules will also help you with the logistics and delivery of the items. Tracking the costs associated with transporting the materials to your customers is critical to understanding your profitability. The software will also help you analyze which mode of transportation is the best in terms of price and delivery time.

Fuel Retail Sales

Delivering products to the market involves another set of complexities. Customer relationship management software can greatly assist with identifying and tracking information related to buyers. This will allow you to manage contact information for each buyer, including typical purchases, the amount spent, discounts applied, and more.

Custom vs. Off-the-Shelf Software

Oil and gas companies often have proprietary processes, like real-time well monitoring. These may require tailored solutions that off-the-shelf software rarely provides. Here is a breakdown of these systems to help you make your decision:

| Feature | Custom Software | Off-the-Shelf Software |

|---|---|---|

| Cost | High upfront cost but tailored to meet complex needs | Lower initial cost for general operations like accounting or inventory management |

| Development Time | Longer development cycle, especially if integrating with specialized equipment or legacy systems | Immediate availability for quicker deployment |

| Customization | Fully customizable to address unique workflows | Limited customization covering broad industry needs |

| Support | Requires dedicated IT team or vendor collaboration to maintain and update | Standard vendor-provided support, often with pre-built knowledge bases |

If you have unique requirements or specific integration needs, custom software is likely your best choice. However, if you’re looking for a budget-friendly and quick system, a standardized software is a good option.