ERP vs. Accounting Software: Differences Explained

The main difference between ERP and accounting software is the number of capabilities offered by each solution. An accounting system will only handle one area of your business (financials), while an ERP is supposed to handle all aspects of running your business (including financials).

- Accounting software provides financial management for your organization through accounts payables, accounts receivables, general ledger accounts with reporting, and payroll.

- ERP software provides multiple modules, including the aforementioned accounting features, as well as applications for supply chain management, inventory management, human resources, and eCommerce.

To help businesses select the right solution for their needs, review the key 7 differences between ERP and accounting software.

ERP vs. Accounting Software: 7 Key Differences

| ERP | Accounting | |

| Goal | Automate the majority of business processes at a workplace | Organize a company's financial and banking data |

| Key Features | Budgeting/forecasting, HR, CRM, inventory and supply chain management, plus accounting tools | General ledger, accounts payables, accounts receivables, financial reporting, and some payroll |

| Scope | Covers a wide variety of back-end business processes | Only covers finance-related business processes |

| Organization Size | Often used by medium to large enterprises, though can be used by smaller businesses | Used by businesses of all sizes |

| Cost | ERP software should cost about 3% of annual sales; can cost thousands per month | Varies widely, from forever-free to thousands a year |

| Integrations | Connects with third-party software to automate additional departments and business processes | Only really integrates with software which is not financial, such as payroll or an ERP |

| Users | Users can be in any department; anyone with a license can use the ERP with some training or tutorials | Users are only in accounting departments; may need to be certified accountants to use the software |

An easy way to distinguish these two is to think of accounting software as a subset of ERP software. Nearly every ERP will include some accounting capabilities on top of the other non-financial tools to provide a true enterprise system. Meanwhile, an accounting system will just handle the financial management, planning, and budgeting your organization needs.

As an example, imagine a very small business or startup. They can probably get by with just accounting software designed for small businesses for the first few years of operation. However, after they start to grow, they’ll need to upgrade to an ERP that can continue to scale with their increasing operations.

Understanding Accounting Software

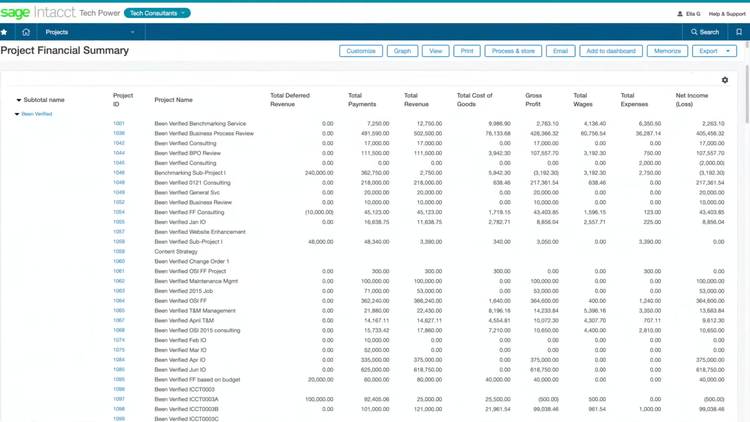

Accounting software tracks financial transactions to record profit/loss and better improve business finances and overall cash flow. Core functionalities include general ledger (GL), accounts payable (AP), and accounts receivable (AR). Common additional functionalities include payroll services, billing, project management, and inventory management data.

Designed to be used by finance teams and accounting departments, this software makes it easier to monitor revenue, sales, and invoicing. Tracking these metrics provides increased visibility into the profitability of your organization. They also create key financial reports such as profit and loss statements, balance sheets, and income statements.

Exploring ERP Software

Enterprise resource planning (ERP software) is an integrated suite of business applications designed to automate your organization’s back-office functions. This includes financials, sales, and operations with a focus on:

- Financial management

- Supply chain management

- Human resources

- Customer relationship management

- Inventory and warehouse management

Additional capabilities provide:

- Sales management via quotes, sales order processing, invoicing, returns and credits, and sales forecasting

- Procurement management via automated purchase orders and requisitions

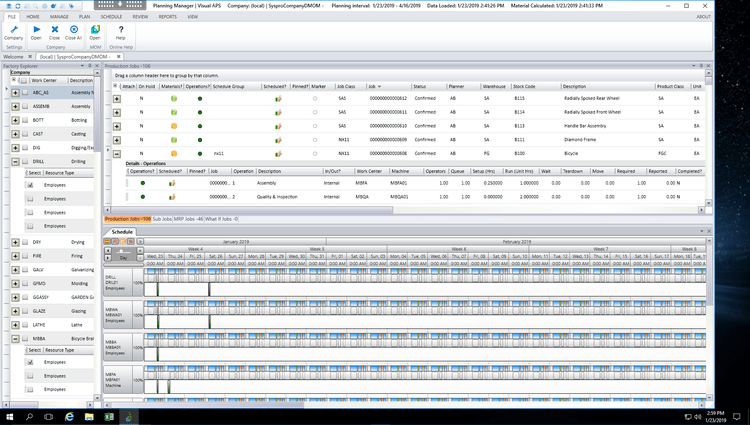

- Production control via material resource planning and bills of materials

- Operations management via workflow-based alerts

- Improved inventory control via warehousing stock transfers and improved picking/packing

Benefits of Integrated ERP Systems

The top benefit of an integrated ERP is the ability to create an all-in-one solution that covers a wide variety of business processes. Instead of buying or subscribing to multiple third-party solutions, companies can get just one software. It also spans multiple departments, making more complex operations possible.

Read more: What is ERP and How Do ERP Systems Work?

Choosing the Right Software for Your Business

| Use ERP when… | Use accounting software when… |

| You need to automate operations at a medium to large enterprise | You want to organize financial data |

| You need to help multiple departments improve workflow | You only need to assist the accounting team |

| You have multiple locations, whether in one area or around the world | You have one or few locations to manage |

| You need a scalable, customizable solution to fit complex business needs | You can get by with out-of-the-box functionality |

| You have an extensive budget to work with | You have a limited budget to start |

Many businesses start out with a basic accounting software (such as QuickBooks Online) when new, but grow into an ERP solution for supply chain, inventory, eCommerce, and other non-financial needs that are required in a growing business.

This distinction does not mean that accounting software is only for smaller businesses and ERP software is for the larger ones. Many enterprises decide to use a dedicated accounting system that can handle multiple entities or multi-currency accounting. These systems are then integrated into an ERP.

Likewise, small business ERP software exists, which is meant to give a growing business a little bit of everything. However, it may still require a dedicated program for specific areas like bank reconciliations.

Spotlight on Top ERP Solutions

These are just a few of the top ERP solutions that include accounting functionality:

1. Oracle NetSuite

Utilized by over 40,000 organizations worldwide, NetSuite is a cloud-based ERP software solution that supports sales, finance, human resources, operations, and service. NetSuite uses a modular approach, starting with core financial functionalities like accounts payable/receivable, cash management, and project accounting, with other modules available separately.

2. Microsoft Dynamics 365 Business Central

Dynamics 365 Business Central is a great fit for those already familiar with using Microsoft interfaces. Its accounting module has tools for detailed audit trails to ensure greater transparency in financial transactions. Multi-currency and multi-language support also create scalability for growing companies with international business dealings.

3. Odoo

This open-source ERP solution offers end-users complete customization. Odoo has a standout accounting module that can be purchased independently. The pre-configured tax reports are based on fiscal localization, so businesses meet local compliance standards.

4. Acumatica

Acumatica has industry-specific ERP editions to help businesses get the best software tailored to their specific workflows. Businesses can pick the functionalities they need instead of using an overwhelming and expensive platform with everything. This approach makes Acumatica a good choice for mid-market businesses that may be beyond basic accounting software’s needs but not ready for an enterprise-level ERP.

5. SAP Business One

This ERP is a highly scalable solution that can grow with businesses. SAP Business One is primarily aimed at the SMB market. The multi-currency and multi-language support allow for international growth opportunities. However, users looking for full accounting services may be disappointed there isn’t a payroll module.

Conclusion: Which Is Best For Most Businesses?

Considering the full scale of possibilities, we recommend most businesses use ERP software to automate work. Accounting software is great for financials, but the minute you need inventory or order management services, an ERP is much less of a headache than integrating with another third-party tool.

Traditional accounting software is becoming less prevalent as businesses turn to fully integrated business management software to meet their needs. While part of this movement could be blamed by the ERP vendors of the world attempting to upsell more products, most businesses are more than satisfied using a unified system with end-to-end capabilities.

In short, ERP solutions are the best choice for growing businesses because they include everything offered by accounting software and then integrate them with non-financial tools.