The Best Accounting Software with Offline Access

In an era dominated by cloud subscriptions, we wrote this guide to recommend the best offline, on-premise, and perpetual license accounting software for those valuing control and reliability.

- Comprehensive GST Support

- Multi-Company Support

- Check Printing Features

- Community version is free

- Heavy customization options

- Double entry inventory system

- Audit trail security

- Open data structure - No data limits

- No arbitrary payroll caps or requirements

Our list of offline accounting software showcases the top products in two categories: perpetual license pricing and QuickBooks Desktop replacements.

The majority of modern accounting systems are cloud-enabled with a month-by-month subscription. Even non-subscription versions of QuickBooks Desktop are being phased out for the subscription model.

We’ve researched secure, low-priced alternatives. Our top picks for security are Odoo and DENALI Business+Accounting. For low pricing, we chose TallyPrime and LedgerLite.

- TallyPrime: Best Perpetual License Pricing

- Odoo: Best Free Option

- DENALI Business Software: Best Security System

- GnuCash: Good Open Source Option

- LedgerLite: Most Simple UI

- AccountEdge Pro: Best Audit Tools

- NolaPro: Most Customizable

- Manager.io: Another Good Option

- Moneydance: Best for Forecasting

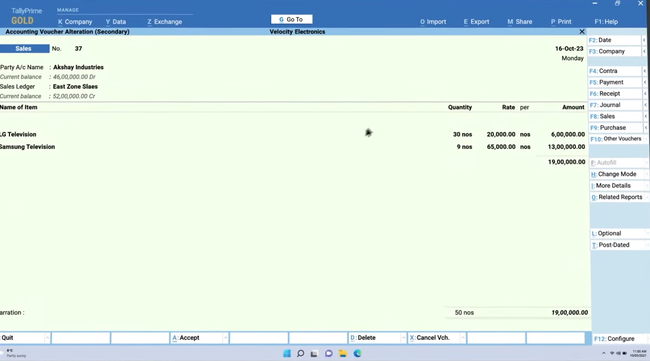

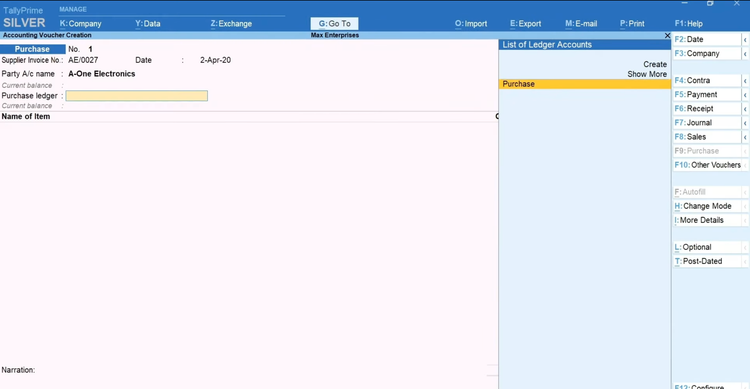

TallyPrime - Best Perpetual License Pricing

TallyPrime offers a one-time purchase option with a lifetime license starting at $855 for a single user (Silver Edition) and $2,565 for a multi-user license (Gold Edition). When you buy it, you own the software outright, and you’ll also get a year free of Tally Software Services (TSS). These include software updates, security patches, priority support, and remote access. After that, you’ll need to renew TSS to continue receiving those extra services.

TallyPrime comes packed with useful accounting tools, including:

- General Ledger: Manages all your financial transactions, from income and expenses to assets and liabilities, in a centralized ledger.

- Invoicing: Lets you print customizable invoices and supports multiple billing formats for products, services, and even multi-item or discounted invoices.

- Accounts Receivable & Payable: Tracks customer payments, outstanding bills, and vendor invoices.

- Bank Reconciliation: Matches transactions in TallyPrime to actual bank statement balances.

- Tax Compliance: Automates tasks like GST calculations, tax reporting, and filing; helps with GSTR return reconciliation and e-way bills.

- Reporting: Generates detailed reports like cash flow statements, balance sheets, and profit and loss statements.

- Multi-currency Support: Handles currencies like USD, INR, EUR, CAD, JPY, GBP, and AUD.

Since it’s installed on your company’s computers or servers, you don’t need an internet connection to access all these features. However, TallyPrime does offer cloud-based options, too, starting at $81 for three months.

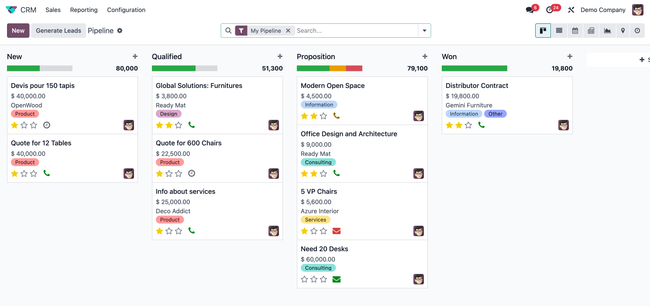

Odoo - Best Free Option

Odoo, though primarily known as a cloud-based ERP system, has an on-premise version that can function just like a desktop accounting solution when installed locally. With this setup, you have full control over your data and infrastructure. You can customize security settings and implement your own encryption, protocols, and access control to suit your business.

If you’re looking for a free option, the Community Edition is a solid choice. It offers basic accounting tools like invoicing and payments but lacks the advanced features of the Enterprise edition. Community is open-source, meaning you can tweak the code however you like. Since there’s no official Odoo support for this option, it relies on a global community of developers for help—perfect if you have an in-house team that can handle setup and maintenance.

The Enterprise Edition is $38.90/user/month billed on a monthly basis. It comes with a complete accounting package, including a general ledger, bank reconciliation, and AI-powered invoicing. It even handles vendor bill OCR and payroll management, plus a detailed audit trail for added security.

Odoo isn’t just for accounting. It integrates with broader business functions like inventory management and sales, making it a full ERP solution.

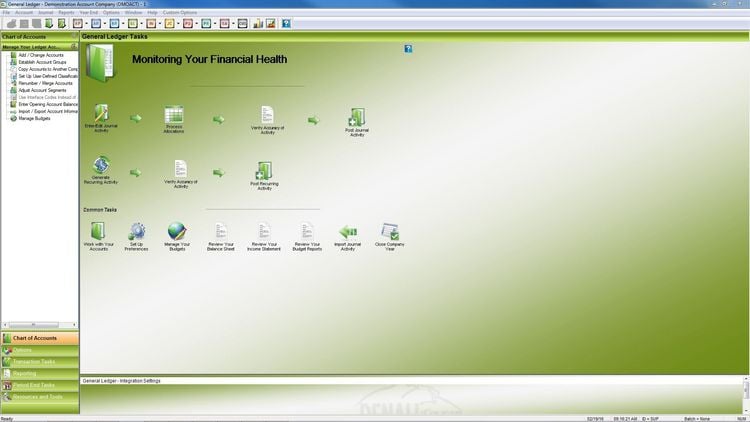

DENALI Business Software - Best Security System

Designed by Cougar Mountain Software, DENALI offers complete desktop accounting for Windows. We like that it provides an advanced, multi-tiered security system that allows you to establish user rights by application and function. In addition, with built-in, user-defined protocols for access to payroll and employee records, you can reduce opportunities for theft and errors.

Your startup or small business can utilize tools to manage cash flow, track inventory, set up recurring invoices, adjust sales tax, and monitor profitability through real-time data. DENALI also allows for easy and secure electronic transactions of checks, debit and credit cards, gift cards, and EBTs. Automate direct deposits from the company account to your employees and monitor bank accounts with their bank reconciliation module.

This accounting solution touts an unbreakable audit trail, with transaction documentation for consumers and auditors of financial reports to help identify internal fraud or data breaches. You can even eliminate the cost of reissuing lost or stolen checks through their add-on ACH direct deposit module, lending security to your payroll process.

We also found that DENALI offers high customizability to tailor the program to your particular requirements. Starting at $1,999 for a perpetual license, this fully-integrated ERP software cuts down on accounting tasks for anyone from the self-employed accountant to the small business owner.

GnuCash - Good Open Source Option

Designed for offline use, GnuCash offers free, open source accounting software for small businesses. This means you can modify the code or even build on top of it, whether you’re just tweaking how reports look or integrating GnuCash with your own in-house tech stack. An active community of developers maintains the project on GitHub, publishing consistent updates. There are even build scripts and platform-specific packaging tools available if you want to create custom versions for Windows, macOS, or Linux.

On the accounting side, GnuCash offers a checkbook-style register for true double-entry accounting. It ties every dollar in or out to a source and destination account, so you can always keep your books balanced. This also makes it much harder to mess up your financial data, even if you’re not an accountant by trade.

Plus, you can split a single transaction across multiple categories, like one check that covers utilities and rent, and GnuCash will keep track of each piece. It also handles transaction autofill and lets you reconcile your entries with paper statements or manually downloaded exports. The reconciliation process is surprisingly strong for a free tool, helping you catch errors or even bank discrepancies without needing to upload anything online.

Combined with its support for multiple currencies and invoicing, GnuCash is adept at small business accounting. While we found it requires manual data transfer from mobile to desktop, its focus on privacy and security makes it an attractive option for many companies.

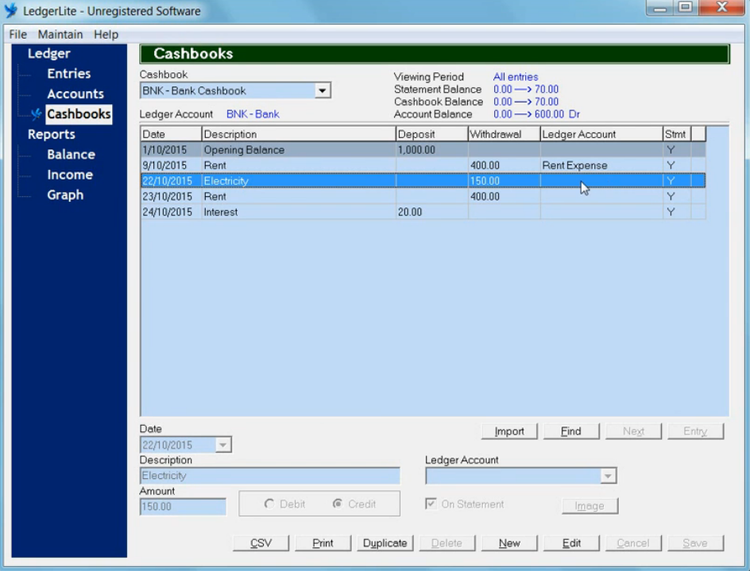

LedgerLite - Most Simple UI

Described as the world’s simplest bookkeeping software, LedgerLite provides double-entry accounting to Windows users. Its cashbook tool feels similar to anyone who has ever balanced a checkbook. The interface is clean; a simple grid shows the date, description, deposit, withdrawal, and account balance.

Entering a transaction is as easy as typing the amount, selecting whether it’s a debit or credit, and choosing the correct ledger amount from a dropdown list. Behind the scenes, LedgerLite auto-generates the ledger entry, so your books stay accurate without you needing to know double-entry accounting rules.

The UI is intentionally old-school, with no confusing dashboards or constant pop-ups. The software opens quickly without relying on an internet connection, and everything you need is right in front of you. That simplicity makes it easier to reconcile balances without distraction. The same minimal design can feel dated compared to modern cloud-based tools. However, it’s an acceptable trade-off if you value control, offline access, and a one-time purchase over recurring subscriptions.

Another big part of LedgerLite’s appeal is its cost advantage. Starting at $149 for a perpetual license, you can pay once and use the software indefinitely. This means no surprise add-ons or risk of losing access if you let a monthly payment lapse. In this way, LedgerLite balances affordability with usability.

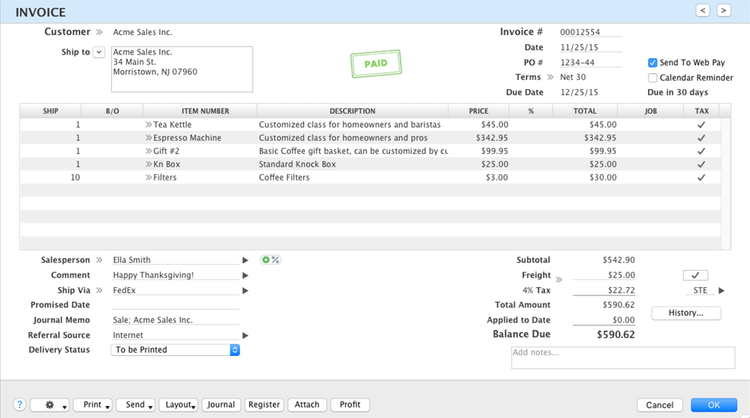

AccountEdge Pro - Best Audit Tools

AccountEdge is a small business accounting software for Windows and Mac users. It offers strong security features and tools like sales and expense tracking, payroll, purchase orders, time tracking, and accounts receivable and payable. Additional functions include inventory management, customer relationship management (CRM), project management, and more. Another big reason we like AccountEdge: all of these features are accessible offline.

AccountEdge’s audit trail tracking function, a security staple of most accounting software, monitors which users create and edit transactions. You can also establish a lock period, disallowing data entry before a specified date.

Similarly, you can turn on prompts for reminders about creating data backups and running verification checks. These checks determine the integrity of your files and notify you if any corruption has occurred.

Optimal for freelancers and small businesses, AccountEdge Pro starts at $20/month for a single user. It’s your go-to for a simple, streamlined program that provides multiple ways to protect your data.

NolaPro - Most Customizable

NolaPro can be customized to fit specific industry needs in an offline environment. Its accounting module includes over 100 stock reports, allowing you to drill down into your financial metrics. If you need to analyze more specific data, the system also includes a custom report writer. This allows companies across several industries, from multi-site retailers to distributors, to tailor reports to their specific needs.

The general ledger module is also highly customizable. You can import your own chart of accounts so they are user-defined or select an industry-specific model. Set multiple budgets and alter them mid-year while maintaining the original to compare. This allows you to stay flexible with your accounting practices and adapt as your company changes.

NolaPro’s free plan is available offline only for one user. It includes a full core accounting module, including payables, general ledger, and even limited inventory. For mid-size businesses, the Enterprise plan is $12/user/month and includes additional modules like a B2B web portal, CRM tools, and order tracking.

Manager.io - Another Good Option

Manager.io is completely free accounting software tailored for small businesses. It offers a rich feature set for offline use on desktops and laptops. Compatible with Windows, Mac OS X, and Linux, it ensures wide accessibility and a seamless experience across different operating systems. We especially like the software’s desktop version, which caters to single users without limitations on usage or time.

Beyond basic accounting functionalities, Manager.io offers many features, including investment recording, performance tracking of various asset types, and specialized fund accounting. It also covers essential processes like bank reconciliation, expense tracking, and payroll management. Manager.io’s general ledger summary and transaction-level reporting make it attractive for accountants or businesses currently relying on external financial statement tools.

We like that Manager.io is customizable, allowing businesses to tailor it to their needs by activating only the necessary modules. Additionally, Manager.io is characterized by its responsive development approach, continuously evolving through user feedback.

That said, bank feeds and reconciliation workflows are functional but limited, especially if you’re managing multiple credit card or bank accounts. Built-in report customization is also relatively light. That’s why Manager.io tends to work best for solo practitioners or smaller teams that need a locally installed system without advanced approval or collaboration workflows.

Moneydance - Best for Forecasting

Moneydance is privacy-centric, offline personal finance software, best for individual accountants and SMBs. We like that the platform ensures all data, including account balances and transactions, are stored locally on the user’s hard drive, enhancing privacy and accessibility. This is useful if you travel frequently or find yourself in areas with unreliable internet service.

Beyond basic financial tracking, Moneydance supports multiple companies or accounts, making it versatile with diverse financial portfolios. It also has a detailed general ledger, cash management functions, and the ability to generate balance sheets and income statements.

Our research shows Moneydance performs best in forecasting, profit/loss tracking, and capital asset planning. Unique features like online bill pay and investment tracking, alongside cryptocurrency support, extend its utility to a global audience. Finally, we like that it has a mobile app, syncing between desktop and mobile platforms.

Why Choose Offline Accounting Software Over Cloud-Based?

Cloud-based systems offer accessibility, automatic upgrades, and rapid deployment, but what advantages can you expect from software intended for desktop only? The top benefits of offline solutions are:

-

Security: With no online presence or cloud-based functionality, desktop accounting software protects the integrity of your business’s information. You maintain control over your financial data through a self-hosted server, minimizing the risk of security breaches in the cloud.

-

Pricing and Perpetual Licensing: Since online accounting tools like FreshBooks, Xero, and Zoho Books are cloud-based, you can expect to pay on a month-by-month subscription basis. This can lead to a higher total cost of ownership over time. With perpetual licensing, you’re paying a one-time fee for the right to use the software endlessly.

-

Other features of standalone accounting software include customizability for your business needs. In addition, you can always access your financial data, even in cases of unreliable internet connection or speeds.

Is QuickBooks Desktop Being Phased Out?

Is QuickBooks Desktop, one of Intuit’s most popular accounting solutions, being phased out? The answer is yes and no: QuickBooks Desktop Pro and Desktop Premiere have transitioned to subscription models rather than one-time purchase licenses.

Non-subscription versions of QuickBooks Desktop received limited support for 3-4 years, with Quickbooks Desktop 2020 through May 2023 and QuickBooks Desktop 2021 through May 2024.

If you’re interested in exploring online accounting software, you can convert QuickBooks Desktop to QuickBooks Online.

Read More: 12 Best QuickBooks Alternatives

QuickBooks Alternatives

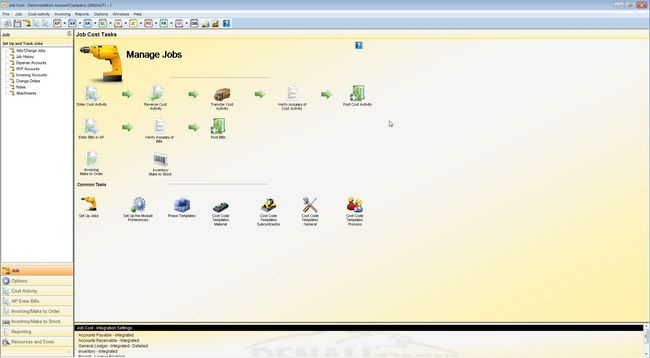

Looking to replace QuickBooks Desktop? You can find perpetual license accounting software for your small to mid-sized business with accounting basics plus inventory control, manufacturing, order entry, job costing, and more.

Our recommendations:

-

Connected Accounting and ERP is a business management application for Windows or Mac with a perpetual license price starting at $649. Go for the Connected Enterprise configuration for the abovementioned features, plus lot/serial number control, quote management, and more.

-

Adagio Accounting is an ERP software for Windows with a perpetual license price starting at $950. Ideal for small to mid-market companies, it provides over 25 accounting modules for bank reconciliation, invoicing, multicurrency, and more.

Further Reading: On-Premise ERP Software vs. Cloud Solutions

Pricing

Pricing for offline accounting software can differ based on the features you need, support options, and whether you’re going for a perpetual license vs. subscription) model.

Perpetual License: $100–$2,000+ (one-time)

Many desktop accounting systems use a perpetual licensing model, where you pay once to own the software indefinitely. This provides savings over time compared to some cloud-based subscriptions.

Examples:

- TallyPrime: $855 (single user)

- LedgerLite: $149

- DENALI: $1,999+

- Connected Accounting: $649+

Support Add-ons: Annual support or update packages may cost an extra $100–$500/year.

Free or Open Source

Some offline systems offer free versions or open-source community editions. These may require more hands-on setup and self-support, but offer unbeatable pricing.

Optional Costs: Internal IT for setup or third-party implementation

Examples:

- Odoo Community Edition (free, self-hosted)

- GnuCash (free, open source)

- Manager.io (free desktop version)

Offline Software with Subscription: $10–$40/user/month

A few hybrid or offline tools still offer a monthly pricing model, especially if they include connected services or advanced modules.

Examples:

- AccountEdge Pro: $20/month

- Odoo Enterprise: $37.40/user/month

- NolaPro Enterprise: $12/user/month

Costs by Business Size

Here’s what your total cost of ownership (TCO) might look like based on your company size if you go with an offline or on-premise tool:

| Business Size | Typical Software Type | Annual TCO Estimate |

|---|---|---|

| 1–5 employees | Free/Open Source or Perpetual License | $0–$1,000 |

| 6–20 employees | Perpetual License with Add-ons | $500–$3,000 |

| 20+ employees | Enterprise/Customizable Solutions | $2,000–$6,000+ |