Guide to ERP Finance Modules: Features and Benefits

The financial module in an ERP system is a component that manages reporting, general ledger maintenance, and transaction processing.

Short Summary

- ERP finance modules provide enhanced visibility into financial operations and automate key processes for improved efficiency.

- These modules differ from traditional accounting software by offering integrated financial management across departments, as well as general ledger management and analytics.

- Benefits include cost reduction and increased transparency to support better decision-making.

What Is a Finance Module in ERP?

ERP finance modules manage and streamline accounting, offering data on key metrics like cash flow, revenue, and expenses. They enhance visibility into financial operations, ensure transparency during audits, and support regulatory compliance. Integrated with core modules like inventory management, CRM, and HR, ERP finance modules provide a full view of workplace operations.

Top Features of ERP Finance Modules

The main features to look for in an ERP are:

- General ledger

- Accounts payable and receivable

- Fixed asset management

- Reporting and analytics

- Budgeting and forecasting

- Bank reconciliation

- Tax compliance

Of course, many ERP systems offer additional modules as add-ons to completely customize the financial functionality.

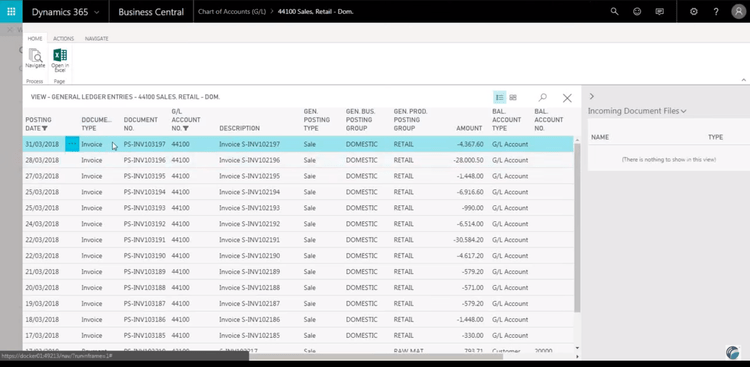

General Ledger Management

A general ledger provides a comprehensive record of all financial transactions, such as income, capital accounts, expenses, assets, and liabilities. This integration ensures that all financial data is consolidated and accessible in real time.

Accounts Payable and Accounts Receivable

Accounts payable and accounts receivable are features in an ERP system that help manage funds owed to vendors and collect customer payments. These functionalities automate payment reminders, recurring invoices, and account reconciliation. This automation not only accelerates the collection process but also strengthens customer relationships by ensuring timely communication and accurate record-keeping.

Fixed Asset Management

This module monitors your assets. Sometimes handled via a standalone fixed asset management software, it helps with tax payments on disposed-of or replaced items and identifies potential sales tax savings based on exemptions.

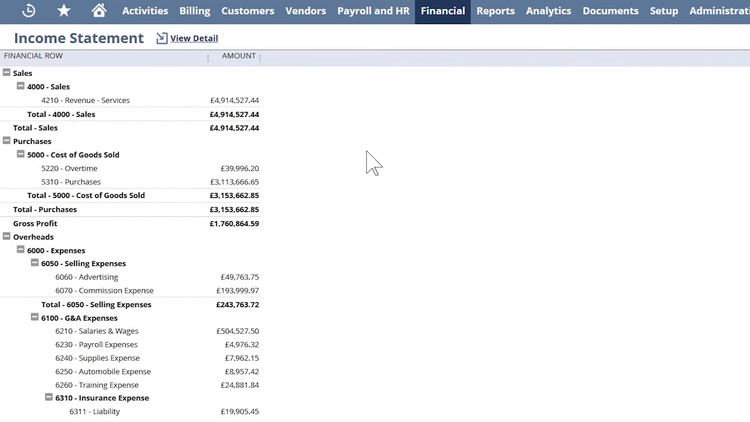

Reporting and Analytics

Reporting and analytics created from data in ERP finance modules enable data-driven decision-making. By consolidating financial data from various departments, businesses gain insights into financial metrics such as cash flows, profitability, and expected sales. This real-time access allows businesses to identify trends and adjust strategies as needed to achieve their financial goals.

Budgeting and Forecasting

ERP finance modules can generate granular budgets for your company using historical data and forecasts. The software also streamlines the budget approval process, allowing users to set up custom approval workflows based on specific rules. Some systems even include scenario planning for ‘what-if’ analysis, allowing businesses to plan for financial impacts under different market conditions.

Bank Reconciliation

Bank reconciliation involves matching internal financial transactions with your bank statements. The finance module can pull data directly from imported bank statements into the ERP system. From there, it uses intelligent matching algorithms to automatically link bank transactions with those in your ERP. Discrepancy detection capabilities will flag unmatched transactions and help identify duplicate payments or unauthorized withdrawals.

Tax Compliance

Some finance modules include tools that integrate tax handling with accounts payable and general ledger. These modules automate tax calculations, including VAT, GST, payroll taxes, and sales tax. Businesses can configure their programs to auto-update tax rates and regulations. Additionally, some ERP software can generate tax reports with summaries of taxable transactions and exemptions.

5 Main Benefits of ERP Finance Modules

ERP finance modules automate key processes, such as profitability analysis and revenue management, and provide real-time access to financial data. By automating these processes, businesses can:

-

- Streamline financial processes

-

- Eliminate accounting errors

-

- Better allocate resources to drive growth

-

- Reduce costs

-

- Increase transparency throughout the organization

These benefits all stem from the automation and integration of key financial tasks, allowing users to focus on growth. Manual processes are eliminated, human errors are reduced, and efficiency is improved.

Furthermore, real-time access to financial data results in enhanced financial transparency, enabling better decision-making and forecasting across the organization.

1 Streamline Financial Processes

Streamlined processes result from automating key financial tasks, such as accounts payable and receivable management, fixed asset tracking, cash management, and general ledger management. This allows staff to focus on revenue growth and strategic decision-making related to business processes.

2 Eliminate Accounting Errors

Automating financial management reduces human errors by limiting manual processes. While users still have final oversight on processes, the majority of the work is handled by the ERP.

3 Better Allocate Resources

Automation through an ERP not only eliminates accounting errors and improves efficiency but also frees up valuable time and resources that can be allocated towards driving business growth and profitability. And the users themselves get more time to focus on other tasks, adding to overall labor resources.

4 Reduce Costs

The ERP’s ability to eliminate manual processes and increase financial management efficiency can reduce costs. Automating key financial tasks, such as invoice processing and bank reconciliation, minimizes the risk of costly errors, which in turn contributes to increased profitability and financial stability for the organization.

5 Enhance Financial Transparency

Full financial transparency results from real-time access to financial data provided by your ERP finance modules, enabling better decision-making and forecasting across the organization. By consolidating financial data from various departments, businesses can gain insights into metrics such as cash flows, profitability, and expected sales.

Who Needs ERP Finance Modules?

With the right ERP software, businesses of all sizes can gain greater visibility into their finances. A comprehensive ERP will have finance modules that can provide everyone from the smallest startup to the largest enterprises with a centralized financial management system, integrating data from multiple departments to enable better decision-making.

Differences from Traditional Accounting Software

Unlike traditional accounting software, a finance module as part of a complete ERP system will focus on integrating financial management with other core business functions, enabling better decision-making and forecasting. This integration sets ERP finance modules apart from standalone accounting software, which often lacks the ability to communicate financial information across various departments and processes.

Real-World Examples of ERP Finance Modules

Companies like Coca-Cola, Nike, Samsung, and Toyota have successfully implemented ERP finance modules to streamline financial processes, reduce costs, and enhance financial transparency. Here are some examples of top ERP systems with notable finance modules:

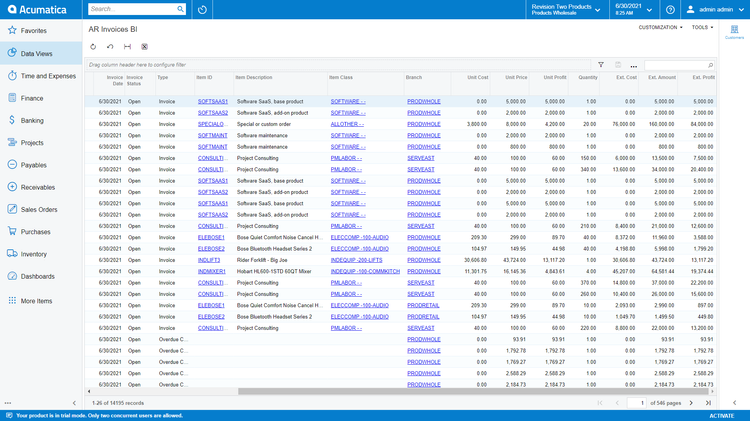

- Acumatica: A cloud-based accounting software with a finance module, such as Acumatica, can help small businesses streamline financial processes, improve cash flow management, and ensure regulatory compliance.

- NetSuite: Another major ERP with financial modules is NetSuite. This software is known for its ability to integrate with eCommerce platforms and POS apps.

- QuickBooks Online: One of the most popular accounting solutions for small businesses, QuickBooks Online is a good starter ERP for new and growing companies.

- SAP: SAP Business One includes in-depth accounting and financial management in addition to the usual features of CRM, reporting, and supply chain management.

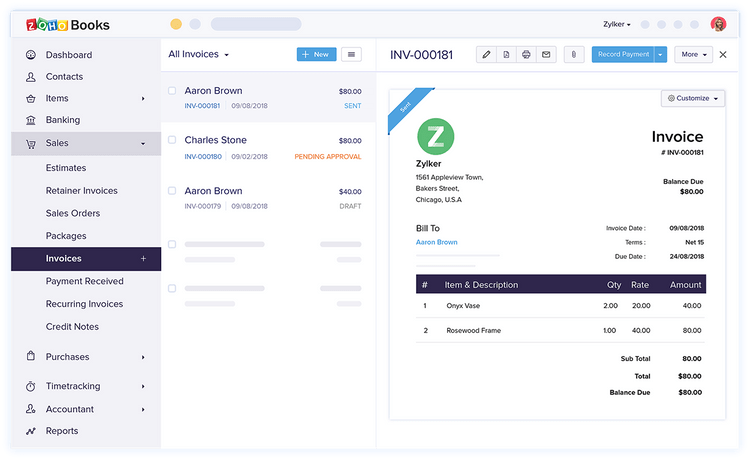

- Zoho Books: Zoho Books is an accounting software that, through integration with other Zoho products, can act as a full ERP. The user-friendly design and simple navigation are ideal for those employees new to accounting processes.Other apps cover inventory, CRM, and more.